Risks are rising from US banking turmoil and looming debt ceiling crisis; Global slowdown also threatens manufacturing activity in key countries

US

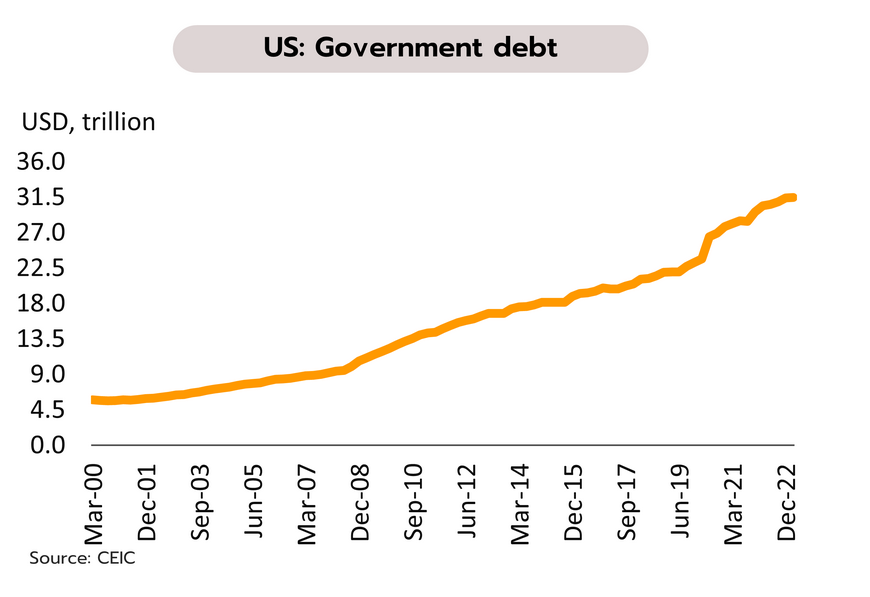

Uncertainty surrounding the US debt ceiling and banking sector could hit the economy in periods ahead. In March, personal consumption expenditure (PCE) price index rose 4.2% YoY, with core PCE price index up 4.6%. US GDP grew by 1.1% QoQ annualized in 1Q23, below the consensus expectation of 2.0%. Alongside this, Congress has passed a bill to raise the debt ceiling that also calls for spending cuts over the next decade.

Struggles over the debt ceiling will weigh on sentiment over the period between now and June, when current financing expires. If the issue remains unresolved and the US is forced to default on its debts, this would have serious consequences for the economy. For the latest banking turmoil, after facing liquidity and confidence crises, First Republic Bank (FRB) has been seized by officials and Its assets sold to JPMorgan. However, risk in regional banks has continued to threaten financial sector. Meanwhile, high inflation for longer than expected may encourage the Fed to maintain its tight monetary policy. Nevertheless, given the looming specter of a debt default and banking turmoil, we expect the Fed to raise rates by 25 bp at its May meeting and then to leave the Fed Funds Rate at 5.00-5.25%. The ending of this cycle of rate hikes would then coincide with an expected slowdown in the US economy in 2H23.

