The US and Eurozone likely to end their current cycle of rate hikes. China is having to loosen monetary policy to support its weak recovery.

US

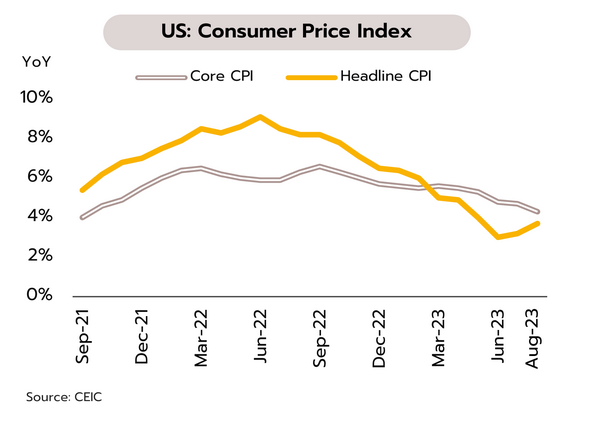

August’s inflation was higher than expected but slowing economy will encourage the Fed to leave rates unchanged the rest of this year. In August, headline inflation stood at 3.7% YoY and 0.6% MoM, up from July’s 3.2% and 0.2%, but core inflation cooled from 4.7% to 4.3% YoY. Excluding shelter, core inflation eased to just 2.2%. Likewise, consumer inflation expectations one-year ahead are now at 3.1%, the lowest since March 2021. Although retail sales rose 0.6% MoM on higher pump prices, up from 0.5% a month earlier and ahead of market expectations of a rise of 0.2%, consumer confidence fell in September, undershooting market expectations.

Surging oil prices pushed August inflation above market expectations, but there is a broad consensus among investors that with the Composite PMI steadily softening and leading economic indicators (employment data, growth in credit, and existing-home sales) pointing to an overall weakening of the economy, the Fed will not risk inflicting unnecessary pain on consumers, and a return to rate hikes is thus deemed unlikely. We therefore see officials holding the Fed Funds Rate at 5.25-5.50% until clear signs emerge that inflation is slowing and will remain within the 2% target range over the long term.

Eurozone

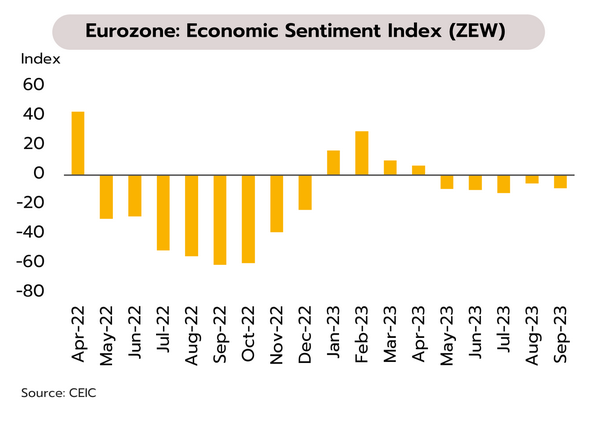

The risk of a 2H23 recession remains elevated. The ECB’s September rate hike is expected to be its last. Manufacturing output contracted -2.2% YoY and -1.1% MoM in July, worsening June’s changes of respectively -1.1% and -0.4%. Septembers ZEW indicator of economic sentiment also fell from -5.5 to -8.9. The ECB Governing Council has responded to persistent inflation by raising rates by another 25bps, taking the deposit facility rate to 4.0%, the marginal lending facility to 4.75%, and the main refinancing rate to 4.50%.

Stubborn inflation and high interest rates are increasingly dragging on the Eurozone’s economy through Q3. The effects of this have shown up in: (i) a drop in retail sales in July, the 10th month of declines; (ii) the first drop in consumer sentiment for a year in August; (iii) also in August, the deepest contraction in the Composite PMI in 33 months; and (iv) in September, the 5th month of a worsening ZEW indicator of economic sentiment. The accelerating slowdown in the economy and the decline in liquidity are expected to lead to a softening of both inflation and labor markets. The ECB is therefore unlikely to raise rates further, and so we expect that September’s hike will be its last, with the deposit rate likely to remain at 4.00% through to mid-2024.

China

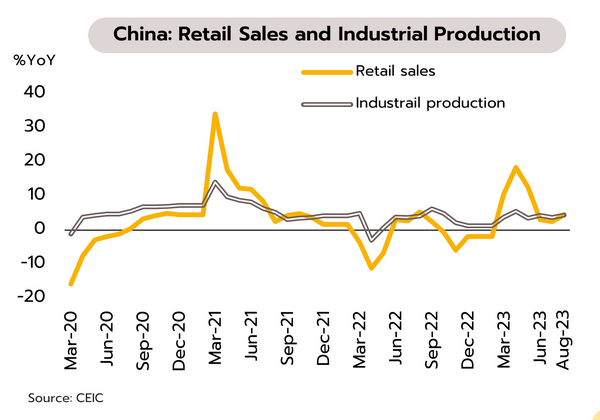

Consumption and manufacturing output improved on stimulus measures, but the real estate crisis is weighing on investment. In August, retail sales rose 4.6% YoY in August, up from 2.5% in July on the effects of summer travel and spending. Manufacturing output growth climbed from 3.7% to 4.5%, and urban unemployment slipped from 5.3% to 5.2%. However, the collapse in real estate investment means that spending on total fixed assets investment grew just 3.2% over 8M23, compared to 7M23’s 3.3% expansion.

