Strength in the service sector is supporting the ‘Goldilocks’ recovery in the US, but there is a growing risk in China and the Eurozone

US

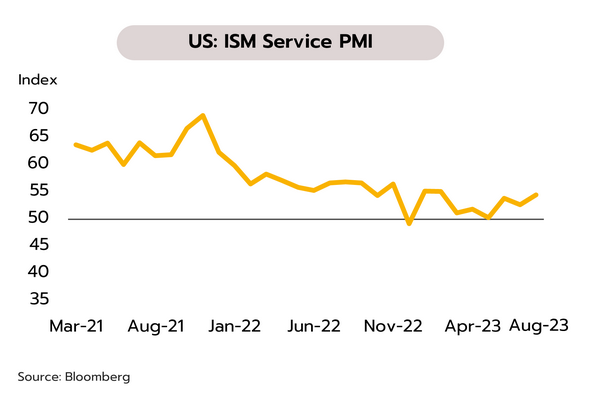

Stronger-than-expected labor market and service sector data raise the chance of a November rate hike in the US. In August, the ISM Non-manufacturing PMI rose to a 6-month high of 54.5. Initial jobless claims last week fell to a 7-month low of 216,000. Nevertheless, moves by China to restrict the use of iPhones by state employees have amplified worries that US-China trade tensions may worsen.

The latest data on services and labor markets underpin expectations that the US economy is in the ‘Goldilocks’ zone (i.e., is not so hot that inflationary pressures are stoked and not so cold that it slips into recession). This view is supported by estimated Q3 GDP growth of 5.6%, which follows Q1 and Q2 growth of 2.0% and 2.1%. Financial markets have thus raised the odds of a November rate hike to 43.6%, up from 33.5% a week earlier. However, with real interest rates now positive and 10-year Treasury yields hitting highs not seen since 2008, the Fed may halt this round of monetary tightening. With the slow easing of inflationary pressures in property markets and in the service sector, and the fact that the US economy remains strongly resilient, we therefore see the Fed needing to keep rates elevated until inflation falls back into the 2% target range over the long term.

Eurozone

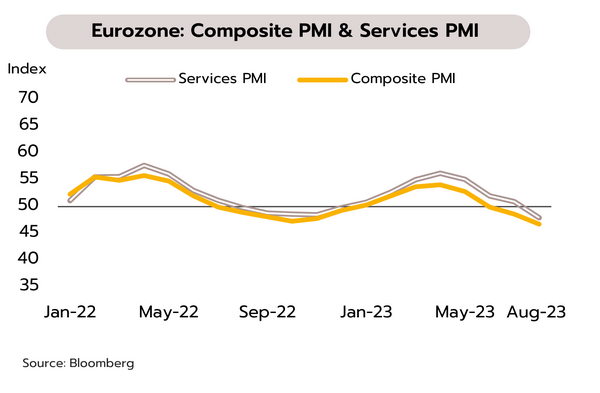

There is an increased risk that the Eurozone will slip into recession in 2H23. The HCOB Composite PMI fell to 46.7 in August, its 3rd month of contraction, while the Service PMI posted the first contraction in 8 months at 47.9, its weakest since March 2021. July retail sales also dropped -1.0% YoY and -0.2% QoQ, while revisions to Q2 GDP estimates cut this to 0.5% YoY and 0.1% QoQ, down from initial estimates of 0.6% YoY and 0.3% QoQ.

The combination of higher policy rates and still-high inflation is dragging on Eurozone growth, and this is now showing up in: (i) falls in retail sales for 10 months running; (ii) the sharpest contraction in the Composite PMI since November 2020; (iii) 4 months of falls in the Economic Sentiment Index; and (iv) the first drop in the Consumer Confidence Index since September 2022. Alongside this, Q2 growth estimates have been revised down from 0.3% to just 0.1% QoQ. There is thus a growing risk that the Eurozone may fall into recession in 2H23. With labor markets resilient and crude prices at a 10-month high, inflation is likely to soften slower than expected and remains above the 2% target. However, since the ECB will wish to avoid pushing the bloc into a recession, we expect that the bank will raise rates only once more, adding 25bps to the deposit facility rate to 4.00%, which will then remain flat until mid-2024.

China

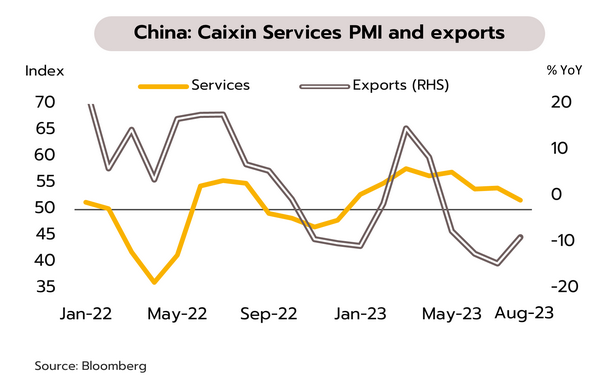

Slowing services sector and exports threaten Chinese economy; Authorities continue to introduce measures to help the real estate sector. At 51.8 against an expected 53.6, the August Caixin Services PMI showed the slowest expansion in 8 months. Although the Manufacturing PMI climbed from 49.2 to 51.0, the Composite PMI slipped to 51.7, its weakest since China’s reopening in January. Exports contracted for the 4th month (-8.8% YoY), and imports fell for the 6th month (-7.3%). Inflation inched up from -0.3% in July to just 0.1%.

