Likely extended supply chain disruptions are adding to headwinds faced by major economies; Monetary policies in leading Asian and Western countries are diverging

China cut interest rates to prevent a sharp slowdown; Supply constraints remain despite easing lockdown. In April, Chinese unemployment rate hit 6.1%, its highest since February 2020. Alongside this, house prices slightly edged up by 0.7% YoY, their slowest rate of increase in over 6 years.

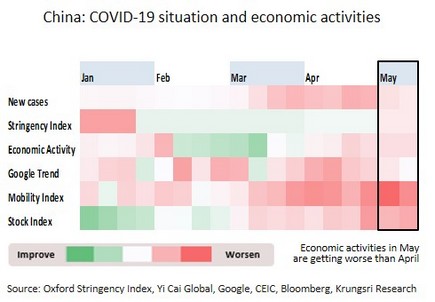

The Chinese economy is slowing, partly due to extended lockdowns in economically important areas, but daily caseloads have fallen from over 32,000 to below 5,500. Having allowed some industrial sites to resume their production, the authorities are relaxing controls in Shanghai by permitting department stores, restaurants and financial institutions to reopen. However, the lockdown has undermined output, labor markets, and spending, while problems with illiquidity in the real estate sector continue to weigh on growth. The depth of these problems and the subsequent need to prevent a sharp slowdown is reflected in the 20 May decision by the People’s Bank of China (PBOC) to cut the five-year loan prime rate (LPR) to 4.45%, the biggest cut in 3 years. Disruption to supply chains caused by China’s pursuit of its zero-Covid policy is worsening, with impacts felt in both China and other countries also reeling from the Ukraine crisis. Recently, the EU has tightened its sanctions, planning to cease imports of Russian oil within 6 months, and now that Sweden and Finland have formally applied to join NATO, the crisis is unlikely to abate soon, thus would worsen current supply disruptions.

The Fed indicated that rates would rise further; Risks are mounting in the US but recession remains unlikely. In April, US retail sales jumped 8.2% YoY, the 22nd month of increases, and industrial production climbed 6.4%, continuing an uninterrupted run of growth going back to April 2021. The continuing jobless claims also slipped to the smallest in 63 years for the week ending 7 May.

Despite the persistence of intense pressure on prices (April inflation remained close to the 41-year high hit in March), US indicators are positive, indicated by healthy spending, production and labor markets. These conditions thus support further rate rises by the Fed, and the Fed Chair has reiterated his determination to bring inflation down to a level that will sustain stable growth, although this will necessitate keeping rates above the neutral interest rate. We expect rate hikes to trigger a slowdown, but although uncertainty from a prolongation of the Ukraine war and the Chinese lockdown will drag on growth, current indicators underline the overall strength of the economy and so the risk of a recession remains low.

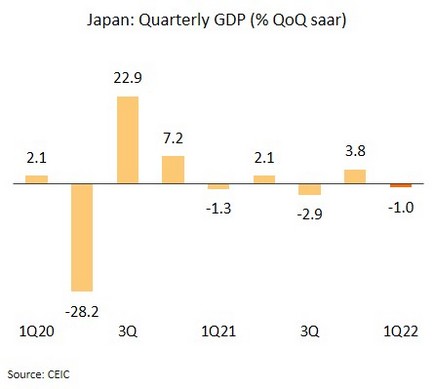

Japanese recovery would be delayed; External risks weakened exports and added to inflation. 1Q22 GDP turned to contract by 1.0% QoQ annualized. In April, export growth slowed for the 3rd month (up 12.5% YoY) and inflation rose to the 7-year high of 2.5%.

Uncertainties from external factors, including the war in Ukraine and the Chinese lockdown are expected to hurt Japanese economy through Q2. Rising inflation is also likely to undercut purchasing power in the next period. These impacts will be partly countered by a project to reopen the country to limited numbers of triple-jabbed tourists in May, which will lead to a broader reopening in June. Nevertheless, policy divergence between Japan and the West is putting pressure on the yen and limiting the room for monetary responses. As such, the bumpy growth will likely delay recovery to lag behind other advanced economies.

Despite strong external stability, the still-weak economic recovery would encourage monetary authority to keep rates low through the end of the year

The extension of cuts to diesel excise will help reduce impacts on the economy and revive weakening industrial sentiment. In April, the Thai Industries Sentiment Index (TISI) slipped from 89.2 to a 5-month low of 86.2, while the 3 month ahead expectation of sentiment also softened from 99.6 to 95.9 on fears over rising costs, including those for raw materials, energy, and transport. In addition, domestic purchasing power is coming under pressure from the rising cost of living and household debt problem.

