Monetary policy in western economies tends to diverge against China amid a backdrop of rising risk to the global economy, especially the Ukraine crisis

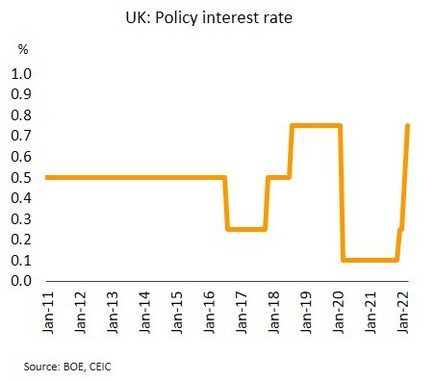

The US and the UK have raised interest rates and signaled to speed up normalization; Japan likely keeps rates low. For the first time since December 2018, the Fed has hiked rates by 0.25%, bringing the rate to 0.25-0.50%. The dot plot shows that the FOMC may raise rates for another 6 times this year (a 25 bps each). The Bank of England (BOE) has also raised rates by 0.25% to 0.75%, its 2020 level prior to the pandemic. However, the Bank of Japan (BOJ) has left rates and its QE program with yield curve control unchanged.

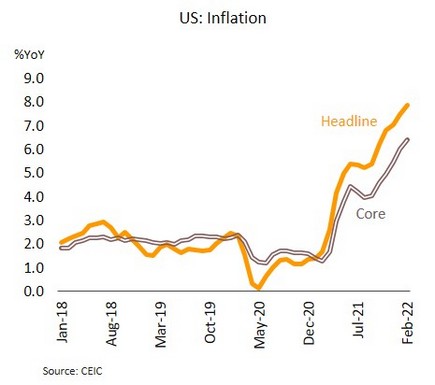

Western economies that have recently been hit by inflation are indicating that policy will be normalized harder and faster than expected. The Fed may thus raise rates at each of this year’s remaining FOMC meetings, bringing these to 1.75-2.00% by the year end, though 8 committee members anticipate more than 7 rate hikes this year. We expect that the scale of rate rises will move in response to inflationary pressure, with a high possibility of a 50 bps rise in 2Q22. With February’s inflation at a 30-year high of 7.1%, far ahead of its target, the BOE is likewise expected to continue its rate hike cycle in 2022. However, the BOJ Governor has stated that Japan’s weak inflation means that the BOJ does not yet need to raise rates, and with core inflation at just 0.6% in February, this is still significantly below the bank’s target. Monetary policy will thus remain relaxed until inflation is securely pegged to the bank’s target. Given the softening demand-pull inflationary pressure and the still-fragile recovery, rates will likely remain low through the rest of 2022.

Nevertheless, central banks view the Ukraine war as a threat to the global economy. Sanctions and possible Russian retaliation will affect global trade, supply chains, and financial markets. We expect that the war will extend into mid-2022, with Western nations ratcheting up sanctions. Under these scenarios, relative to the baseline, the GDP of major economies would be reduced, including the US (by 0.9 ppt), the UK (1.3 ppt), the Eurozone (1.9 ppt), China (0.7 ppt), and Japan (0.8 ppt).

Amid gradual improvement in China, a broad range of risks, including the Ukraine crisis, means that more stimulus measures has been added. Indicators for January-February strengthened relative to the end of 2021, including industrial production (up 7.5% YoY from 4.3% in December), retail sales (up 6.7% from 1.7%), and fixed asset investment (up 12.2% from 4.9%).

Although data on China is improving, these do not reflect current lingering uncertainties include: (i) the latest wave of COVID-19, which has driven infections to a new high of over 5,000/day, and that has been most noticeable in Shenzhen and Guangdong, digital hub and gateway to maritime trade routes, which may thus disrupt global supply chains; (ii) the rise in unemployment rate to a 1-year high of 5.5% in February; and (iii) the possible decelerating exports due to the Ukraine war and its impacts on world trade and growth. The authorities have therefore introduced new measures to prevent a sharp slowdown, including fiscal and monetary measures to support the real estate sector, and an easing of measures targeting monopolistic behavior and excessive profits in the tech sector. Trusts, wealth management and insurance companies as well as institutional investors are encouraged to step up their investments in China’s stock markets and real estate sector. The government has pledged to focus on stimulus to ensure further stable growth.