Japan

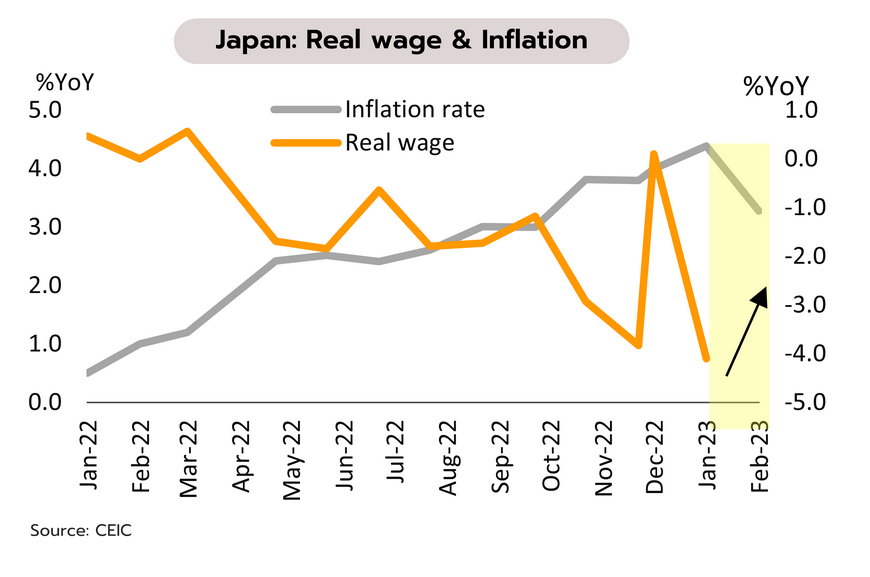

The BOJ has countered hopes of an immediate change in direction for its monetary policy. At its most recent meeting, the Bank of Japan (BOJ), led by the new governor Kazuo Ueda, agreed to leave its very relaxed monetary policy unchanged. Short-term interest rates thus remain at -0.1%, and yield curve controls (YCC) are still in place that target a 0% (+/- 0.5%) yield on 10-year government bonds. However, the bank has abandoned its promise to keep rates at the current (or lower) level, and it will now also carry out a broadly scoped review of monetary policy.

The latest meeting of the BOJ has thwarted hopes of a course correction for Japanese monetary policy given the likely 12-18 months that it will take to complete a policy review and to withdraw major stimulus packages. In addition, the global slowdown is feeding into softness in exports and private investment, which is in turn undercutting economic growth. However, services remain strong and with inflation weakening, real incomes are rising and signs of a rebound in domestic consumption should therefore become clearer in 2H23. Likewise, the reopening of the country is supporting recovery in the tourism sector and these trends will help to compensate for weakness elsewhere in the economy. We thus see only a limited risk of recession for Japan this year.

China

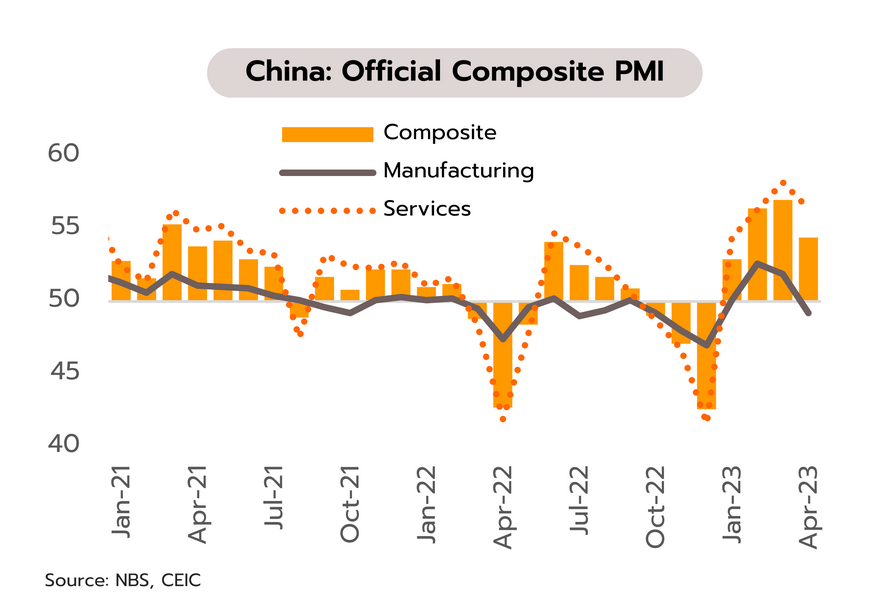

The Chinese economy is being lifted by the service sector through the start of Q2 but growth is patchy and for many industries, the recovery remains weak. In April, the official composite PMI fell from 57.0 in March to 54.4. The services PMI remained high at 56.4, down from 58.2, but showing a further expansion in services sector. The manufacturing PMI fell unexpectedly to 49.2 from 51.9, indicating pressure from the global slowdown and weakness in the real estate sector.

