The impetus given by the reopening of China is increasing, but geopolitical risk and rising interest rates continue to drag on the global economy

US

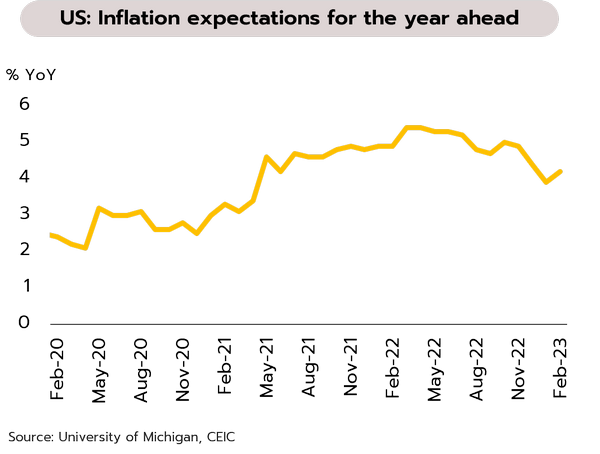

Fed officials are indicating that rate hikes will continue while indicators point to US economic slowdown. With February’s rise in one-year-ahead inflation expectations to 4.2% from 3.9% in January underlining the continuing strength of inflationary pressures, Senior Fed officials are reiterating the need to raise policy rates further and to keep them elevated for longer than the market currently anticipates.

We expect more rate hikes in March and May, giving a terminal Fed funds rate of 5.00-5.25% that will remain unchanged for the rest of 2023. The current cycle of increases should thus end soon, especially given Chair Powell’s recent comments that “the disinflation process has begun” and that the Fed had the tools necessary to bring inflation down to the 2% target. Evidence of the impacts of prior hikes is also becoming clearer with (i) a sharp deceleration of consumer credit growth from 7.1% in November to 2.9% YoY in December, and (ii) the fact that although employment figures increased unexpectedly, full-time jobs are stable and the rise is due to growth in part-time work. For the week ending 4 February, initial jobless claims also rose to 196,000 from a 9-month low.

Japan

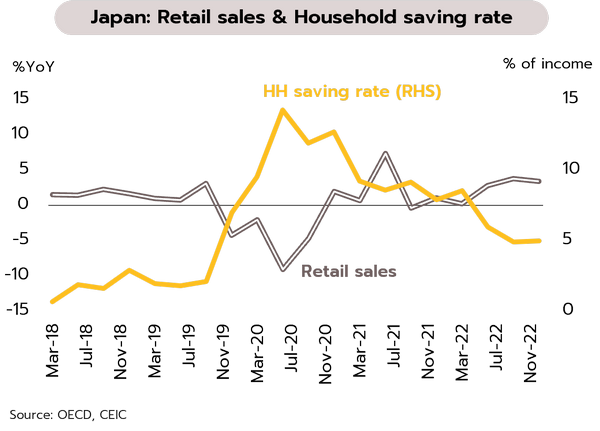

Shrinking household savings and falling real wages may impact Japan’s consumption through 1H23. Retail sales beat the expected 3.0% increase to rise 3.8% YoY in December, helped by the post-Covid rebound in domestic demand. Similarly, nominal wages rose 4.8% YoY, with the real wage thus increasing by 0.1%, the first such rise in 9 months. However, this is largely attributable to one-off bonus payments, rather than any permanent increase in base salaries.

Indicators are pointing to a weakening of consumption through 1H23. (i) As the cost of living has risen, the proportion of savings to household income has dropped, falling to just 4.9% in 3Q22 from an average of 8.7% in 2021. (ii) Wage growth has fallen behind inflation and so real wages are tending to shrink. At the same time, the reopening of China and the potential boost given by the return of Chinese tourists to Japan will be blunted by Japan’s maintenance of strict pandemic controls and the fact that Japan is not among the 20 countries that Chinese tour groups are allowed to visit. In any case, spending by Chinese tourists accounted for just 0.5% of Japan’s GDP in 2019.

China

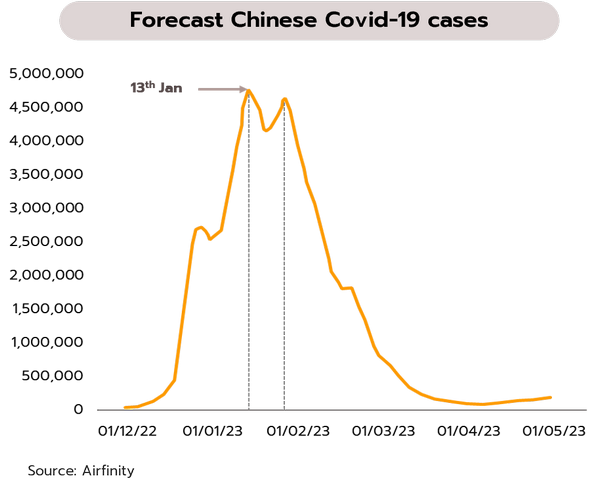

Domestic spending is strengthening, but a limited increase in wealth may cap upside of China’s growth. The ending of zero-Covid, the reopening of the country, and the celebration of the Lunar New Year all helped life begin to return to normal at the start of the year, as seen in data for travel between Beijing and other major cities, box office takings (up USD 38m from 2019 for the first seven days of the Chinese New Year), and the number of domestic flights. International flights are also projected to return to their pre-Covid level in 3Q23.

