The outbreak of fighting between Hamas and Israel has added to uncertainty over inflation, monetary policy, and the overall economic outlook

World

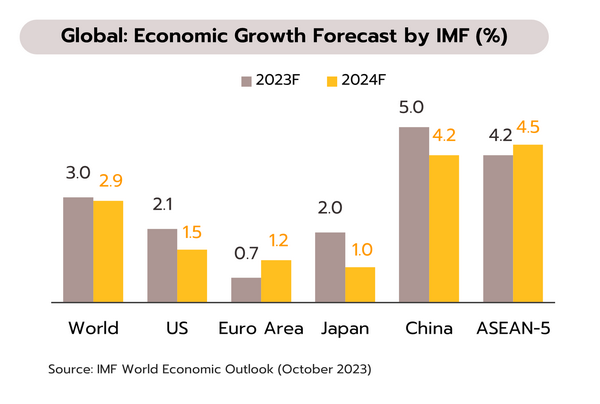

The IMF sees the global economy has recovered from a series of crises, in many countries, growth will slow in the coming period. The International Monetary Fund (IMF) is maintaining its 3% forecast for 2023 global growth, but the 2024 forecast has been revised down from 3.0% to 2.9%. Although it has added 0.3ppt and 0.5ppt to US growth this year and next, expansion in the US economy will still slow from 2.1% in 2023 to 1.5% in 2024. Chinese growth is also forecast to drop from 5.0% in 2023 to 4.2% in 2024, downgrades of respectively 0.2ppt and 0.3ppt. Likewise, the IMF has cut its forecast for Eurozone growth from 0.9% and 1.5% in 2023 and 2024 to 0.7% and 1.2%.

The IMF believes that although the world economy has shaken off the effects of the Covid-19 pandemic, the war in Ukraine, and the energy crisis, growth will slow in 2024 at both global and national levels, in particular in the US and China. Economies will struggle against scarring from these crises, the impact of the highest interest rates in over a decade, and risk arising from both China’s troubled real estate sector and volatile commodity prices. It remains to be seen what the knock-on effects of the Israel-Hamas conflict will be. The IMF has stated that if the war results in crude prices rising by 10%, this will cut global growth by 0.15ppt and add 0.4ppt to inflation.

US

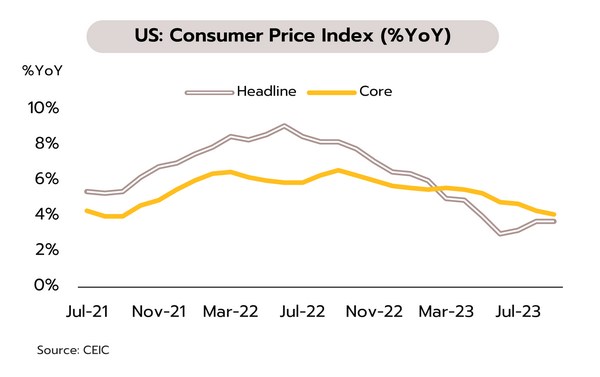

It appears that at least initially, the most recent troubles in the Middle East will not affect the Fed’s view on policy rates through Q4. In September, the producer price index (PPI) rose from 2.0% YoY to 2.2%, with the core PPI also rising from 2.5% YoY to 2.7%. Increases in the consumer price index (CPI) were unchanged at 3.7% YoY, but core inflation dropped from 4.3% YoY to 4.1%. October’s consumer confidence index also softened from 68.1 to 63, its weakest since May.

The violence in Gaza and Israel has added to uncertainty over the direction of inflation and policy rates through Q4, but the exact impacts of the war will be highly dependent on whether the fighting remains contained or whether it ignites a wider regional conflict. Initially, it appears that with the global economy slowing and the fighting contained, energy prices will not rally strongly, and this will then help to keep inflation expectations within the 3.3% and 2.5% forecast for 2023 and 2024. Pressure on core inflation and average wages is also softening alongside a weakening of labor markets. Thus, with clearer signs of an economic slowdown and real interest rates at their most positive since the 2008 financial crisis, we see the Fed holding policy rates steady at 5.25-5.50% through to at least mid-2024.

