The Thai Economy in 2022 and Outlook for 2023

In 2022, the economy has been recovering since mid-2022 full reopening but high inflation is a concern

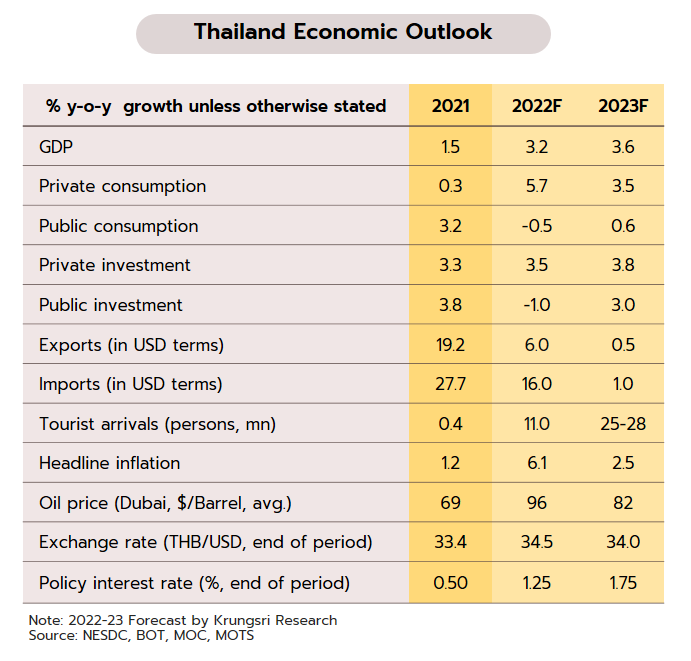

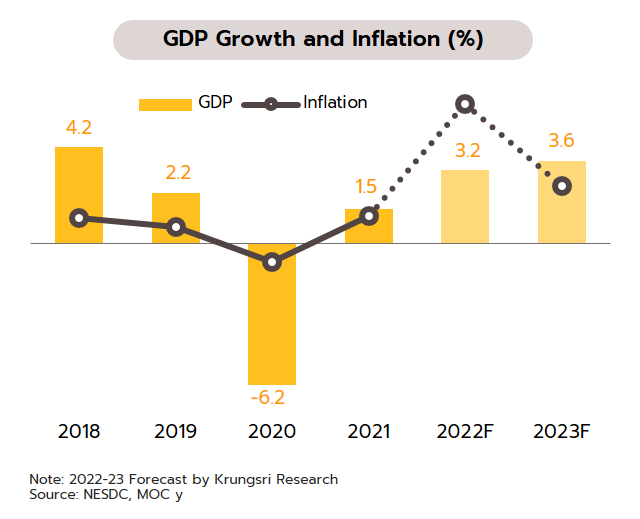

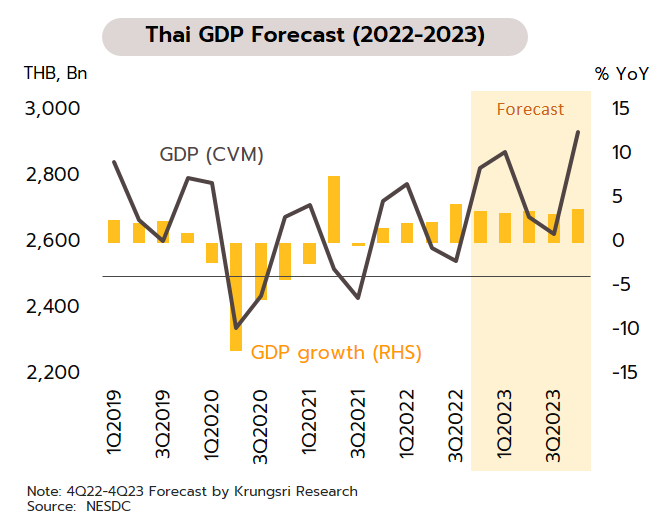

Following lackluster growth of just 1.5% in 2021, we see the Thai economy expanding by 3.2% through 2022, helped by the success of the vaccination program and the abating of the Covid-19 pandemic. Thanks to this and the global easing of restrictions on international travel, the authorities were able to fully reopen the country to foreign visitors in the middle of the year, and with this, tourist arrivals have begun to rebound rapidly. Nevertheless, the global environment remains troubling, and the outbreak of war in Ukraine and the reintroduction of widespread lockdowns in China helped to trigger renewed disruptions to supply chains worldwide. Worse, this coincided with the post-pandemic acceleration in demand as economies worldwide surged back to life, and the result of the two sides of the market pulling in opposite directions inevitably fed into sharply rising prices in both Thailand and the major economies. In response, central banks pivoted rapidly, and across much of the world monetary policy shifted from the accommodative position adopted throughout the pandemic to a dramatically more hawkish stance.

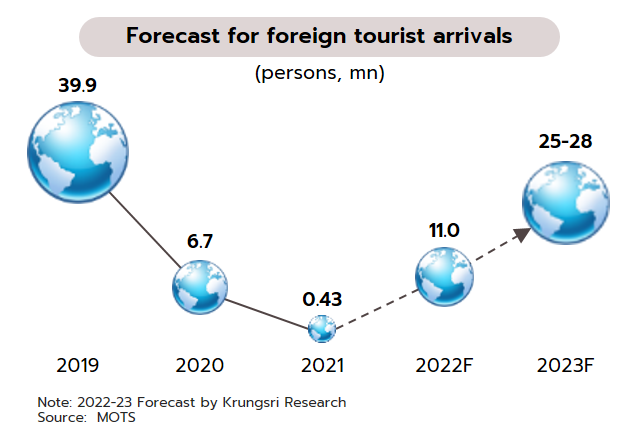

Recovery in the tourism sector emerged as a clear trend from the middle of the year, and for 2022 overall, Thailand should welcome 11 million foreign arrivals, a remarkable turnaround on 2021’s total of just 0.43 million. The sector has been revived by the lifting of domestic pandemic controls in mid-2022 and the move by almost all countries to reduce or remove restrictions on international travel. Nevertheless, the majority of this year’s tourists were still short-haul travelers coming from within the region, and the impact of the all-important Chinese market has remained minimal given the periodic reimposition of lockdowns and the ongoing enforcement of the zero-Covid policy through the year. With growth of 19.2%, exports were a major driver of the economy in 2021, and the sector continued to grow in 2022. Sales into export markets thus are expected to expand by another 6%, buoyed