Mixed economic data raises concerns about global growth outlook though expansion in the service sector is reducing fears of a hard landing

US

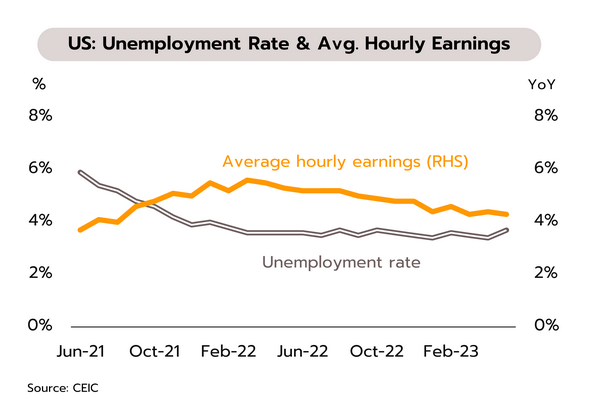

President Joe Biden is set to sign an agreement to increase the debt ceiling this week while US economic indicators present a mixed picture. April’s Job Openings and Labor Turnover Survey (JOLTS) showed 10.1m job openings in April, ahead of the 9.37m expected by the market. Non-farm payrolls also rose by 339,000 in May. However, the unemployment rate edged up to 3.7%, its highest since October 2022, and growth in average hourly wages slowed to 4.3%. The ISM manufacturing PMI also dipped to 46.9, the 7th month of contraction.

Senators have reached an agreement on extending the debt ceiling, and this week President Biden set to sign the new law, thus closing off the risk of a US default. However, the economic data remain inconsistent. On the one hand, the manufacturing index is close to the sub-45 level seen in crises in 2001, 2009 and 2020 but new openings and non-farm payrolls reflect ongoing strength in labor markets, which will then help to offset the risk of a sharp recession. Nevertheless, with wage growth slowing and unemployment rising, we expect the Fed to leave their benchmark interest rate at 5.00-5.25% at June’s FOMC meeting. This will keep policy in line with real interest rates that are now positive, reduce risk to the banking sector, and prevent a steep US economic slowdown.

Eurozone

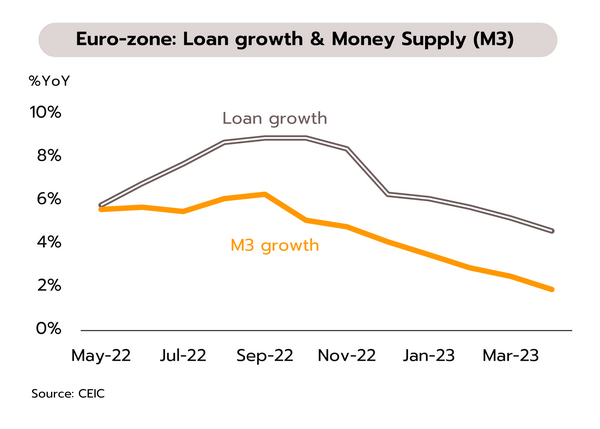

With core inflation stubbornly resilient, the ECB will likely press on with rate rises. In April, growth in the release of new credit by banks to businesses and consumers slowed to respectively 4.6% and 2.5% YoY. Growth in M3 money supply also dropped to 1.9%, worse than the anticipated 2.1%. Meanwhile, the Eurozone manufacturing PMI softened to 44.8 in May, though headline inflation was also down to 6.1% YoY.

The past week’s economic data have been broadly negative for the Eurozone. With the economy continuing to slow, considered on an annual basis, ECB interest rates rising at an historic pace, the manufacturing PMI has slipped for the 10th month, the release of new credit has been on a downward spiral since November 2022, and growth in M3 money supply is at a 9-year low. Moreover, although May’s headline inflation weakened more rapidly than the market expected (6.1% vs. the anticipated 6.3%), core inflation remains stuck at 5.3%. We therefore believe that the ECB may move forward with at least two more rate hikes of 25 bps each as the authorities look to reestablish price stability and to pull mid-term inflation back towards the 2% target.

China

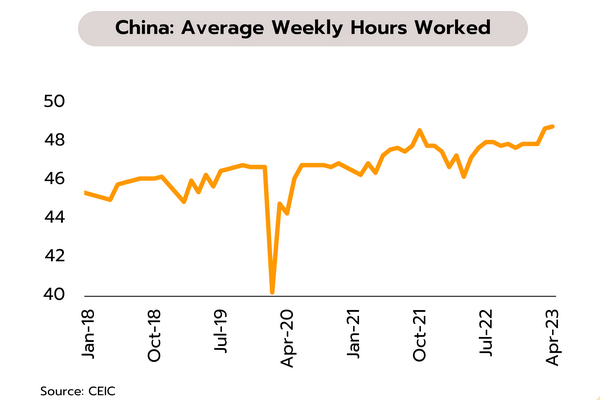

Cyclical recovery is supporting Chinese growth, especially in the service sector, but in manufacturing, the pace of recovery is diverging for large and small players. In May, the services PMI (surveyed from large corporations by the official NBS) remained positive for the 5th month, and although it dropped from 56.4 to 54.5, it is higher than last year’s number and remains in expansionary territory. However, the manufacturing PMI slipped for the second month, sliding from 49.2 to a 5-month low of 48.8. Against this, May’s Caixin survey (of SMEs) points to a rise in the manufacturing PMI from 49.5 to 50.9. Within this, the manufacturing output and new orders components jumped by respectively 11-month and 2-year highs, though less positively, sentiment has slumped to its lowest in 7 months.

