Global economy is likely to slow down from several headwinds; The US and Eurozone are expected to flexibly adjust monetary policies in the next period as risks increase

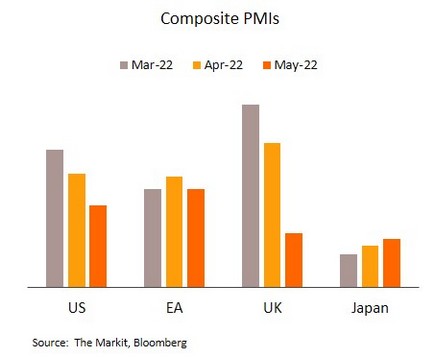

The Ukraine war, Chinese lockdown, and food crisis would worsen global economy through Q2. In May, the Flash Composite PMIs for the major western economies weakened on fall in both of their Manufacturing and Services PMIs. Declines were seen in the US (down to a 4-month low of 53.8), the Eurozone (a 3-month low of 54.5) and the UK (a 15-month low of 51.8). Nonetheless, Japan’s PMI climbed to 51.4, its highest in 5 months, reflecting the relatively later in the easing of outbreak than others.

The world economy, especially global manufacturing, tends to slow down in Q2, with Manufacturing PMIs in the US, the Eurozone, the UK, and Japan all worsening. The output and new orders sub-indices both weakened, while the input prices component increased on the impacts of the extended Ukraine war, the severe sanctions on Russia, and the Chinese lockdowns, all of which worsen global supply chains. Imbalances between supply and demand also pushed up the cost of some commodities, while the pressure of persistently strong inflation is weighing on manufacturing output and eating into purchasing power. The worsening food crisis may now amplify these problems, and with more than 30 countries restricting food exports, prices are expected to rise further. Moreover, with Russia making advances in the east of Ukraine, the war is likely to intensify. As the impacts of Chinese lockdown continue, President Xi Jinping has warned that China may not hit this year’s target of 5.5% growth. These headwinds may thus buffet the global economy.

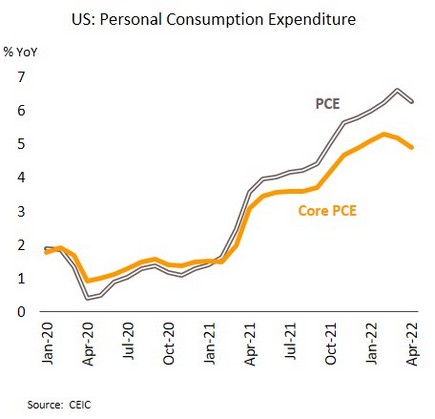

Inflation still threatens the US; The Fed indicates that its move would be more flexible after September’s meeting. In April, rises in core personal consumption expenditure (Core PCE) slowed to a 4-month low of 4.9% YoY, while personal consumption expenditure was up for the 4th month. Continuing jobless claims for the week ending 14 May also stood at 1.34m, largely unchanged from the previous week’s record of the lowest level since 1969.

Despite slowing down, April’s inflation as per core PCE remained double its target, and this combined with ongoing tightness in labor markets will support further hikes in interest rates. These are in line with the minutes of May’s FOMC meeting, which indicates that 50 bps increases are likely at the next 2 meetings, but after this, the Fed’s approach will be directed by an assessment of the economic situation and the prevailing risks. The Fed is expected to show more flexibility following September’s FOMC meeting, with a greater emphasis on economic developments that will be more data-dependent.

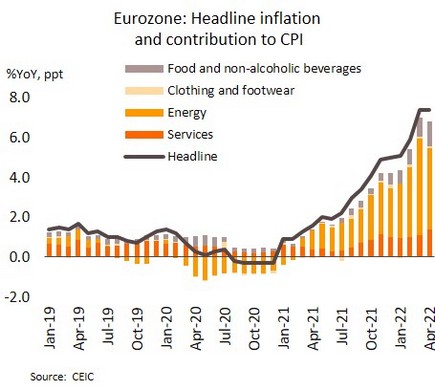

The ECB may exit negative rates in September and would gradually adjust policy to balance risks to growth. In March, Eurozone imports climbed to a historic high of EUR 260bn, mostly due to elevated energy costs. These thus expanded 35.4% YoY against growth in exports of 14.0%. In April, headline inflation held steady from the previous month at a historical record of 7.4%.

Eurozone indicators reflect the continuing impacts of high prices, especially of energy, which is raising fears that should inflation run hot for an extended period, expectations will not be anchored to the ECB inflation target. The ECB President has thus indicated that policy interest rates will be hiked in July with an exit from negative territory by the end of Q3. We expect that the ECB will raise rates by 25 bps in July and will gradually normalize policy as the bank looks to balance between risks to inflation and growth, especially those arising from the intensifying Ukraine war and sanctions.