With the lifting of Covid restrictions and the impetus that has provided to the service sector, we see the Chinese economy continuing to expand, but recovery is inconsistent and many industries remain sluggish. This is reflected in economic indicators, including youth (aged 16-24) unemployment, which in March rose from 18.1% to near record high at 19.6%, and investment in real estate, which contracted by 5.8% YoY in Q1. In addition, Q1 corporate profits also undershot market expectations, slipping 21.4%. Of the 41 industries surveyed, 28 saw losses, led by petroleum and coal

(-97%), non-ferrous metal smelting and rolling (-58%), computers, communication, and electronic equipment (-58%), chemical products (-55%), textiles (-34%), non-metallic mineral products (-31%), automobiles (-24%), and agricultural and food processing (-18%).

Better-than-expected export data, a strengthening economy, and the BOT’s stance on inflation all point to a likely 25bps rate hike in May

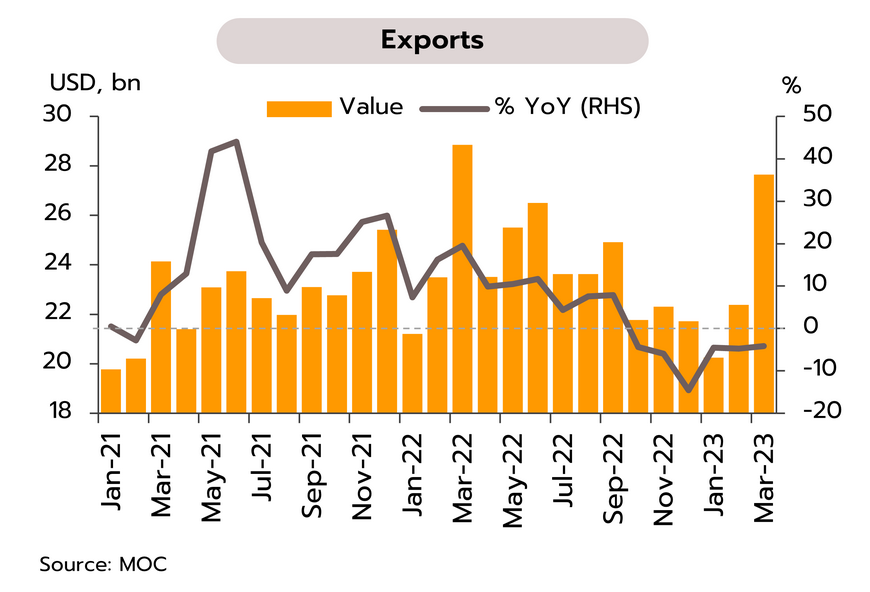

Despite contracting for the 6th straight month, Thai export value reached a 1-year high in March. Data from the Ministry of Commerce show that in March, exports generated receipts worth USD 27.7bn, and although this represented a decline of 4.2% YoY, this was better than the 14% contraction expected by the market. Excluding oil and gold, exports in fact expanded by 1.3%. Sales into most of the major export markets improved, with the size of declines lessening in China, the ASEAN zone, and the CLMV countries, while those to the US and Japan returned to growth. Exports of agricultural and agro-industrial goods expanded by 4.2%, with growth seen in the important product segments of fresh, chilled, frozen, & dried fruits, sugar, cassava products, and rice. Overseas sales of industrial goods contracted for the 6th consecutive month by 5.9%, though again, growth was seen in the major segments of autos, auto parts & auto components, air conditioners, and fresh, chilled & frozen chicken. Meanwhile, at USD 2.72bn, the current account balance returned to a surplus for the first time in a year.

