Although turbulence in the financial sector is subsiding, risks to global growth are rising

Global

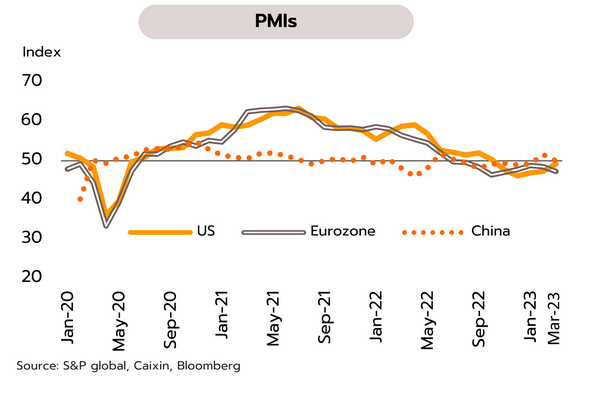

IMF and WTO see growth of world economy and trade falling below trend. March manufacturing activity also weakened. With the extended conflict in Ukraine, continuing high inflation, and tighter monetary policy worldwide, the WTO forecasts growth in global trade of just 1.7% this year, down from 2.7% last year and below the average of 2.6% maintained for the past 12 years. Likewise, the IMF sees global growth falling from 2022’s 3.4% to below 3% in 2023, and then averaging only 3% through the next 5 years, compared to 3.8% over the past 2 decades. The IMF also sees geopolitical tensions, especially the US-China conflict over access to technology, cutting global GDP by 2% in the long term.

Although service sectors in many countries are rebounding and the global economy continues to benefit from the reopening of China, world trade is slowing and the global growth will weaken in 2023, as predicted by the WTO and the IMF. Data for March also indicate that manufacturing activity is softening. In the US, the ISM manufacturing PMI contracted for the 5th month to an almost-3-year low, while the Eurozone manufacturing PMI contracted for the 11th month to a 4-month low. In Asia, the Japanese manufacturing PMI contracted for the 5th month, and the Chinese Caixin manufacturing PMI fell to 50 points, indicating zero growth.

US

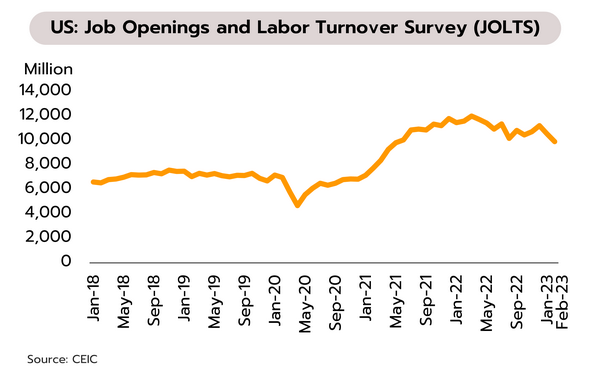

Risk to US growth tilts to downside and the Fed is expected to halt this cycle of rate rises in 2H23. March’s non-farm payrolls rose by 236,000, below the market expectation of 238,000 and the lowest increase since December 2020. Moreover, although unemployment dipped to 3.5%, better than the forecast 3.6%, average hourly earnings rose just 0.3% MoM and 4.2% YoY, the weakest increase since June 2021.

Although fears of a banking crisis are lessening, the combined effect of rapid rate rises, tighter lending conditions, and the prospect of a credit crunch may be emerging in data on economic activity and employment. The latest US jobs opening showed the weakest in almost 2 years, non-farm payrolls slowed for the 3rd month, and the ISM manufacturing index contracted for the 5th month. We expect that this slowdown will continue and intensify, particularly through 2H23, and this is reflected in the implied interest rates given by markets, which see the Fed raising rates by 25 bps at its May meeting, this hike giving a terminal rate of 5.00-5.25%. The outlook for year-end rate cuts remains highly uncertain since this will be dependent on the severity of the economic slowdown and inflation developments thereafter.

Japan

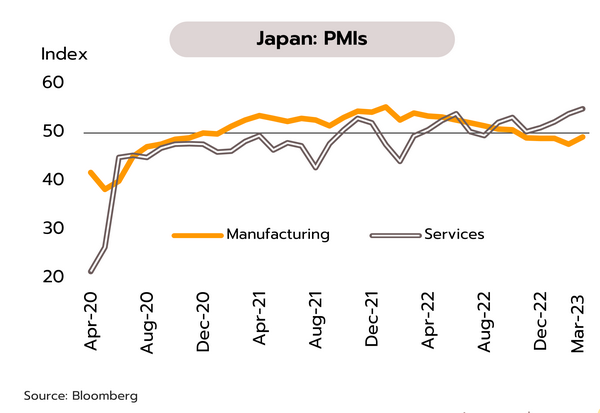

Softer inflation and tourism recovery will support consumer spending in 2H23, but Japan’s exports will remain weak. The service sector continues to rebound after the pandemic is ending and consumer confidence is returning. March’s services PMI rose to 55.0, the biggest jump since October 2013. This will partially offset manufacturing weakness, as reflected by the manufacturing PMI that stayed in contractionary territory for the 5th straight months.

