The world economy is coming under rising pressure from the war in Ukraine, sanctions, and the escalating cycle of retaliation

The Ukraine crisis is more serious than expected and adding to global risk, especially in Europe. The violence in Ukraine is worsening, but President Putin is persisting with the use of force to crush opposition. In reply, Western powers have stopped Russia accessing its central bank’s reserves, blocked 7 Russian banks from the SWIFT system, and closed their airspace to Russian carriers. The severity of these moves triggered a sell off of Russian assets, with downgraded government bonds towards junk status and shedding ruble 30% of its YTD value. The Central Bank of Russia (CBR) had to hike rates from 9.5% to 20.0%. The economic and financial impact of the crisis will thus likely cause enormous damage to the country.

The Russian attack on Ukraine is ratcheting up tensions, and this is now a major risk to the global economy, especially the Eurozone. The ECB estimates that the war will cut 0.3%-0.4% from 2022 Eurozone growth, previously expected to grow 4.2%. The conflict is likely to worsen and to be prolonged, which would then raise inflationary pressures from escalating commodity and energy prices. The crude oil prices have continued to rise. Recently, Europe and its allies discussed to ban energy imports from Russia.The war is also likely to disrupt international supply chains. The World Bank has thus described the conflict as a catastrophe that will undercut global economic growth.

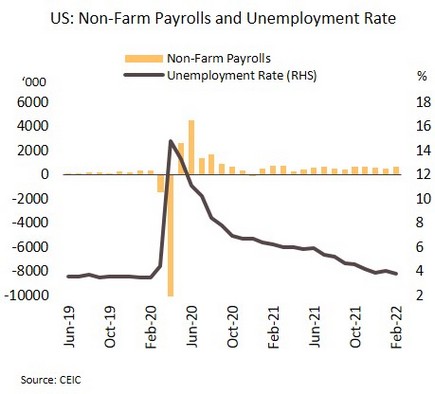

Tight labor markets may force a US rate rise, though the Ukraine war is adding to uncertainty. February’s Composite PMI hit 55.9, up from January when it touched its lowest since July 2020. Non-farm payrolls also grew by a 4-month high of 678,000. The unemployment rate dropped to a pandemic low of 3.8%, and wages beat expectations to jump to USD 34.7/hour. Initial jobless claims for w/e 25 February softened to a 2022-low of 215,000.

Although the Fed has stated that the invasion of Ukraine has “highly uncertain” implications for the US, figures for economic activity and labor markets continue to improve. Fed chair has said that rising inflation and tight labor markets are pushing the Fed towards a rate rise at March’s meeting. Unexpectedly high wage rises may add to the risk of a wage-price spiral developing. We expect 5 rate hikes this year, with an initial increase of 25 bps in March.

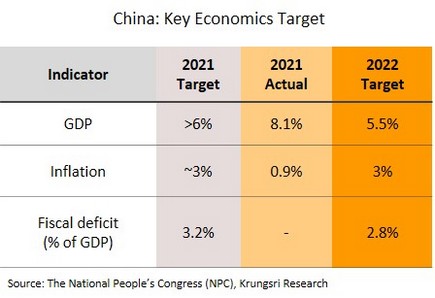

Chinese economy is gradually improving; Higher-than-expected GDP growth target was announced amid rising risks. February’s Composite PMI rose to 51.2 from 51.0. The Manufacturing PMI was up only slightly (to 50.2 from 50.1), while the Non-manufacturing PMI did better, rising to 51.6 from 51.1.

China’s economy has gradually improved on an easing of COVID-19 infections and the positive effects of monetary and fiscal policy. However, the economic outlook remains clouded by uncertainty over the war in Ukraine and its impacts on commodity prices. Since China is a major importer of Russian products, including nickel, aluminum, palladium, and vegetable oils, state enterprises and local governments have thus been told to build up reserves sourced elsewhere. At the 2022 two-session meeting of the national legislators and policy advisors, a target of around 5.5% was set for 2022 GDP growth. Although this was higher than expected (the IMF predicted 4.8%), it was the lowest in over 30 years. The fiscal deficit target is also falling from 3.2% of GDP to 2.8%. Nonetheless, spending on infrastructure projects will be accelerated and monetary policy will be further loosened as the government tries to counter rising external risks and avoid a sharp slowdown.

