The economic slowdown in the US, Eurozone, and China is raising hopes that the next move on monetary policy may accommodate growth

US

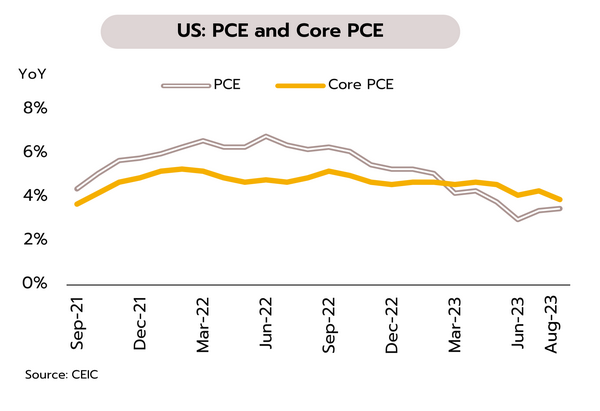

With softening economic growth and cooling inflation, the US Fed may hold rates steady at its next meeting. Congress avoids government shutdown in last minutes. In August, headline PCE inflation edged up to 3.5% YoY from 3.4% in July, but core PCE inflation eased to a 2-year low of 3.9%. 2024 GDP growth is expected to slow down to 1.5% from 2023’s 2.1%, according to the FOMC. September’s Consumer Confidence Index fell from 69.5 to 68.1, while 1-year consumer inflation expectations slipped from 3.5% to 3.2%.

The House and Senate passed a bipartisan bill to avert a government shutdown, and President Biden signed it before the midnight deadline, allowing the government to stay open for 45 days, and giving the House and Senate more time to finish their funding legislation. The tightening of monetary policy is slowing the economy, and this is now reflected in weaker data on employment, loan growth, existing home sales, and Composite PMI. Thus, with inflation easing, clearer evidence of an economic slowdown, and positive real interest rate, we expect the Fed to hold rates steady at 5.25-5.50% through to mid-2024, or until there are clear signs that inflation is back to its 2% target over the long term.

Eurozone

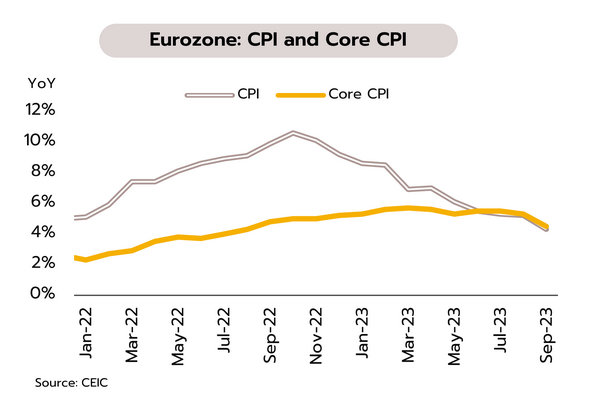

Following the sharpest drop in Eurozone core inflation in a year, the ECB is expected to leave interest rates unchanged. In August, the contraction in Eurozone M3 money supply accelerated from -0.4% to the historic high of -1.3%, while growth in private credit slipped from 1.3% YoY to 1.0%. Meanwhile, in September, headline inflation softened from 5.2% YoY to 4.3%, with core inflation also dropping to a year low of 4.5% YoY, down from 5.3%. In addition, the Eurozone economic sentiment index fell from 93.6 to 93.3.

Tight monetary policy and the recent high inflation are weighing on the Eurozone, which from Q3 onwards has been evident in worsening economic indicators, including: (i) 5 months of softening business confidence; (ii) 2 months of declines in consumer sentiment; (iii) 10 months of worsening retail sales; and (iv) the fall in the Composite PMI to its lowest level since December 2020. There is thus a significant risk that the bloc will enter recession in 2H23, and given clearer signs of weakening inflation and a general economic slowdown, we expect that the European Central Bank (ECB) will leave interest rates unchanged at its October meeting as it looks to mitigate the effects of the earlier rate hikes on economic growth.

China

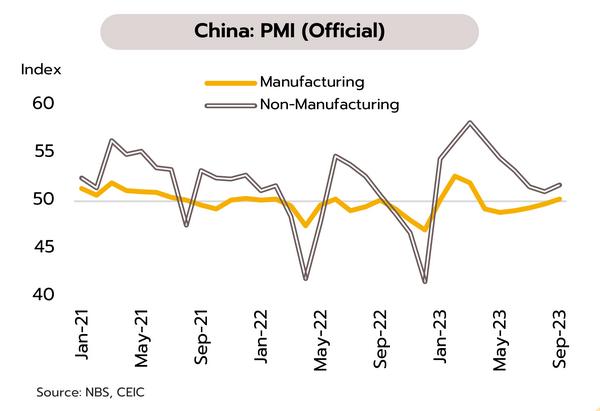

Chinese economy showed signs of improving in late Q3, but sluggishness in the real estate, financial, and export sectors continues to drag on growth. The official manufacturing PMI climbed from 49.7 to 50.2 in September, returning to expansionary territory for the first time in 6 months amidst the rollout of government measures to support the economy. Having declined since April, September’s services PMI also rose for the first time to 51.0. Beyond this, industrial profits bounced back to growth of 17.2% YoY in August, having contracted -8.3% and -6.7% in each of June and July.