by the easing of the Covid-19 pandemic and the lift to demand that this triggered, though the disruption that the Ukraine-Russia war has brought to supply chains also then stoked additional demand for food and other goods. The war has been one factor underpinning higher global commodity prices, which further boosted incomes for some Thai exporters. However, the year-end softening of the world economy was also clearly reflected in a slowdown in the export sector.

Thanks to the easing of the pandemic and the success of the vaccine rollout, domestic expenditure and the level of economic activity have returned to normal, though these were also helped by the extension from 2021 of government stimulus packages and the introduction of new measures to help consumers weather the impacts of the surge in energy costs. The economy has benefited further from the 5.02% hike in the minimum wage that was announced at the end of the year, and so for 2022 overall, growth in private sector consumption is expected to jump from 2021’s 0.3% to 5.7%. Private sector investment will be largely unchanged, with the rate of expansion running at 3.5%, up slightly from 3.3% in 2021. Growth has been supported by the export sector, which remains strong despite supply chain bottlenecks in some industries, and a firming up of domestic demand, which has risen on the back of recovery in the tourism sector and the rebound in the economy more broadly. Spending on construction has also improved with the fading of the pandemic, especially for infrastructure megaprojects, many of which are structured as public-private partnerships and which had fallen behind schedule. Indeed, a general improvement in investor sentiment is reflected in continuing inflows of foreign direct investment. Through the year, government spending has continued to provide support for the economy, though the importance of this has lessened in step with the weakening of the pandemic and the 5.7% cut in the overall size of the 2022 budget to THB 3.1 trillion. However, some funds earmarked for spending on responses to the impacts of the pandemic remain from the two earlier rounds of emergency borrowing, one for THB 1 trillion and one for THB 500 billion. Overall public debt rose to 60.4% of GDP at the end of fiscal year 2022 from 58.4% at the end of fiscal year 2021.

