Fed rate hikes should end this year, but in Japan these are just beginning. In China, growth may be threatened by the property sector

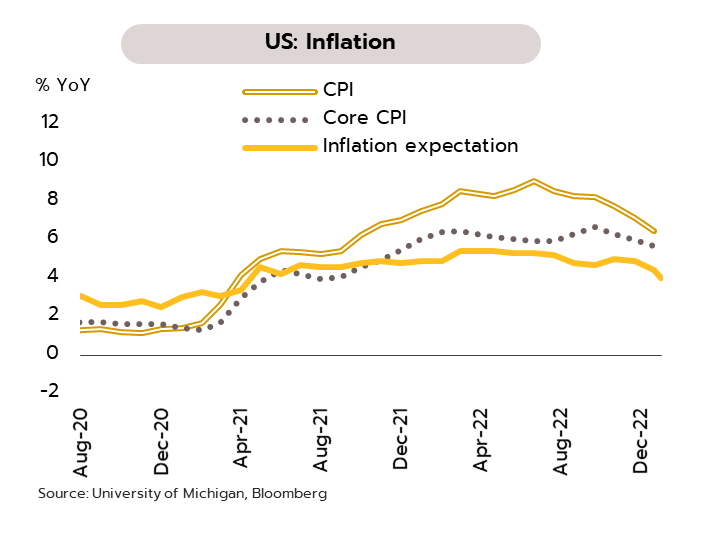

US inflation appears to be softening, and this will allow the Fed to slow the pace of future rate hikes. As expected by analysts, key inflation indicators softened in December. Thus, the headline Consumer Price Index (CPI) fell for the first time in 2½ years, dropping 0.1% MoM from November, and although it was up 6.5% YoY, this was the lowest in 14 months. This also marks a sharp fall from June 2022’s peak of 9.1%. At 5.7% YoY, core CPI, which excludes food and energy, was also down from 6% in November.

Having launched a cycle of rate hikes in 2022 that rapidly took rates to a 15-year high, the Fed will now slow the pace of these because (i) inflation is softening, and this month, the one-year inflation outlook slipped to a 2-year low of 4.0%, with wages falling alongside this. (ii) The data point to the rising risk of a recession for the US, and in December, indicators for both manufacturing and services posted a contraction. We thus expect two more rate hikes of 25-bp each, taking the terminal rate to around 5%. Rates will then likely remain unchanged this year as the Fed looks to balance the competing needs of price stability and growth.

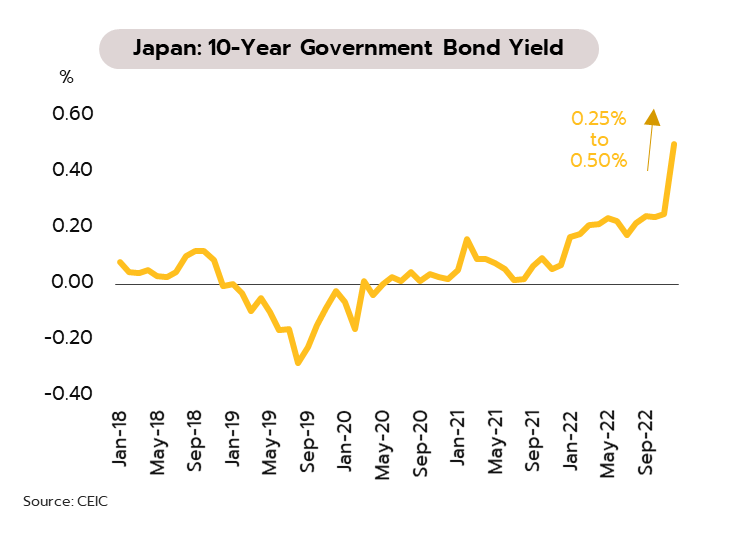

Tweaking its policy of yield curve control by widening the target range for bond yields may be a turning point for Japanese monetary policy. In November, headline inflation climbed to 3.8% YoY, with core inflation rising to a 41-year high of 2.8%, thus moving against the trend seen in other developed economies. The Bank of Japan also shocked markets by making a surprise change to its Yield Curve Control (YCC), widening the target range for 10-year government bond yield from +/-25bps to +/-50bps, indicating that a turning point for the end of ultra-low interest rates and quantitative easing may be on the horizon.

With the Yen strengthening and global demand softening (as reflected in the contraction of manufacturing PMI readings for major export markets), the Japanese economy is facing downside risks that may weigh on the export sector, especially through 1H23. However, we believe that the positive effects of the reopening of the country, high levels of household savings, public subsidies on electricity bills for households and businesses, and rising wages will underpin stronger domestic spending and keep GDP growth in positive territory through the year.

China's outlook is likely to improve further in 2023, but risk in the property sector may drag on the economy. Growth is likely to be boosted by China’s abandonment of its Zero-Covid strategy and the country reopening, but the property sector remains at risk from a downturn in demand and rising debt defaults. Indeed, 41% of real estate corporate bonds maturing in 1Q23 (worth USD 16.3 billion) are at risk of default. In 2022, Chinese developers defaulted on USD 26.57 billion’s worth of debt, up 260% from 2021. The authorities thus announced at the start of January that they would relax borrowing restrictions, particularly the ‘Three Red Lines’ measure that have played a major role in deflating the market over the past 2-3 years.