We expect that the size of pent-up demand will be limited. Although the savings rate rose to 34.3% last year and three-year excess savings are now worth USD 827bn, Chinese asset prices remain below their pre-Covid level and so consumers will likely spend with caution (unlike in the US, where property and stock prices were above their 2019 level even before the 2021 reopening). Spending should rise in 2Q23 since the infection rate has passed its peak and, from mid-February, a clear fall in the infection rate is seen. Even though China’s economy is improving, geopolitical tensions are intensifying, most recently with the US downing of the Chinese spy balloon, which is likely to cause uncertainties for China and the world.

![]()

Domestic consumption remained the main driver of the Thai economy at the start of the year, while both headline and core inflation undershot market expectations in January

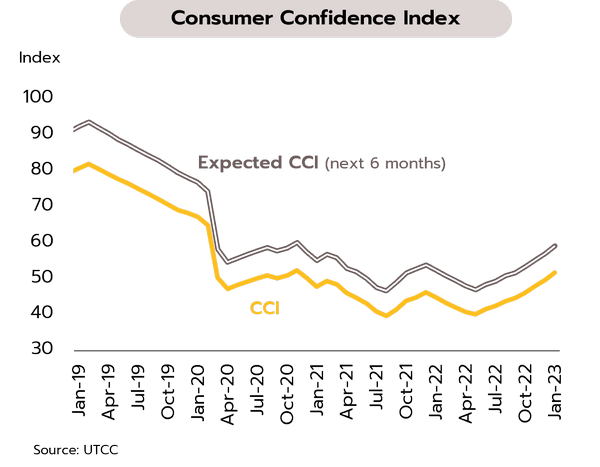

Strengthening sentiment is supporting growth in domestic expenditure through the start of the year. In January, the Consumer Confidence Index climbed from 49.7 in a prior month to 51.7, the 8th straight month of increases and a 26-month high. Consumer sentiment is being lifted by the effects of government stimulus packages, clear signs of recovery in both the domestic and international tourism segments (especially in the Chinese market, now that China has reopened), and continuing strong prices for agricultural products. However, this is somewhat balanced by fears over the rising cost of living and the existence of external threats to the economy.

The positive effects of steadily rising consumer confidence are reflected in strengthening domestic expenditure, which has then helped to drive economic growth through the start of the year. Likewise, an improving outlook for the tourism industry is also supporting stronger employment in tourism and related services, while the looming election will also push more funds into the economy. However, still-high household debt, higher lending rates and high cost of living are all dragging on spending by low-income groups and so recovery in consumption remains unevenly distributed across the economy.

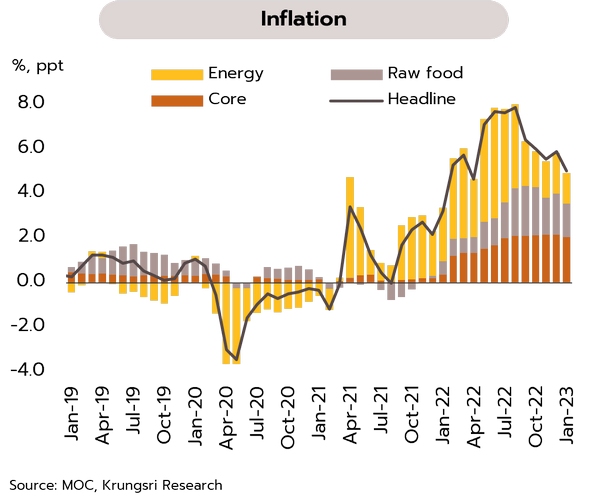

Headline inflation slipped to a 9-month low in January, and this is expected to reenter the official target zone during 2H23. In January, headline inflation dipped below the 5.12% anticipated by the market by weakening to 5.02% YoY from 5.89% in December, pulled down by: (i) weaker global crude prices that slowed the run-up in the cost of transport fuels; (ii) government assistance with the cost of living, e.g., through help with electricity bills; and (iii) softening food prices (e.g., for vegetable oil and pork), although prices rose for transport (taxis and the metro) and for fresh fruits, the latter due to rising demand attributable to the Chinese New Year celebrations. Core inflation, which excludes raw food and energy prices, dropped to 3.04% in January, down from 3.23% in December and below the 3.10% expected by the market.

At present, inflationary pressures are continuing to be fed by a broad range of factors, including rising prices for cooking gas, steeper domestic electricity bills (now that government subsidies are ending), and recovery in the tourism industry and in demand more generally, which will then add to upward pressure on the prices of goods and services as inputs become more expensive. Nevertheless, we see headline inflation softening overall, partly due to the fading of base effects, partly due to the easing of earlier disruption to global supply chains, and partly due to the strengthening of the baht relative to a year ago. We thus expect inflation to return to the 1-3% target range during 2H23.