The US has accelerated its interest rate hike amid monetary policy divergence in many countries; The global economy tends to slow down from rising threats to manufacturing

For the first time in 20 years, the Fed has raised rates by 50 bps, while signaling more aggressive fight against inflation. The Fed has raised policy rates by 0.50%, bringing these to 0.75-1.00%, the first 50 bps hike since May 2000. From June, the Fed balance sheet will also shrink by USD 47.5bn per month, and this will accelerate to USD 95bn per month from September.

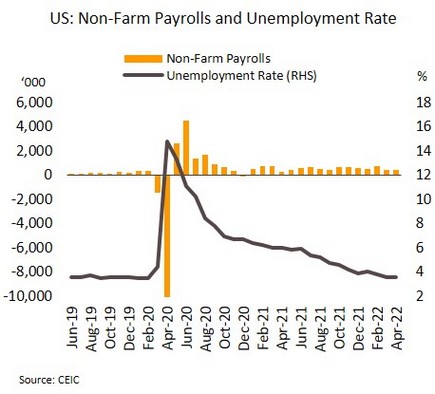

With core inflation hitting a 40-year high in March, the Fed is continuing with this round of rate rises, and the Fed Chair has indicated clearly that further 50 bps hikes should be expected at the next two FOMC meetings. Tight labor markets are likely to increase the pressure on the Fed to act, a state that is continuing with the jump in April’s non-farm payrolls, which with 428,000 new jobs beat market expectations, and unemployment rate remaining at the post-pandemic low of 3.6%. Although the economy is coming under pressure from the war in Ukraine and the lockdown in China, the strength of the labor market is thus providing the room for the Fed to raise rates with less likely risk to recession.

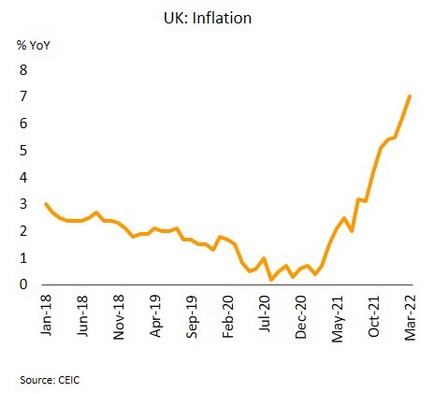

Interest rates are rising in several countries; The different policy implementation may lead to financial volatility. The Bank of England (BOE) has raised policy interest rates by another 0.25% (the 4th consecutive hike since December 2021) to bring these to a 13-year high of 1.00%. For the first time in over a decade, the Reserve Bank of Australia (RBA) has hiked rates, raising these by 0.25% to 0.35%. The Reserve Bank of India (RBI) recently held an out-of-turn policy meeting to announce a surprise increase in rates to 4.40%, a rise of 0.40% and the first hike since 2018.

Central banks are raising rates in response to Fed’s rate-hike cycle that has undercut the value of their currencies and pushed the dollar index to a 20-year high. However, the speed of these increases varies by country, and this may affect capital flows and so add to fluctuation in financial markets. In the case of the BOE, fears over the higher likelihood of a recession will limit future rate hikes, but the RBA and the RBI will likely continue with their current cycle of rate rises if pressure from prices remains elevated and continues to threaten their economies.

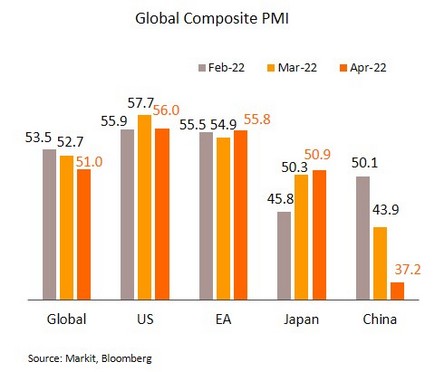

Signs of global economic slowdown emerge amid the risks of Chinese lockdown and extended Ukraine war. In April, the Composite global PMI slipped to 51.0, its lowest in 3 months. This was largely driven by the drop off in the Chinese PMI, which hit 37.2, the weakest since the start of the pandemic in February 2020. In addition, the US PMI softened to a 2-month low of 56.0. Meanwhile, the Eurozone and Japanese PMIs rose to respectively 55.8 and 50.9.

