Fears of a recession are receding on improved economic data and US debt ceiling deal, but both risk and uncertainty remain significant

US

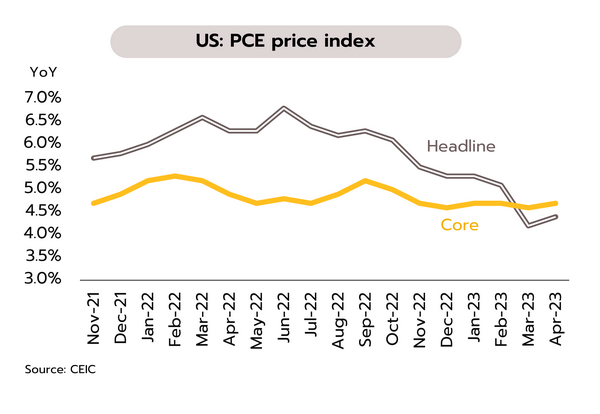

Tentative US debt ceiling deal has been reached, while uncertainty over Fed’s rate hikes remains a concern. April’s headline and core PCE rose by respectively 4.4% YoY and 4.7% YoY, while in May, consumer sentiment slipped to a 6-month low of 59.2. Nevertheless, personal spending and income were up by respectively 0.8% and 0.4% MoM. Moreover, minutes from May’s meeting of the Fed indicate that most members now agree that the need for future rate rises is declining and these may thus be left unchanged next month.

U.S. lawmakers had reached a tentative budget agreement to raise the debt ceiling averting a potential debt default. Meanwhile, most economic indicators have become positive over the last week, and with the data pointing to a lower risk of a severe slowdown in the US, the Fed is unlikely to cut rates in 2023. We therefore expect that to reduce stress in the banking sector and with real interest rates now positive and the economy tending to slow down, the Fed will leave the benchmark target rates at 5.00-5.25% at its June meeting. In addition, the 12-month inflation expectation slipped to 4.4% YoY in April from 4.6% in March, further reducing pressure on rates.

Japan

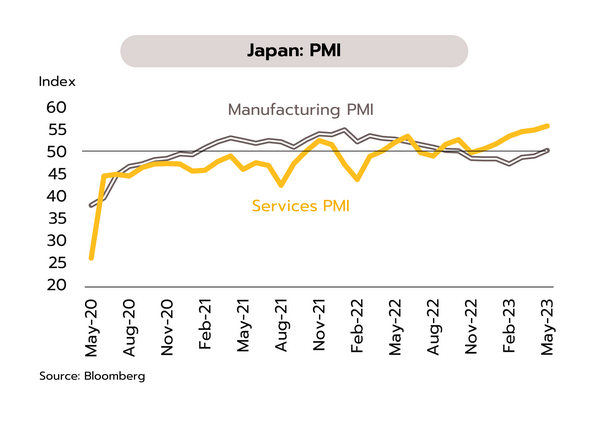

Japan’s reopening is feeding recovery in the tourism sector and in consumption generally, and this may encourage the BOJ to rein in its yield curve control policy in 2H23. In March, core machinery orders fell for the second month, slipping 3.9% MoM and 3.5% YoY, but May’s flash PMI was stronger than expected. The manufacturing PMI climbed to 50.8, the first increase in 7 months, while the services PMI hit the historic high of 56.3. Tokyo’s headline and core inflation also dropped to an 8-month low of 3.2% YoY.

Although exports are at significant risk from a slowdown in Japan’s most important overseas markets, recovery in the tourism sector and in domestic economic activity more broadly will help to support stronger consumption and growth in the economy through 2H23. We expect that an improving service sector will compensate for weaker exports, and this will underpin growth rates for Japan that will outpace other developed economies, including the US and the EU. Monetary policy may also be shifted and with the economy recovering, inflation over the 2% target, and pressure in bond markets rising, the BOJ may move to tighten its currently relaxed monetary policy in the second half of 2023.

