World’s leading organizations downgraded 2022 economic growth projection; Longer-than-expected surging inflation forces the US and the Eurozone to tighten monetary policies

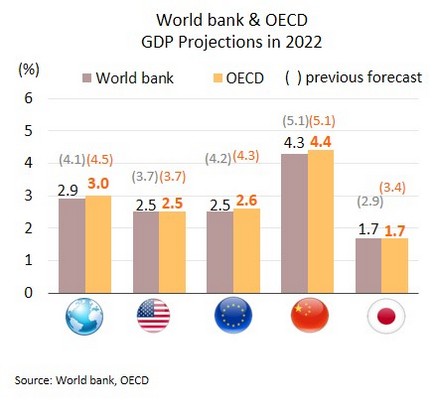

The World Bank and the OECD cut their 2022 global growth forecasts amid multiple risks. The World Bank has cut its outlook for global GDP growth for 2022 and 2023 from January’s 4.1% and 3.2% to 2.9% and 3.0%, respectively. The outlook for major economies has also been downgraded, with forecasts cut from 3.7% to 2.5% for the US, from 4.2% to 2.5% for the Eurozone, from 2.9% to 1.7% for Japan, and from 5.1% to 4.3% for China. Likewise, the OECD forecast for 2022 global growth has been slashed from 4.5% (December 2021) to just 3.0%.

The more-than-expected slowdown in the world economic growth is due to the extension of the war in Ukraine, the sanctions on Russia, and the imposition of strict lockdowns in China, which have now been reintroduced in parts of Shanghai. These situations have aggravated supply disruption and intensified inflationary pressures, of which the latter factor leads to weaker purchasing power. The new investment would consequently be weighed on and production is likely to be limited below potential growth. As such, risk of stagflation is growing. Alongside this, the rise in inflation is forcing some central banks to raise interest rates while recovery remains incomplete. Some emerging and developing economies, which are sensitive to fluctuation in capital flow and facing accelerated debts, would be at risk and thus affect overall global recovery.

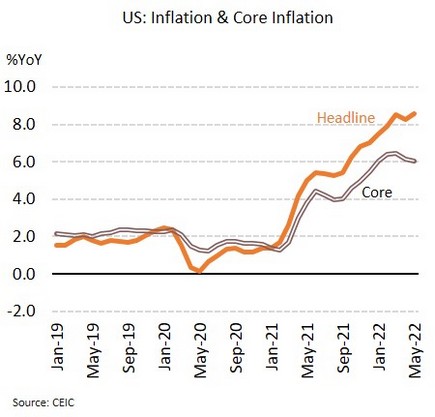

Tight labor markets and the ongoing rise in inflation will encourage the Fed to raise rates by 50 bps this week. In May, headline inflation hit the 40-year high of 8.6%. Although core inflation fell to 6.0%, this was still above expectations. Unemployment rate is also at the 2-year low of 3.6%. For the week ending 28 May, continuing jobless claims remained steadily at 1.31m, their lowest since 1969.

Despite a decelerating core inflation, the latest economic data reflect the continuing tightness of labor markets and elevated inflation. Against this backdrop, the Fed will be encouraged to hike rates, and a 50 bps increase is expected this week. There would also be the possibility of a 75 bps hike. However, any decision will be made upon economic developments, particularly the latest data on inflation and employment, together with the anchoring of inflation expectations.

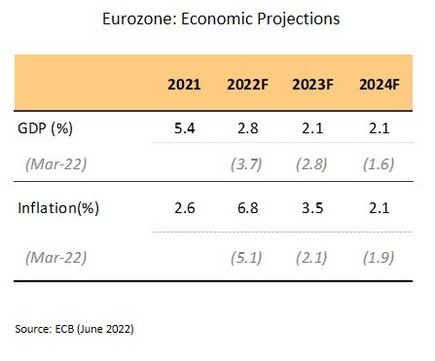

Eurozone’s policy rates are expected to rise by 25 bps in July, followed by gradual moves amid risk of debt distress. The European Central Bank (ECB) decided to maintain policy interest rates. Nonetheless, the ECB president has indicated that rates will likely rise by 0.25% in July. The ECB has also raised its forecasts for 2022 Eurozone inflation from 5.1% (as of March) to 6.8% and cut its outlook for 2022 GDP growth from 3.7% to 2.8%.

The ECB signaled that policy rates will be raised to curb inflation, which as of May had hit a record high of 8.1%. The ECB president has said that the bank intends to hike rates by 0.25% at its July meeting and again in September, though the scale of the latter rise will depend on price evolvement at that time. After that, rates would be adjusted gradually. The ECB is unlikely to keep pace with the Fed since it will have to balance monetary tightening with the need to sustain the recovery, which remains fragile. In addition, the ECB will wish to protect the European periphery from risks arising from higher debt burden, reflected by the increase in 10-year Italian government bond yields to an 8-year high.

