Developed economies may face mild recessions while Chinese reopening could be a game changer, its effects remain uncertain

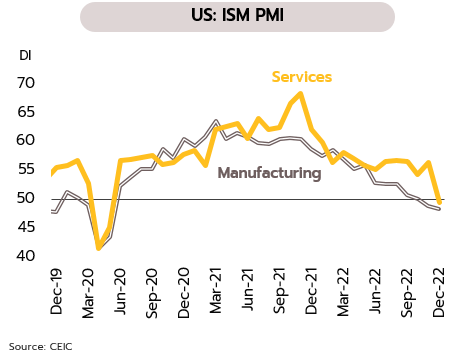

US economy is slowing, but tight labor markets indicate continuing Fed rate hikes. With domestic and external demand softening, December’s manufacturing PMI posted a contraction for the 2nd month a row, dropping from 49.0 to 48.4 in November, while the services PMI declined from 56.5 to 49.6, its first contraction in over 2 years. November imports also slid by -6.4% to a 1-year low. However, labor markets are strong, and at 235,000 and 223,000 respectively, both ADP Employment Change and growth in nonfarm payrolls in December beat analysts’ expectations. The unemployment rate also fell to 3.5%.

Krungsri Research believes that the strength of labor markets will push the Fed to continue with rate hikes. However, given the likelihood of a mild recession for both the manufacturing and services sectors, easing inflationary pressures, slowing wage increases, and the coming negative impacts of 15-year high interest rates, the pace of rate hikes is likely slow. We thus expect the Fed to announce a 25bp rise at its 31 Jan-1 Feb meeting, which following the 50bp hike in December would bring the fed funds rate to 4.50-4.75%.

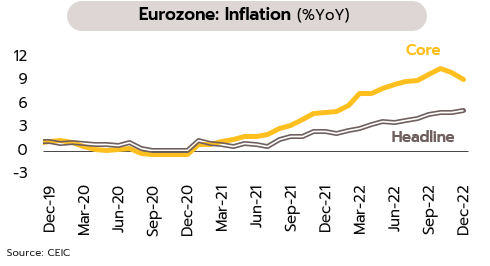

Despite eurozone economic indicators still staying within a contraction zone, there are signs of less-severe-than-expected recession. The composite PMI has been below the 50 marks separating growth from contraction since July, and weakness in new orders and slowing demand kept it there in December. However, the PMI rose for the 2nd consecutive month from 48.8 in November to a 5-month high of 49.3, indicating less contraction of eurozone economy. Headline inflation dipped from 10.1% in November to 9.2% in December on softening energy prices, though core inflation edged up from 5.0% to 5.2%, above market expectations.

We are beginning to see a weakening in the 3 main headwinds buffeting the eurozone, namely supply chain disruption, cost-push pressures, and the energy crisis. This is then leading an improvement in household and business sentiment - the ZEW Economic Sentiment and Consumer Confidence indices - have both improved for the 3rd straight month, and inflationary expectations are softening. Nevertheless, inflation will remain higher than the ECB’s 2% target throughout 2023, keeping policy rates elevated and weighing on the eurozone economic activity. We therefore expect a significant slowdown in eurozone economic activity this year, though the severity of the recession will likely be less intense than many analysts have predicted.

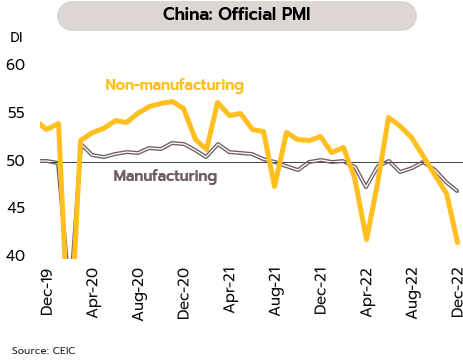

The outlook for China remains highly uncertain, although the recent reopening of the country may lift the economy through the start of 2023. Thanks to the new wave of Covid infections and the subsequent widespread lockdowns in Q4, economic growth in 2022 is expected to be around 3%, falling short of the IMF’s forecast of 3.2%. This was reflected in the slip in the Chinese manufacturing PMI to 47.0 in December and the slump in the non-manufacturing PMI from 46.7 in November to just 41.6. However, Covid restrictions are being loosened more rapidly than expected, and from 8 January, the country will reopen, with quarantines lifted and arrivals now required only to show a negative Covid test taken 48 hours before departure.

We expect the Chinese economy to improve slightly in January, helped by the abandonment of the zero-Covid policy and the upcoming Chinese New Year. Nevertheless, daily Covid infections and deaths are estimated to run to 3.7m and 25,000 respectively, and with these figures expected to worsen following New Year, the economic recovery is likely to remain vulnerable through Q1.

