With risk rising, rate hikes are ending in the EU and US, while the Chinese authorities are trying to head off a worsening real estate crisis.

US

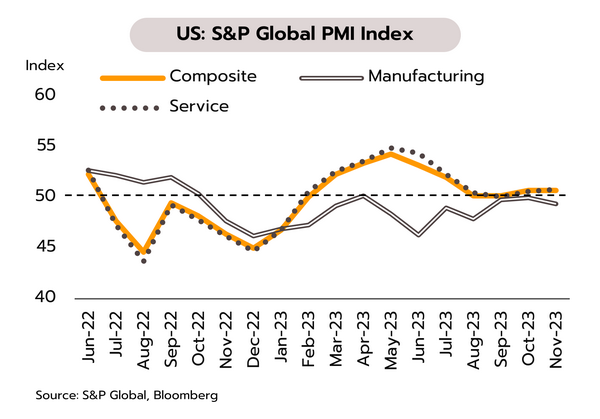

Although the Fed is sticking with its ‘higher for longer’ messaging, the room for future rate hikes is shrinking with the slowing economy. Existing-home sales dropped to a 13-year low of 3.79m in October, while in November, the Consumer Confidence Index slipped to a 6-month low of 61.3. The Composite PMI held steady at 50.7 but the Manufacturing PMI contracted to a 3-month low of 49.4. Moreover, while the Services PMI edged up to 50.8, its strongest in 4 months, the employment component contracted for the first time since June 2020. Leading economic indicators are also pointing to an elevated risk of an approaching recession.

The FOMC minutes point to a continuing belief in the need to persist with tight monetary policy and to keep the door open to possible further hikes in December, but indicators show the economy slowing and inflation weakening substantially in the coming period. In addition, with the recent ceasefire and hostage exchange in Gaza, fighting in the Middle East will likely be limited to the Gaza Strip itself. We thus expect that at its December meeting, the Fed will leave target rates unchanged at 5.25-5.50%, where they will remain through to mid-2024 before easing at the start of Q3 as authorities look to avoid a hard landing.

Eurozone

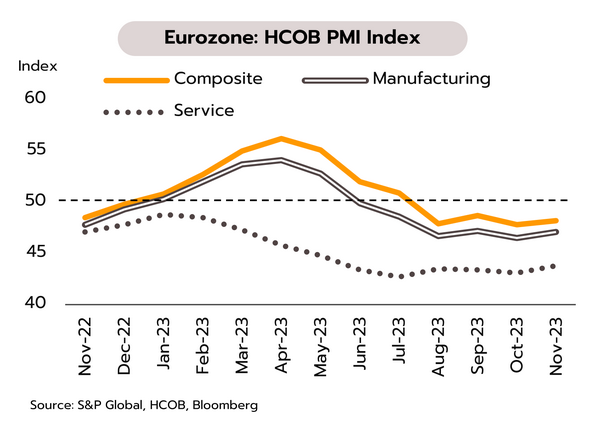

Drivers of growth remain largely absent from the Eurozone. A weakening economy and softening inflation will allow the ECB to cut rates in mid-2024. In November, the Consumer Confidence Index edged up from -17.8 to -16.9, but at 47.1, the Composite PMI has been in contractionary territory for 5 straight months, and the Manufacturing and Services PMIs both stayed in a contraction zone at respectively 43.8 and 48.2. With delinquencies rising and credit conditions worsening, the European Central Bank (ECB) has also warned that early signs of stress are emerging in the banking sector.

Worsening economic indicators reflect the rising risk that the bloc will slip into recession in Q4, and the Eurozone economy is likely to remain weak through to mid-2024 given the strengthening impacts of high interest rates on overall economic activity. Moreover, although inflation remains above the 2% target, pressure on prices is abating and conditions look increasingly fragile for the financial sector. We therefore anticipate that the ECB will keep rates at 4.00%, but to help stimulate the economy and to dodge a recession, the bank will let monetary policy relax in mid-2024.

