The risk of recession is lessening but with rates at multi-year highs, guiding economies to a soft landing will remain a challenge

US

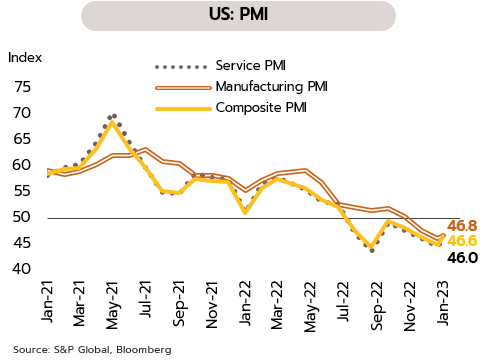

Although indicators are improving, US growth remains weak and the Fed is expected to announce a 25bps rate hike this week. January’s manufacturing and services flash PMIs strengthened to 46.8 and 46.0 from respectively 46.2 and 44.7 in December, but while these outperformed expectations, they remain below the key 50-point mark. At the same time, January’s Consumer Confidence Index climbed from 59.7 to a 9-month high of 64.9 on receding worries over inflation and recession. At 2.9%, the Q4 GDP print was also above expectations, bringing 2022 growth to 2.1%.

Despite signs of improvement, we expect the Fed to announce a 25bps rate hike at its 31 Jan-1 Feb meeting, down from December’s 50bps increase, as (i) inflationary pressures are softening, with one-year-ahead inflation expectation falling to 3.9%, the lowest since April 2021; and (ii) economic growth remains weak with the flash PMI pointing to a contraction in economic activity. Consumption also slipped 0.3% in December. Excluding trade and inventories, 4Q22 domestic demand growth slowed down sharply to 0.2% from 1.1% in 3Q22. We expect the effects of lifting rates to a 15-year high will become clearer this year.

Eurozone

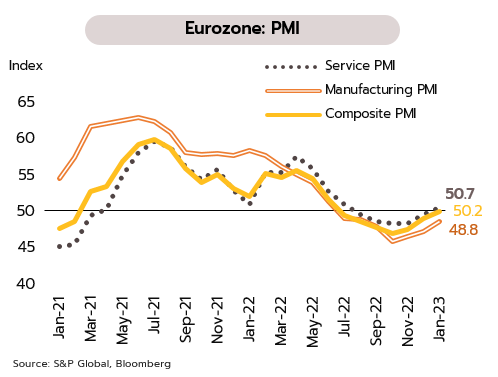

The risk of a Eurozone recession is decreasing but the region’s economy is likely to undershoot its long-term growth potential. At 50.2, January’s Eurozone composite flash PMI flipped back into expansionary mode (i.e., over 50) for the first time in 7 months. Recovery in both the manufacturing and services components of the PMI mirrored the 3-month recovery in sentiment that has now taken this into positive territory for the first time in 9 months. The indications are thus that the overall situation for the Eurozone is improving, and it may now be possible for the bloc to avoid a recession in 1Q23.

We see both Eurozone sentiment and economic activity benefiting through 1H23 from a relaxation of pressure on three fronts, namely supply chain disruptions, rising costs, and the regional energy crisis. Nevertheless, plans for reform of the EU’s energy sector will add to costs over the long term, while the effect of rate rises by the European Central Bank (ECB) are expected to start taking consequences for the real economy in 1Q23. This will then weigh on growth in consumption and investment, potentially dragging the bloc’s growth below its long-term potential.

China

The production of goods and services has passed through December’s lows, and the situation should improve markedly in 2Q23. The abrupt shift of China’s zero-Covid policy at the start of December fed into a surge in infections, and although these have peaked, this placed a significant drag on the economy. December’s employment PMIs for the manufacturing and non-manufacturing sectors thus slipped to 44.8 and 42.9, while the production PMI of both sectors also fell to 44.6 and 41.6, bringing these close to the lows seen last April during the Shanghai lockdown.

We expect that although both the manufacturing and non-manufacturing sectors will remain sluggish in 1Q23, this will not significantly affect global supply chains since China holds around 20 days’ worth of inventory in reserve and average global freight charges have dropped steadily since the ending of the zero-Covid policy. The outlook for production should improve markedly in 2Q23 as infections decrease and workers return to the production line. This will have positive knock-on effects on global supply chains, easing blockages and removing some of inflationary pressure.

