Rates have risen to highs not seen in over a decade as the US and Europe battle inflation, but positive signs are emerging in China in Q1

US

US economy is outperforming expectations while the Fed is signaling that further rate hikes may be coming. At its 31 Jan-1 Feb meeting, the Fed hiked its benchmark rate by 25bps, bringing the Fed Funds Rate to 4.50-4.75%, with Chair Powell signaling a couple more rate hikes to pull inflation back to the 2% target. The latest data remain positive, with January’s ISM services print rising to 55.2 from 49.2. Employment indicators also surprised to the upside, in particular January’s 517,000 jump in non-farm payrolls (its highest since July 2022), the drop in unemployment to a 53-year low of 3.4%, and December’s 11.0m new job openings.

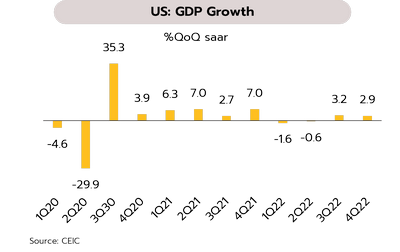

With labor markets still hot, we expect further rate hikes, but an end to the current cycle of increases is likely by mid-year: (i) This was the first time that the Fed Chair referred to disinflationary trends emerging from the data; and (ii) US growth will slow in 2023, with the GDPNow model showing growth down to 0.7% in 1Q23 from 2.9% in 4Q22, and although the IMF has raised its 2023 outlook for US growth from 1.0% to 1.4%, this is below 2022’s 2.1%. The ISM manufacturing print also dropped to 47.4 in January, its lowest since May 2020. Markets are thus now pricing in rate hikes of 25bps in March and May, giving a terminal rate of 5.00-5.25%.

Eurozone

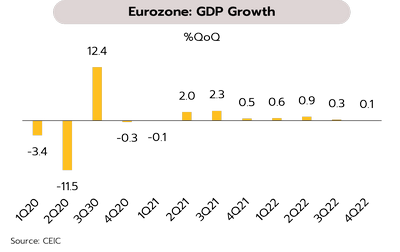

The Eurozone may avoid a recession, but the economy will still soften. 4Q22 GDP growth beat expectations of -0.1% to grow by 0.1% QoQ, underlining the Eurozone’s resilience and indicating that weak growth may still be possible in 2023. Headline inflation also dropped for the 3rd month, to 8.5% YoY, but core inflation rose to 7.0% in January. This will likely prompt the European Central Bank (ECB) to maintain its aggressive pace on rate hikes. Following the 50bps increase announced at last week’s meeting, which took Eurozone policy rate to 2.5%, the bank is indicating that in their ongoing struggles to bring inflation back down to 2%, another 50bps rise will be on the cards at their next meeting.

We see an improving outlook for the Eurozone due to a mild winter, lower energy costs, and support for electricity bills (thus alleviating the energy crisis), the bloc may dodge a recession in Q1. However, the ECB rate hikes are expected to start dragging the area’s economy from Q1 by undercutting growth in consumption and investment. The IMF thus sees growth of just 0.7% in 2023, down sharply from 2022’s 3.5%.

China

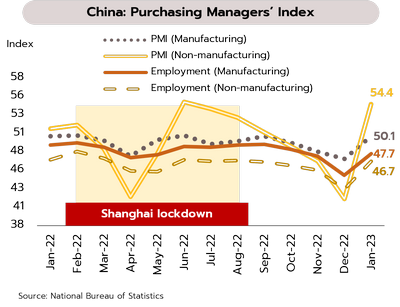

Positive signals are emerging in Q1, and recovery should accelerate in Q2. Despite supply disruptions through December caused by a surge in infections following the abrupt shift in the zero-Covid policy, the Chinese economy is recovering faster and stronger than expected. Both the manufacturing and non-manufacturing PMIs moved into expansionary territory (>50) in January for the first time since September, with the non-manufacturing PMI jumping to 54.4 due to recovery in the tourism sector (data as of 20 Jan., indicating that domestic travel is now back to pre-Covid levels). Moreover, the PMI employment index of both sectors significantly rose as well. Given these encouraging signs, the IMF has raised its forecast for Chinese economy in 2023 from 4.4% to 5.2%.