China

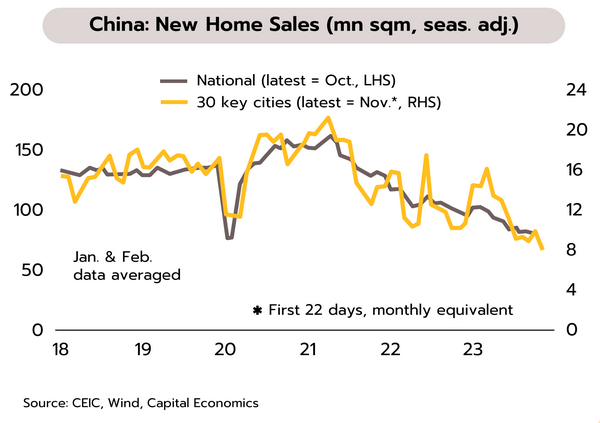

By changing policy and stimulating both demand and supply, China hopes to alleviate the real estate crisis. Bloomberg reports that China will support the release of USD 446bn by banks to help address the liquidity shortage and debt problems faced by developers. These problems have affected work on projects, prevented developers from handing completed housing over to buyers, and dragged on sentiment. So, the government is preparing a list of 50 developers eligible for this assistance, such as Country Garden Holdings Co. and Sino-Ocean Group.

The liquidity injection into developers marks a major shift in policy, implying authorities are now stimulating supply or supporting work on unfinished projects. Previously, China attempted to boost demand by cutting mortgage rates, reducing down payments, and instituting tax cuts, but the effects have been limited by fears that work on projects may still not be completed. Following similar moves in Guangzhou in early 2023, the conditions of downpayments required for second homes has also been relaxed in Shenzhen. Despite the boost via demand and supply, it will take time to have a significant impact and to improve sentiment. It remains also to be seen what the consequences of taking on more risk will be for banks.

Slow recovery in the Chinese segment will drag on the tourism sector. Public-sector spending will be limited following a delay in FY2024 Budget Bill.

Recovery in Chinese arrivals remains sluggish, and this will likely keep total arrivals for 2023 below the forecast. Initial data for the period 1 January to 19 November indicate that total arrivals for the year to date come to 23.85m (66% of the pre-Covid total), generating receipts of THB 1.01trn (60% of the pre-Covid level). The 5 most important originating countries were Malaysia (3.90m arrivals), China (2.98m), South Korea (1.41m), India (1.39m), and Russia (1.21m).

During the first 10 months of this year, Chinese arrivals have averaged around 280,000 per month, down from the pre-Covid monthly average of over 900,000. Although the visa-free scheme has been in operation since end-September, as of November, its positive effects have been limited. Daily totals have thus averaged around just 10,000, peaking at 17,000-18,000 arrivals per day during Golden Week, and so for the year, Chinese arrivals are expected to total 3.4-3.5m, down from the official target of 4-4.4m. Given this weakness in the Chinese market, we have revised our 2023 forecast for foreign tourist arrivals down from 28.5m to 27.7m. Nevertheless, arrivals during the winter high season (November 2023 to February 2024) will still benefit from the increasing number of flights linking Thailand to overseas markets, which in many cases have now returned to close to their pre-pandemic level. These are thus now at 98.5% of their 2019 level for flights from Malaysia, 93.5% for those from Singapore, 87.7% from South Korea, and 82.1% from India. However, in the case of China, flights to Thailand are still only 41% of their pre-pandemic total.

Public-sector spending will be limited through 4Q23 and into 1Q24 after delays to the FY2024 budget bill. On 21 November, the cabinet agreed in principle with FY2024 budget, which will now rise 9.3% from its FY2023 level to a total of THB 3.48trn. This will be split between: (i) THB 2.54trn for current expenditure (72.9% of the budget) (ii) THB 715.38bn for capital expenditure (20.6% of the total); (iii) THB 118.36bn for replenishing the treasury reserves (3.4%); and (iv) THB 118.32bn for repayments of the principal amount on loans (3.4%). The FY2024 budget deficit will be down 0.3% from FY2023 to THB 693bn. The central government discretionary fund will be set at THB 603.27bn.

Delays to approving the FY2024 Budget Bill, which will cover spending from October 2023 onwards, will mean that expenditure from the fourth quarter of 2023 through to the first quarter of 2024 will now be restricted. Following the 2019 general election, the contribution to GDP growth of capital expenditure was -5.7% in Q4 of 2019 and -9.5% in Q1 of 2020. However, the FY2024 budget should be passed and enacted during Q2 2024, and this will then allow government expenditure to bounce back, lifting overall economic growth through the year as the government makes headway on its policy agenda and its plans for infrastructure development.