April’s data show that the global economy is slowing on the impacts of the Chinese lockdown and the war in Ukraine. Thus, the global Manufacturing PMI has slipped to its lowest in 19 months, though the easing of Omicron infections in Japan and the Eurozone has helped services in these areas to rebound. In the coming period, the prolongation of the Ukraine war and tougher sanctions against Russia together with the continuation of China’s strict lockdown will add to global risk and potentially drag on the world economy.

Higher energy prices are continuing to stoke inflationary pressures; The recovery in the tourism sector is gaining pace

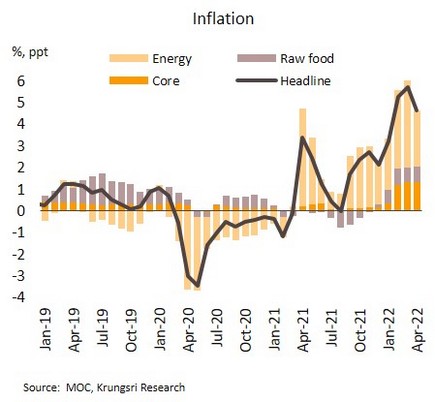

Although inflation decelerated in April, it will likely rise again in the coming months. Headline inflation dropped to 4.65% YoY in April, down from March’s 13-year high of 5.73% on a combination of last year’s high base effect and falling prices for some goods including rice, flour, and apparel & footwear. Nevertheless, high energy costs in the form of the 29.74% rise in the price of retail fuels and the ending of controls on the price of cooking gas will allow its prices to gradually increase. In addition, some foods, especially swine, chicken, eggs, vegetable oils, prepared foods at home and food away from home have been expensive due to rising production and input costs. At 2.0%, core inflation (excluding raw food and energy prices) remained steady from the near-10-year high in a month earlier, while for 4M22, headline and core inflation averaged 4.71% and 1.58%.

Inflation will likely rise again in May on higher energy costs, in particular for diesel fuel following the ending of the THB 30/liter cap on prices, which then be allowed to adjust step by step towards a new ceiling of THB 35/liter and would thus affect transportation and production costs. Likewise, the prices of cooking gas and fuel tariff (Ft) charged on electricity bill over May-August are set to climb, while higher overheads for inputs and raw materials will push up the price of consumer goods. On a wider scale, the war in Ukraine and the sanctions on Russia are keeping global prices for oil and other commodities elevated. Hence, there remains a probability that the 2022 annual inflation will exceed our projection of 4.8%. However, although inflation has run hotter than the BOT’s 1-3% target range for some time, we expect that the MPC will keep policy rates at 0.50% for the rest of 2022 as it looks to maintain its focus on the recovery.

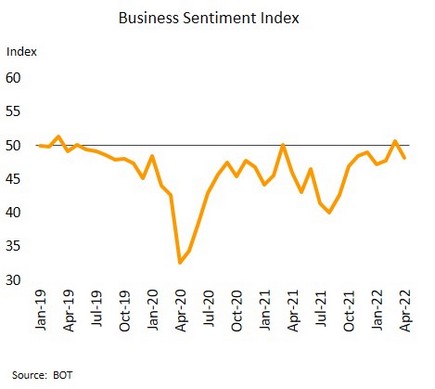

Rising production costs stoked business concerns; Services are benefiting from tourism recovery. The Business Sentiment Index (BSI) slipped from 50.7 in March to 48.2 in April, due mainly to rising costs. This was especially noticeable in the manufacturing and real estate sectors, for whom the impact of the Ukraine war on the cost of energy and of raw materials was pronounced. In addition, the ending of some stimulus measures to support purchasing power also affected confidence over orders, production and business performance.

Global supply chain disruption is more severe under the impacts of the prolonged Ukraine war, the intensified sanctions on Russia, as well as the lockdown in China. This may have an adverse impact on Thai manufacturing sectors in the next few months. Indeed, in March, some industries start to show signs of a slowdown as shortages of inputs began to bite, with this most noticeable for manufacturers of electrical appliances and electronic components & integrated circuits, while property sector also began to be affected by the rising cost of construction materials. Nevertheless, the outlook for the services sectors have brightened with continuing recovery in tourist arrivals, and now that the Test & Go program has been withdrawn, average arrivals numbered 19,000/day over 1-5 May, up from highs of 12,000-13,000/day in April. Domestic tourism would also be boosted continuously by the phase 4 of the ‘We Travel Together’ program, whose extension is expected.