Growth is under pressure in the major economies, while Chinese recovery will rely on domestic activity and pandemic situation

US

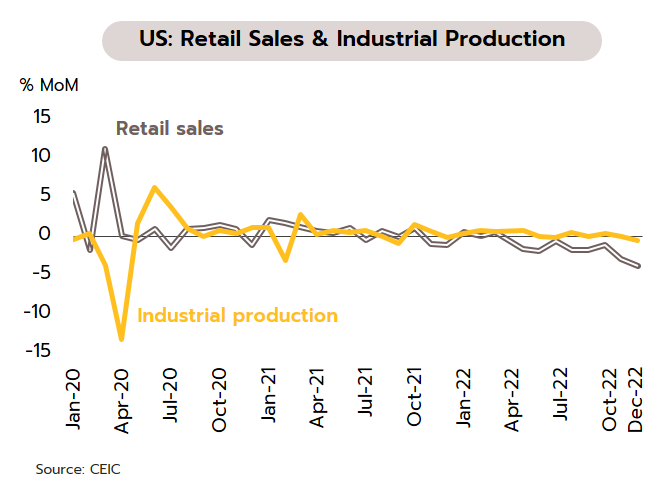

The risk of a US recession is rising, potentially allowing for a Q2 halt in rate hikes. December’s retail sales contracted faster than expected, sliding by the most in a year at -1.1% MoM. Ex-fuel retail sales were also worse than expected, falling 0.8% and reflecting weakness in New Year spending. Likewise, industrial output dipped 0.7% MoM, the worst in 15 months. Existing home sales fell for the 11th month a row to their lowest since November 2010, and building permits dropped 1.6% MoM to their lowest in 31 months. However, for the week ending 14 January, initial jobless claims fell more than market expectations to its lowest in 4 months.

The strength of labor markets may encourage the Fed to continue with rate rises over the next 2-3 months but the Producer Price Index dropped 0.5% MoM in December, its sharpest decline since the start of the pandemic in April 2020, and so inflation is now showing signs of softening. With declines being seen in consumer expenditure, industrial output, and housing markets, the risks of recession are rising and so we now expect that the Fed may announce a pause in rate hikes in Q2 as it shifts to a greater emphasis on avoiding recession and sustaining growth.

Japan

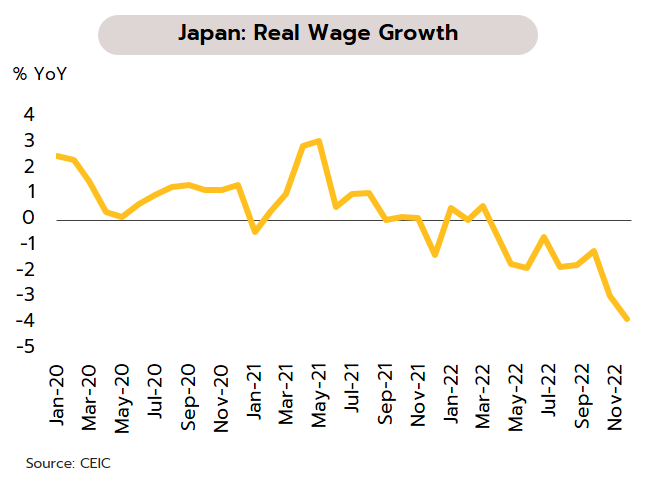

The BOJ keeps intact its relaxed monetary stance as it looks to support a rise in wages and higher long-term inflation. Core inflation rose to a 41-year high of 4.0% YoY in December; however the forecast for 2023 remained at 1.6%, well below the BOJ's target of 2.0%, due to falling energy prices and electricity subsidy measures that will take effect in February. Alongside this, the BOJ agreed at its most recent monetary policy meeting to maintain policy rate at -0.1% and to leave the target range for 10-year government bond yield at +/-0.5%, which resulted in bond buying back and a drop in the Japanese Yen to a 1-week low.

The Japanese economy remains fragile from weak global demand, which could put pressure on exports, especially in the first half of 2023. At the same time, the increase in short-term inflation may drag on any rebound in private consumption, as can be seen in November real wages which posted the fastest fall in 8 years at -3.8% YoY. We thus see the BOJ preventing an excessive acceleration in inflation while still supporting economic recovery by gradually unwinding its ultra-loose monetary policy.

China

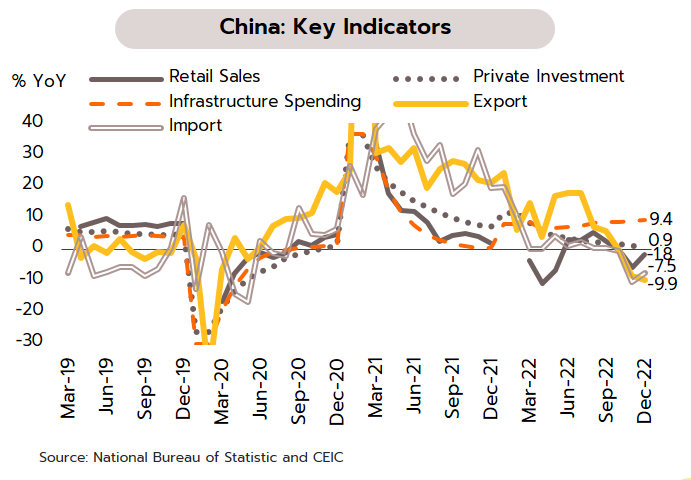

The main engines of the Chinese economy remain fragile, but improvements should be seen once the surge in Covid-19 cases recedes. December’s GDP growth slowed to 2.9%, limiting 2022 growth to 3%, and although this matched our forecast, it undershot the official target of 5.5%. December’s retail sales shrank 1.8%, an improvement on November’s 5.9% decline, while increases in investment in fixed assets slipped from 5.3% to 5.1% over the same period. Growth in private investment slumped from 11.4% in early 2022 to just 0.9% in December, though growth in infrastructure spending rose to 9.4% in the same month. Exports have shrunk with the cooling of the global economy, and in December, these contracted 9.9%, their worst performance since February 2020. Meanwhile, imports expanded by around 1% over 2022.