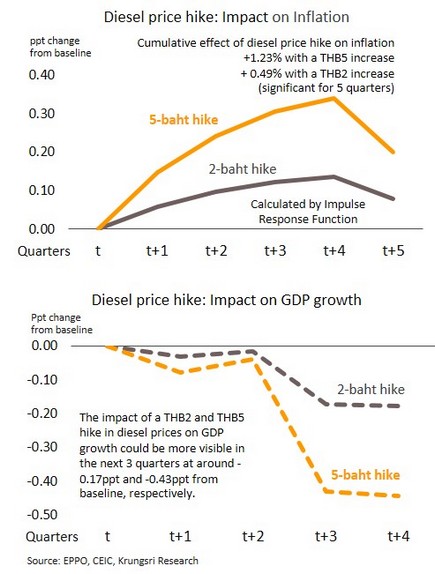

The Russian invasion of Ukraine has had a dramatic impact on a more fluctuated and persistently rising crude oil prices, which has translated into higher retail oil prices domestically, most notably for diesel. Since the latter is an important contributor to manufacturing costs, this has then had a broader impact on the business and household sectors. Recently, the government approved an extension of the measure to cut diesel excise by THB5/liter, effective from 21 May to 20 July 2022 (from the previous reduction of THB3/ liter, ending on 20 May), in order to help reduce the retail price of diesel fuel, so that it would not highly affect cost of living and economic recovery. Based on Krungsri Research estimation, a THB 2/liter price rise would cause cumulative effect of diesel price hike on inflation for 5 quarters by 0.49 ppt from base case, while the impact on GDP growth could be more visible in the next 3 quarters at around -0.17ppt compared to the baseline case. In the case of a THB 5/liter rise, inflation would increase by 1.23 ppt over 5 quarters and GDP would drop by 0.43 ppt in the next 3 quarters relative to the baseline scenario.

Thailand is less vulnerable to external shocks than peers, and this will allow BOT to maintain low policy rates in response to slow economy recovery. The Bank of Thailand (BOT)’s governor has stated that at present, although the Fed is trying to reduce inflationary pressures by raising rates, there is no need for the MPC to follow suit. Nevertheless, the widening gap between policy rates may affect capital flows and add to financial markets turbulence .

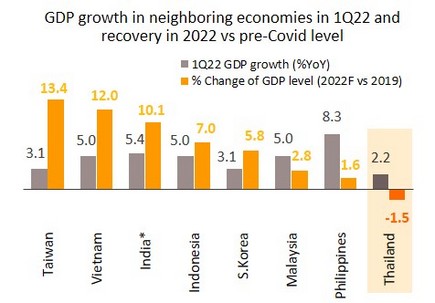

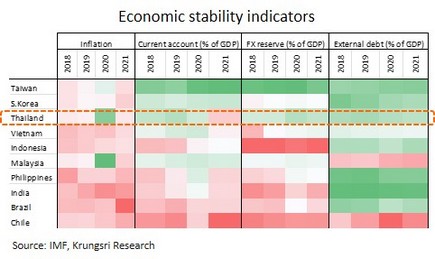

We expect that the MPC will keep policy rates unchanged through the rest of 2022 for the following reasons. First, the rise in headline inflation is not broad-based, with only mild signs of rising price pressure in the services sector as demand-pull inflation remains weak amid the sluggish labor market. Second, Thailand is less vulnerable to external shocks than peers, ranking third in terms of external stability after Taiwan and Korea. This would ease fears of fund outflows and leave room for the BOT to focus on economic growth rather than economic stability. Third, Thailand’s recovery remains fragile and economic activity this year would be weaker than peers. Activity is still below pre-pandemic level. Thailand’s 1Q22 GDP grew only 2.2% YoY, weaker than most economies in the region. In addition, for the whole of 2022 (based on the IMF’s GDP projection), economic activity (real GDP) in Thailand will be 1.5% below pre-Covid level while peers are expected to register activity that is 1.6-13.4% higher than pre-pandemic levels. So, despite peer pressure on policy rate hikes, Thailand’s weak economic recovery relative to peers would have a strong influence on the MPC’s next policy move. For Thailand, rate hikes this year are unlikely to tame cost-push inflation and could even hurt the still-fragile economic recovery.