As inflation is rising and likely to remain above target for all of 2022, Thailand has now prepared to raise interest rate earlier than expected

The BOT is anticipated to hike policy rate at August meeting after signaling accommodative measures would become less necessary. At the June 8 meeting, the BOT’s Monetary Policy Committee (MPC) unexpectedly voted 4 to 3 to leave policy rate unchanged at a record low of 0.50%. This marked a sudden shift in voting stance from the previous meeting.

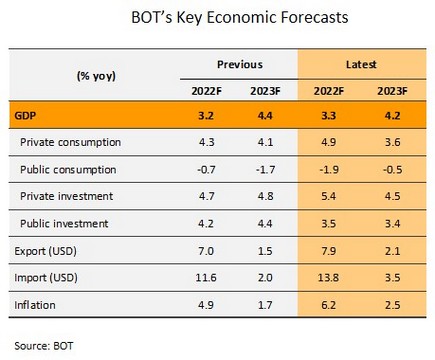

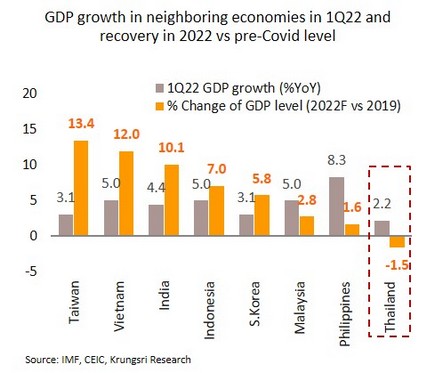

Krungsri Research sees high probability for the BOT to raise rate this year, sooner than our expectation, given these following factors. (i) The MPC saw better-than-expected outlook of economic growth with an upward revision of 2022 Thai GDP growth projection to 3.3% from 3.2% in a prior forecast owing to stronger domestic demand and the pickup in foreign tourists amid limited effect of Russia-Ukraine crisis. (ii) The key concern is that the elevated inflation would last longer than expected as the MPC estimates that inflation is likely to exceed the upper bound of the target range in 2022 due mainly to increasing domestic energy prices and higher cost passthrough that have broadened into wider ranges of products. The MPC’s 2022 outlook of inflation has been markedly raised to 6.2% from 4.9%. (iii) The current record-low policy rate would become less necessary, reflecting the MPC’s concern over falling behind the curve in battling inflation. We anticipate the first rate hike would start at the next MPC meeting on 10 August. However, the speed of rate hikes is likely to be very gradual and will not outpace Thailand’s peers since real GDP this year will be below its pre-Covid level.

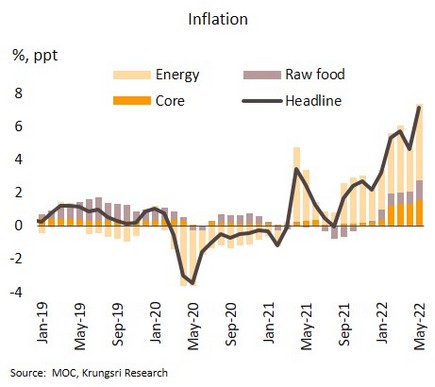

Alongside weakening consumer and business sentiment, inflation jumped to over 7% in May and is likely to continue upwards. Headline inflation surged from 4.65% in April to a 13-year high of 7.1% YoY in May on higher energy costs, especially retail oil prices (up 35.9%), together with the ending of price control over cooking gas, and the more costly electricity bills from the increase in the float time (Ft) charge during May to August. In addition, higher production costs are feeding into rising food prices, most notably for pork meat, chicken, eggs, fresh vegetables, and seasonings & condiments. Core inflation (excluding raw food and energy prices) was up from 2.0% in April to 2.28%. For the first 5 months of the year, headline and core inflation have averaged 5.19% and 1.72%, respectively.

Headline inflation is expected to run above 7% in the coming months. Apart from the base effect in comparison to 2021’s levels, the rising inflation was also caused by elevated energy prices, especially Diesel prices which are now climbing close to the new THB 35/liter limit after the ending of the THB 30/liter cap. This would affect manufacturing and transport costs. In addition, electricity bills will become more expensive during September to December from the expected raise of float time charge. The protracted Ukraine war and sanctions on Russia are also keeping crude prices high and adding to the cost of commodities globally. We thus expect that for all of 2022, headline inflation will average around 6% (up from our earlier prediction of 4.8% ). Moreover, the rise of living and production cost has undercut sentiment. As such, the consumer confidence index and the Thailand Industry Sentiment Index (TISI) have fallen to respectively 9-month and 7-month lows of 40.2 and 84.3.