There is an increasing possibility of Eurozone and US rate cuts in 2024 while China is in no rush to roll out further stimulus measures

US

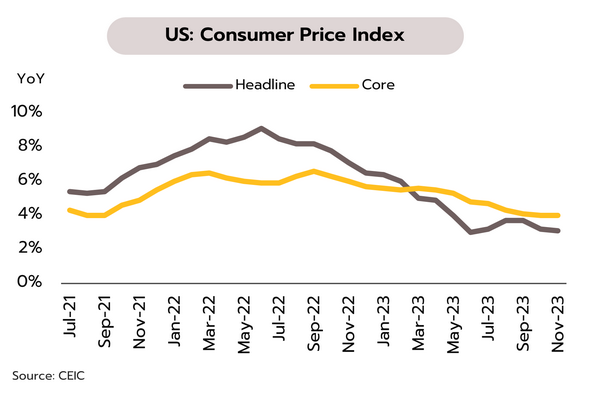

US Fed is signaling that rate hikes may be at an end, and indicators are pointing to a soft-landing for the economy. In November, headline and core inflation softened to respectively 3.1% and 4.0% YoY. Headline and core Producer Price Indices slowed to 0.9% and 2.0%. Growth in retail sales improved from 2.24% to 4.09%. At its latest meeting, the FOMC agreed to hold the Fed funds rate steady at 5.25-5.50%, signaling that 3 cuts totaling 75bps could be seen in 2024 and a further 4 cuts totaling another 100bps may come in 2025. The 2023 GDP growth forecast has been revised up from 2.1% to 2.6%, with the 2024 and 2025 forecasts now standing at 1.4% and 1.8%. Inflation forecasts have also been revised, falling from 3.7% to 3.2% for 2023 and to 2.4% and 2.2% for each of 2024 and 2025.

With inflation and growth forecasts slowing, the Fed indicated that cycle of rate hikes may be over with three more rate cuts expected in 2024 (by 25bps each). The likelihood of a 2024 soft-landing is rising. Even though geopolitical conflicts and wars that may affect energy prices are less risky, there is still high uncertainty, together with the lagged effects of tight monetary policy amid an increase in real interest rates, all of which should remain a risk factor for the US economy in 2024.

Eurozone

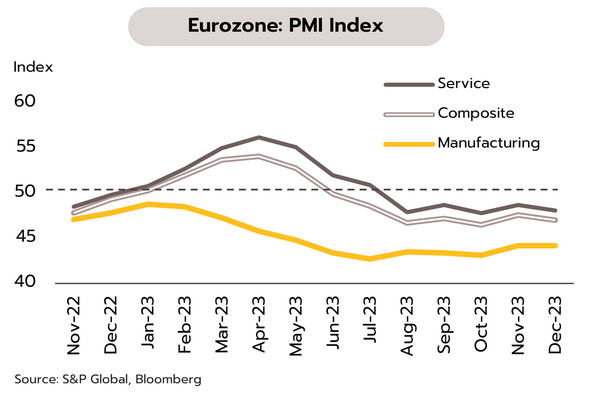

Given the more rapid drop in Eurozone growth and inflation, the ECB is expected to begin cutting rates before the Fed. At 47.0, December’s Composite PMI remained in recessionary territory for the 7th month, split between 44.2 for the Manufacturing PMI and 48.1 for the Services PMI. At its most recent meeting, the European Central Bank (ECB) held its key deposit rate steady at 4.00%. The bank has also cut its 2023 and 2024 GDP forecasts from 0.7% to 0.6% and from 1.0% to 0.8%, while inflation forecasts are down from 5.6% to 5.4% and from 3.2% to 2.7% for 2023 and 2024.

Eurozone may fall into a recession in Q4 given: (i) weak consumer and investment sentiment; (ii) the fact that the Manufacturing and Services PMIs remain in recessionary territory; (iii) the deeper contraction in retail sales in Q3; and (iv) export slowdown caused by weakness in overseas markets. At its last meeting, the ECB’s Governing Council did not signal 2024 rate cuts, but in light of the Eurozone’s worsening economic outlook, the more rapid decline in inflation relative to the US, and the increasing possibility of recession at end-2023 and start of 2024, we expect the ECB to begin cutting policy rates in 2Q24, ahead of the beginning of expected rate cuts by the Fed in 3Q24.

China

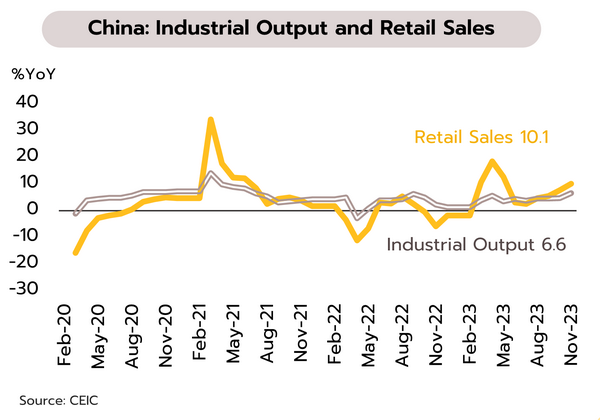

Industrial output and consumption in China are improving, but unemployment remains steady and property crisis continues to drag. Industrial output beat expectations to grow 6.6% YoY in November, its fastest growth since February 2022 and up from 4.6% in October. However, while retail sales grew 10.1% (up from 7.6%), this undershot forecasts. Urban unemployment is stuck at 5%. 11M23 growth in investment in fixed assets was unchanged from 10M23’s 2.9%.