Policies to improve liquidity and relax restrictions on home purchases have lifted economic indicators, but real estate remains in crisis. August new house prices dropped -0.3% MoM, the fastest decline in 10 months. Property investment contracted for the 18th straight month, by -19.1% YoY. House sales have fallen for 26 months. Recently, Sino-Ocean, one of Beijing and Tianjin’s biggest house builders, has said that it is suspending all repayments on offshore debt. The economy therefore requires further assistance. Last week, to increase liquidity and expand lending, the PBOC has announced 2023’s second reduction in the reserve ratio requirement (RRR) by another 25bp, effective from 15 September, while the 14-day reverse repo rate has been reduced by 20bps to 1.95%.

The rapid rollout of policies by the incoming government will help both private consumption and tourism sector, but the economy remains under pressure from domestic and external headwinds

Officials are hoping to boost the tourism sector by allowing visa-free entry to Thailand by Chinese arrivals, but outlook of tourism income remains unclear. The new government has announced plans to stimulate foreign tourism that target tourists from China and Kazakhstan. For arrivals from these countries, the requirement to have a visa will be waived for a period of 5 months, starting from 25 September and running to the end of February 2024. Initially, officials expect that through the last quarter of the year, this will improve total monthly Chinese arrivals to 700,000, compared to around 400,000 in July and August.

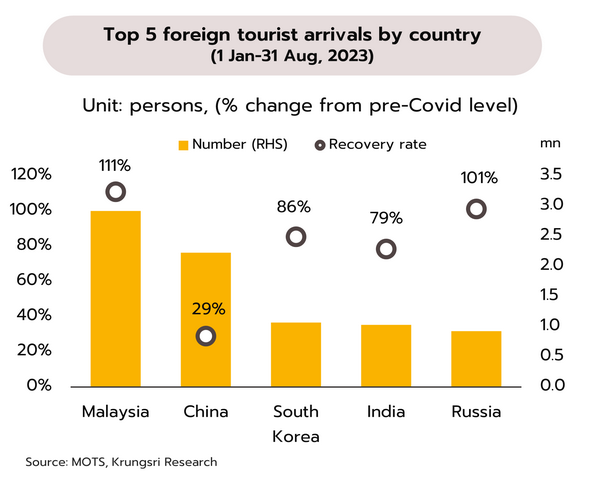

The latest data from the Ministry of Tourism and Sports indicate that between 1 January and 10 September, 18.53mn foreign arrivals were recorded, and this then generated THB 775.30bn in income. This includes 2.28mn Chinese tourists, making China Thailand’s second most important market after Malaysia (2.99mn arrivals). However, at present, Chinese arrivals are running at only around 30% of their pre-Covid total, compared with 80% for South Korean and Indian arrivals, and over 100% for Malaysian and Russian tourists. The decision to waive visas for Chinese visitors will boost numbers for both independent travelers and those arriving in tour groups, and will also help to counter problems with delays in approving visas. However, the slowdown in the Chinese economy may drag on spending by Chinese tourists. In addition, average spending by foreign tourists remains a worry, and at present this runs to just THB 42,000 per person per trip, down substantially from the 2019 pre-Covid total of THB 48,000.

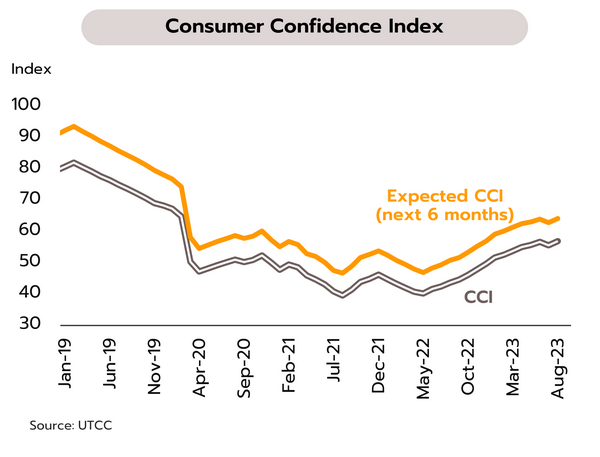

Private consumption will benefit from improving consumer sentiment and government measures to reduce the cost of living. Having fallen for the first time in 14 months in July, the Consumer Confidence Index strengthened from 55.6 to 56.9 in August on the installation of the new government and the expectation that the authorities will now be able to move forward with measures to stimulate the economy.

The likely ongoing trend in improving sentiment is reflected in expected consumer confidence 6 months out, which in August rose from 62.8 in July to 64.2, its highest since March 2020 and the start of the Covid-19 pandemic. Sentiment should also benefit from measures rushed through by the new government to assist consumers with the high cost of living, in particular by helping with the cost of fuel and electricity. (i) The government will reduce the cap on diesel prices from THB 31.94 per liter to a maximum of THB 30 (the lowest price since May 2022), with effect from 20 September through to the end of the year. In addition, the price of cooking gas will be held at THB 423 for a 15-kilo tank for 3 months, beginning 1 October. (ii) Electricity charges will be reduced from THB 4.45 to THB 3.99 per unit for bills sent out between September and the end of 2023. Nevertheless, although the combination of government assistance and strengthening sentiment will lift consumption, this will come under pressure from headwinds including the high level of household debt, the rising cost of borrowing, and the impact of the drought on agricultural incomes.