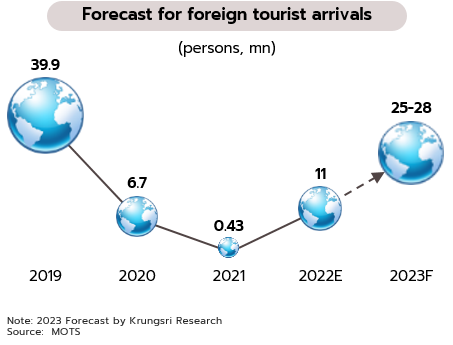

Krungsri Research expects Thailand to see 25-28 million foreign arrivals this year; with 2023 inflation forecast for 2.5%, two more rate hikes are likely

China’s rush to reopen will help to boost Thai tourist arrivals, and these are now forecast to reach 25-28m in 2023. The Ministry of Tourism and Sports has announced that with Chinese border controls being relaxed on 8 January, the first flight of 200 travelers from China to Thailand will leave from Xiamen in Fujian province just a day later. Following these pioneers, the number of flights linking China and Thailand will gradually increase.

Given the sudden reopening of China, Krungsri Research has raised our forecast for 2023 arrivals from 22.7m to 25-28m. Initially, the recovery in the Chinese market will be limited by the lack of flights and continuing restrictions on outbound tours from China. Thus, at first, arrivals from China will be limited to independent travelers and/or high-income earners. Overall recovery will become much clearer in 2H23. For the year, the significant rebound in the tourism sector will be a key driver for the Thai economic growth which is expected to reach 3.6%. This will be despite a slowdown in the global economy and the risk of recession in the US and the Eurozone, which will then undercut the export sector and keep growth in Thai exports limited to just 0.5% in USD terms (down from a prior forecast of 3.5%).

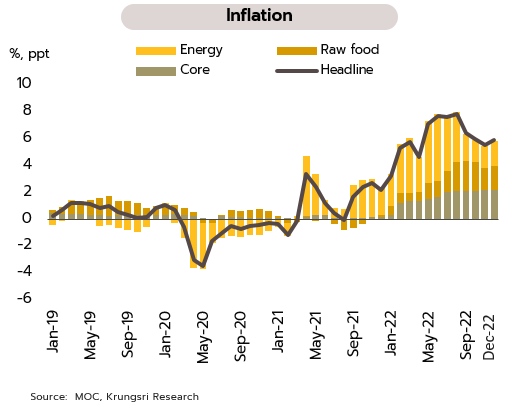

Headline inflation will soften through 2023, falling from 2022’s 24-year high of 6.1%, while policy rates are expected to rise to 1.75%. In December, headline inflation climbed from 5.55% to 5.89% YoY on higher energy costs (transport fuels, electricity, and domestic gas), the hike in transport fares, and more expensive ready-to-eat food. However, core inflation (which excludes the food and energy prices) barely moved, edging up to 3.23% from 3.22%. For all of 2022, headline and core inflation stood at 6.08% and 2.51% respectively, up from 2021’s 1.23% and 0.23%.

We expect headline inflation to remain elevated at the start of 2023 given the effects of higher electricity bills, the rise in the minimum wage (thus adding to manufacturing costs), and stronger demand from both the domestic market and the recovering tourism sector. However, this should slip back into the official target range of 1-3% from mid-2023 onwards as the major economies slow and global demand weakens, thus easing pressure on global energy markets, especially for oil. The figures will also benefit from last year’s high base, which reflected the initial impact of the outbreak of war in Ukraine on prices. As such, average inflation for 2023 is expected to drop from 6.1% in 2022 to 2.5% in 2023.

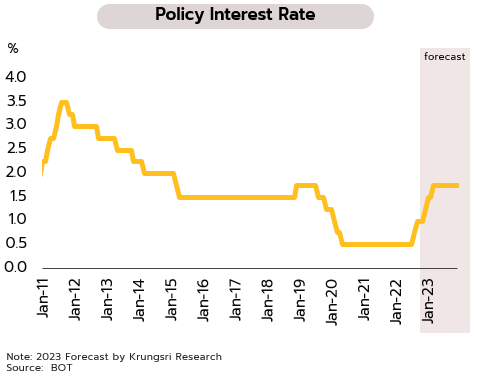

Given that (i) inflationary pressures are weakening and (ii) the Thai economy is still only at the initial stages of recovery and this year, it will have to contend with a slowdown in the global economy and risk of recession in some major countries, we expect domestic monetary policy to be less tightened than for Thailand’s regional peers. We thus anticipate that to balance price stability with economic recovery, the BOT’s Monetary Policy Committee will announce two more rate hikes in 1Q23, taking the policy rate to 1.75%, and keep it there throughout the rest of 2023.