We expect a visible improvement in private consumption and investment in Q2 after the peak in Covid-19 infections. Exports are expected to remain weak due to sluggish global demand and the risk of recession in the US and Europe. Imports, on the other hand, are likely to gradually increase as consumption recovers, benefitting countries that rely heavily on exports to China.

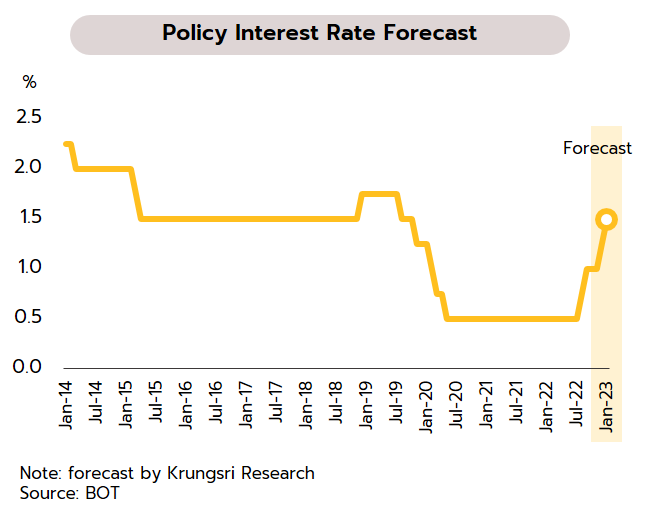

Krungsri Research expects the MPC to raise rates by 25bps at this week’s meeting, while monitoring economic assessments. Alongside this, investment is benefiting from stronger FDI.

The Monetary Policy Committee (MPC) is expected to raise policy rate to 1.50% at its 25 January meeting. This would be the 4th hike since the current cycle of increases began in August 2022, with the most recent increase made at the 30 November meeting that the MPC agreed unanimously to a 25-bp hike in policy rate to 1.25%. The BOT expected GDP growth of 3.7% in 2023 and 3.9% in 2024 as the economic benefits materialize of recovery in the tourism sector and growing private consumption. This will then help to lessen the impact of the global economic slowdown, and although rising domestic energy costs may lift inflation, this will gradually fall back into the target range by this year

We see the MPC raising rate by 25bps at its 25 January meeting, taking this to 1.50% from the year-end rate of 1.25% as the Committee looks to combat persistent inflation, which is being kept above the target range by increases to electricity bills and public transport fares. The Thai economy should also continue to grow steadily through Q1 on stronger consumption and recovery in the tourism sector, the latter having a larger role to play in the coming period thanks to the unexpectedly rapid reopening of China. However, a number of factors will encourage the MPC to slow the pace of rate hikes, including: (i) the slowdown in the global economy and, with monetary policy tightening, the higher risk of recession; and (ii) the likelihood of inflation softening in Q2, partly due to comparison with last year’s high base and partly due to the rapid strengthening of the baht (up over 5% since the end of 2022) relative to its regional peers. Nevertheless, it remains to be seen what view the MPC will take on the overall state of the Thai economy and how the Committee will approach monetary policy and the need to balance price stability with economic growth.

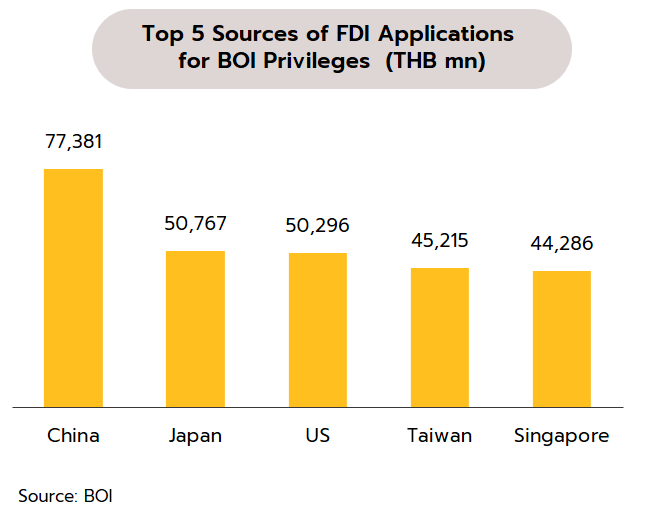

FDI applications for BOI investment support are showing sign of improvement, and going forward, this will lift investment. The Board of Investment (BOI) reports that in 2022, 2,119 applications (up 41% YoY) worth THB 664.63bn (up 39% YoY) were made for investment support, the highest level since the start of the Covid-19 pandemic in 2020. Of this total, THB 433.97bn was from FDI applications, which were therefore up 36% from a year earlier. China accounted for the greatest share of investment value, followed in order by Japan, the US, Taiwan, and Singapore.

With countries competing vigorously to attract FDI, the latest news that in 2022, FDI applications for BOI privileges in Thailand returned to close to their pre-Covid level of THB 465.44bn in 2019. Indeed, the 2022 figures are significantly above the 2017-2021 5-year average of around THB 350bn, and this buoyancy in inflows reflects investor confidence in Thailand as a production base and as a major regional recipient of investment. The outlook for growth in investment is thus positive over the coming period, with investors from China, Japan and the US focused especially on electric vehicles, smart electronics, clean energy, and digital technologies.