US monetary policy will remain unchanged on positive real interest rates. Despite reopening, risks remain for Japan and China.

US

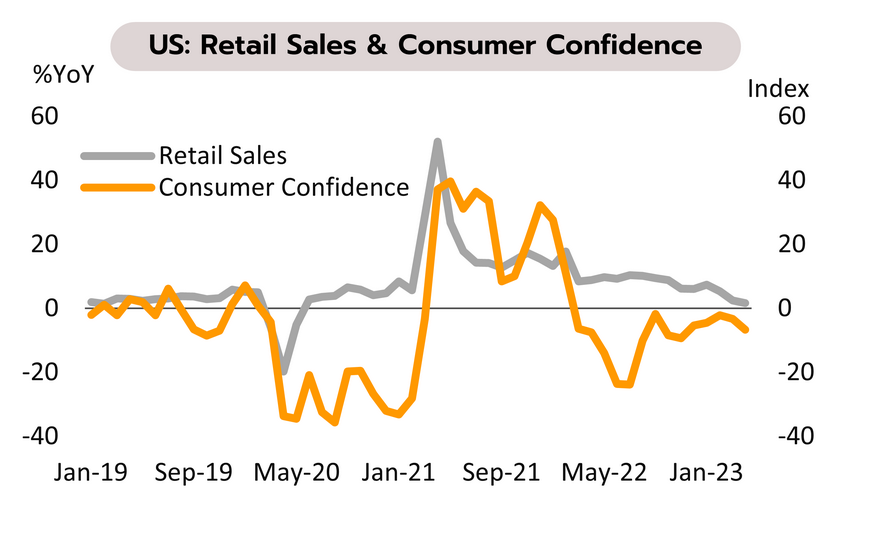

The US Fed may not raise rate as much, while discussions over raising the debt ceiling have stalled. April’s retail sales figures edged up 0.4% MoM and 1.6% YoY, though growth is now down for 3 months compared to a year earlier and this is now at its slowest since June 2020. Following declines in February and March, core retail sales were up 0.4% MoM, while industrial production rose 0.5% MoM, a turnaround on the expected -0.1% decline and the strongest print in 8 months. Meanwhile, Fed Chair Powell has stated that given stress in the banking sector and the need to avoid negative economic impacts, the “policy rate may not need to rise as much as it would have otherwise.”

Friday’s negotiations between the White House and congressional Republicans were inconclusive and further talks will be needed in the coming week if a June default is to be avoided. Consumer sentiment also remains weak and with retail sales growing at their slowest in almost 3 years, consumer confidence dropped to a 6-month low in May. The outlook for 2H23 is thus negative, though persistent strength in labor markets and the lowest unemployment rate in over 50 years will help to offset recessionary risks. We expect that with the economy slowing, ongoing risk in the banking sector, and positive real interest rates, the Fed will leave rates at 5.00-5.25% at its June meeting.

Japan

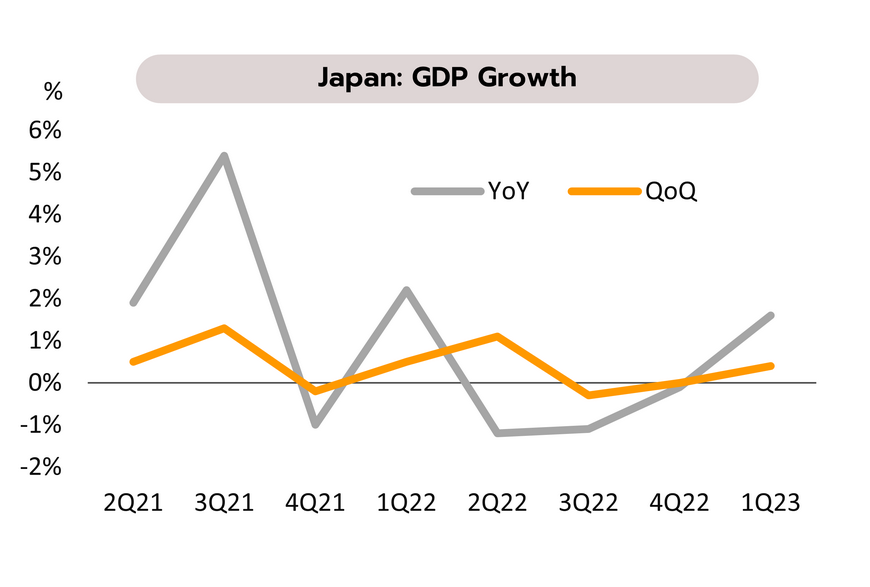

Strengthening domestic consumption has returned the Japanese economy to growth following 2 quarters of contraction. Japan’s GDP grew 0.4% QoQ and 1.6% YoY in Q1, after contracting in the previous two quarters. In April, tourist arrivals rose to 1.95m from 1.82m in prior month, thus bringing these to around 70% of their pre-Covid-19 level. The producer price index also softened for the 4th month, dipping from 7.4% to 5.8% YoY.