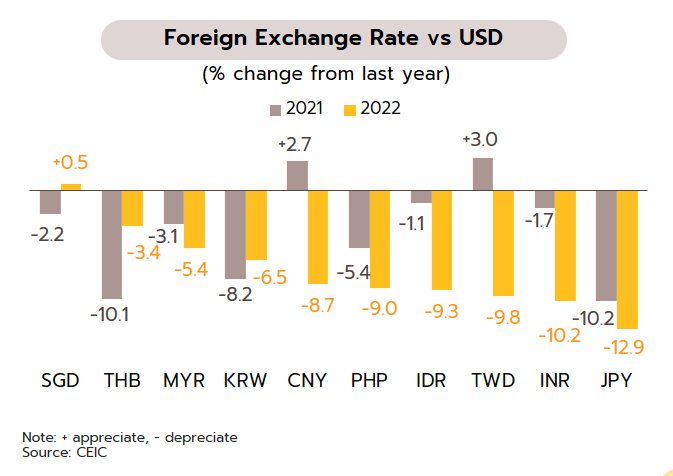

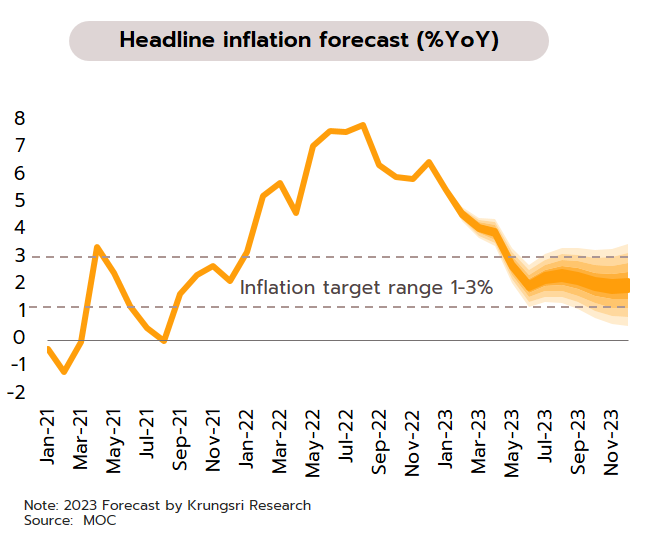

The unwinding of the pandemic and the subsequent recovery in the Thai economy has occurred alongside a sharp increase in supply-side inflation that has, thanks to the Ukraine war, been particularly intense in commodity markets. The result of the commodity shock has then been to push domestic headline inflation to a 14-year high of 6.1% in 2022, up from 2021’s much more sedate level of just 1.2%, and in response, the Bank of Thailand has been forced to pull harder on monetary levers. As such, for the first time in 4 years, policy rates were raised in August 2022, and another two hikes have taken the year-end rate to 1.25% from the 0.50% rate at the close of 2021. In keeping with the overall uncertainty in the global economy, the baht-US dollar exchange rate has been volatile through the year, but for much of 2022, the Fed’s unexpectedly hard and fast cycle of rate hikes has fed a steady weakening in its value. However, moving towards the year-end, the Fed has softened its stance and Thailand’s tourism sector has rebounded, thus improving the country’s current account balance, and with this, the baht has strengthened again.