![]()

Weakness in the global economy implies limited growth of Thai exports; MPC is expected to raise rates to 1.75% by the end of 1Q23

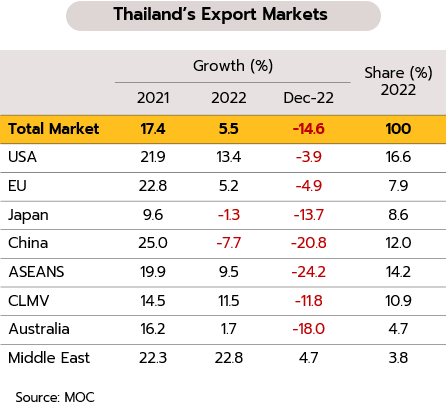

Export value contracted for the 3rd straight month in December, dragged by weaker global demand. The Ministry of Commerce’s data show that in December, exports plunged 14.6% YoY to USD 21.7bn (or -12.5% ex gold and oil products). The contraction were seen for many industrial goods, including chemicals (-35.3%), plastic nurdles (-32.1%), computers and computer equipment (-24.2%), and automobile & parts (-17.1%). The falls were also recorded for agricultural goods, with declines seen in rubber (-47.7%), cassava products (-12.4%), and rice (-4.1%). This weakness was repeated across almost all major export markets, led by the ASEAN-5 (-24.2%), China (-20.8%), Japan (-13.7%), the EU (-4.9%), and the US (-3.9%). For 2022, export value rose to USD 287.1bn from 2021’s USD 272.0bn while its growth slowed to 5.5% from 17.4%.

Signs of weakness in the Thai export sector have been evident since 4Q22 as the sector responds to a global slowing of demand. This has been driven by fears of recession in many of Thailand’s major export markets, which have moved to bring inflation under control with an aggressive tightening of monetary policy. These rate hikes are likely to extend into 2023, and this will weigh on consumption and investment. The latest indicators also point to softness in global manufacturing, though this is most pronounced in the US and the Eurozone. Beyond this, exports are also under pressure from the baht’s appreciation, which has put Thailand at a disadvantage relative to its competitors. We see Thai exports expanding by only 0.5% in 2023 on (i) persistent demand for non-discretionary items, such as food, and (ii) the reopening of China, which will support stronger demand for some goods, including fresh, frozen and dried fruit. The return of the Chinese manufacturing sector to more normal conditions will also help to ease supply chain bottlenecks, which will in turn support growth in the Thai export products related to Chinese production.

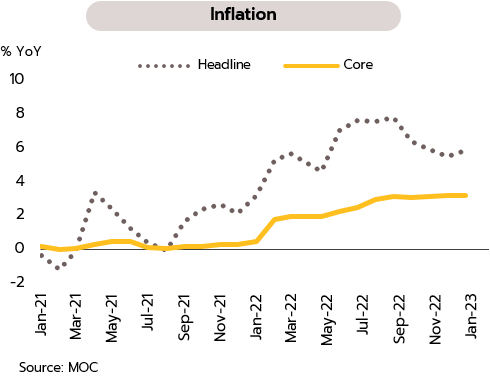

The MPC signals that the current cycle of rate rises is not yet complete given worries over demand-pull inflation. At its 25 January meeting, the Monetary Policy Committee (MPC) agreed unanimously to raise policy rate by 25bps to 1.50% assessing that the Thai economy is likely to continue to recover. This is being driven by the rebound in the tourism sector and stronger private consumption, themselves the result of the reopening of the country and the return to Thailand of Chinese tourists. However, export growth is likely to slow through 2023 before picking up again in 2024 as the global economy emerges from this year’s slowdown. Headline inflation is also expected to soften as cost-push inflation abates, particularly where this is related to energy and commodities, though core inflation is forecast to remain elevated, and there is a risk that this will rise if economic recovery adds to demand-side pressures.

We expect the MPC to raise policy rate by another 25bps by the end of Q1, bringing this to 1.75%, where it may remain for the rest of 2023. Headline inflation is likely to fall back into its target range of 1-3% in 2H23 as a result of: (i) comparison with the high base set last year, when the outbreak of war in Ukraine in 2Q22 triggered a surge in commodity prices; (ii) the easing of global supply disruptions, especially now that Chinese manufacturing will be returning to normal; and (iii) the fragility and patchiness of Thailand’s recovery despite the MPC’s concerns over core inflation. In addition, the export sector has weakened, the world economy is slowing, the baht has appreciated relative to the currencies of regional competitors, and the financial conditions are tightening. There is, though, a possibility that the policy rate may rise beyond 1.75% if Chinese spending on goods and services is stronger than expected and this provides an unanticipated boost to the global trade and the Thai economy that reignites inflationary pressures.