The service and manufacturing sectors are losing momentum across the major economies

US

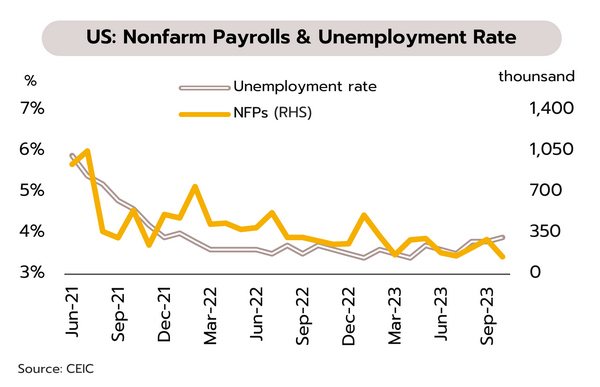

Less need for US rate hike due to weaker economy and easing inflation. At its most recent meeting, the FOMC agreed to hold the Fed Funds rate steady at the 22-year high of 5.25-5.50%, though it stands ready to begin hiking again if inflation comes in above expectations. However, non-farm payrolls rose by just 150,000 in October, the slowest pace in 3 years, the unemployment rate rose to 3.9%, its highest since January 2022, and average hourly earnings increased by 4.1% YoY, its slowest since July 2021. The ISM Service PMI also slipped to a 5-month low of 51.8, while at 46.7, the ISM Manufacturing PMI has now contracted for 12 months.

Softer-than-expected employment data, the continuing slide in the Manufacturing and Service PMIs, and weakening inflation reflect the impacts of 18 months of tightening monetary policy. This slowdown is expected to accelerate through Q4 and into 2024. The Fed has said that it is ready to raise rates again at its December meeting, but we expect that with real interest rates at their highest since the financial crisis of 2007, labor markets and the economy overall looking increasingly sluggish, and the risk of recession in 2024, the Fed is unlikely to push policy rates above 5.25-5.50%.

Japan

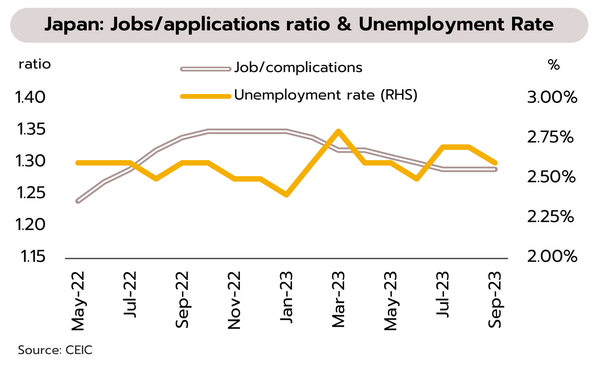

Weak exports and slowing wage growth will encourage the BOJ to leave monetary policy loose through to year-end. The Bank of Japan (BOJ) has left short-term policy rates at -0.1%, set the limit on its yield curve controls for 10-year bonds at 1.0% and adjusted its outlook for inflation for the 2023 financial year upwards from 2.5% to 2.8%. In September, the jobs to applications ratio was unchanged at 1.29, but the unemployment rate slipped from 2.7% to 2.6%.

Through 2H23, the Japanese economy has come under pressure from: (i) wage growth that has fallen behind inflation, eroding real income and purchasing power; (ii) weak growth in export markets that has undercut income in the export sector; and (iii) a slowdown in the overall economy, reflected in the Manufacturing and Service PMIs showing the weakest in 8 and 9 months, respectively. However, fighting between Israel and Hamas has the potential to ignite a wider regional conflict, which would then push up crude prices, and because Japan imports 95% of its oil from the Middle East, this would have the potential to trigger quicker policy shifts and a worse outlook than the market has currently priced in. In the event that the war does not spread, we see the BOJ persisting with accommodative monetary policy, leaving rates low and yield curve controls in place for the rest of 2023.

China

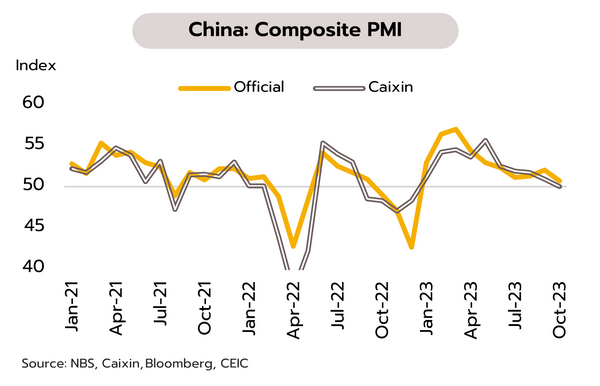

The Chinese recovery is slowing, and activity in the overall manufacturing and service sectors is at a 10-month low. In October, the official Manufacturing and Service PMIs (for large firms) slipped from 50.2 in September to 49.5 and from 51.7 to 50.6. For smaller firms, the Caixin’s survey show that the Manufacturing PMI fell from 50.6 to 49.5, below the 50-point, entering contractionary zone for the first time since July. Although stronger tourism sector lifted the Caixin Services PMI from a 9-month low of 50.2 to 50.4, new orders grew at their slowest since the start of the year. Sentiment was also at its weakest in 3½ years.

