With the danger of recession receding, central banks are tightening monetary policy further, though this risks triggering a synchronized slowdown

Global Economy

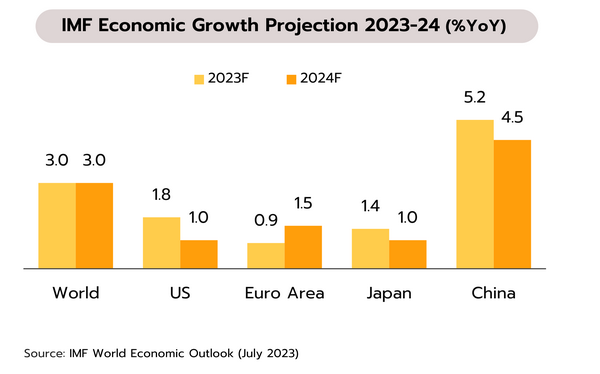

Although the impacts of the pandemic and the Russia-Ukraine war are fading, the global economy is slowing. The IMF sees global growth hitting 3.0% this year, and while this is up on the prior forecast of 2.8%, it is down from 2021’s and 2022’s growth of 6.3% and 3.5%. Growth is also expected to remain at 3.0% in 2024, below the 2-decade average of 3.8% for 2000-2019. The outlook for major economies is thus slowing, falling from growth of 1.8% this year to 1% next year in the US, from 1.4% to 1.0% in Japan, and from 5.2% to 4.5% in China. For the ASEAN-5 group, growth would edge down slightly from 2023’s 4.6% to 4.5% in 2024.

Despite the resolution of the US debt ceiling and the lessening of stress in the financial sector, the fight against inflation and tighter monetary policy still imply the risk of a further slowdown for the global economy, and any worsening of the war in Ukraine or greater impacts from climate change may reignite inflationary pressures. China’s rebound is dissipating, and many countries’ debt distress could spread. The latest services PMI also show negative signs across the major economies: in July, the US services PMI slipped to a 5-month low; in the UK, growth has largely stalled; the Eurozone activity is at its weakest in 6 months; and in Japan, growth is at a 4-month low. The slowdown is especially noticeable in services activity, recently a major driver of the world economy.

US

The Fed has hiked rates, as expected, seeing no recession, while data-dependent approach suggests a possible end of this rate-hike cycle. The US central bank has raised rates by 25bps to a 22-year high of 5.25-5.50%, though at the same time, the Fed outlook has improved from a likely ‘recession’ to a ‘noticeable slowdown’. The Fed is adopting a data-dependent approach for future rate decision. In July, the Consumer Confidence Index also climbed to 71.6, its highest since October 2021, while advance estimates of 2Q23 GDP growth show this hitting 2.4%, up from 2.0% in Q1.

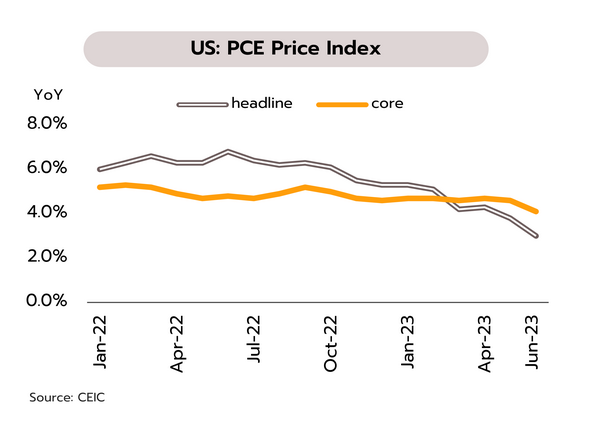

The Leading Economic Index is at a 15-month low, the Composite PMI is at its weakest in 4 months, and growth in credit is slowing, and these point to the continuing risk that the US may undershoot market expectations for growth and then potentially slip into recession next year. In light of this, and the fact that real interest rates are now positive and the PCE price index is weakening (headline PCE inflation has fallen from 3.8% to 3.0% YoY, while core PCE inflation is down from 4.6% to 4.1% YoY), we believe that this is likely to be the last hike in the current cycle, and we now expect rates to remain elevated but unchanged through to mid-2024.

Eurozone and Japan

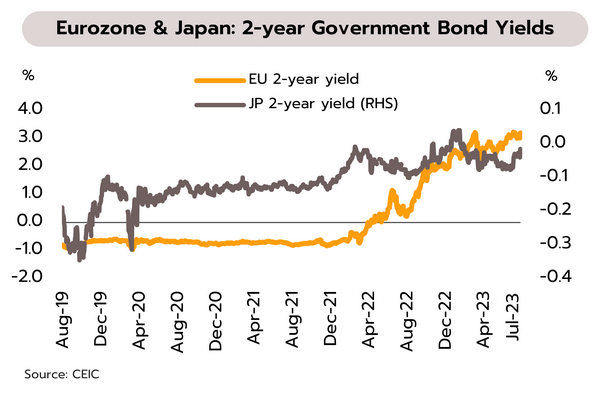

The Eurozone rate rise cycle is approaching an end, while Japan has eased yield curve controls to make these more flexible. The ECB has raised rates by 25bps, bringing the deposit rate to an over 22-year high of 3.75% and lending and refinance rates to 4.50% and 4.25%, respectively. Meanwhile, in Japan, the BOJ has kept its target for short-term rates at -0.1% but yield curve controls have been relaxed. Although target yields on 10-year Japanese government bonds (JGB) remain centered on 0.0% and the official cap is still set at 0.5%, the BOJ will allow 10-year JGB yields to rise above the current cap of 0.5% up to 1%.