The improvement in March brought Thai export value back to close to the historic high of USD 28.9bn that was recorded in March 2022, and this has then helped to lift 1Q23 exports to a total of USD 70.3bn (down 4.5% YoY). Through the rest of 2023, exports will benefit from the reopening of China, the easing of supply chain disruptions, and stronger demand for food and agricultural products in overseas markets. Nevertheless, the export sector will have to contend with weakness in global manufacturing, the effects of tighter monetary policy on demand in the major economies, and ongoing troubles in the banking and financial sector. In light of this, we expect the value of Thai exports to increase by only 0.5% in 2023.

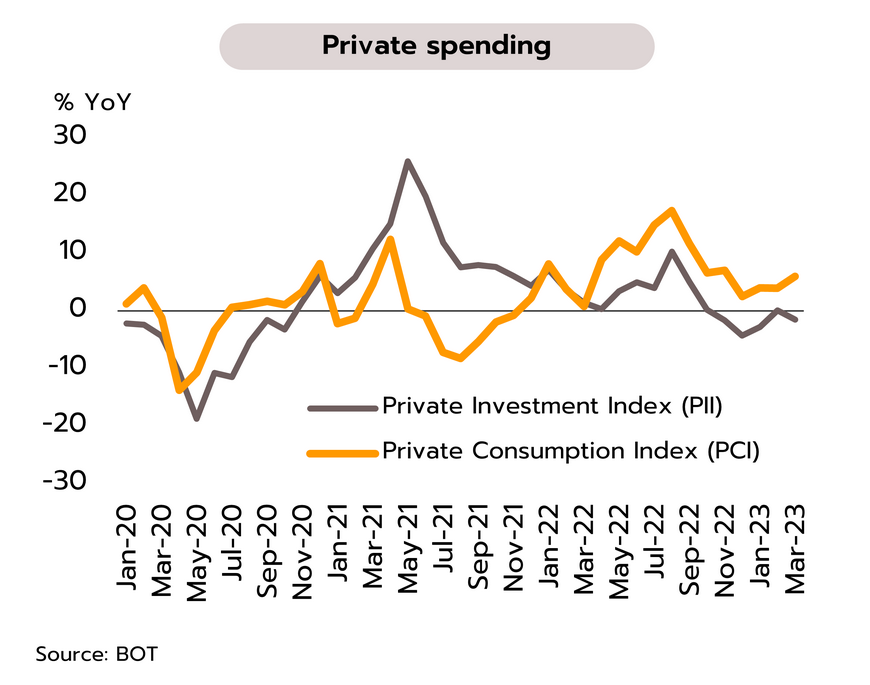

In March, the economy benefited from strength in the tourism sector and higher domestic spending, and as a result, the economy expanded in 1Q23 relative to 4Q22. The Bank of Thailand (BOT) reports that the Private Consumption Index (PCI) rose 6.0% YoY in March, led by spending on services, where recovery in both domestic and international tourism continues to exert a positive influence. And although spending on durable and nondurable goods dipped slightly, this was offset by stronger labor markets and rising consumer confidence that is then translating into expanding household spending power. Private sector investment contracted -1.6% in March, with declines seen in machinery & equipment and construction. Overseas markets gave a mixed performance, and while export value contracted for the 6th month, tourist arrivals rose from 2.11mn in February to 2.22mn.

Economic indicators reflect the improving outlook for 1Q23 compared to the previous quarter, with momentum coming especially from strong recovery in both the domestic and international segments of the tourism sector. This is then lifting both services overall and domestic expenditure, as well as strengthening labor markets, with the result that at less than 1.0%, unemployment is now at a 4-year low. Likewise, despite continuing to contract, the value of exports is improving. For the policy rate outlook, in a communication to the Ministry of Finance, the BOT also expressed the view that given continuing growth in the Thai economy, and risk from demand-pull inflationary pressure, normalization in policy rate may be appropriate. Against a backdrop of recovering domestic economic activity, better-than-expected export data, and the BOT’s recent concern over sticky core inflation, we therefore expect that at the 31 May meeting of the MPC, policy rate will be raised from 1.75% to 2.00%.