Major central banks set to raise policy rates again later this week and may open door to the end of current rate-hike cycle

US

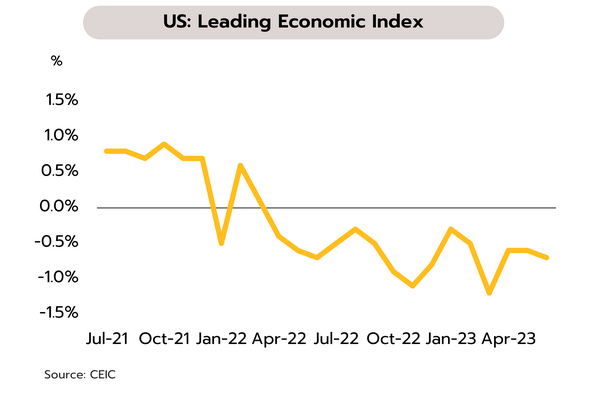

Against a backdrop of a slowing economy, the current cycle of rate rises may be close to the end after a possible hike this week. In June, the Leading Economic Indicator (LEI) declined by 0.7%, the 15th month of contractions. Retail sales were up by just 1.49% YoY and 0.2% MoM, undershooting market expectations of growth of respectively 1.60% and 0.5%. Likewise, manufacturing output came in below predicted growth of 1.10% YoY and 0.0% MoM to contract 0.43% YoY and 0.5% MoM, while at -13.5, the Philadelphia Fed Manufacturing Index was up from -13.7 but remained in negative territory. However, initial jobless claims fell by 9,000 to hit a 2-month low of 228,000.

A slowdown in labor markets is better than expected, inflationary pressures are easing, and the major banks remain resilient, and as such, the risks of a 2H23 recession are receding. The Fed will thus feel more comfortable about raising rates by another 25bps at its 25-26 July meeting, bringing the Fed Funds Rate to 5.25-5.50%. Nevertheless, data from LEIs and from consumption and manufacturing show the economy softening, while the yield curve is still inverted, and so the risk of recession remains. Given that real interest rates are now positive, a possible rate hike this week may be the final increase of this cycle, with rates likely then remaining elevated through to mid-2024.

Eurozone

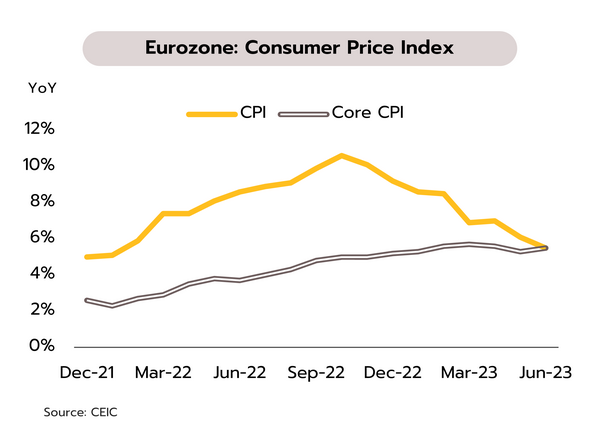

The Eurozone entered a technical recession in Q1 and so it is likely that the current round of rate increases will soon end. In June, headline inflation dropped from 6.1% to 5.5% YoY, but core inflation edged up from 5.3% to 5.5% YoY, while in July, consumer confidence stood at -15.1, up from -16.1 in June. A Reuters survey of analysts shows that a majority expect that the ECB will announce a 25bp rate rise at its July 27 meeting, though this may be the last of the year.

Eurozone inflation remains above the target zone and so we expect that in the second half of the year, the ECB will raise deposit rates to 3.75-4.00%. However, a combination of the high cost of living and tight monetary policy means that the Eurozone economy is likely to remain sluggish for an extended period, and this will drag on domestic consumption and investment, though this will be countered by falling energy prices and ongoing buoyancy in labor markets. A sharp slowdown should thus be avoided, and if inflation weakens and rates can be cut next year, the Eurozone should recover gradually.

China

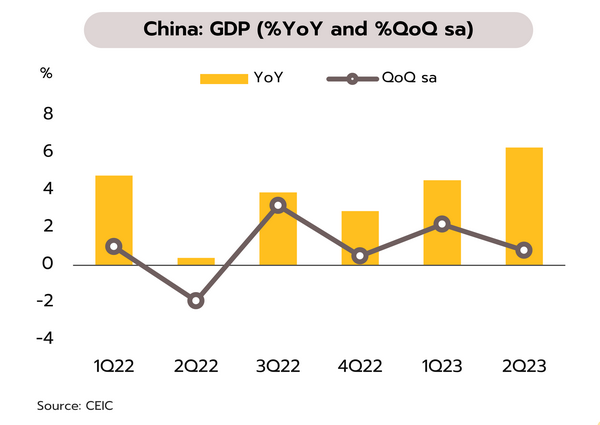

The Chinese economy is showing signs of slowing, putting pressure on businesses and FDI, while overseas investments are up. Q2 GDP growth rose to 6.3% YoY from 4.5% in Q1 but below the 7.3% expected by analysts. Momentum from the reopening is slowing, with Q2 QoQ sa GDP growth at just 0.8%, down from 2.2% in Q1. A range of indicators from June also point to a slowdown, including retail sales (+3.1% YoY vs +12.7% in May), unemployment among 16-24-year-olds (at a record high of 21.3%), real estate sales (-28.1% vs

-19.7%), and fixed asset investment (+3.8% in 1H23 vs +5.5% at the start of the year).