2023 Outlook: Domestic recovery will be driven by twin-engines - tourism and domestic consumption - but the global slowdown and external risks remain a threat

2023 should mark the point when the Thai economy finally returns to or surpasses its size prior to the outbreak of Covid-19. Krungsri Research thus see growth accelerating from an estimated 3.2% in 2022 to 3.6% in 2023, driven in particular by the ongoing rebound in the tourism sector and stronger labor markets, especially in areas linked to tourism, that will boost household consumption. Investment will also benefit from growth in the service sector, continuing expenditure on infrastructure, and an expansion in the scale of work undertaken in the Eastern Economic Corridor (EEC). However, investment in some industries, and across all of the export sector, will have to contend with what may be a darkening international business environment. Risk will rise from a global slowdown and especially from an underperformance by the Chinese economy, tighter financial conditions, the extension of the Ukraine-Russia war, worsening geopolitical tensions, and longer-term trends to deglobalization. The net effect of these headwinds will then be to dampen growth prospects for Thailand.

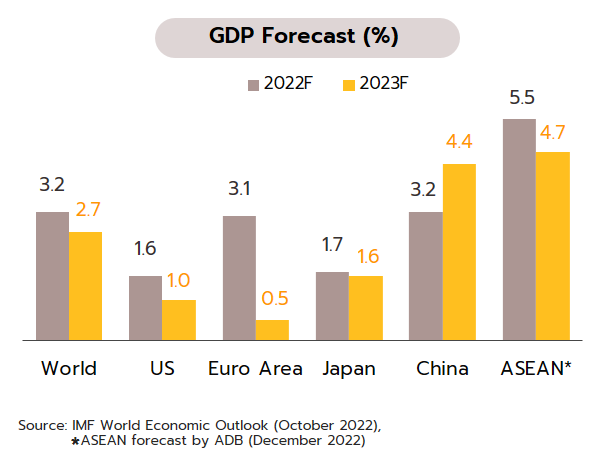

The steadily improving outlook for the tourism sector will be an important pillar on which recovery will be built through 2023, and although the world economy will soften next year, the reopening of the country and the relaxation of pandemic-era controls on international travel will continue to boost the market for short-haul arrivals from within the region. Alongside this, recovery in the crucial Chinese market should be stronger in the second half of the year, and so for 2023 overall, 25-28 million foreign arrivals are expected. Nevertheless, although this would be more than double 2022’s total, the sector will remain far from its 2019 level of health. Export growth rates will decline with what is expected to be a global slowdown. Thus, the International Monetary Fund (IMF) sees the world economy expanding by just 2.7% in 2023, its weakest expansion since 2001 and significantly down from 2022’s 3.2%. More significantly, the IMF also believes that a third of the world’s economies will slip into recession next year and that a full half of European nations will see their economies contract in 2023. This unhappy outlook is, though, in step with the forecast by the World Trade Organization (WTO) that growth in global trade will slump from 3.5% in 2022 to just 1.0% in 2023, and both the IMF and WTO have issued warnings that international tensions between major economies may accelerate deglobalization. More positively, 24% of the value of Thai exports originates in markets in the ASEAN zone, and the Asian Development Bank (ADB) estimates that despite the poor outlook at the global level, the ASEAN region will be able to keep favorable growth of 4.7% in 2023, compared with 5.5% in 2022.

