A slowing economy and troubles in the financial sector are putting pressure on EU and US monetary policy. in China, growth remains patchy.

US

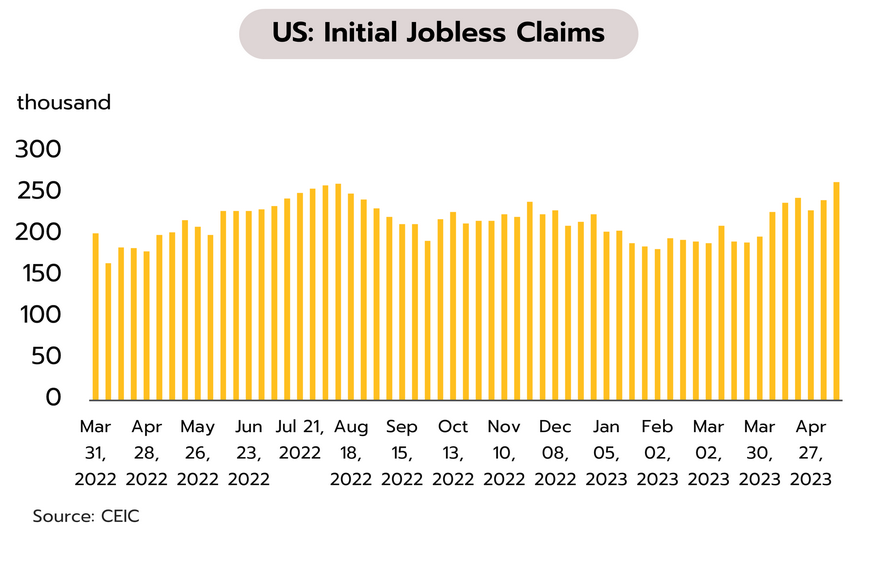

The Fed has indicated that the current cycle of rate hikes will end in 2H23. Keep an eye on the risk of a US default. In April, headline and core inflation both edged down 0.1% to 4.9% and 5.5%, while the consumer sentiment index slipped to a 6-month low of 57.7 in May. Likewise, initial jobless claims rose by 22,000 to 264,000 last week to hit their highest since October 2021. At May’s meeting of the FOMC, the Fed also announced a further 25bp rise in rates, taking the target range to 5.00-5.25%, however officials indicated that this round of increases was coming to an end.

The worse-than-expected data on employment and consumer sentiment will add to the headwinds blowing against the economy in 2H23. Tussles over government debt also remain unresolved and the Congressional Budget Office estimates that without a rise in the debt ceiling, a US debt default may occur as soon as the first 2 weeks of June. If there is no increase in the debt ceiling, this will have a serious impact on investment, employment, and sentiment. Moreover, fragility in the regional banks continues to undermine the financial sector. Given this, the move by real interest rates into positive territory and the rising risk of recession, rate hikes are ending, and we expect that at its June meeting, the Fed will leave the Fed Funds Rate at 5.00-5.25%.

Eurozone

Although GDP remained positive in Q1, Eurozone growth has slipped to a 2-year low. In March, the retail sales index contracted by 1.2% MoM and 3.8% YoY, worse than market expectations of respectively -0.1% MoM and -3.1% YoY. In addition, headline inflation also edged up from 6.9% to 7.0% YoY in April, though core inflation softened slightly, dropping from 5.7% to 5.6%.

Despite remaining positive through Q1, Eurozone growth rates have fallen to their lowest in two years. This is a result of strong inflation and high interest rates, which is then depressing household spending and undermining sentiment. Demand for credit is also falling and a survey of bank lending standards has shown that the latter is now at its tightest since 2008. Nevertheless, against a backdrop of pressure from wage growth and persistently high inflation, we expect the European Central Bank (ECB) to push forward with rate hikes, and we thus see the ECB raising policy rates by 25bps at least twice more as the bank looks to reestablish price stability and bring inflation back within reach of its 2% medium-term target.

