The global economy is slowing; The US and China monetary policies are diverging

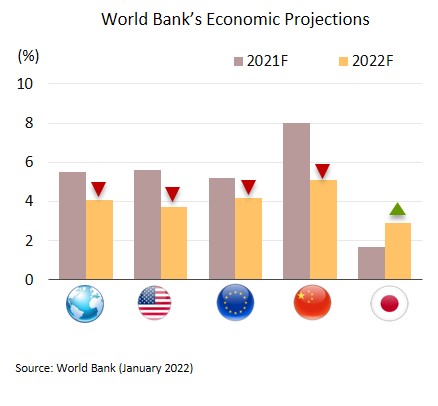

The World Bank has cut its forecast for 2022 growth in the face of rising risks. Following an expansion of 5.5% in 2021, the World Bank has downgraded its estimate of 2022 global GDP growth from 4.3% (as of June 2021) to 4.1%. Likewise, the outlook for major economies is that growth will weaken in 2022 relative to 2021, especially the US (from 5.6% to 3.7%), the Eurozone (from 5.2% to 4.2%), and China (from 8.0% to 5.1%). Nonetheless, Japan is expected to grow from 1.7% to 2.9%.

The recent surge in COVID-19 infections, the scaling down of stimulus measures in many countries, and the prolonged supply constraint mean that the world economic growth is likely slower than anticipated. Risks to recovery are also coming from: (i) rising debt, which may cause emerging markets and developing countries to encounter more limitation to extend stimulus measures, potentially pushing them into a hard landing; (ii) escalating inflationary pressures that tend to persist for an extended period, encouraging central banks in some advanced economies (the US and the UK) to tighten currently loose monetary policy before recovery is completed; and (iii) high levels of job insecurity and household debt in low-income groups, particularly in developing countries, which will increase the fragility and patchiness of recovery.

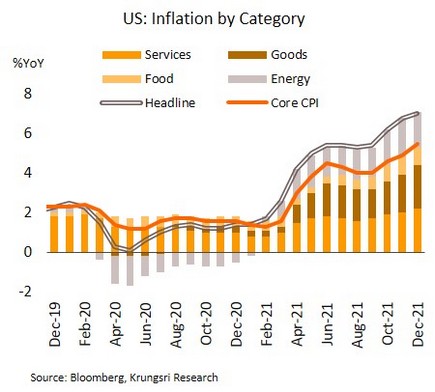

US inflationary pressures continue to mount; The Fed is expected to hike rates early, possibly as soon as March. In December, headline inflation reached a 40-year high of 7.0% YoY, which was in line with the Producer Price Index that rose 9.7%, close to its November’s level, the highest jump since 2000. Retail sales also increased by 16.9%, the 10th month of double-digit growth.

Having exceeded the Fed target range for 10 months, inflation continues to elevate, and the inflationary pressures are spreading to a wider range of goods. This is reflected by the increase in core inflation to a 30-year high of 5.5%. In response, the Fed has promised that it will act to prevent inflation becoming entrenched and so threatening consumers, reiterating that interest rates will need to rise sooner and faster than expected. We thus believe that rates will rise in March, June and September. The Fed may also consider the development of inflation and employment before making a decision for rate hike in December.

Chinese economy further slowed down amid escalating pressure from outbreaks; The PBOC step up monetary easing. 4Q21 GDP growth recorded 4.0% YoY, decelerating from 4.9% in the previous quarter. Throughout 2021, the Chinese economy expanded by 8.1%. December’s exports beat market expectations to jump 20.9% YoY, while headline inflation slowed down to 1.5%. However, new car sales slipped -1.6%, the 8th month of declines.

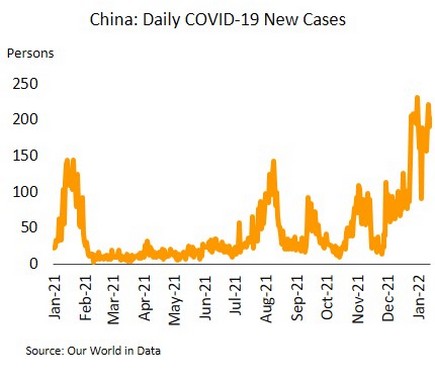

The Chinese economy is slowing down. Though the average number of daily new infections since the beginning of 2022 is around just 170 per day, the stringent ‘zero COVID policy’ is causing bottlenecks in transportation and forcing the temporary closure of factories. The lockdown measures also affect services sectors and drag on spending. Meanwhile, real estate sector is also struggling against a lack of liquidity and the risk of missed repayments on outstanding debt, the value of which will increase from its 4Q21 total to around CNY 21bn in 1Q22. Elevated uncertainties affecting the growth caused the People's Bank of China (PBOC) to cut interest rate on one-year medium-term lending facility (MLF) by 10 bps to 2.85%. A further loosen monetary policy is thus expected to prevent a sharp slowdown.

