The risk of a slowdown is becoming a greater concern to the authorities in the major economies

US

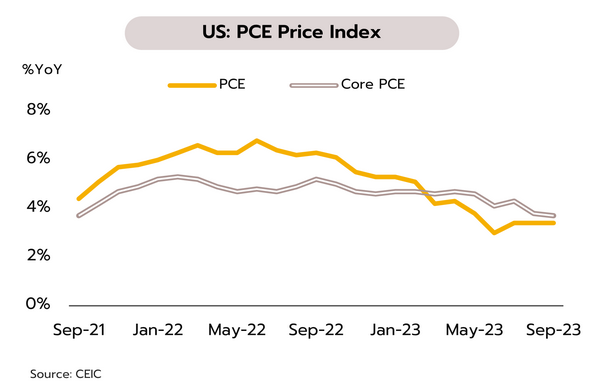

With key indicators pointing to a clearer risk of the economic slowdown, the US Fed is expected to hold rates steady this week. Although the initial print for Q3 GDP growth came in at 4.9% QoQ SAAR, above market expectations of 4.7%, October’s Consumer Confidence Index slipped to 63.8, its lowest since May. The latest initial jobless claims also rose at 210,000. September’s core PCE matched expectations at 3.7% YoY, its slowest since May 2021.

Q3 growth may have surprised to the upside but going forward, the economy will tend to soften. (i) Real disposable incomes contracted in August for the second month, and with excess savings below their pre-Covid level, consumers’ ability to sustain current expenditure will likely weaken. (ii) The slowdown in the services sector, which contributes more than 80% of GDP, is becoming more evident. (iii) Consumer confidence predictions for 6 months out have fallen below 80 points, indicating recessionary expectations. This is in line with Q4 forecast growth of 0.8% QoQ SAAR, down from 4.9% in Q3 (source: Bloomberg Consensus). So, with the economy slowing and inflation weakening, we expect that the Fed will leave policy rates at 5.25-5.50% at its November 1 meeting.

Eurozone

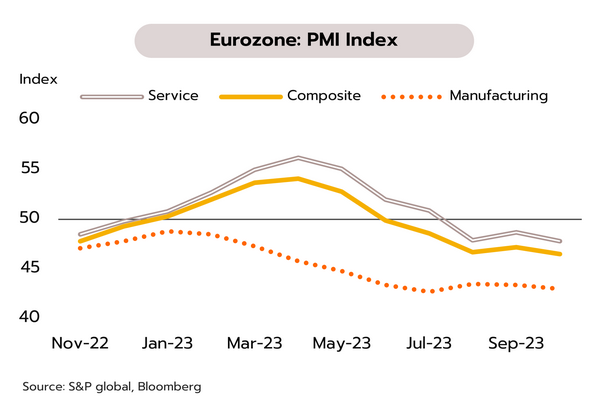

The Eurozone economy will likely contract in Q3 under weak consumption and sluggish exports. October’s Manufacturing and Services PMIs stood at respectively 43.0 and 47.8, giving a Combined PMI of 46.5, its 4th month of below 50 (a contraction zone). In September, M3 money supply contracted -1.2%, while private credit growth slowed to 0.8% on continuing tight monetary policy. In addition, for the first time since July 2022, the European Central Bank (ECB) has agreed to pause rate hikes, leaving its deposit facility rate at 4.00%.

Eurozone consumption and exports are softening under the impact of high interest rates and weaker growth in key trading partners, particularly in China since this accounts for more than 50% of Eurozone export value. As a result, the economy is stuttering, and there is a risk that the bloc will slip into recession in Q3, an outcome that is being made more likely by the tightening money supply and the slowing credit growth. Given weakening overall momentum within the economy and the increasingly uncertain geopolitical environment, we expect that the ECB will leave its deposit facility unchanged at 4.00% through to mid-2024, or until there are clear signs that inflation is back into the 2% target range for the long term.

China

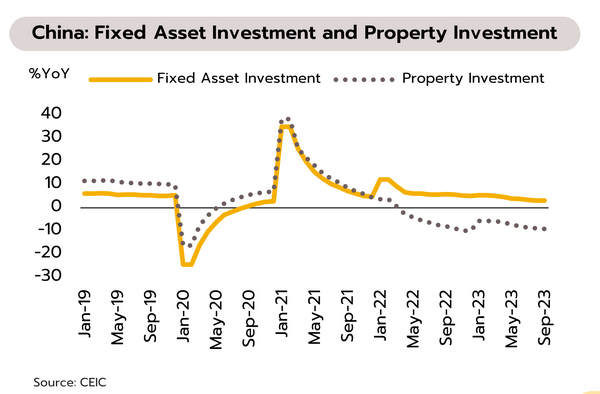

China has approved support for local governments targeting reconstruction following natural disasters, but troubles in the real estate sector continue. The National People's Congress (NPC) has approved CYN 1trn in new government bond issuance and passed a law confirming the local government bond quota for the 2024 fiscal year. Bloomberg expects this to add 0.1ppt to China’s GDP in Q4 and 0.5ppt through 2024. Other indicators have also improved. September’s industrial profits rose for the 2nd month to hit 11.9% YoY (up from -11.7% over 8M23), while manufacturing output and retail sales beat expectations to rise by 4.5% and 5.5%, respectively.