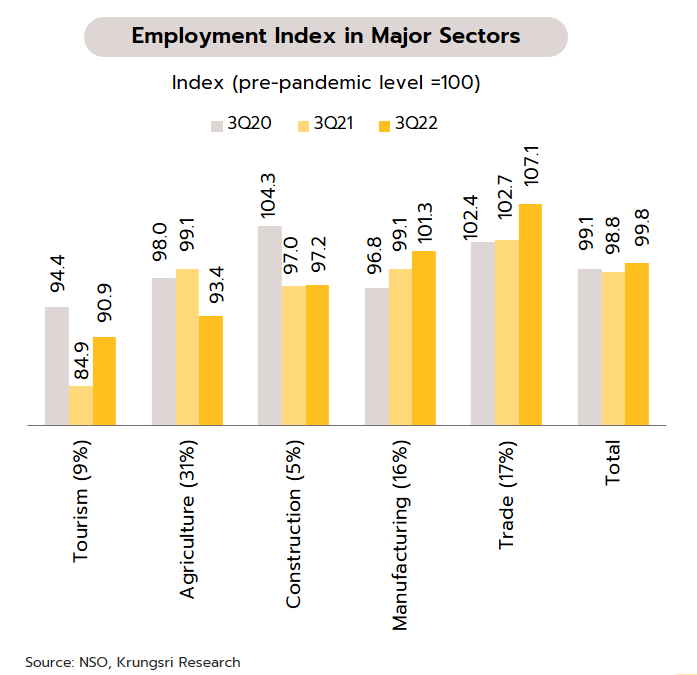

Private sector consumption will continue to rise on improving consumer sentiment and strengthening labor markets. The latter will be helped by recovery in the domestic economy and especially in the tourism sector, and this will feed into higher household incomes. However, for low-income earners, there will only be limited room within which consumption will be able to rise, and high levels of household debt, the current cycle of rate hikes, and the ending of government stimulus spending will all drag on growth in expenditure. Private sector investment will benefit from the broadly positive outlook for the domestic economy, and although this will be affected by the combination of softening demand in the export sector and the impact of higher interest rates on the cost of financing, the indicators provided by the value of FDI inflows and applications for Board of Investment (BOI) support remain positive. This is particularly so for projects in the EEC, where investors are continuing to show interest in industries targeted by the government, including the next-generation automotive and smart electronic industries. Moreover, from 2023, the BOI will be implementing an additional set of investment promotion schemes that will cover the five years from 2023 to 2027. Government spending on infrastructure should also continue to flow for both existing and new projects, including both the Northern and Northeastern twin-track railways (the Den Chai-Chiang Khong and Ban Phai-Nakhon Phanom sections respectively). As regards overall government spending, this is likely to remain largely unchanged given total allocations of THB 3.185 trillion for the 2023 budget year, a 2.7% increase on the previous year’s spending. This will then keep the budget deficit fairly stable at THB 695 billion and so, as the economy grows and pandemic stimulus programs end, the public debt-to-GDP ratio should dip slightly.

Unfortunately, even as the domestic economy begins to travel down the road to recovery, it may be buffeted by storms originating overseas, including the likely slowdown in the global economy and outright recession in many individual countries. Headline inflation is expected to slip back into the Bank of Thailand’s target range in mid-2023, and so Thai monetary policy can be expected to be looser than that of many countries. In particular, two more rate hikes are forecast for the first quarter of 2023, giving a terminal policy rate of 1.75% that should remain unchanged until the end of the year. This will then have implications for exchange rate movements, and as uncertainty regarding central bank policy in the major economies and China’s handling of its exit from Covid-19 swirls across markets, the baht may experience fluctuations in its value. Markets will also be affected by a potential worsening of geopolitical tensions and ongoing political and economic decoupling, but despite this, the baht should see a net strengthening as rising foreign currency earnings from the tourism sector help to return the current account balance to surplus for the first time in three years.

A number of risk factors have the potential to cause lower-than-expected growth in the Thai economy in 2023. These include turbulence in capital markets, the risk of a global recession occurring with interest rates in many countries at multi-year highs, and the possibility of the Chinese economy undershooting its growth targets as a result of its mismanagement of Covid-19, continuing problems in the real estate market, and the impacts of the US block on tech exports. Alongside this, the continuation of the war in Ukraine is adding to the risks facing the global economy and raising the likelihood that inflationary pressures will continue , while on the other side of the world, there is also the possibility that US-China tensions over Taiwan will worsen further. Closer to home, Thailand faces an election in 2023, and any delay in installing a new government will likely disrupt economic policy, and even in the absence of this, the Covid-19 pandemic caused economic scarring that has yet to heal. This includes elevated levels of household debt, and this is now adding to the risk that SMEs and low-income earners will see their economic situation become more precarious; it thus remains the case that the recovery will not be felt equally across the country, and risk and uncertainty will pool noticeably in some parts of the economy.