Although the outlook for China is improving, significant risk remains. (i) In the past week, China Evergrande was unable to issue new bonds, its flagship unit Hengda Real Estate Group missed repayments, and in Hong Kong, trading in China Evergrande Group shares was suspended following reports that the Evergrande chairman was under criminal investigation. (ii) China Beige Book reports that corporate borrowing fell back to “very low levels” as loan rejections and average loan rates spiked, despite moves by the People’s Bank of China to lower the cost of borrowing. (iii) Export order growth declined to its weakest since March, underscoring the strength of the pressure on China from slowing global demand.

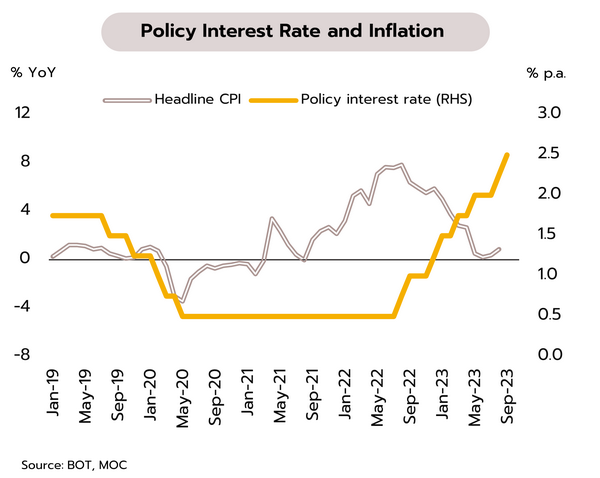

The latest hike in policy rate to 2.50% may mark the end of the current tightening cycle, but economic recovery remains concentrated in the tourism sector and related industries

The MPC has raised policy rate by 25 bps to a 10-year high of 2.50%, but this will likely remain unchanged through 2024. At its 27 September meeting, the Monetary Policy Committee (MPC) unanimously agreed to raise policy rate by 25 bps to 2.50%, and although the forecast for 2023 GDP growth has been cut from 3.6% to 2.8%, strong growth in consumption has lifted the outlook for 2024 growth from a projected 3.8% to 4.4%. 2023 and 2024 forecasts for headline inflation have also been revised to 1.6% and 2.6% from respectively 2.5% and 2.4%, while those for core inflation now stand at 1.4% (down from 2.0%) and 2.0%. However, significant risks exist for the 2024 outlook as a result of both the new government’s policies, which may add to demand-side pressures, and the impact of the El Niño on food prices.

By taking rates to a decade high of 2.50%, the MPC prioritized outlook over past data, paying attention to stimulus measures set to be introduced next year by the new government. After the meeting, the BOT governor noted that the rate is expected to stay at a neutral level, projecting growth meeting its potential and inflation remaining within target. Additionally, the BOT’s statement noted that “the current policy interest rate (is) appropriate for supporting long-term sustainable growth.” This is thus indicating that this cycle of increases may be over. However, while the BOT remains optimistic about the economic outlook, we foresee more modest growth due to uneven and uncertain recovery. Risks include the global economic slowdown and the implementation of fiscal stimulus policies, but we expect that inflation risks from fiscal expansion and cost pass-through will be limited by underutilized resources. Krungsri Research now sees the MPC keeping policy rates unchanged into next year, and the 2.5% rate, which is higher than the pre-pandemic average of 1.5% and close to the BOT’s 2.6% inflation forecast, is regarded as adequate to meet concerns with financial stability while also supporting economic growth.

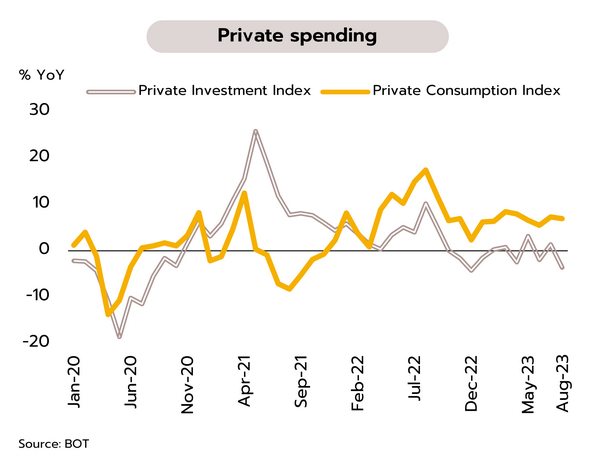

Thai economy continued to be lifted by the strength of the tourism sector through August, but domestic demand is softening. Data from the Bank of Thailand show that in August, the economy grew on receipts from tourism, though having strengthened in July, growth in domestic demand weakened again. Expansion in private consumption slowed from 7.3% YoY to 6.9% on slower spending on both durable and non-durable goods. However, spending on services was boosted by the strength of both domestic and international tourism. Although expenditure on construction strengthened, weak spending on plant and machinery also fed into a drop in private investment (-3.5% vs +1.3% a month earlier). In addition, the value of exports dropped for the 11th month (down -1.8%), with manufacturing output also down -7.5%, its biggest decline in 4 months.

Although the Thai economy is on the path to growth, the latter is unevenly distributed and ongoing support is still required to keep the economy on track. Thus, recovery in private investment remains shaky, and indeed turned negative in August, while the export sector remains sluggish, partly due to weak demand in overseas markets. Likewise, although private consumption was showing strength, this too is now softening. Nevertheless, consumption should continue to strengthen through the rest of 2023, helped by government measures to alleviate problems with the elevated cost of living through cuts to electricity bills and diesel pump prices, and debt relief for farmers (due to begin in October). In addition, the strength of the rebound in the tourism sector will be helped further by the move to provide free visas for arrivals from China and Kazakhstan. We expect this supportive measure would help to boost total 2023 foreign arrivals to 28.5mn.