Fed is likely to raise rates by 50 bps in May; Risks to the global economy are rising

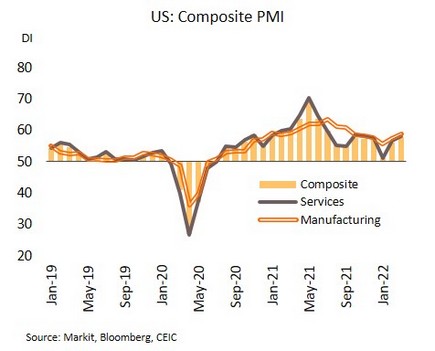

Strong US growth is continuing to stoke inflationary pressures; Fed signaled to accelerate pace of rate hike. In March, the US Composite PMI hit 57.7, its highest since July 2021. Initial jobless claims for the week ending 2 April dropped to 166,000, the lowest since 1968.

Indicators reflect the strength of US growth, though tightness in labor markets is now feeding higher inflation and pushing the Fed to accelerate this cycle of rate rises. Minutes from the March meeting thus show that some members stated that “one or more 50 basis point increases could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified.” The Fed is also moving to cut its balance sheet by up to USD 95bn/month, significantly faster than the USD 50bn/month seen when QE was wound up in 2017. We now expect that the Fed will hike rates by 50 bps at its May meeting, with the possibility of a second 50 bps rise in June now steadily increasing. Policy interest rates are expected to be in the range of 2.00-2.50% by the year end.

The ADB and the World Bank downgraded their 2022 Asian growth projection amid stiffening headwinds. The World Bank has revised its forecast for growth in the Asia-Pacific region downward from 5.4% (made in October 2021) to 5.0%. Likewise, the Asian Development Bank (ADB) has cut its forecast from 5.3% (December 2021) to 5.2%.

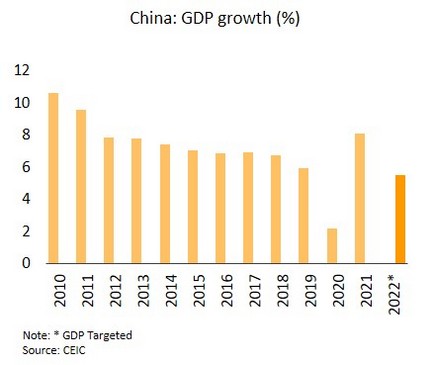

The Asian economy is likely to slow down more than expected due mainly to the impacts of the Ukraine crisis on a situation that was already difficult, given widespread of COVID-19 outbreaks. Recovery is also coming under threats from: (i) the consequences of the Ukraine war and of Russian sanctions, which most recently have extended to include a possible ban on Europe’s imports of Russian coal that would drive up commodity prices and further disrupt supply chains; (ii) Accelerating Fed rate hike that are increasing the risk of some countries in the Asia-Pacific region seeing worsening capital outflows, thus forcing them to tighten monetary policy even while domestic recoveries remain incompleted; and (iii) a slowdown in China, with the World Bank and ADB expecting the Chinese economy to grow by 5.0% this year, down from 8.1% in 2021, though in view of the severity of the current outbreak, the situation and attendant consequences could worsen further.

The current lockdown in China is likely to be extended and may contribute to further global supply disruption. The latest outbreak of COVID-19 in China is worsening, especially in Shanghai, where new cases have reached a record high for China of over 20,000 per day. In response, the authorities have locked down the entire city, closed some industrial areas (including the Tesla factory), and introduced strict controls to manage outbreaks in semiconductor and mobile phone production facilities.

China’s current wave of infections has engulfed major economic areas that combined account for 22% of Chinese GDP, and the lengthening lockdown may add to the turbulence already caused by the Ukraine war to further shake global supply chains. In response, the People’s Bank of China (PBOC) has promised to implement concrete measures that will protect against escalating risks to the economy. The authorities are also expected to provide additional supports to prevent a sharp slowdown, though a broad array of threats continue to put pressure on the government’s 5.5% target for 2022 economic growth.