Japan’s overall consumption will benefit from softening inflation, which will have positive impacts on real incomes. The economy will also benefit from the return of Chinese tourists now that travel restrictions have been lifted. However, the recovery will be uneven through 2H23. Manufacturing and export businesses may see activity weaken as the economies of major trade partners (i.e., Europe and the US) are slowing. This may then offset gains made by the Chinese recovery and the stronger demand that this is feeding, and so overall Japanese exports will tend to remain weak. In addition, the appointment of a new governor of the Bank of Japan is expected to lead to a tightening of monetary policy as the BOJ looks to ease inflationary pressures and reduce policy divergence with the central banks of other developed economies.

Inflation has returned to its target range quicker than the BOT expected, and this will reduce the upward pressure on policy rate

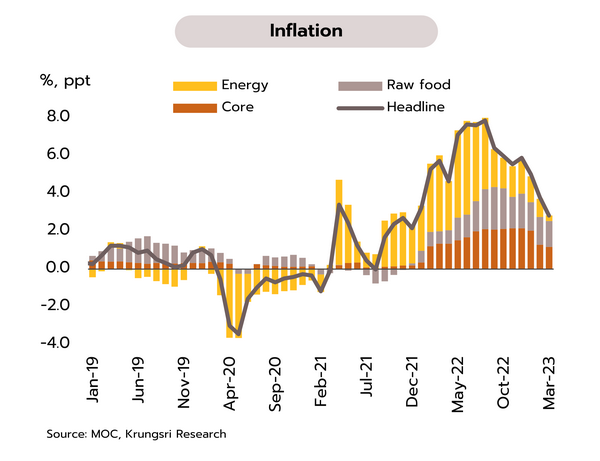

In March, headline inflation slipped to a 15-month low, and this may encourage the MPC to hold rates steady at 1.75% at their May meeting. Headline inflation dropped to 2.83% in March, below analysts’ and Krungsri Research’s estimate of 3.25% and down from 3.79% in February and 5.02% in January. This sharp decline has been driven by weaker global crude prices, which has then fed through into a softening of domestic fuel prices together with March’s THB 0.50/liter cut in the diesel price. In addition, prices for some fresh foods, including pork and vegetable oil, have fallen from a month earlier. Core inflation, which excludes food and energy costs, also fell to 1.75% in March, down from 1.93% in February and 3.04% in January. Across the first quarter of 2023, headline and core inflation have therefore averaged 3.88% and 2.24% respectively. The Ministry of Commerce now expects headline inflation to average 1.7-2.7% for 2023, down from its earlier prediction of 2-3%.

We think that the Monetary Policy Committee (MPC) may leave policy rate unchanged at their next meeting, scheduled for 31 May, due to the following reasons. (i) Inflationary pressure is softening and headline inflation has slipped back into the BOT’s target range some 3-4 months earlier than expected. Core inflation is also predicted to stay below 2% for the rest of the year, which would keep this below the BOT’s forecast of 2.4%. Moreover, the Producer Price Index dropped 1.7% YoY in March, indicating that price pressures on inflation are abating. (ii) We estimated Thai GDP growth for Q1 at just 2.2% YoY (figures will be released on 15 May), which would be significantly below the long-term average of 3.7%. (iii) Thailand’s export sector will continue to be negatively affected by slowdowns in major export markets and in the global economy, and the World Trade Organization (WTO) now expects that global trade will expand by just 1.7% in 2023, down from 2.7% a year earlier.

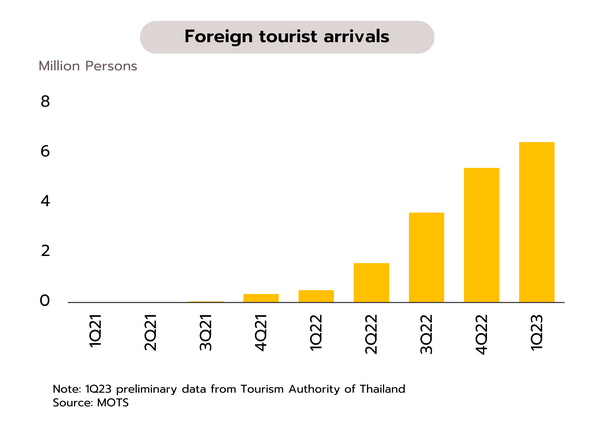

Through the first quarter, the Thai economy has been boosted by recovery in the tourism sector with the more than 6mn tourist arrivals. Preliminary data from the Tourism Authority of Thailand indicate that in March, the country welcomed 2.21mn foreign arrivals, up from 2.14mn and 2.11mn in each of January and February. For 1Q23, foreign arrivals thus totaled 6.46mn, and these generated receipts of THB 256bn. By region, more than half (56.8%) of arrivals came from East Asia, with 26.5% from Europe and the remainder coming from countries including India, the US, Australia, Israel, Canada and Saudi Arabia. In the first quarter of this year, the top 5 foreign arrivals were tourists from Malaysia, Russia, China, South Korea, and India.

With the easing of the Covid-19 pandemic, domestic economic activity is returning to normal and the tourism sector is recovering rapidly. The latter is thus expected to be a major driver of Thai economy this year. In the first quarter, arrivals were up more than 11-fold relative to a year earlier. The Chinese market is also returning, and for the last week (27 March to 2 April), Chinese arrivals became the largest group (68,177 individuals), followed by Malaysia and Russia. However, despite this, overall economic growth will remain lackluster through 1H23 at under 3%, and the weak performance of economies in the main overseas markets, particularly the US and Europe, will drag on Thai export growth in Q1 and Q2. The Ministry of Commerce sees Thai exports to contract by 8% in 1Q23. This gloomy outlook is further underscored by the further contraction in manufacturing activity in the Eurozone and the US.