Surging global energy prices will feed inflationary pressure, but Thailand’s recovery remains weak and so monetary policy should remain loose

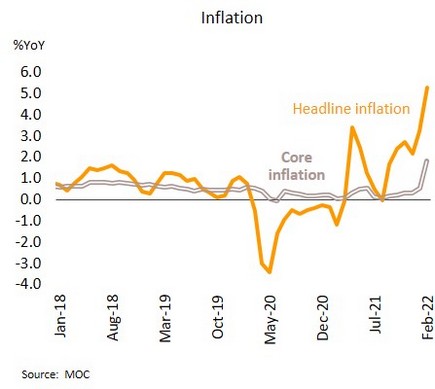

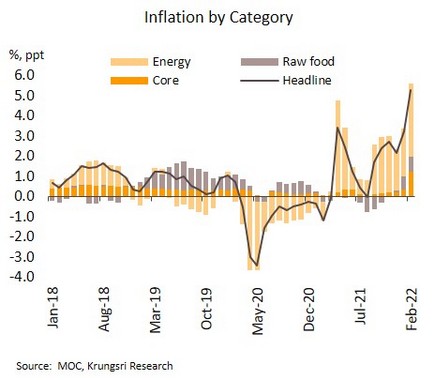

February’s inflation jumped to a 13-year high; Impact of Ukraine war on energy prices is likely push this higher. Headline inflation surged to 5.28% YoY in February (from 3.23% in January) on rising energy prices, especially electricity and retail oil prices, that have been pushed up by the steep run-up in global crude oil prices. Nonetheless, the authorities have cut excise taxes on diesel, which helps keep their prices below THB 30/liter until the end of May. Prices for food, and especially for ready-made foods and food consumed outside the home, have risen sharply with the higher cost of inputs. Core inflation (excluding raw food and energy prices) was at a 7-year-high, having climbed from 0.52% in January to 1.80% in February. For 2M22, headline and core inflation have thus averaged 4.25% and 1.16%, respectively.

Prices are ramping up sharply and inflation is now at its highest since October 2008. This is also the second month that inflation has run above the BOT targets. Prices are expected to rise further in the coming months as crude oil prices has been well above USD 100/bbl, sustaining by what is expected to be a prolonged war in Ukraine. Inflationary pressures, especially those in energy markets, are thus stronger than anticipated, and would raise cost of production. It is likely to push average inflation across 2022 above our current projection of 2.7%.

Inflationary pressure tends to elevate faster than expected, largely due to rising commodity prices, though as stated, energy prices have been particularly strongly affected by the war in Ukraine. This is then adding to the headwinds blowing against the Thai economy. In addition, the daily infections, driven by the Omicron variant, are now running over 20,000 per day, and this may undercut confidence among consumers and domestic tourists. We therefore expect that to support what remains a weak and fragile recovery, policy rates will remain at their historic low of 0.50% through 2022.

There are positive signs ahead but the Ukraine crisis will weigh on the tourism sector. At the meeting held 1 March, the cabinet agreed to establish an ‘air travel bubble’ linking Thailand and India. This will pave the way to restart commercial flights between the two countries this month after having been on hold since March 2020 due to the COVID-19 pandemic.

In 2019, approximately 2m Indian tourists came to Thailand (or 5% of the total). Since the introduction of the Test & Go program, just 7,671 Indian arrivals, or 1.6% of the total, have been recorded during November 2021 to January 2022. It is therefore hoped that the creation of the air travel bubble will help to make tourism between the two countries easier and encourage more Indian tourists to visit Thailand. China is also reported to be looking for easing its ‘zero COVID policy’, and any moves in this direction would help to revive the tourism sector. However, the Ukraine war is threatening, and its negative impacts should be monitored. In January, Russians are the biggest group of arrivals, with 23,761 Russian tourists coming to Thailand (17.7% of the total) against a 2019 total of 1.5m (3.7% of the total). Any extension or worsening of the war thus runs the risk of causing broader disruptions to the European market, which has provided considerable support to the tourism sector after reopening.