China

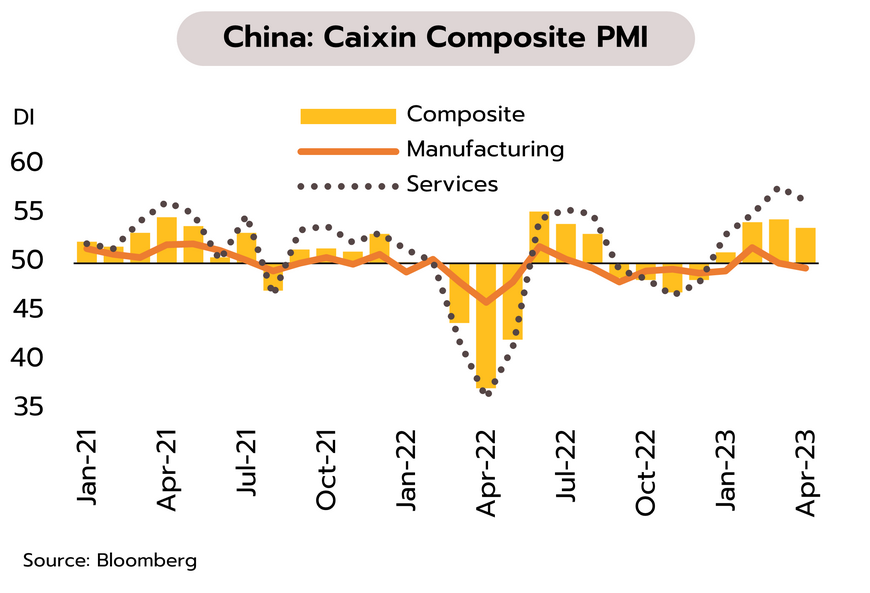

The Chinese economy continues to benefit from the reopening of the country, but softening inflation and a slowing manufacturing sector are raising fears over growth. At 53.6, the Caixin composite PMI remained in positive territory for the 4th month in April, though this was down from March’s 9-month peak of 54.5. Growth was supported by the services PMI, though in April this slipped to 56.4 from the 28-month high of 57.8, but having sat at exactly 50.0 in March, the manufacturing PMI dropped to 49.5 in April, thus slipping into recessionary territory for the first time in 3 months.

Growth is being buoyed by services and those parts of the economy related to tourism, and so over the Labor Day holidays (29 April to 3 May), domestic tourists made 274mn trips, up almost 20% from 2019. However, recovery is uneven and the manufacturing PMI is now back into negative territory, export growth is slowing (+8.5% YoY in April vs +14.8% in March), the contraction in imports is accelerating (-7.9% vs -1.4%), and headline inflation has slipped from 0.7% to a 2-year low of 0.1%. Moreover, April’s total new yuan-denominated loans came to CNY 0.718trn, lower than the expected CNY 1.4trn and March’s CNY 3.89trn. The indicators therefore point to an elevated risk of a slowdown in China, especially once the initial impetus given by the country’s reopening has dissipated.

1Q23 Thai economic growth was close to our forecast. Election result reflects shift of political pole with uncertainty over forming the next government.

