Although the risk of outright recession is receding, strong headwinds mean that major economies may still face a period of low growth

US

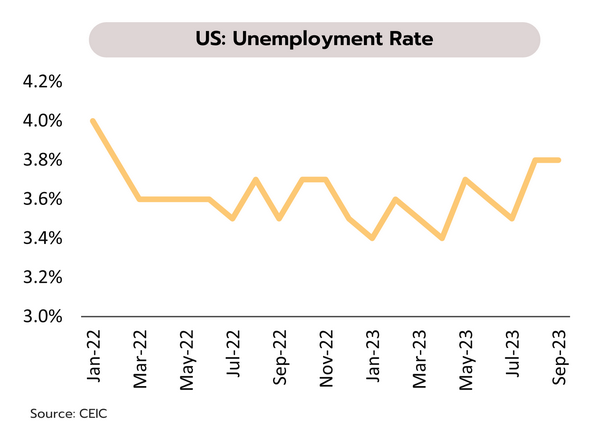

Softening inflation and weaker wage growth may encourage the Fed to halt this rate-hike cycle at its November meeting. The latest JOLTS report surprised to the upside, with job openings rising from 8.92mn in July to 9.61mn in August, while in September, non-farm payrolls increased by 336,000, up from a 227,000 rise a month earlier, making this the largest increase since January. However, the unemployment rate remained at 3.8%, worse than the 3.7% expected by the market, and average hourly wages grew by just 4.2% YoY, the lowest rate of increase since June 2021. In addition, the Services PMI slipped from 54.5 to 53.6.

While the Fed has left the door open to another rate rise this year, previous hikes have taken policy rates to a 22-year high and with this, price pressure in the service sector and in real estate markets is clearly now slowing. In addition, unemployment will trend upwards with the slowdown in the economy, and going forward, this will weigh on wage growth. In light of this, and with inflation softening, clearer signs of a cooling economy, and real interest rates now positive, we believe that at its next meeting the Fed will hold rates steady at 5.25-5.50%.

Japan

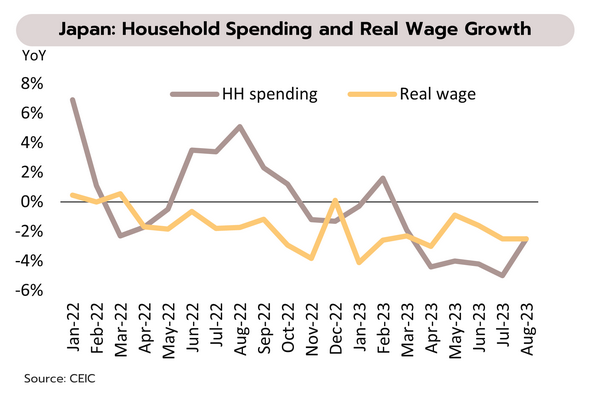

Japanese household expenditure is under pressure from weak wages and high inflation. In August, household spending contracted for the 6th month at -2.5% YoY, compared to the previous month’s drop of -5.0%. Likewise, although average wages were up 1.1% YoY in nominal terms, real wages have slipped for 17 consecutive months, dropping another -2.5% in August. September’s manufacturing PMI also fell from 49.6 to 48.5, its lowest reading since February.

Japan’s growth will weaken through 4Q23 on a slowing export sector, softening labor markets and still-high inflation, which is then eroding real incomes and dragging on household spending. This will be somewhat compensated for by recovery in the tourism sector and the continuation of Japan’s ultra-loose monetary policy, and this will then reduce the risk of the country slipping into a recession. Nevertheless, with forecast inflation (1.5% for all of 2024) remaining below the target range and growth still soft, the Bank of Japan will likely keep rates low until inflation returns to its 2.0% target over the long term.

China

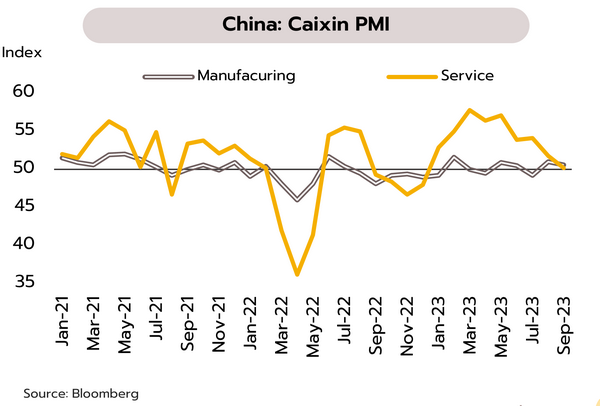

Given ongoing debt problems, weak exports, and tensions with the US, signs of a turnaround remain obscure. Official data showed an improvement for large corporations in the service and manufacturing sectors in September, and during the most recent holidays, daily expenditure on travel and tourism rose 3% above pre-Covid levels. However, September’s Caixin report reflected a weak growth for SMEs, as seen by the Caixin manufacturing PMI slipped from 51.0 to 50.6, and the Caixin services PMI went from 51.8 to 50.2, its weakest since the start of the year.