Overall, the Japanese economy performed better in Q1, and with pandemic restrictions ending and the country reopening, economic activity picked up and domestic spending rose with the result that the economy returned to growth for the first time in 6 months. Inflation is expected to soften further and tourist numbers should continue to increase, and so recovery will likely extend into 2H23. Moreover, although weakness in the global economy will increase downside risk to the export sector, we anticipate that the positive impetus provided by stronger consumption will compensate for this and so we are giving only a small weight to the possibility of a recession. To reduce pressure in bond markets and with inflation over the BOJ’s 2% target, we also expect the authorities to consider normalizing monetary policy during 2H23.

China

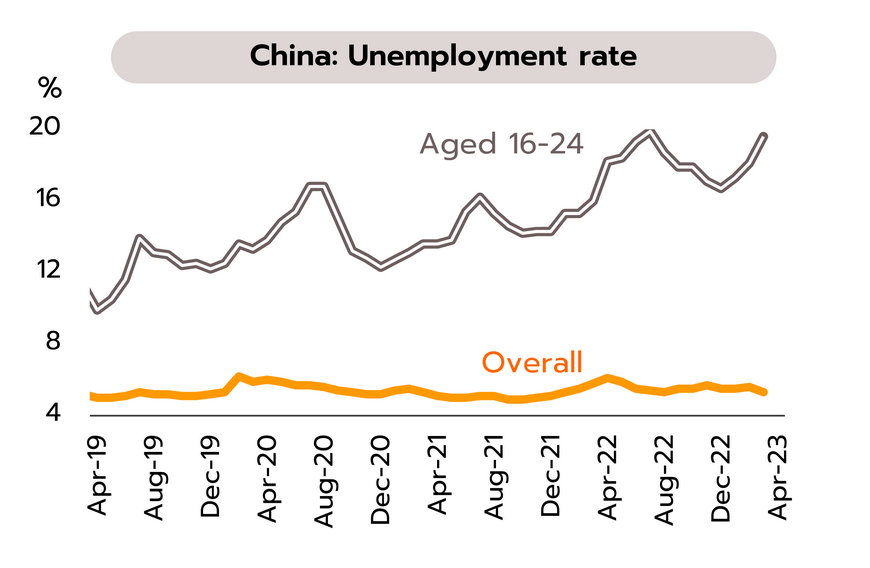

The Chinese economy continued to grow at the start of Q2 but due to a combination of structural problems and the global slowdown, growth undershot market expectations. In April, retail sales and industrial output rose by 18.4% and 5.6% YoY, up from respectively 10.6% and 3.9% in March, while unemployment inched down to 5.2% from 5.3%. The IMF expected Chinese growth to hit 5.2% this year, compared to 3.0% in 2022, with the country contributing 34.9% of total global growth.

Although consumption and manufacturing output appeared to strengthen from Q1 into Q2, this is partly an artefact of the lockdowns in major urban centers (e.g., Shanghai) that were instituted in 2Q22 and that thus set a low baseline for comparison. The strength and persistence of the recovery is thus open to question. (i) A range of economic indicators underperformed expectations in April, with analysts forecasting jumps in retail sales and industrial output of respectively 22% YoY and 11%. (ii) Export growth slipped to 8.5% YoY from 14.8% in March, reflecting the impact on China of the global slowdown. (iii) Other indicators highlight ongoing structural problems, including declining investment in retail estate (-6.2% YoY during Jan-Apr vs -5.7% in 1Q23) and the jump in youth unemployment (16-24-year-olds) to the historic high of 20.4% in April.

Both external and internal factors are dragging on sentiment, but although the tourism sector has softened slightly, an increase in the number of flights from China reflects positive growth trends