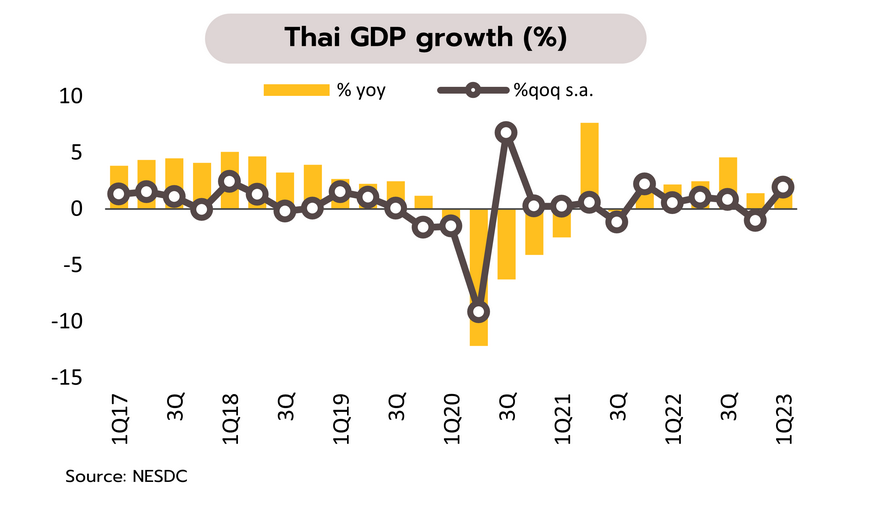

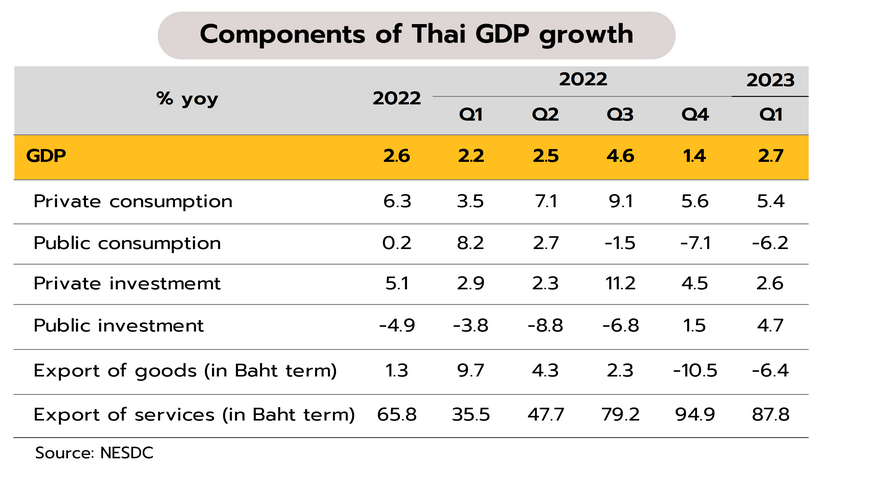

1Q23 GDP grew 2.7% YoY. Krungsri Research has maintained 2023 growth forecast at 3.3%. The NESDC reported the Thai economy expanded at 2.7% (vs consensus and Krungsri Research forecasts of 2.3% and 2.2%, respectively), up from 1.4% in 4Q22. Its growth was fueled by (i) tourism recovery which supported an increase in private consumption (+5.4%, closed to 4Q22 growth), and (ii) improving public investment (+4.7%), supported by road and bridge construction. Private investment rose at a slower pace in both construction sector and machinery equipment. Merchandise exports and public consumption continued to shrink (-6.4% and -6.2%, respectively). As for the whole year of 2023, the NESDC has maintained it GDP growth forecast at a range of 2.7-3.7%.

The NESDC reported 1Q23 GDP growth at 1.9% QoQ sa, close to Krungsri Research’s estimate of 1.8%. The Thai economy could avoid a technical recession after it contracted 1.3% in 4Q22. In the rest of 2023, the Thai economy is on the path of further recovery with tourism sector as a key driver. However, the political development after the general election is a key factor. Although the opposition parties, led by the Move Forward party overwhelmingly supported by voters, look set to set up a coalition government, the formation of the next government, including consideration about economic and political policy direction, remains highly uncertain and take times. These could affect an implementation of the government budget for fiscal year 2024 (normally effective in October 2023). As such reasons, Krungsri Research has maintained our 2023 GDP growth forecast at 3.3%, waiting for clearer political situation and economic policy direction.

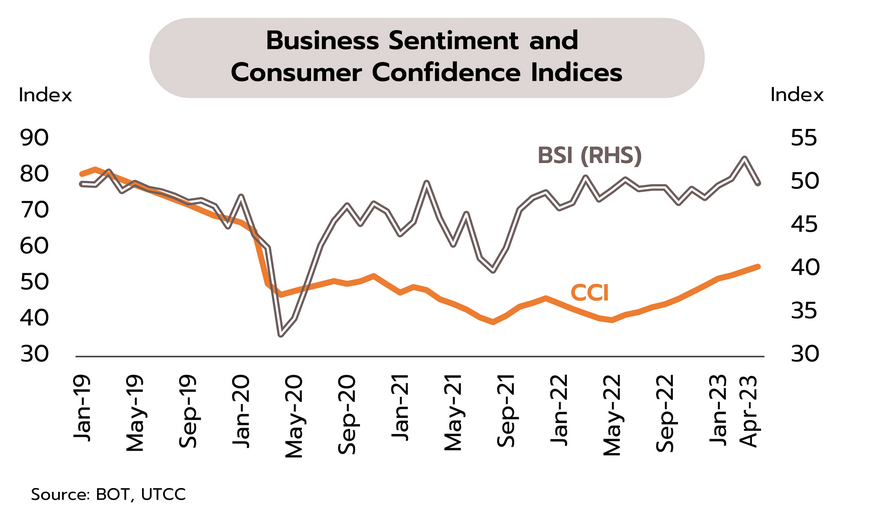

Consumer confidence continues to rise while business sentiment remains fragile. Greater clarity over the political direction will help to support sentiment. In April, the Consumer Confidence Index rose for the 11th month, climbing on a combination of recovery in the tourism sector and the stimulus effects of electoral campaigning. This thus rose from 53.8 in March to 55.0 in April, the highest since March 2020. However, business sentiment softened for the first time in 3 months, dropping from 52.9 in March to 50.1 in April, and in the manufacturing sector, fears that the global slowdown will feed into a drop in exports pulled sentiment below the all-important 50-point waterline.

We believe that although the outcome of the government formation remains unknown, if a new government is installed quickly, this will help to lift confidence among both consumers and investors and if, as promised, populist policies are rapidly introduced, short term stimulus packages will help to boost private sector consumption. By contrast, any extended hiatus in central government administration runs the risk of negatively impacting sentiment and of delaying the annual budget, which would then interrupt disbursements. This would increase risk to economic growth in 2H23, amplifying the effects on the export sector of the sluggish performance of Thailand’s major overseas markets.