The worse-than-expected slowdown in the Chinese economy has prompted authorities to prepare measures to stimulate domestic demand and to promise private-sector companies the same level of support as state enterprises, but there is as yet no sign of large-scale concrete measures. Businesses are thus under pressure, and major corporations are likely to have turned loss-making in 1H23, including in the steel making, chemicals, cement & construction materials, and paper & pulp industries. Foreign direct investment (FDI) also fell by 2.7% YoY to USD 98.5bn in 1H23 while outward direct investment (ODI) from China jumped 14.8% to USD 62.3bn.

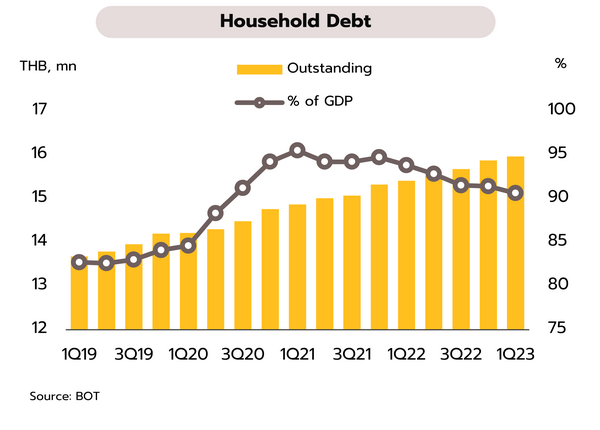

The BOT has introduced measures to help alleviate household debt problems and signaled that policy rates may rise. The outlook for investment and the wider economy will depend on how the political situation evolves.

The BOT has announced measures to alleviate debt problems, while it has indicated that policy rate will rise at the 2 August MPC meeting. The Bank of Thailand (BOT) has issued new measures for dealing with 4 categories of problematic household debt: (i) current non-performing loans; (ii) persistent debts; (iii) rapidly growing new debt, and (iv) informal lending. The Responsible Lending measures will be the first to be enforced, coming into effect on 1 January 2024, followed by the Persistent Debt (PD) measures, which will be enforced from 1 April 2024. Policies to deal with persistent debt will affect around 0.5m accounts, which can be divided into the two categories of: (i) general PDs (debts for which interest payments have exceeded the principal for 3 years), which will receive a warning and advice on increasing monthly repayments so that the interest can be reduced and the debt repaid more rapidly; and (ii) severe PDs (debts for which interest payments have exceeded the principal for 5 years), which are split into the subgroups of debtors to commercial banks and related businesses with an income below THB 20,000/month, and debtors to non-banks with an income below THB 10,000/month. These will benefit from revised interest rates of no more than 15% annually, with loans repaid within 5 years at most.

These moves will help offset some impact of tighter monetary policy and provide support for households in place of pandemic era measures expiring at the end of the year. Most recently, the governor of the Bank of Thailand has stated that, there is no indication yet that the current round of rate normalization needs to be brought to an end since the overall direction of the economy remains on track and as predicted. Although inflation fell in June, this was likely only temporary, and going forward, there is a chance that inflation will rise as businesses pass on higher costs. In addition, the effects of spending by the incoming government have not yet been factored in. We therefore believe that at its meeting on 2 August, the MPC will raise policy rate from the current 2.0% to a 9-year high of 2.25%.

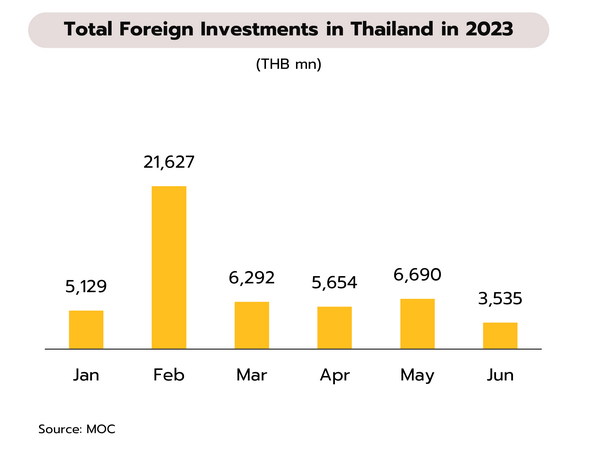

Uncertainty over the political outlook and the establishment of a new government may drag on growth and undercut sentiment. The Ministry of Commerce has reported that as per the 1999 Foreign Business Act, 326 applications by non-Thais to invest in businesses in Thailand were approved (+15% YoY) in the first half of the year (January-June), with the total investment for these running to THB 48.93bn (-30%). The most important originating countries were Japan (74 applications worth THB 17.53bn), the US (59 applications worth THB 2.91bn), Singapore (53 applications worth THB 6.92bn), China (24 applications worth THB 11.51bn), and Switzerland (14 applications worth THB 1.86bn).

There is still considerable uncertainty over the establishment of a new government. Last week, Pita Limjaroenrat, head of the Move Forward party and the party’s candidate for prime minister, was suspended as an MP by order of the constitutional court, with effect from 19 July until the court rules on the case involving Pita’s ownership of shares in ITV. At the same time, parliament also blocked Pita’s second nomination as PM. Move Forward have now accepted that Pheu Thai, the second largest party in parliament, should try to form a government, though it is not clear whether Pheu Thai will do so according to the earlier MOU agreed with 7 other parties, or if the party will try to form a new alliance as it looks to assemble the 376 votes needed to secure the election of its candidate as PM on 27 July. In our base case forecast, a new government is expected to take office in August, but any delays to this risk impacting growth and eroding investor sentiment. The latest data on foreign business approvals also show that the value of applications dropped to THB 3.54bn in June, down from THB 6.69bn a month earlier.