China’s official and private Composite PMIs have fallen to a 10-month low of 50.7 and 50.0. Activity in manufacturing sector contracted again, and new orders show domestic demand stagnated after growing for just 2 months. External demand also dropped. Construction activity is lower than the pre-Covid 2019 average (the Construction PMI fell from 56.2 to 53.5, compared to the 2019 average of 59.4). The average of official and privately collected Services PMIs also fell to a 10-month low of 50.3 against the 2019 average of 52.8. Thus, despite the recent policy support, a re-opening recovery is weakening, exports are softening, and the property sector remains in crisis.

The tourism sector boosted by policy support will be an important driver of the Thai economy through Q4

To help boost arrivals and meet the year’s targets, visa-free travel has been extended to tourists from India and Taiwan. At a recent meeting of the cabinet, it was agreed that the requirements for visas would be waived for arrivals from India and Taiwan. These measures will be in effect from 10 November 2023 to 10 May 2024, and so for the next 6 months, visitors from these countries will be able to stay in Thailand for 30 days without needing to apply for a visa.

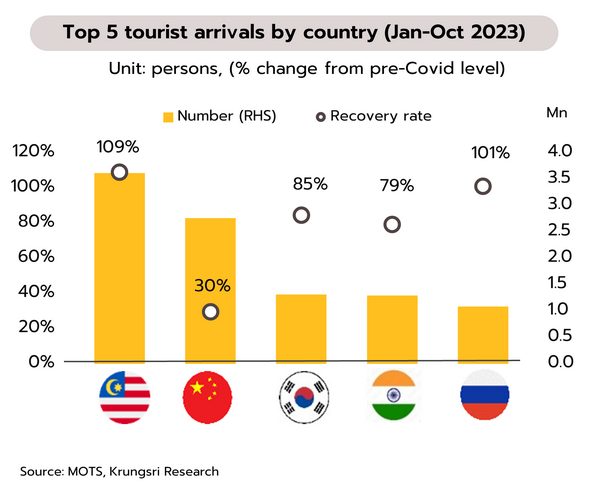

A total of over 22 million foreign arrivals were recorded between 1 January and 29 October, with the 5 most important originating nations being in order, Malaysia, China, South Korea, India, and Russia, and for these countries, arrivals were back to respectively 109%, 30%, 85%, 79%, and 101% of their pre-Covid level. Officials expect the most recent extension to the visa-free measure to increase arrivals from India to 1.55m (up from 1.3m over 10M23) and to 0.7m for those from Taiwan (up from 0.52m over 9M23). Authorities hope that combined with the earlier temporary waiving of visas for tourists from China, Kazakhstan, and Russia, this will provide a boost for the tourism industry and will help the sector reach the goal of welcoming 28m visitors to the country (around 70% of the pre-Covid level), thereby generating receipts worth some THB 2.3trn.

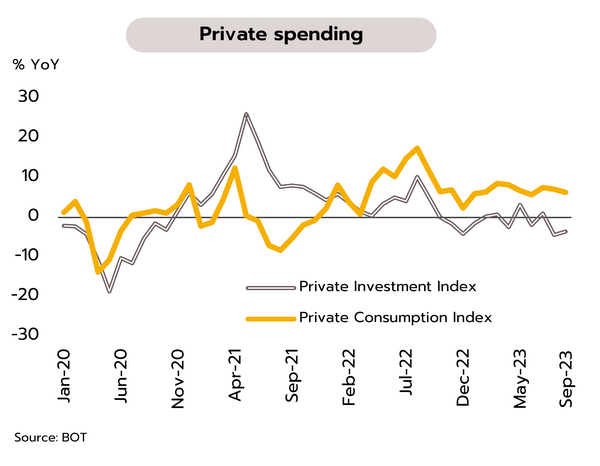

Tourism and exports were major drivers of the economy in September, and overall, this helped to improve the outlook in Q3 relative to Q2. The Bank of Thailand reports that the economy continued to grow in September on strong receipts from the tourism sector and the return to growth in export value for the first time in a year (+1.0% YoY). Having performed well in the previous month, domestic demand slowed in September. Private consumption softened slightly (+6.3% vs +7.0% in August) due to weaker spending on non-durable and semi-durable goods, though spending on services grew with rising receipts for hotels and restaurants. Private investment continued to contract (-3.6% vs -4.4%), with weakness seen in spending on machinery & equipment, and on construction.

The economy improved through September on a better performance by the service sector and an improving outlook for exports, and so the overall figures for Q3 are likely to be stronger than for Q2. In the final quarter of 2023, growth will continue, but some parts of the economy will lag, and in particular private investment will likely remain weak. It also remains to be seen how sustained the rebound in exports will be, particularly given the outbreak of fighting between Israel and Hamas and the potential impacts of this on energy prices and overall demand in export markets. Nevertheless, stronger labor markets and improving sentiment should lift overall consumption, which will also benefit from government measures to help with the cost of living now that the latter has been extended from help with electricity bills and the cost of diesel to additional support for lower petrol pump prices. Moreover, strength in the tourism sector will be further underpinned by the extension of visa-free travel to arrivals from additional countries.