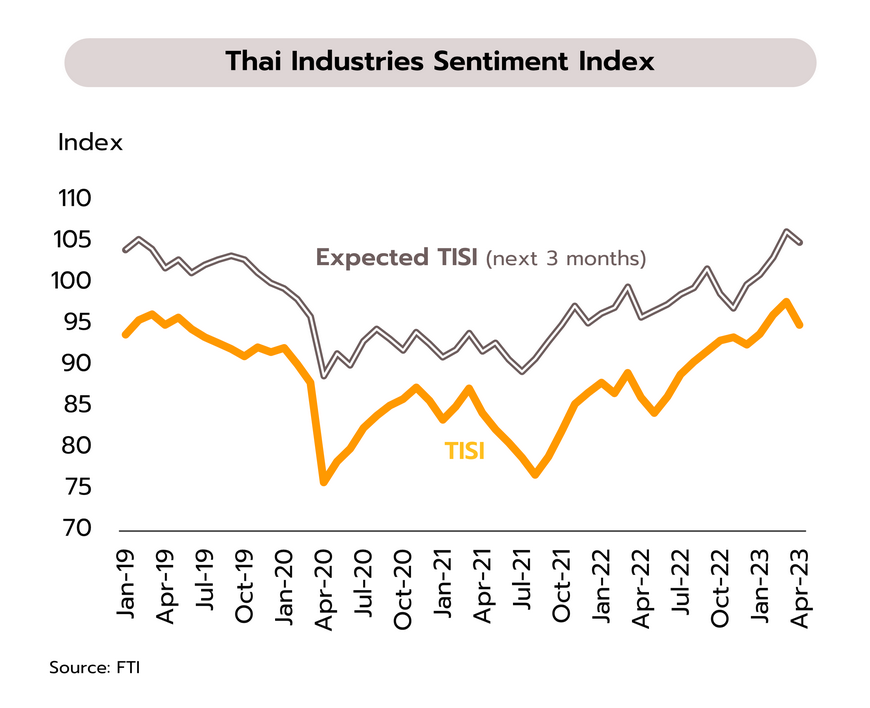

Softening exports are weighing on industrial sentiment, which has weakened for the first time in 4 months, while political uncertainty may delay the FY2024 budget. In April, the Industrial Sentiment Index slipped from 97.8 in March to 95.0, its lowest in 3 months, on a drop in output (due partly to Thai New Year holidays in April) and weak overseas demand, the latter showing up in a decline in new orders and overseas sales. Investor confidence has been adversely affected by high operating costs, and businesses are wary over the impacts of more expensive energy (especially of electricity) and rising interest rates.

Growing concerns over the outlook for the global economy have fed a decline in industrial sentiment now and 3 months out, the latter dropping from 106.3 to 105.0. Sentiment has been further impacted by slowing demand in export markets that has then dragged on the Thai export sector. The Office of the National Economic and Social Development Council now sees growth in global trade slipping to just 2.1%, down from 5.1% in 2022. Through the remainder of 2023, the authorities thus urgently need to address problems in the export sector by accelerating sales into markets that are still growing, developing new markets where spending power is strong (the Middle East, South Asia, and the ASEAN zone), and easing bottlenecks that restrict cross-border trade by increasing CLMV connectivity. In addition to external factors, sentiment has also been affected by domestic politics and although the election has been concluded, uncertainty remains over the formation of the next government. Thus, while 8 parties led by Move Forward have agreed to form a coalition that includes 313 of the country’s 500 MPs, it is not clear that they will be able to take power or, if they do, what policies they will enact. In addition, there is a significant risk that setting out and approving the FY2024 budget will be delayed, and even if a government is able to take office in August, this will leave less than 2 months to agree on central government funding before the start of the next fiscal year on 1 October.

The number of foreign arrivals dipped at the start of May, but growth in foreign tourism is expected to be a major driver of the economy through 2H23. The Ministry of Tourism and Sports reports that for the week 8-14 May (the latest data that is available), 415,309 arrivals were recorded, down around -7% from a week earlier. though this is partly due to the lack of holidays in foreign (and especially long-haul) markets. The five most important markets accounted for 47.5% of all arrivals, these being Malaysia (-14.8% week-on-week), China (-5.3%), India (+4.5%), Lao PDR (-8.7%), and South Korea (-7.2%).

Although the number of overseas tourists coming to Thailand dipped slightly at the start of Q2 (preliminary data indicate that April’s arrivals totaled 2.13m compared to 2.22m in March), this is largely due to the fact that the industry is now in its low season. During the first four months of this year, Thailand welcomed 8.6m foreign arrivals, or 61% of the 2019 pre-Covid-19 total. Malaysian, Russian, South Korean, and UK arrivals are now back to 80-100% of their pre-pandemic total, but the Chinese market is recovering more slowly and is still only 21% of its earlier size. However, data from the Civil Aviation Authority of Thailand show that as of 1 June, the number of flights from China to Thailand will increase from 152 to 327 per week and then to 450 in July. This will therefore help to drive an increase in the extent of the Chinese market and then to return this more rapidly to its pre-Covid size. We thus expect that foreign arrivals will total 14.5m in 2H23, up from 12.5m in 1H23.