Growth of consumption and industrial output is improving following assistance measures and low base last year when China imposed lockdown. However, the property sector remains depressed and with new home prices falling for the 5th straight month (-0.3% MoM). At the Central Economic Work Conference, it was announced that given the need to develop AI and other new technologies, the top priority for 2024 will be industrial policy, while stimulating domestic demand (2023’s top priority) will fall to a matter of secondary importance. Although the growth outlook may improve to the start of 2024, China is not rushing to further stimulate the economy, and with fading reopening tailwinds, property crisis, and structural problems, Chinese growth is likely to slow down in 2024.

Discussions over minimum wage hikes are ongoing while the government has announced new debt-relief measures. Krungsri Research expects consumption to drive growth through 2024 though it could slow down.

Changes to the minimum wage are still under review, though these are expected to be concluded by the end of the year. On 8 December, the Minimum Wage Commission approved THB 2-16 increases to the minimum wage, bringing this from THB 328-354 to THB 330-370. Phuket will see the sharpest rise of THB 16 (up from THB 354 to THB 370 per day), while in Chonburi and Rayong, the increase will be THB 7 (from THB 354 to THB 361), and in the Bangkok Metropolitan Region, the minimum wage will rise by THB 10 (from THB 353 to THB 363). The lowest increase of only THB 2 per day will be seen in Yala, Pattani, and Narathiwat. However, the Minister of Labour will review these changes before presenting them to cabinet for approval this December, and so these increases should be implemented at the start of 2024.

The Minimum Wage Commission’s proposals will raise the average minimum wage from THB 337 to THB 345 per day, an increase of 2.37%. The Trade Policy and Strategy Office estimates that this will then push up inflation by 0.13-0.25%, with the most heavily impacted goods and services including instant foods, rice, telecoms, and fresh fruit and vegetables since these are relatively heavily weighted in the calculation of inflation and constitute a high proportion of spending by low-income workers The review of the proposals may reconsider the bottom end of the increases, where a rise of just THB 2 per day is currently on the cards. Overall, only 15% of Thai workers are now on the minimum wage, down from 25% in 2012, and so increases to this have less impact on production costs and overall inflation than in the past.

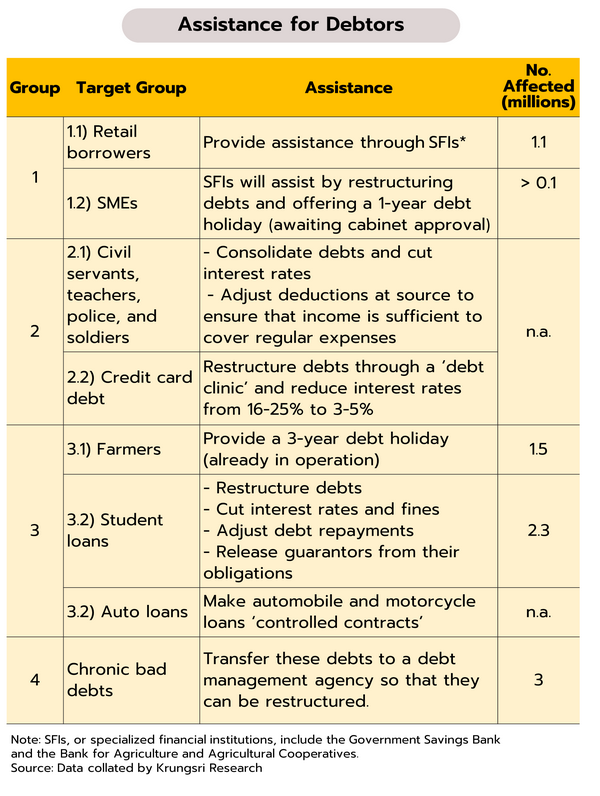

Plans to assist a total of 10m debtors have been announced by PM Srettha Thavisin. A scheme to provide assistance for troubled debtors will tackle debt problems in the formal sector according to their causes, which have been classified into four groups: (i) debtors impacted by Covid-19; (ii) debtors with a regular income but whose debts are excessive and who thus face difficulties making their payments; (iii) debtors without a regular income and who are thus unable to make their repayments; and (iv) debtors with long-term bad debts. Government assistance for these groups is detailed in the accompanying table.

At present, Thai household debt totals over THB 16trn, or more than 90% of GDP. This is one of the highest debt ratios in the world, and after South Korea, it is the second highest in Asia. This thus represents a major risk to the economy, and if this problem is not resolved, it has the potential to affect the country’s financial stability and drag on growth in the coming period. The government has thus made resolving Thailand’s debt problems a matter of national importance, though solutions are unlikely to materialize for some time yet, and so growth in household consumption may be limited. We therefore see private consumption expanding 3.3% in 2024, a deceleration from 2023’s 7.1%, though this slowdown will have a range of causes including the weakening of the impetus gained by the reopening of the country and the release of pent-up demand, the worsening impacts of drought, and of course, the effects of worrisome levels of household debt. Despite this, strengthening labor markets and government support for the economy (e.g., the E-Receipt or tax refund program scheduled for the start of 2024 and assistance with the cost of living) will mean that private consumption will continue to expand, and this will make it an important driver of the economy through 2024.