The US and global economies are slowing and this is dragging on growth momentum in China and Japan

US

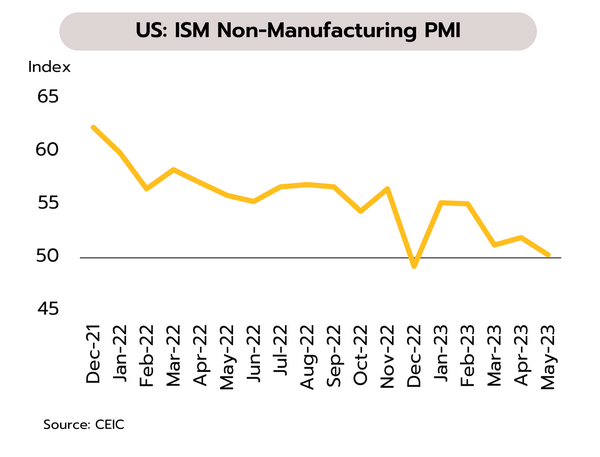

With US labor markets cooling, it is increasingly likely that the Fed will leave rates unchanged at its meeting this week. The US goods and services trade deficit expanded by 23% to an 8-year high of USD 74.6bn in April, while last week, initial jobless claims rose by 28,000 to 261,000, the highest since October 2021. May’s ISM Services PMI also dipped to a 5-month low of 50.3.

Against a backdrop of the recent aggressive cycle of rate hikes, elevated inflation, continuing troubles in the banking sector, and lingering geopolitical tensions, there is a risk of a sharp deceleration or even of a technical recession in 2H23. In fact, signs of a slowdown are already being seen in rising unemployment rate, softening consumer confidence, a contraction of the Manufacturing PMI, and, as pent-up demand unwinds, a softening of the previously strong services sector. We therefore expect that as it looks to reduce downside risk and with real interest rates now positive and inflation on a downward track, the Fed will leave its benchmark interest rate at 5.00-5.25% at the 13-14 June meeting of the FOMC.

Japan

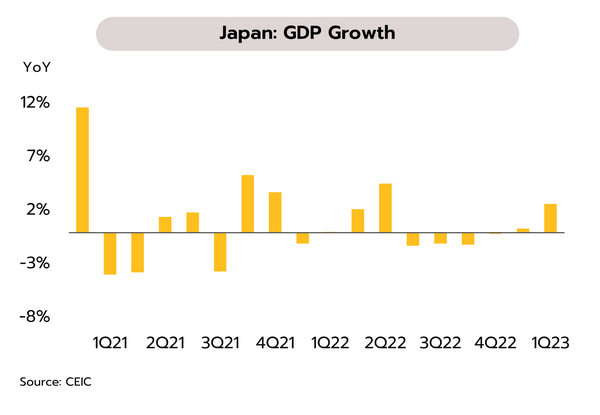

The positive effects of reopening will support growth in the Japanese economy through 2H23. Q1 GDP growth came in at 2.7% YoY, ahead of the initial assessment of growth of 1.6%. Private non-residential investment, or capital spending, rose 1.4%, higher than initial government estimates of 0.9%. Likewise, private demand rose 1.2%, and domestic demand was up 1%, though exports of goods and services contracted -4.2%.

Although current global conditions imply significant risk to the export sector, growth in domestic economic activity should stay positive through 2H23 on the reopening of the country, the rebound in the tourism sector, the easing of pressure from elevated costs, and the continuation of relaxed monetary policy. In addition, inflation remains high and with ongoing turbulence in the bond market, we expect that the Bank of Japan will consider gradually normalizing policy as it looks to bring inflation back to the long-term target of 2%.

China

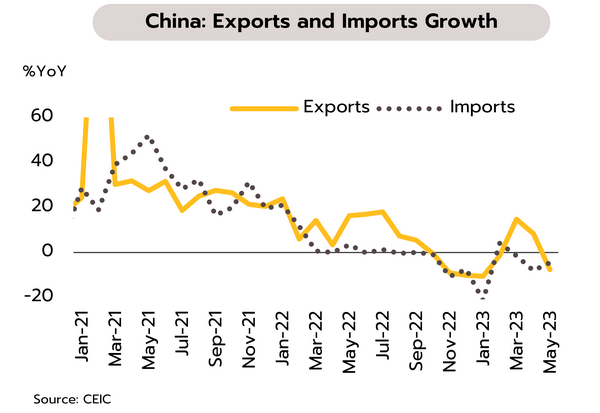

The Chinese economy is coming under pressure from the global slowdown, though low inflation may provide space for a loosening of monetary policy. Having expanded by 14.8% and 8.5% in each of March and April, exports fell back into contractionary territory in May, and at -7.5% YoY, the decline was significantly worse than the -0.4% expected by the market. It is now the case that over 5M23, Chinese exports have grown by just 0.3%. However, inflation stood at only 0.2% in May, up fractionally from April’s 26-month low of 0.1%.