Interventions are beginning to help the tourism sector and large corporations, but for much of the economy, growth is under pressure from factors beyond the real estate sector. (i) SMEs are struggling, and the Caixin Services PMI shows growth at a 9-month low. (ii) The WTO expected global growth to slow down to 2.8% in 2024 from 3% in 2023 and so exports will tend to soften. (iii) US-China tensions are dragging on trade, with the US warning that it will tighten restrictions on the export of chips used in AI applications. (iv) The World Bank has said that public and corporate debts are rising in China which will limit public and private investment. Amid structural problems, the World Bank thus sees 2024 China’s growth dropping to 4.4% from 2023’s 5.1%.

Partly thanks to measures to cut energy costs, inflation will remain weak through to the end of the year, but there is rising concern over a recovery in tourism sector

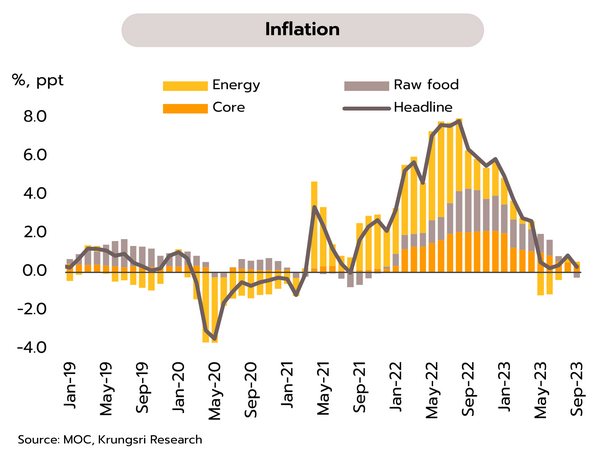

Headline inflation dropped to 0.30% in September, and we expect inflation to remain below the target range through Q4. September’s print showed headline inflation sliding from 0.88% YoY in August to a 3-month low of 0.30% on: (i) government measures to reduce energy costs, which has then significantly cut the contribution of these to overall price rises; and (ii) the first fall in food and beverage prices for 2 years, particularly for fresh foods including pork and vegetables. Core inflation, which excludes more volatile prices for raw food and energy, also softened in September dropping from 0.79% to 0.63%. Over the first 9 months of the year (January to September), headline and core inflation have therefore averaged 1.82% and 1.50% respectively.

Headline inflation remained below the lower bound of the official 1-3% target range for the 5th month in September, and we expect that through the last quarter of the year, price rises will remain weak and will possibly continue to undershoot the BOT’s target. This will partly be due to the introduction of government measures to help the public with high energy costs. In particular, the authorities are cutting electricity tariffs from THB 4.45/unit to THB 3.99/unit for bills issued between September and December 2023, and capping diesel prices (previously at THB 31.94/liter) at THB 30/liter between 25 September and the end of the year. The government is also helping households by watching prices for consumer necessities, and so average 2023 headline inflation may now be lower than our forecast of 1.7%.

Although new visa-free travel arrangements will help to stimulate the Chinese market, the rebound in the tourism sector may face uncertainty. Data from the Economics Tourism and Sports Division show that between 1 January and 1 October, 20.05mn foreign arrivals were recorded (68% of the pre-Covid total), generating receipts worth THB 834.05bn (60% of the pre-pandemic total). Over the period, the 5 most important markets were Malaysia (3.28mn arrivals), China (2.51mn), South Korea (1.20mn), India (1.17mn) and Russia (0.99mn).

In the first week following the introduction of visa-free travel for Chinese tourists (24 September to 1 October), arrivals from China surged 72.5% from a prior week to 106,472. We have forecast that in 2023, 28.5mn foreign tourists would come to Thailand, but reaching this total would require over 2.8mn arrivals monthly in the last quarter, compared to an average of 2.4mn per month in Q3. Given the impact of violent event in a famous Bangkok shopping mall, this has become more challenging. Thus, the president of the Smart Tourism committee of the Tourism Council of Thailand has said that the bombing of the Erawan Shrine in Bangkok in August 2015 reduced foreign arrivals by 1.33mn, causing losses to the industry worth THB 64.30bn. The most severe impacts were seen in the first month following the attack, though it took 4 months for the market to return to normal.