Exports showed signs of slowdown; Labor market remains weak and may need additional assistance to counter the rising cost of living

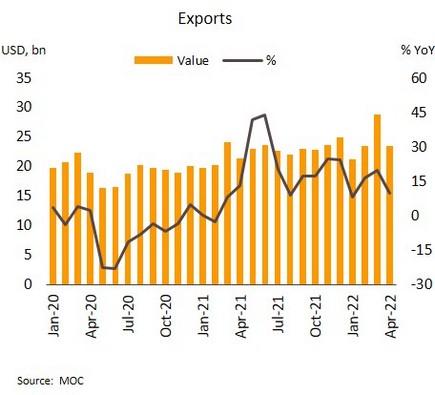

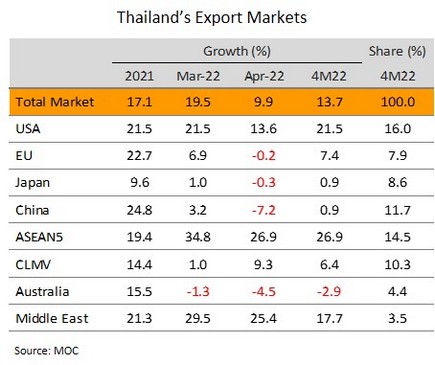

April exports weakened as the impacts of supply chain disruption became more obvious. In April, export value totaled USD 23.5bn (+9.9%), down from March’s historic high of USD 28.9bn. Excluding gold, exports growth slowed down to 8.9%, compared to 9.5% in March. The expanding exports were: (i) products that gained from rising energy and commodity prices (e.g., refined oil, chemicals, and plastic pellets); (ii) food and agricultural products, since demand for stockpile is increasing (e.g., rice, cassava products, and sugar); and (iii) products that rose in line with economic recovery and continually growing demand for medical products (e.g., IC, microwaves, and medical devices). Exports to the US, the ASEAN-5, and the CLMV performed well, but sales to the EU, Japan and China turned to shrink, while those to Russia contracted sharply.

Although the export sector has been boosted by the reopening of ASEAN nations, sales into the major markets of China and Europe fell back in April for the first time in over a year as the lockdowns in major Chinese cities, the war in Ukraine, and the sanctions on Russia took their toll on global supply chains. We expect that for the rest of 2022, exports will continue to come under pressure from softening global trade and a more slowdown in the world economy. Given the uncertainty surrounding the Ukraine war, the evidence of slowing exports in some Asian countries, which are major suppliers of electronics (e.g., South Korea and Taiwan), and May’s weakening of PMIs for many leading economies, the World Trade Organization (WTO) has recently downgraded its forecast for 2022 global trade volume from 4.7% to 3.0%. This implies that Thai exports are likely to slow down from the 13.7% growth averaged through 4M22. For 2022 overall, export value is expected to grow by around 6%.

Officials are considering additional measures to alleviate impacts of high energy prices amid fragile labor markets. Deputy Prime Minister Supattanapong Punmeechaow recently stated that in June, discussions will be held between the Bank of Thailand, the Office of the National Economic and Social Development Council, and the Ministry of Finance. These will assess the impacts on Thailand of the extension of the Ukraine war, review measures to counter rising energy prices, and decide whether to implement additional measures to the public following the previous short-term assistances.

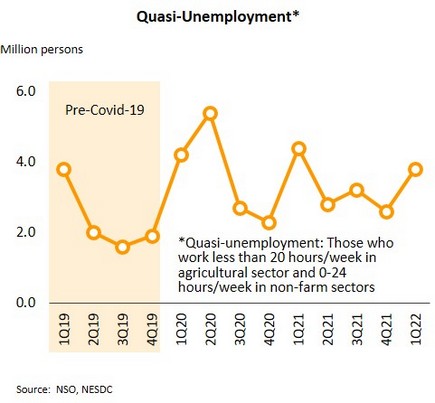

The steep runup with high volatility of energy prices has stoked inflationary pressures and added to the cost of living. Meanwhile, employment data in the agricultural and non-agricultural sectors, including, manufacturing, wholesale & retail trades, and logistics sectors, improved over Q1, though employment in construction, hotels & restaurants worsened slightly. In addition, the latest wave of infections is abating, and economic activities are rebounding, especially in the tourism sector, where an improving outlook will support recovery in labor markets, even if it will take some time for the situation to return to the pre-pandemic status quo. Nevertheless, many companies have reduced employees’ hours as they tried to sustain their businesses and at present, it is estimated that 3.8m workers are quasi-unemployed or working less than 4 hours per day. This is thus impacting income and expenditure of those who remain hardly hit, and it may be necessary to implement additional measures to help these individuals.