We expect that (i) the economy will continue to recover through the rest of Q1 as the expected infection rate begins to fall in early February, and (ii) the recovery will be much stronger in Q2 since the current wave of Covid-19 infections passes and the labor force is able to return to work. Rather than our earlier forecast of 4.8%, we thus now see the Chinese economy meeting the government’s target of 2023 growth of 5.5%.

![]()

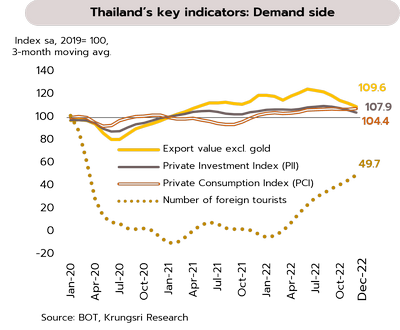

Q1 growth is being driven by tourism and private consumption, while manufacturing sector may improve somewhat.

Tourism and private consumption were major drivers of the economy at the end of 2022, and will remain so into 2023. Overall, December’s indicators showed that the economy was supported by growth in consumption that was itself driven by rising tourist arrivals (up to 2.24m from 1.72m in November). This then boosted employment in the tourism sector and helped to underpin a 2.7% YoY rise in private-sector consumption. However, exports fell for the 3rd month, slipping 12.9% on economic weakness in export markets, and this is then dragging on manufacturing and investment.

We see economic growth continuing to be supported through the start of the year by recovery in tourism, most notably by the sudden reopening of China. This has then given a strong boost to the tourism sector and related industries, and with this, service sector labor markets have strengthened, unemployment levels have dropped to close to their pre-Covid level, and both consumer sentiment and private consumption have risen. In addition, the latter has benefited from government stimulus measures including the ‘Shop and Refund’ scheme and additional help for low-income earners. However, the situation for exports is less positive, and although the reopening of China is feeding stronger demand, this is restricted to a more limited range of products for which demand is sensitive to changes in income (e.g., fruit, rubber products, autos & auto parts, and computers & computer parts). The positive impetus given by higher Chinese demand may therefore not be sufficient to offset weakness elsewhere. On the world stage, although the IMF has raised its forecast for 2023 global GDP growth from 2.7% to 2.9%, this is still significantly lower than 2022’s 3.4% and 2021’s 6.2%, and as such, the Thai export sector will come under pressure from the slowdown in major export markets, especially the US and Europe.

Business sentiment in the manufacturing sector is recovering, and overall business activity is returning to its pre-Covid level, with services in the vanguard. In January, the Business Sentiment Index rose from 48.4 in December to a 7-month high of 49.8, and while sentiment in the manufacturing sector remains below 50 points, it still rose to 47.9. Non-manufacturing sentiment also remains north of the 50-point waterline, although this slipped to 51.9, and both the manufacturing and non-manufacturing indices are now slightly above their 2019 pre-Covid averages.

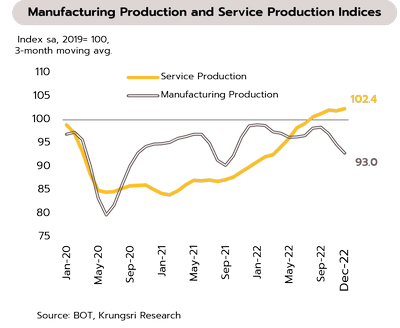

With the domestic Covid-19 pandemic largely over, economic activity recovering, and the country reopening to foreign tourists, 2022’s average Service Production Index (SPI) rose 13%, having stood still in 2021. Momentum remains strong and in December, the most recent data available, the SPI climbed above its pre-Covid level, led in particular by hotels and restaurants, passenger transport, and retail and wholesale. In keeping with the year-end decline in manufacturing and exports, the trade and freight components have weakened, but signs of an improving outlook for manufacturing are now emerging and this is reflected in stronger sentiment in the manufacturing sector. In addition, strength in the output, new orders, and employment components pushed the manufacturing PMI from 52.5 in December to 54.5 in January, and so for the first time in 17 months, Thailand’s PMI was the best performing in the ASEAN region.