Japan

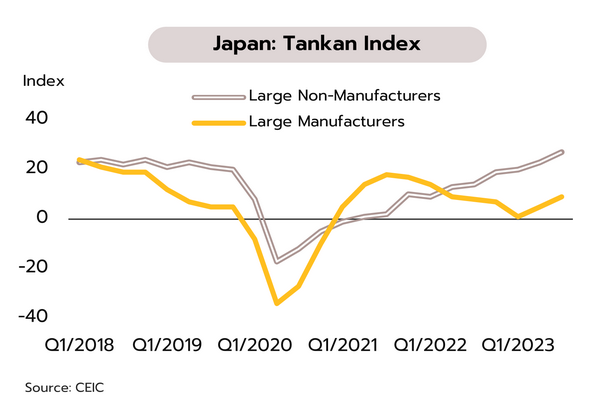

If the Israel-Hamas violence does not spread further, ongoing economic weakness may encourage the BOJ to keep interest rates low. In August, core machinery orders contracted -7.7% YoY and -0.5% MoM compared to July’s slippage of respectively -13.0% and -1.1%. September’s producer price index (PPI) was up 2.0% YoY, down from 3.3% a month earlier, while on the narrow M2 measure, money supply expanded by 2.4% YoY, its weakest rate of growth since November 2019.

In the event that fighting in the Middle East remains contained but soft exports and weakening wages continue to drag on growth, we see the Bank of Japan (BOJ) persisting with its current loose monetary policy. Policy rates will thus remain low and yield curve control will stay in place until inflation climbs back to its long-term 2% target, and this is not expected to happen until 2025. However, Japan imports 95% of its oil from the Middle East, and so if the Israel-Hamas conflict spreads across the wider region and so pushes up crude oil prices, this may well initiate a much earlier shift in Japan’s monetary policy than the market currently expects. Such a situation would have a detrimental impact on the economy, potentially forcing the country into recession over the next 2-3 quarters.

Private consumption is being buoyed by strengthening consumer sentiment and the rollout of new government policies, but private investment is growing more slowly

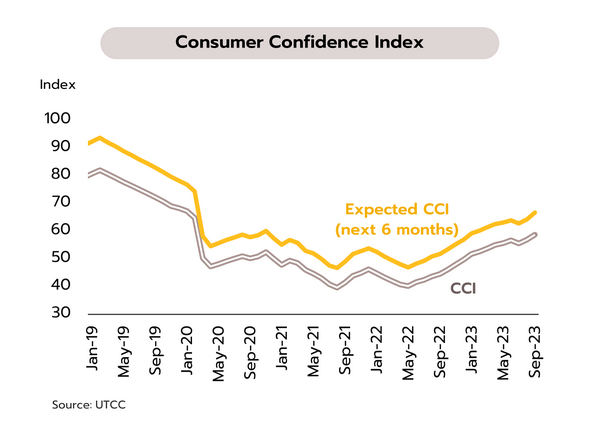

Consumer confidence continued to improve in September, and greater clarity over the digital wallet policy is expected by the end of October. The Consumer Confidence Index rose for the second month in September, climbing from 56.9 to a 42-month high of 58.7 on the installation of the new government and the rollout of policies to help with electricity price and the cost of diesel, debt relief for small farmers, and further support for the tourism sector.

Private consumption jumped 6.8% YoY in the first half of the year, and thanks to the impact of the new government’s policies, growth is continuing through the latter half of 2023. Trends in sentiment should remain positive with September’s expected confidence 6 months out rising from 64.2 to 66.7, its highest since March 2020. However, it remains to be seen how the digital wallet policy and the plan to distribute THB 10,000 to all Thai adults will pan out. A working committee has been established but it is not yet clear under what conditions and where consumers will be able to spend the money, or how the project will be funded, though the Deputy Minister of Finance has said that all the relevant details might be revealed in October.

Private investment is growing only slowly though positive indicators can be seen in applications for investment promotion. The Board of Investment (BOI) reports that for 8M23 (January-August), the number of applications for BOI privilege jumped 33% YoY to 1,375, while by value, these rose 47% to THB 465.06bn. Applications were focused on electronics and electrical appliances, followed by agro-industry & food processing, and autos & auto parts. In terms of approvals, which is only one step short of making the actual investment itself, 1,106 projects (+17% YoY) had passed this stage, and these were worth THB 288.71 bn, which is close to the level for last year. This is a sign that capital inflows should remain over the next 1-2 years as investors respond to an expanding economy.

Private investment edged up 1.8% YoY in 1H23, but Private Investment Index (PII) for July and August show this contracting -1.1%. On the positive side, investment is being boosted by recovery in the domestic economy and especially in tourism, but exports are suffering from the global slowdown and weakness in major export markets. Headwinds could be added by violence between Hamas and Israel. If fighting does not spread, the impacts of this on Thailand should be limited since Israel numbers only 40th among Thai export markets, and although the value of exports to Israel during January-August rose 12.6% YoY to USD 546mn, this was still only 0.3% of total Thai exports, led by motor cars & parts (see table). At the same time, imports slipped -14.2% to USD 311mn (0.2% of the total). However, the situation remains highly uncertain and it is undeniable that fighting may spread, amplifying the risks to trade and investment, disrupting transport and, if global crude prices spike, adding to manufacturing costs.