Recoveries of the major economies are likely to diverge amid being faced with a wide range of risks

US energy-driven inflation is being amplified by rising wages. In February, Core PCE inflation jumped 5.4%, the biggest rise in almost 40 years. In March, average hourly wages rose by a nearly 2-year high of 5.6%. Unemployment rate fell to 3.6%, a lowest since the pandemic erupted. For the week ending 12 March, the continuing jobless claims dropped to 1.04m, the bottom most since 1970.

US labor markets are recovering strongly, and wage growth has outpaced market expectations. The wage-price spiral is stoking inflationary pressures that are being amplified by the effects of the Ukraine war on surging oil and commodity prices. In response, the Fed is likely to accelerate rate hikes, and we thus now expect a 50-bps rate rise in May and around 200 bps in cumulative hikes by the end of 2022. Market expectations of a harder and faster than anticipated rise in rates have pushed yields of 2-year Treasury notes above those of 10-year notes. Though inverted yield curves are seen as an indicator of future recession, only 3 recessions occurred within one year, following a total of 8 yield curve inversions since 1965, so currently this remains only a weak possibility.

Risks to the global economy are rising on the Ukraine crisis and the outbreak in China. For the Eurozone, March’s Manufacturing PMI fell into a 14-month low of 56.5, the Economic Sentiment Indicator dropped to 108.5, and headline inflation hit a new high of 7.5%. Regarding to Chinese economy, March’s Composite PMI dropped to 48.8, staying under the key 50-point waterline for the first time in 7 months. Both Manufacturing and Non-manufacturing PMIs slipped into recessionary territory for the first time since February 2020.

China and the Eurozone are having to confront rising risks to growth. In the latter, the war in Ukraine is impacting sentiment and expected to undermine consumption and manufacturing, weaken recovery progress, and amplify policy dilemmas. For China, a flare-up of outbreak and following containment measures have negatively affected economy. Despite a more flexible than the earlier lockdown, Chinese restriction measures remains harsh compared to other countries. Moreover, the recent lockdown has covered key economic areas, including Guangzhou, Shenzhen and Shanghai, where totally account for 8.9% of GDP. The Ukraine war and the Chinese lockdown may also worsen global supply chain disruptions, which could now extend into 2023.

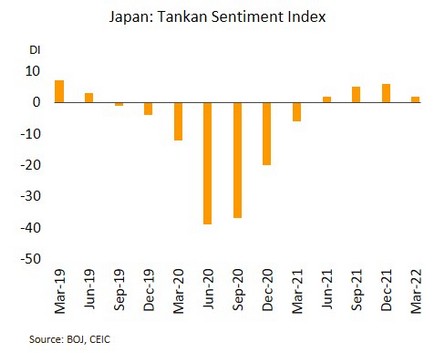

The Japanese recovery may be undercut by the war in Ukraine. In February, unemployment rate beat expectations to drop to 2.7%. Meanwhile, industrial production grew by 0.2% YoY. In March, Tankan sentiment index for manufacturers weakened to its lowest since June 2021.

Although Japanese economic indicators improved with the lifting of the quasi-state of emergency, the weakening confidence in March reflected concerns over the impact of the war in Ukraine on supply chain disruptions and rising energy prices, given the fact that 31% of Japan’s total imports are of crude oil and natural gas. In addition, the wider US-Japanese bond yield spreads discouraged investors’ interest in Japanese bonds. The Bank of Japan (BOJ) recently announced that it would employ an unlimited bond purchases to maintain its yield curve control (YCC) measure, reflecting the need for continuing accommodative monetary to support a further economic recovery.

Given continuing fragility in the economy amid inflationary pressure, we expect the BOT to support the recovery by keeping policy rates unchanged at 0.50% through 2022