The Chinese economy is under pressure from both domestic and external headwinds. Authorities have responded by issuing measures to increase liquidity and to support the real estate sector, including cutting interest rates, easing restrictions on first time homebuyers, and reducing down payments. Country Garden avoided a default by making a USD 22.5m interest payment on 5 September. Nonetheless, China remains exposed to risk from the weak global outlook, the slowing service sector, and continuing problems in real estate markets. Bloomberg reported that of the 50 most dollar-indebted Chinese developers, 34 (or 68%) have already been defaulters, and the remaining 16 firms (32%) face USD1.48 bn of combined bond payments due September, thus adding to the liquidity risk in the sector.

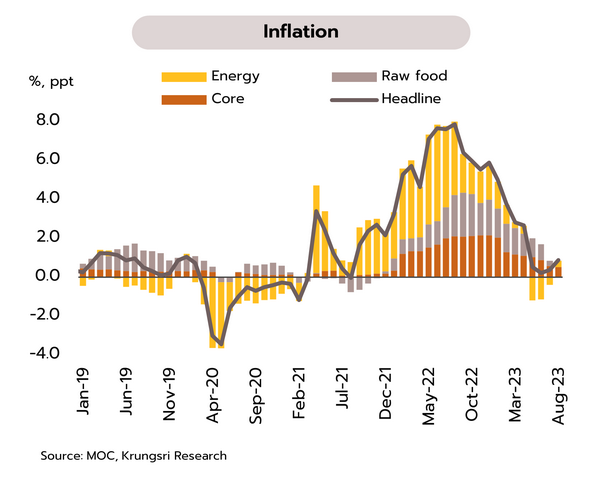

Cooling core inflation could be a factor supporting the MPC to hold policy rate steady at 2.25% at their September meeting

At 0.88%, headline inflation undershot the official target range for the 4th month in August, and 2023 inflation is now expected to average 1.7%. Headline inflation rose from 0.38% in July to 0.88% YoY in August, due mainly to increases in domestic pump prices (after a decline for the previous 5 months) and higher prices for some foods, including white rice, glutinous rice, eggs, and fresh fruit & vegetables. Meanwhile, core inflation (which excludes more volatile prices for raw food and energy) slipped from 0.86% to 0.79%. For the first 8 months of the year (January to August), headline and core inflation have averaged 2.01% and 1.61% respectively.

Headline inflation is expected to increase somewhat through the rest of 2023 on: (i) cuts in crude output by OPEC of 1m bbl/day and in exports by Russia of 0.3m bbl/day that will last through to the end of 2023, thus increasing price volatility on global markets; and (ii) the effect of El Niño on the prices of agricultural goods. However, the upward inflationary pressure will be limited by government assistance to relieve the cost of living such as cuts to utility bills and the price of diesel and moves to hold off on increases to the price of cooking gas. We so see headline inflation averaging 1.7% across 2023. With headline inflation now below the Bank of Thailand’s 1-3% target for 4 months running, softening core inflation (which reflects slowing consumer spending), and the economic activity (or GDP level) underperforming its long-term potential, we expect that at its 27 September meeting, the Monetary Policy Committee (MPC) will call a halt to the current round of rate hikes, and the policy rate will therefore remain at 2.25%.

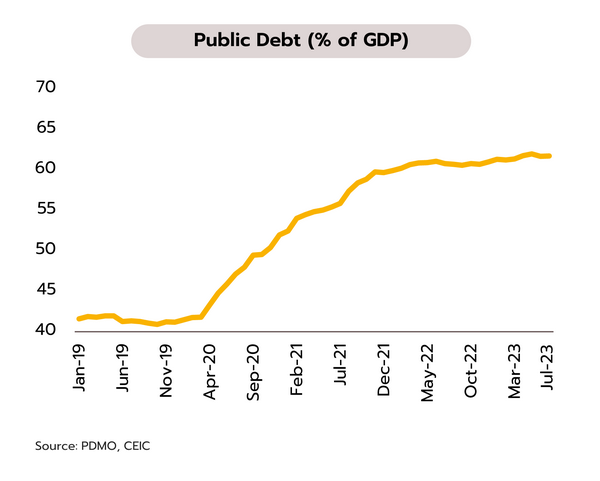

Fitch has warned that the spending plans proposed by the incoming government may add to public debt, potentially impacting fiscal stability. Fitch Ratings has recently stated that the Thai economy may be negatively affected by the global slowdown, and indeed, this is evident in the decline in Thai exports seen in every month since October 2022 and in the fact that tourist arrivals have yet to return to their pre-Covid-19 level. In addition, Fitch has also warned that promises made during the election campaign of widespread increases to social spending may impact Thailand’s fiscal stability. Fitch sees populist policies such as these potentially boosting growth over the short term, but if growth is not sustained over the longer run, their implementation would increase the public debt to GDP ratio.

This week, the new government will present its policy proposals to parliament, one of the most prominent of which is the payment of THB 10,000 to all Thai adults. These payments would be made to digital wallets held by all Thai citizens over 16 (to a total of 56m individuals, giving a cost of THB 560bn), though the money would need to be spent within 6 months and within a radius of 4 kilometers (there may be some flexibility on this). It is not yet clear how this will be funded or exactly how the disbursements would be made, but initially, the government has indicated that funds will come from a variety of sources including budget allocations and borrowing (as of July, public debt stood at 61.7% of GDP). The impacts of these payments on the broader economy through 2024 will depend on the extent to which the money is recirculated. The analysis made by the Parliamentary Budget Office (in 2021) shows that for general transfer payments, the fiscal multiplier is just 0.947, below that of public-sector wages (1.871), transfers to low-income earners (1.356), and spending on investment (1.242).