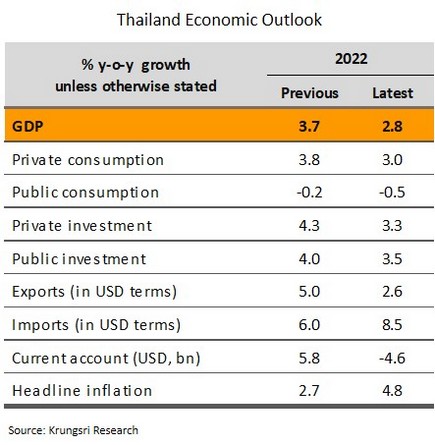

Krungsri Research revises our Thai GDP growth projection in 2022 downward from 3.7% to 2.8% in response to the Ukraine war

The BOT insists that stagflation has not set in yet in Thailand; We cut our 2022 GDP growth forecast to 2.8%. Piti Disyatat, Assistant Governor for monetary policy at the Bank of Thailand (BOT), said that Thailand has not shifted into stagflation. Under such condition, growth has to slow down, and the economy would then slip into a recession. However, Thai economy is likely to grow, albeit at a slower pace than anticipated due to the impacts of the attack on Ukraine. Meanwhile, inflation tends to rise on higher oil prices, which are temporary factors. The average inflation for 2022 is expected to run above 3%, the upper bound of BOT target.

We believe that if the Ukraine-Russia conflict drags on through 2Q22, Western powers may tighten sanctions on Russia by banning the import of all non-energy goods from the country until mid-2023. This would then undermine global manufacturing and trade, with consequences for Thailand’s manufacturing, export and tourism sectors. In light of this, we have cut our forecast for 2022 Thai GDP growth from 3.7% to 2.8%, with growth in export value (in terms of USD) also dropping from 5% to 2.6%. Beyond this, the higher cost of commodities, especially energy prices, means that imports would be more expensive. Having combined that with the softening of the export sector and the drop in income from tourism, current account is thus likely to post a continuing deficit this year. 2022 inflation is now expected to average 4.8%, which may then worsen consumer purchasing power, and the effects of this on recovery of consumption will vary across different income groups. The forecast for 2022 growth in private consumption expenditure has been cut from 3.8% to 3.0%. On the positive side, improving farm income on rising commodity prices may partly support domestic spending.

Despite relaxed restrictions on entry to Thailand, the tourism sector’s recovery would continue to struggle against several headwinds. To help support economic recovery, at an 18 March meeting, the Center for COVID-19 Situation Administration (CCSA) agreed to cut the number of provinces designated as ‘controlled areas’ (orange zones) from 44 to 20, to raise the number of provinces designated as ‘close surveillance areas’ (yellow zones) from 25 to 47, and to increase the number of ‘pilot areas for tourism’ (blue zones) to 10 from 8. In addition, the requirements made under the Test & Go program have also been loosened, and travelers are no longer required to present a negative RT-PCR test taken 72 hours before travel. As of 1 April, travelers will now need to take an RT-PCR test on the day of their arrival and to take an ATK test on their 5th day in Thailand.

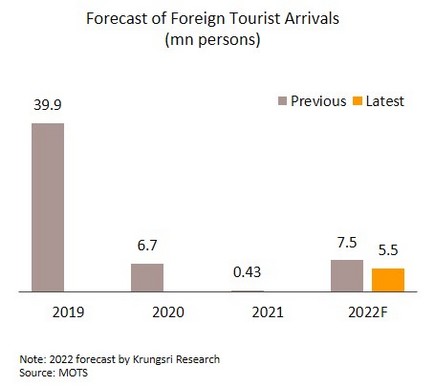

Although the authorities are trying to make travel to Thailand easier and more attractive by relaxing the rules on entry to the country, recovery in the tourism sector will continue to come under pressure from a number of negative factors. (i) The number of daily new cases remains high, prompting the US to issue a level 4 alert at the start of March warning against travel to Thailand, which may then weaken confidence in Thai tourism. (ii) The Russian attack on Ukraine is now expected to extend into 2Q22, and in addition to having direct impacts over the rest of the year on travel from Russia to Thailand, the slowdown in the global recovery will cut income to the tourism sector, while more expensive energy will raise travel costs and drag on demand. Thus, we now expect 5.5m foreign arrivals in 2022, down from our earlier prediction of 7.5m.