Despite the impetus provided by the service sector, indicators underscore the current weakness of economic growth

US

Slowing growth in the US economy may lead to ending cycle of rate hikes in 2H23. In April, the US composite PMI climbed to an 11-month high of 53.5. At a 6-month high of 50.4, the manufacturing component has returned to expansionary territory, while the services PMI hit 53.7, its strongest in 11 months. Nevertheless, the Conference Board Leading Economic Index (LEI) contracted by 1.2% in March to 108.4, its weakest since November 2020.

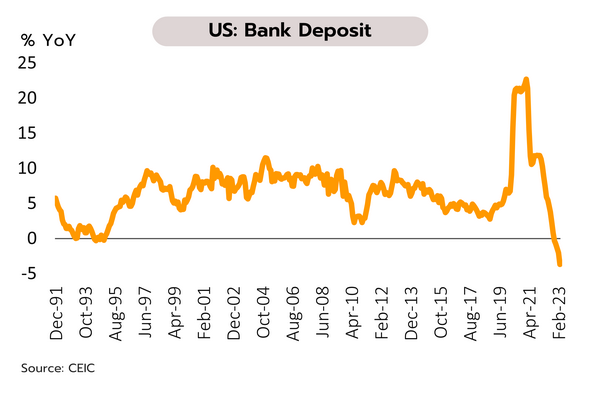

The risk of a US recession is rising, and leading indicators are pointing to a loss of momentum. For instance, retail sales are growing at their slowest rate since June 2020, consumer confidence is sitting close to low level last seen during the global financial crisis in 2008, house prices are softening, and the Leading Economic Index (LEI) is back to where it was in November 2020. In addition, banking deposits have dropped dramatically (-3.67% YoY in March alone), and this will likely feed a tightening of lending conditions, with knock-on effects for the wider economy. We therefore expect the Fed to raise rates one more time at its May meeting, with a 25-bp hike giving a terminal rate of 5.00-5.25%. The current cycle of hikes will then end in 2H23, bringing policy into line with softening economic conditions.

Eurozone

Strong inflation and correspondingly high interest rates are threatening the Eurozone with stagflation. April’s composite PMI climbed to an 11-month high of 54.4. Although the services PMI rose for the 4th month to hit 56.6, the manufacturing PMI slipped to 45.5, its weakest since March 2020, the beginning of the Covid crisis. Meanwhile, headline inflation dropped from 8.5% to 6.9% YoY but core inflation climbed from 5.6% to the historic high of 5.7% YoY. The Eurozone Consumer Confidence Index also slipped to -17.5 in April.

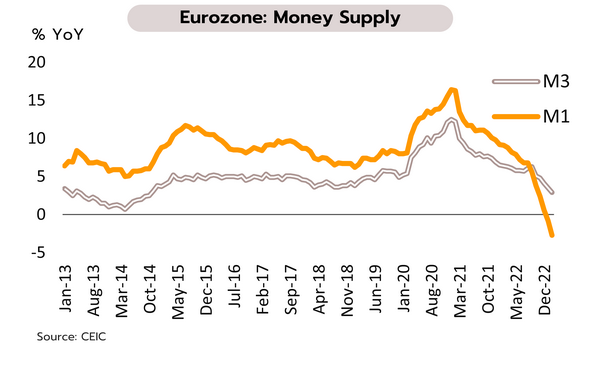

Under pressure from persistently high inflation and rising interest rates, demand for new credits from households and businesses is weakening, while for the 2nd month, there has also been a net outflow of deposits from the banking sector. In February, M1 money supply tightened by a record breaking 2.7% YoY, and the M3 measure grew at its slowest since October 2014, indicating that overall economic activity will slow significantly in 2H23 with higher risk of stagflation. We believe that Eurozone demand will soften on falling real net incomes and weak consumer sentiment. With the manufacturing PMI posting a contraction for 10 straight months, exports and private sector investment would remain weak.

China

Helped by stronger consumption, 1Q23 GDP growth outperformed expectations, but data from economic indicators reflect the fragility of China’s recovery. GDP growth hit 4.5% in 1Q23, above the expected 4.0% and up from 2.9% in 4Q22. The relaxation of Covid controls at the end of 2022 has boosted domestic spending. In March, retail sales jumped 10.6% YoY, the largest expansion since mid-2021, compared to 3.5% growth during the first 2 months. March’s unemployment rate also dropped to 5.3% from 5.6% in February. Having softened for 5 months, exports expanded by 14.8%.