Since July, authorities have issued new measures to support the economy, most recently authorizing bond issuance worth CYN 1trn. This will increase the budget deficit from 3.0% of GDP to 3.8% but these funds will be used for rebuilding and strengthening capability in dealing with natural disasters. However, long-running troubles in the real estate sector continue to drag on the economy, and for the first time, Country Garden has defaulted on a USD denominated bond. Investment in real estate contracted -9.1% over 9M23, and investment in fixed assts grew less than expected by just 3.1%. China’s growth prospects will thus continue to be constrained by these structural problems.

While exports are recovering, risks remain. Discounting the likely impacts of Digital Wallet policy, FPO sees 2024 GDP growth at 3.2%

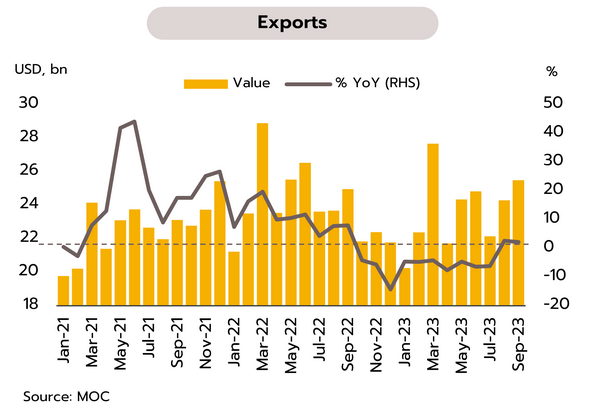

Export value grew 2.1% in September, the second month of expansion. Krungsri Research maintains 2023 export growth forecast at -1.5%. Data from the Ministry of Commerce for September show that in the month, exports brought in USD 25.5bn. Growth continued from August’s +2.6% YoY, and at +2.1% YoY, this outpaced market expectations of a rise of 1.8%. Overseas sales were helped by an improving outlook in the major markets of China, Hong Kong, Taiwan, India, and the ASEAN-5 nations, as well as by firmer demand for food products. Exports of agricultural and agro-industrial products therefore returned to growth for the first time in 5 months (+12.0%), though overseas sales of industrial goods contracted slightly (-0.3%). For 9M23, (January-September) the total value of exports slipped -3.8%.

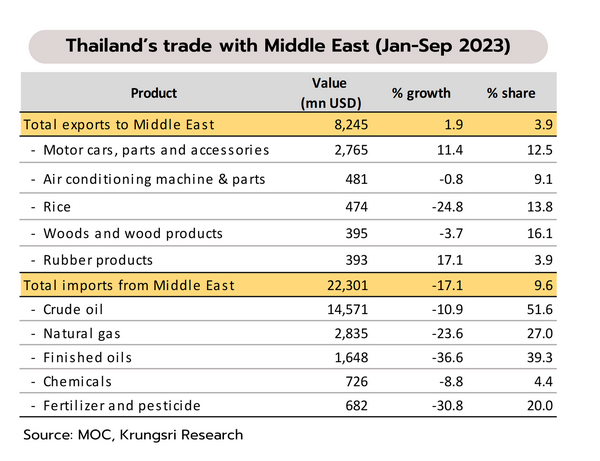

Momentum has been building in the export sector from late Q3 onwards, and it is possible that in Q4, exports may return to growth for the first time in a year. The situation is line with improving outlook of the key export markets in Asia. Export figures will also benefit from comparison with the low base last year, when China was in lockdown. Nevertheless, any return to growth for exports in Q4 will likely be insufficient to turn the overall 2023 figures positive, and so we see export value contracting -1.5% this year. The picture may be further complicated by fighting between Israel and Hamas, and if the conflict spreads across the wider Middle East region, this will impact trade at the global level, and it will hurt Thai exporters. Most obviously, exports of motor cars & parts and rice are exposed to elevated risk since they account for 13% and 14% of total Thai exports of these goods to the world, respectively.

Discounting the possible impacts of the Digital Wallet policy, the FPO forecasts economic growth of 3.2% in 2024, compared to 2.7% in 2023. The Fiscal Policy Office (FPO) has cut its forecast for 2023 GDP growth to 2.7% (over a range of 2.2%-3.2%) from the previous forecast of 3.5% on the weaker-than-expected performance of the tourism and export sectors. However, the FPO sees 2024 GDP growth reaching 3.2% (over a range of 2.2%-4.2%), helped by stronger private consumption, continuing growth in the tourism sector (arrivals are forecast to reach 34.5m), and a 4.4% expansion in exports, which will support increased private-sector investment.

The FPO’s forecast of 3.2% GDP growth for 2024 does not take into account the possible impacts of the government’s plans to distribute THB 10,000 to Thai citizens via the Digital Wallets since details of the policy are still under discussion. Initially, the government planned to target all citizens over 16 years old, but this may be changed, and three groups are now being discussed as possible recipients: (i) holders of government welfare cards (15-16m people); (ii) excluding individuals earning over THB25,000 a month or with deposits of over THB100,000, leaving 43mn eligible people; and (iii) excluding individuals earning over THB50,000 a month or with deposits of over THB500,000, leaving 49mn eligible people. It is not yet clear which route the government will take, but we predict that compared to a baseline case of no digital wallets being introduced, the policy will boost GDP by 0.4-1.1%, though impacts are likely to be at the lower end of this range.