Driven by a rebound in the services sector and a better outlook for SME manufacturers, we expect that cyclical recovery will sustain growth of 5-6% for China this year. In addition, urban unemployment slipped to a 16-month low of 5.2% in April, beating the target of 5.5%, with this seen alongside an increase to record highs in average hours worked per week. The positive effects of these trends will continue through 2023, but a slowdown in the global economy and structural problems within China (e.g., weakness in real estate and demographic change) will limit the growth.

Strength in the services sector continues to underpin growth; MPC may maintain policy rate in August amid easing inflation and political transition

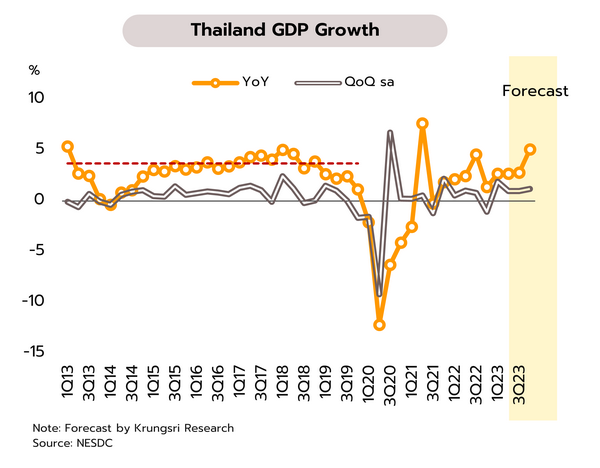

The MPC has taken policy rate to an 8-year high, citing growth prospects could be better-than-expected and core inflation remains high compared to historic norms. At its 31 May meeting, the Monetary Policy Committee (MPC) agreed unanimously to hike policy rate by 25bps to 2.00% on the view that growth will continue thanks to the strength of the recovery in the tourism sector and the positive effects of this on employment and private-sector consumption. Exports are expected to improve gradually. The latest prediction is for overall economic growth to come in at 3.6% for 2023 and 3.8% for 2024. Headline inflation is also softening and at a forecast 2.5% (down from 2.9%), this has fallen back into the target range. Likewise, core inflation is forecast to average 2.0% in 2023, down from an expected 2.4%.

Although the MPC has cut its inflation forecast, the situation with core inflation remains troubling since this may stay elevated relative to its historical levels. Moreover, if the new government is able to implement its policies, The Thai economy may also perform better than expected. Against this backdrop, we believe that the MPC may decide to suspend rate rises given that: (i) growth would remain flat in Q2 and Q3 (growth of less than 3% is expected, below the long-term average of 3.7%); (ii) uncertainty persists over the formation of the next government and the implementation of economic policy amid political transition; and (iii) headline inflation would remain within the target range throughout this year. Core inflation is expected to fall below 1.5% the rest of this year. This would pull the annual rate below the Bank of Thailand’s forecasts of 2%. In addition, the real policy rate should now turn positive, and so we anticipate that at its 2 August meeting, the MPC will leave policy rate unchanged at its current 8-year high of 2.0%, though there is a chance of further rate hikes if new data show the economy performing unexpectedly well and/or if the political outlook brightens.

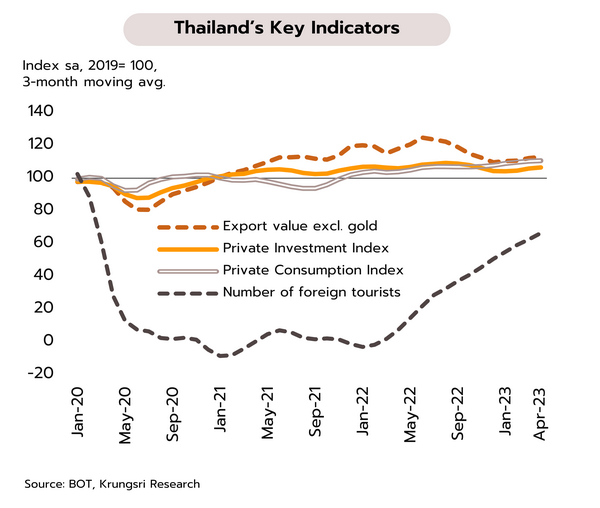

In April, the economy was lifted by a combination of continuing recovery in tourism and stronger domestic spending. We see Q2 growth remaining close to that of Q1 thanks to the support given by accelerating economic activity in the service sector, as reported by the Bank of Thailand. This is especially pronounced in the tourism industry, where growth is being seen in both the domestic and international markets, and this is then boosting private sector consumption. However, Thai exports contracted for 7 months consecutively (most recently falling by -4.9% YoY) as demand in overseas markets weakens. Similarly, industrial output fell (-8.1%) and private sector investment in plant and machinery remains soft.

Following GDP growth of 2.7% and the return of the economic activity to close to its pre-pandemic level in Q1, April’s indicators point to continuing steady growth, and we therefore expect that in Q2 and Q3, growth will remain close to the level established in the first quarter. On the positive side, the economy will benefit from the further rebound in tourism, rising private sector consumption, and stronger labor markets, though this needs to be set against policy rate that is now at 2% (the highest in 8 years) and weakness in the global economy that is undercutting the export sector. Overall, we expect Thai economic growth to average 3.3% in 2023, amid lingering uncertainties over the political outlook and the direction and shape of future economic policy.