Consumer spending will tend to weaken through the start of 2022, but industrial production is showing more positive signs

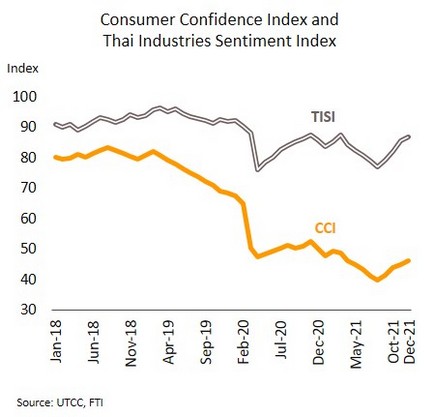

Consumer confidence strengthened at the close of 2021, though consumption may slow down for short term. The Consumer Confidence Index (CCI) rose for the 4th month in December 2021, climbing from 44.9 to a 9-month high of 46.2. Increases were seen in all categories, helped by a lessening of worries over COVID-19, falling case numbers, continuing progress with vaccinations, and further relaxation of restrictions in mid-December to support New Year celebrations.

However, the continuity of regaining consumer confidence may falter at the start of 2022 as concerns over rising prices mount and the domestic spread of the Omicron variant feeds into a sharp escalation in daily case numbers. Krungsri Research foresees that daily COVID-19 cases would peak by mid-February under our base case scenario. Therefore, the impact on a slowing down sentiment and spending would be only over the short term due to (i) progress of vaccination with the public now receiving booster shots, which thus limits the severity of outbreak, (ii) unlikely reimposition of lockdown measures, and (iii) further support on consumption from additional stimulus by measures to promote spending and domestic tourism, including 'Shop Dee Mee Khuen - shop & payback scheme’, Phase 4 of 'Khon La Khrueng - co-payment subsidy scheme, and Phase 4 of 'We Travel Together - tourism subsidy program’. These are expected to inject an additional THB 140bn into the economy.

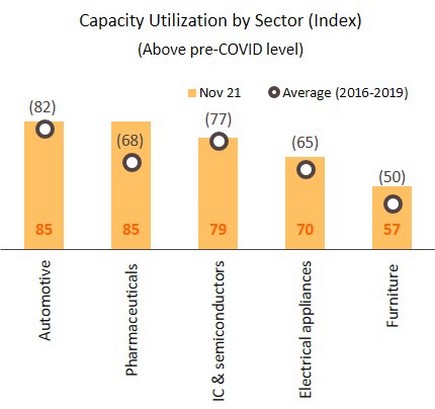

Industrial sentiment rose steadily; Capacity utilization in major industries returned pre-pandemic level. In December, the Thailand Industrial Sentiment Index (TISI) rose for the 4th month, increasing from 85.4 to a 9-month high of 86.8. This is a result of recovery in domestic demand after more easing restrictions, which in turn supports a resumption of activities in areas of manufacturing, trade, and domestic travel. In addition, a further expansion of exports alongside economic recovery in trading partners’ markets also contributes to this improvement.

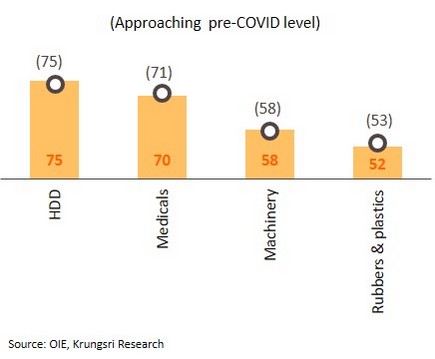

Recovery in demand domestically and abroad is translating into stronger manufacturing production. The capacity utilization in several key industries (especially, automobile, pharmaceuticals, IC & semiconductors, electrical appliances and furniture) have exceeded pre-pandemic levels, though the average capacity utilization across industry remains below its pre-pandemic level (65.8% in November 2021 compared to 67.6% before the start of the pandemic). Meanwhile, production in some industries are approaching their pre-pandemic levels, including HDD, medicals, machinery and rubber & plastics. The strengthening exports with an expected growth rate of 5% in 2022, together with gradual recovery in the domestic economy, will be important factors underpinning growth in manufacturing investment and output in 2022.