With inflation still some way off the 2% target, the ECB may raise rates once more in 2H23, taking the deposit rate to 4.00%. However, the high cost of living and tight monetary conditions are dragging on consumption and investment, and so the Eurozone outlook will remain depressed for some time. In Japan, to alleviate pressure in the bond market and to shore up the value of the yen, the BOJ is expected to unwind its ultra-loose monetary policy. To avoid the risk of a return to deflation, any changes will be only gradual. Overall, Japan’s abandonment of Covid controls, the reopening of the country to foreign tourists, and recent wage rises will all help to offset the risk of recession and to drive economic expansion in the coming period.

The drought will begin to impact the economy in 2H23 and its effects will worsen in 2024. For exports, comparison with 2022’s low baseline will mean that export growth should be positive in the second half of the year.

Farm income contracted for the 4th straight month in June. The drought impacts on Thai economy may be limited this year, but these will intensify through 2024. In June, farm income index slipped 6.0% YoY, due mainly to a drop in farm price index (-6.0%) driven by weaker prices for major products including rubber, pork and whiteleg shrimp. Farm outputs were up just 0.02%. Across the whole of 1H23, farm income index contracted 1.0% YoY, resulting from a 3.4% fall in farm price index and a 2.5% rise in farm output index.

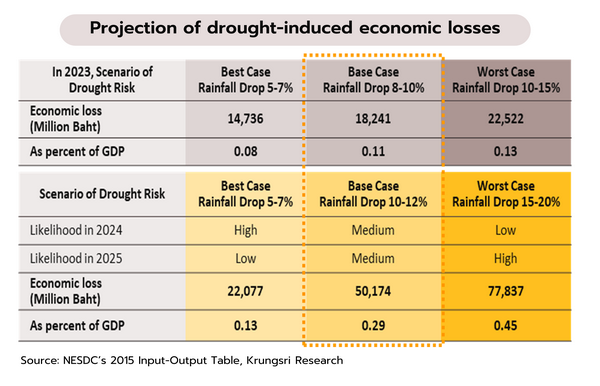

The emerging El Niño will affect the agricultural sector through the rest of 2023, but will fully manifest over 2024 and 2025 in the form of higher temperatures, heatwaves, interruptions to rainfall, and reduced water in aquifers, natural storage areas, and manmade reservoirs, which will then translate into drought for farmers. We expect that in 2023, the effects of this will be most evident in the yields of crops that are sensitive to water shortages, such as off-season rice and cassava, and this will then trigger losses worth some THB 18bn, or 0.11% of GDP. However, in 2024 and 2025, the reach of these negative impacts will widen to include many other major crops, including sugarcane, corn, fruits, and forestry goods, though in some cases, the effects will be felt more strongly in downstream industries than among upstream suppliers. In the baseline case, overall drought-related losses are expected to run to THB 50 billion, or 0.29% of GDP, though this may rise to as much as THB 78 billion, or 0.45% of GDP, if impacts are more severe. (for more details, please see Research Intelligence: Impending drought: Impacts on agriculture and related industries)

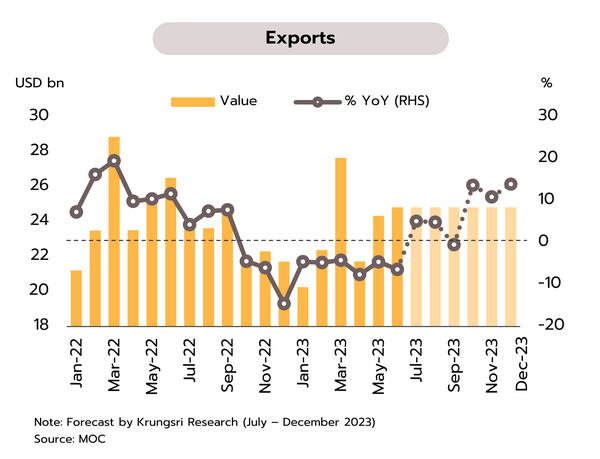

Thai exports contracted for the 9th month in June, but if the monthly value of overseas sales remains unchanged, exports will grow by around 8% in 2H23. The Ministry of Commerce reports that in June, exports totaled USD 24.8bn, and although this was down 6.4% YoY, this was less than market expectations of a 7.3% fall, while excluding oil, gold and weapons from the calculations brings the decline down to -2.9%. Having grown in the previous month, exports to the US, the EU, and the ASEAN-5 countries contracted in June, though those to China and Japan strengthened. Exports of agricultural and agro-industrial goods dropped by 8.6%, the 2nd month of declines, while those of industrial goods flipped back to a contraction of 4.6%. For 1H23, the value of Thai exports thus fell 5.4%.

Although export value slid for the 9th consecutive month in June, this was both up slightly from a month earlier and above the average for the first 5 months of this year. Going forward, if the monthly value of exports remains at June’s total of USD 24.8bn through 2H23, total exports would grow by almost 8% YoY thanks to comparison with last year’s low baseline, during which China was in lockdown. Nevertheless, the outlook remains uncertain in major export markets, including China, where the post-Covid recovery has been weaker than expected, and the EU, where soft domestic demand and the effects of the Russia-Ukraine war are dragging on growth. Moreover, with manufacturing PMIs under 50 and thus indicating recessionary conditions, the manufacturing sectors in the US, the EU, China and Japan remain sluggish.