Rising inflationary pressure is straining household expenses and business costs

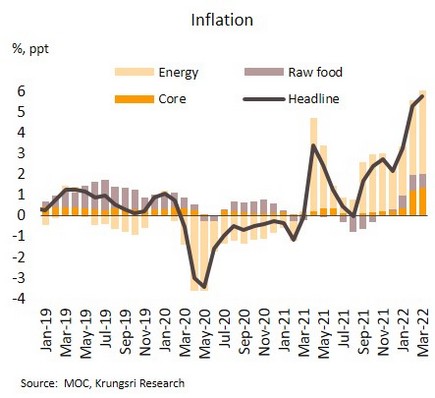

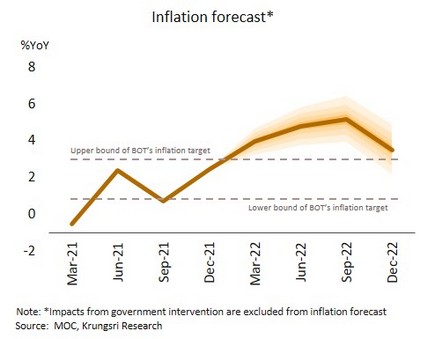

Inflation climbed to a 13-year high in March, adding to fears over the rising cost of living. Headline inflation rose to 5.73% YoY in March from 5.28% in February on rising global energy prices as the Russia-Ukraine conflict intensified, which then fed into a 31.43% jump in the domestic retail price of oil. In addition, prices of some food products, especially chicken eggs, vegetables, and seasonings and condiments, also increased. Core inflation (excluding raw food and energy prices) hit the highest in almost a decade at 2.00%, compared to 1.80% in February. For all of 1Q22, headline and core inflation have thus averaged 4.75% and 1.43%, respectively.

The rapid run up in the inflation rate has brought headline inflation to its highest since October 2008 and kept inflation above the BOT’s target range for 3 months running. Price rises are largely being driven by higher energy costs. Although prices have not risen across the board, fears are escalating over the impact of inflation on consumer spending and purchasing power. Indeed, Google searches for ‘inflation’ carried out within Thailand have also reached highs not seen since 2008, and this is one factor behind the slip in the Consumer Confidence Index, which in March dropped for the 3rd month to hit a 6-month low of 42.0 (down from 43.3 in February). We expect that the rise of vehicle and food-at-home prices, coupled with spike of energy prices driven by the war in Ukraine, will likely sustain Thai inflation above the target range until at least Q4, when the rate may begin to soften. Beyond this, our analysis shows that because of differences in their typical expenditure, low-income earners spend roughly twice as much of their income on transportation and food-at-home categories as high-income earners. This suggests the low-income groups are likely to experience rising prices that would accelerate more than 6 times compared to last year. By contrast, for high-income earners, inflation is expected to be largely unchanged this year.

Industrial sentiment improved in March, though confidence remains under threat from a range of factors. In March, the Thai Industries Sentiment Index (TISI) rose from 86.7 to a 25-month high of 89.2, owing to a combination of the relaxation of control measures, which then helped economic activity to rebound, and an improving outlook for the tourism sector as many countries have gradually eased restrictions on international travel. In addition, many manufacturers also pushed through production orders in March ahead of April’s lengthy Songkran holidays.

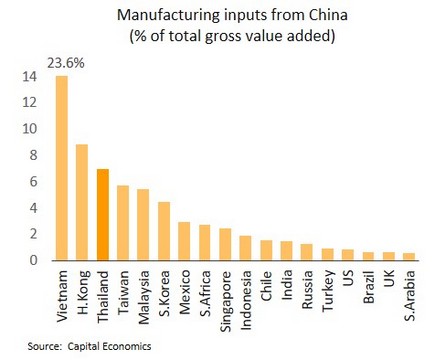

Although manufacturing showed signs of improvement on recovery in domestic and external demand at the beginning of 2022, we believe that there would be a risk of prolonged Ukraine war which may then weigh on global trade and growth, with consequent effects on the Thai exports and manufacturing sectors. At the same time, the sharp rise in the price of energy is adding to manufacturing and transport costs, while there are risks of further supply disruptions if the current Chinese lockdown lengthens or widens. Thailand is particularly exposed to the latter since Thai industry is highly dependent on China. Considering the ratio of Chinese input to gross value added, Thailand comes after only Vietnam and Hong Kong in terms of the importance of Chinese supplies to its domestic industry.