Although economic growth is accelerating through Q1 on the back of the positive impetus given by the reopening of the country and the release of pent-up demand, indicators point to the continuing fragility of the recovery. Industrial output rose by just 3.9% YoY in March, mirroring the drop in the manufacturing PMI to just 50, indicating that growth is flat. Output of semiconductors and smartphones also contracted by 15% and 13.8%, respectively. Investment in real estate continued to fall by 5.8%. March’s inflation stood at just 0.7%. Manufacturing, real estate, and domestic demand are therefore all weak, and this may drag on economic growth through 2H23.

Rising foreign fund inflows and strengthening sentiment in the manufacturing sector are lifting business investment

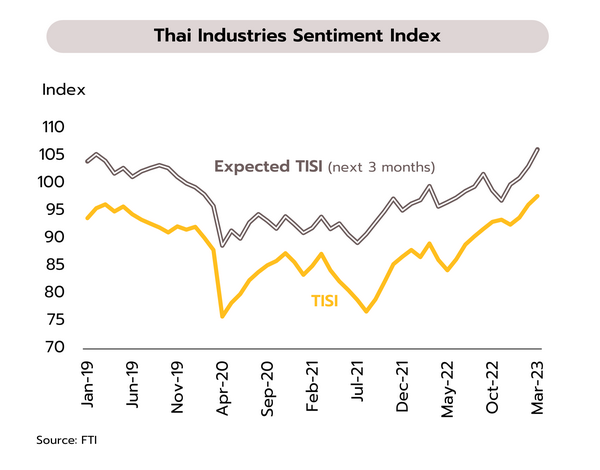

Sentiment is at a ten-year high, reflecting a positive outlook for industry and manufacturing. The Thai Industries Sentiment Index has rallied for 3 months running and at 97.8 (up from 96.2), its highest since January 2013. Industrial confidence is being lifted by rising domestic demand, stronger farm incomes (that are boosting regional spending power), recovery in tourism, and greater activity in the construction sector (which is benefiting related industries). However, businesses remain wary over the high cost of inputs, especially of raw materials and of electricity. Moreover, energy costs remain volatile and the upward trend in interest rates will likely have negative impacts on SMEs.

The positive effects of rising sentiment are expected to translate into increasing output and strengthening investment in industries that will benefit from firmer domestic demand and recovery in the tourism sector, even as exports are weakening. February’s Manufacturing Production Index (the latest available) thus slipped -2.7% YoY, the 5th month of declines, as the slowdown in overseas markets, especially in the US and Europe, feed into a drop in activity in related manufacturing industries. However, other parts of the economy, including refining, automotive production, and food and drink processing, saw continuing growth. In addition, domestic economic activity has and will continue to benefit from election campaigning and the long holidays in April and May, and this will boost output in industries that depend on the domestic market.

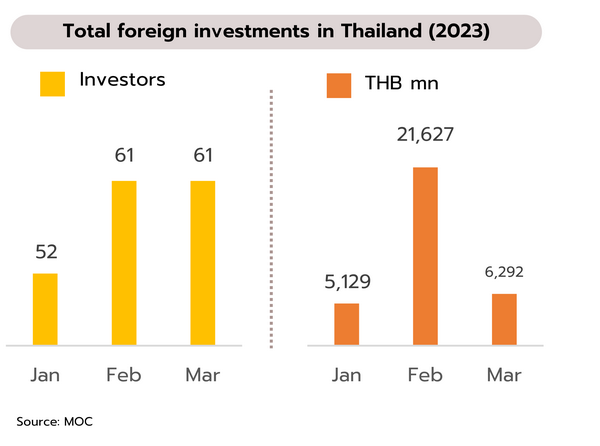

Foreign investment jumped 25% YoY in 1Q23, led by inflows from Japan and China. The Ministry of Commerce reports that as per the requirements of the 1999 Foreign Business Act, investments from 174 overseas businesses were approved in 1Q23, a rise of 19% YoY, and that these had a combined value of THB 33,048mn (+25%). The most important source of foreign investments was Japan (46 companies, with investment value worth THB 12,712mn), followed by Singapore (30 companies and THB 4,507mn in investments), the US (25 companies, worth THB 1,687mn), China (10 companies, THB 10,987mn), and Switzerland (9 companies, THB 1,677mn).

Although total foreign investments dropped from THB 21,267mn in February to THB 6,292mn in March, this was partly a result of the THB 10,439mn surge in investments that came from China in February. Compared to January’s THB 5,129mn, the situation looks much better. Indeed, over 1Q23, foreign investment value was up 25% YoY. In addition, the Secretary of the Board of Investment (BOI) has recently announced that Changan Auto, China’s 4th biggest auto manufacturer, has decided to establish an EV production facility in Thailand. With a value of THB 9,800mn, this will be the company’s first major investment outside China, and a request for investment support from the BOI is expected to be formally submitted in May.