The ending of pandemic restrictions and the reopening of the country are underpinning domestic growth, and this is reflected in May’s 27.9% YoY jump in vehicle sales to 2.38m units. The decline in imports has also softened from -7.9% to -4.5%, as strengthening demand meant that imports grew in many categories including crude oil, coal, natural gas, and soy. However, the slowing global outlook is weighing on Chinese exports, with sales into the US and EU slumping by 18.2% and 26.6% and this is dragging on growth, especially in the industrial sector. Nevertheless, low inflation may open the way for a relaxation of monetary policy. Authorities may loosen the reserve requirement ratio (RRR), which would then release additional funds into the economy and so help to support economic growth.

Inflation is abating and consumer confidence is strengthening, but mid- to lower-income households are facing constraints on spending

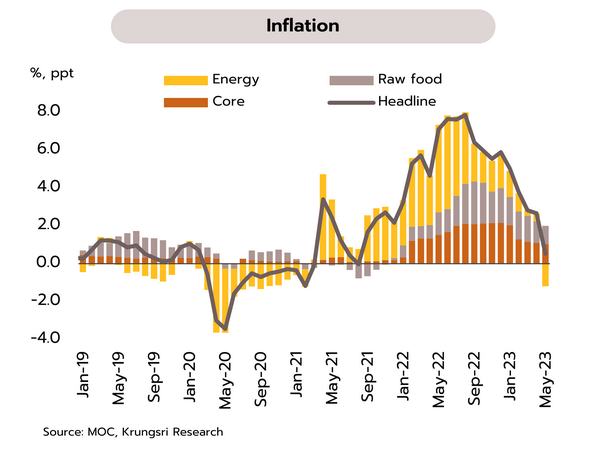

Headline inflation dropped to just 0.53% in May, beneath the BOT target range and potentially pulling the annual average below the expected 2.5%. Headline inflation softened for the 5th month running in May, sliding from 2.67% in April to a 21-month low of 0.53% YoY, significantly below the consensus expectation of 1.7% and our forecast of 1.5%. The overall rate was undercut by cheaper crude that then supported a 11.3% drop in fuel prices, a cut in the variable tariff (or Ft) for electricity over May-August, and falling prices for some foods, including pork and vegetable oils. Core inflation (which excludes food and energy prices) also fell from 1.66% in April to 1.55% in May. For the first 5 months of the year, headline and core inflation have averaged 2.96% and 1.98% respectively.

Inflation not only weakened faster than expected in May, it also slipped under the Bank of Thailand’s (BOT) target range of 1-3%. Moving forward, inflation will likely continue to soften and may even turn negative in some months during the remainder of 2023 thanks to baseline effects from 2022, falling energy prices relative to a year ago, and government assistance with electricity bills for some users. We therefore see inflation averaging 1.0-1.5% across the rest of the year, and this may mean that for the year as a whole, average inflation undershoots our prior forecast of 2.5%. At the same time, the policy interest rate turned positive in May and this may encourage the Monetary Policy Committee (MPC) to hold off from further rate rises at the 2 August meeting.

Although consumer confidence continues to recover, many households are struggling with high levels of debt and tight finances. Consumer confidence index rose for the 12th straight month in May, edging up from 55.0 to 55.7, its highest since March 2020. Sentiment has been lifted by (i) the sharp rebound in the tourism sector, (ii) the period of intense election campaigning that injected funds into provincial economies and helped to stimulate domestic economic activity, and (iii) falling fuel prices that have eased concerns over high costs of living.

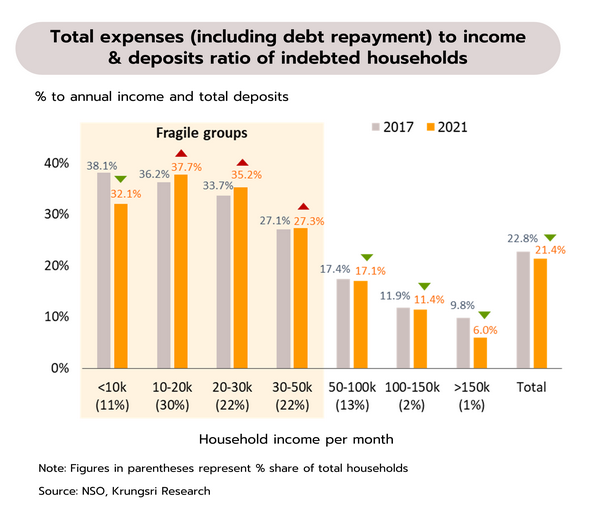

Although this gradually strengthening sentiment will likely support a rise in consumption in the coming period, the recent interest-rate hikes will increase debt burdens, especially for more exposed households and those facing tighter spending constraints. Work by Krungsri Research on household spending indicates that when considering the ratio of total expenditure (including debt repayments) to income and deposits, indebted households with a total income of less than THB 50,000/month are more likely to encounter difficulties due to tight spending constraints. For these households, total outgoings represent 30% of income and deposits, and so at present levels, these will be able to sustain current expenditure and debt repayments for just 3 more years. Moreover, this group represents 85% of all indebted households (see figure). By contrast, for indebted households with income of more than THB 50,000/month, their outgoings account for 6-17% of income and deposits, and so these families will be able to sustain consumption and debt repayments for over another 5-10 years. However, this group accounts for just 15% of indebted households, and the sharp difference in outlook for the two groups reflects persistent problems with inequality that are being maintained even as the economy grows.