We see Chinese growth hitting 4.8% in 2023, up from an estimated 3% in 2022. This will be driven by recovery in private consumption, which should begin to emerge more clearly following the peak in Covid infections in March. Nonetheless, the real estate sector is likely to keep contracting and dragging on the economy, despite a slight improvement brought on by government rescue measures and recovering domestic demand.

Consumption is benefiting from expanding employment, strengthening sentiment, recovering tourism, and stimulus measures, though government spending will play a less important role in boosting economic growth.

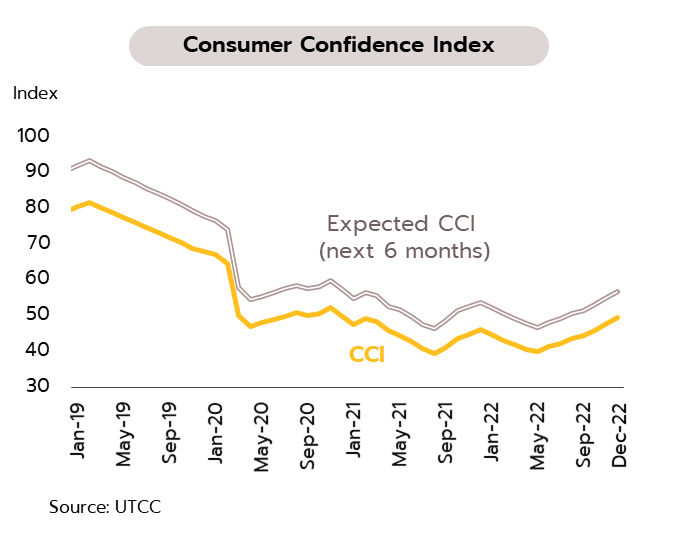

Consumer sentiment continues to recover and this will add to the tailwinds lifting domestic consumption. The Consumer Confidence Index (CCI) was up for the 7th straight month in December, climbing from 47.9 to a 3-year high of 49.7. Likewise, expected CCI in the next 6 months also rose from 55.2 to 56.9. Improvements were seen in all components of the index, driven higher by stable or weakening domestic oil prices, recovery in the tourism sector, and stronger farm income due to higher agricultural production and price.

Consumption is expected to continue to grow through the start of the year thanks to brightening sentiment, stronger labor markets that, on the evidence of the number of section 33 self-insured workers, are now back to close to their pre-Covid-19 state, and thanks to the unexpectedly rushed reopening of China, faster recovery in the tourism sector. Consumption is in addition being helped by the ‘Shop and Refund’ scheme, which allows for expenses made between 1 January and 15 February of up to THB 40,000 to be set against personal tax, and additional assistance by the government for welfare card holders. However, post-pandemic pent-up demand was largely exhausted in 2022, and the continuing high cost of living will also likely suppress growth in consumption through this year. We therefore expect 2023 private-sector consumption to expand further by 3.5%, though this would represent a slowdown from the high baseline of 5.7% set last year.

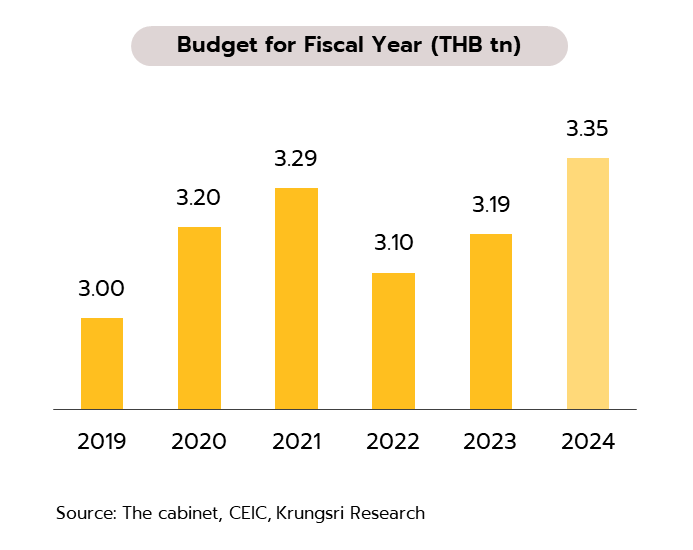

Officials have agreed a framework for the FY2024 budget that will cut the budget deficit from 3.7% to 3% of GDP. At a meeting held on 10 January, the cabinet approved the FY2024 budget, for which allocations total THB 3.35tn, up from THB 3.185tn in FY2023. However, the deficit will be reduced from THB 695bn (3.7% of GDP) to THB 593bn (3% of GDP), with THB 2.51tn of the total (74.9% of the FY2024 budget) allocated for ongoing expenses, and THB 690bn (20.6%) going to investment.

Having played a central role in reviving the economy through the pandemic, the importance of government spending will lessen this year. However, the economy is only at the early stages of recovery and so state expenditure still has a role to play. With an election due in the first half of the year, budget disbursements should not be delayed. Last year, the 1st reading of the FY2023 budget was approved in June, with the 2nd and 3rd readings approved in August. Normally, the next fiscal year would start on 1 October and so any delays of the formation of a government could hold up voting on the FY2024 budget, damaging confidence and possibly putting the economic recovery in danger.