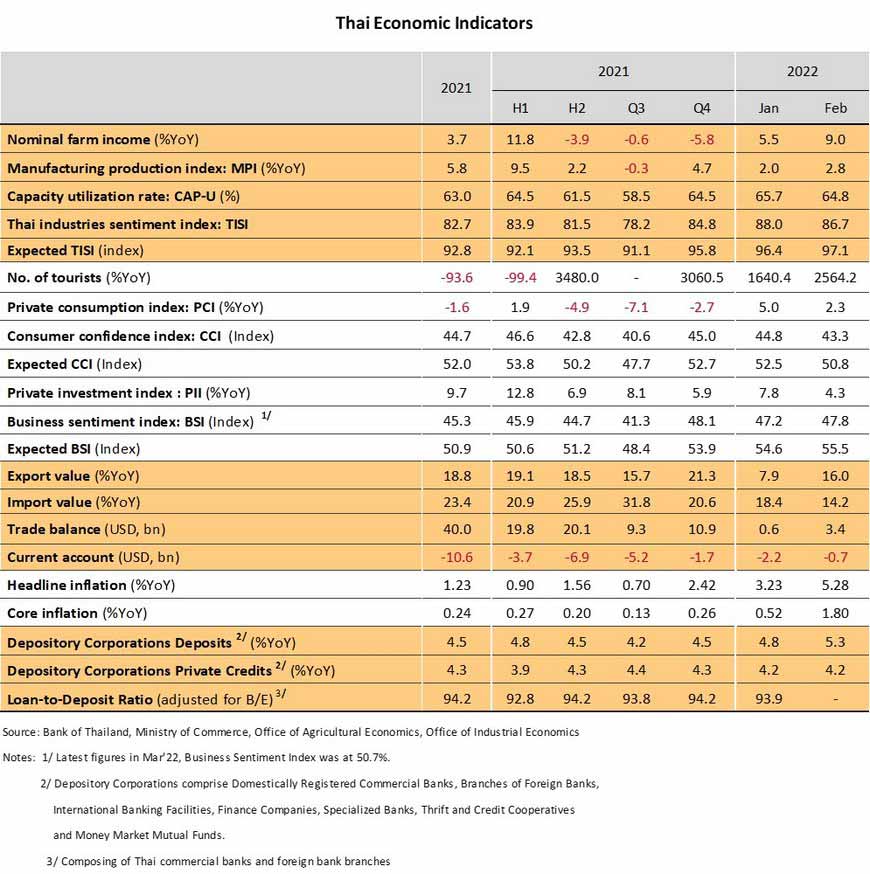

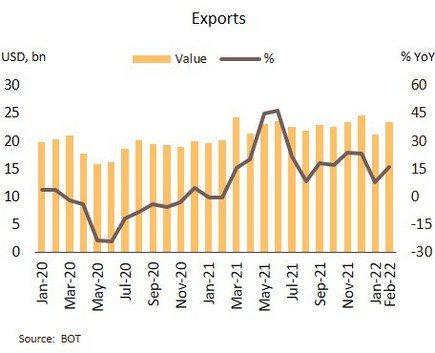

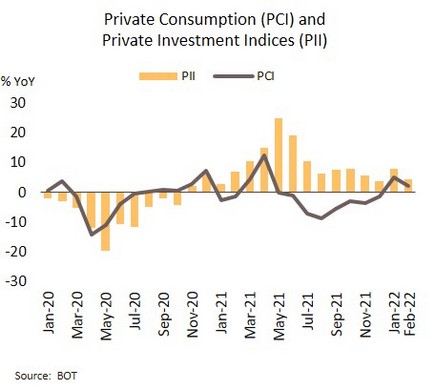

The economy was boosted in February by strong growth in exports, but domestic consumption softened slightly. The value of exports returned to double-digit growth of 16% YoY in February on strong demand in overseas markets, while the number of foreign arrivals also improved from January with the relaunch of the Test & Go program. However, growth in the Private Consumption Index (PCI) slowed from 5.0% to 2.3% on a combination of the worsening domestic spread of COVID-19 and rising energy and food prices which subsequently weakened consumer confidence, though government measures have helped support household spending. Likewise, growth of Private Investment Index (PII) decelerated from 7.8% to 4.3%, due principally to a fall in imports of capital goods, while construction investment remained flat.

Although the economic recovery was on track at the start of the year, the road to growth has been made more difficult to traverse by the impact of the high number of Omicron infections on sentiment and domestic economic activity. At the same time, the Ukraine war remains highly uncertain and fighting may extend through 2Q22, with negative consequences for the global recovery, especially in Europe. This will then: (i) weaken international trade by cutting demand for goods and services, disrupt transport, and interrupt supply chains of Russian goods that are currently sanctioned; and (ii) further rising energy and commodity prices, which then add to production expenses, cost of living, and thus erode household spending.

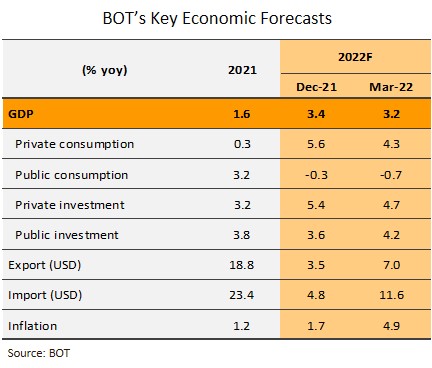

The MPC slightly trimmed 2022 GDP growth but raised inflation forecast above its target, and we expect rates to remain at 0.50% through the year. At its 30 March meeting, the Monetary Policy Committee (MPC) kept policy rates unchanged at 0.50% to facilitate a sustained economic recovery. However, sanctions on Russia would affect Thai economy through rising oil & commodity prices and weaken demand in trading partner economies, leading the committee to cut Thailand’s 2022 GDP growth projection from 3.4% to 3.2%. The MPC has also raised its forecast for 2022 headline inflation from 1.7% to 4.9% on higher energy and cost pass-through mainly in food category.

Although 2022 average headline inflation is likely to run ahead of the 1-3% target, we still expect the MPC to keep policy rates at their historic low of 0.50% throughout the year because: (i) inflation is largely driven by cost-push, while demand-pull inflationary pressure is still weak due to slow recovery in incomes; (ii) rising prices have been concentrated in energy and transmitted through food category, which is likely to be a temporary phenomenon; (iii) over the medium term, inflation is expected to anchor within the target range, and the MPC has said that “headline inflation in 2022 will exceed the upper bound of the target in the second and third quarters of 2022, but will return to the target range in 2023”; and (iv) the MPC has also stated that “the committee continues to put emphasis on supporting the economic recovery”. Given the BOT’s recent downgrade of 2022 growth to 3.2%, a return of the economy to its pre-pandemic level is now expected at the end of this year or the start of the next year.