China

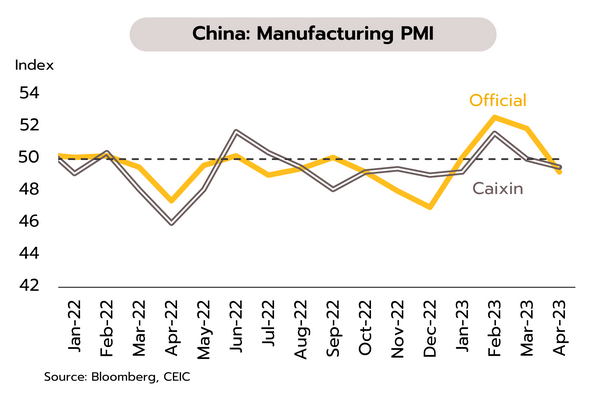

Industrial profits continue to slide, raising fears of a K-shaped recovery. China also bans Micron chips, further fueling US-China tensions. With weakness of domestic and external demands in areas including PCs, steel and industrial metals, China’s industrial profits contracted for the 4th month in April, dropping by 18.2% YoY (vs -19.2% in March). Over the past week, Chinese authorities also slapped controls on sales of chips produced by the US Micron Technology, arguing that these pose a risk to national security. These are therefore banned from use not only by Chinese critical information infrastructure operators (CIIOs) but also other organizations ranging from telecoms operators to banks and public utilities.

China’s recovery is looking increasingly K-shaped as the rebound is split between two groups. A first group, which includes consumption, tourism and services, are enjoying rapid growth. A second group sees only slow growth or ongoing sluggishness. For example, the manufacturing PMI entered contractionary territory in April, industrial profits have slid for 4 months, investment in fixed assets is weakening, and investment in property sector are shrinking. The further ratcheting up of US-China tensions may also have impacts on technology supply chains, both in China and globally.

Political uncertainty is weighing on investor sentiment, and while labor markets are improving, high levels of household debt may be a problem

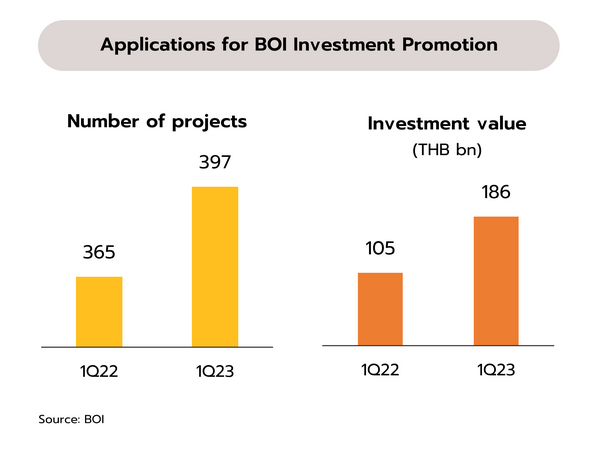

Applications for BOI investment support surged in Q1, but uncertainty over the outlook for domestic politics may impact investor confidence. The Board of Investment (BOI) reports that in 1Q23, it received 397 requests for investment promotion, and these had a combined value of THB 185.73bn, increases of respectively 9% and 77% YoY. 205 of these applications worth THB 154.41bn (83% of the total) were for investments in the government’s targeted industries, led by (in order of investment value) electrical appliances and electronics, food processing, chemicals, and autos and auto parts.

The Q1 jump in BOI applications was helped by the easing of the Covid-19 pandemic, the reopening of countries that are the source of major FDI inflows to Thailand, and the decision by some corporations to respond to rising geopolitical tensions by relocating or diversifying their production sites. Nevertheless, investor sentiment may be undercut by ongoing uncertainty over the domestic political outlook. 8 parties controlling 312 MPs and led by Move Forward are attempting to form a government, and on 22 May, these signed an MOU agreeing the outlines of 23 policies based on 5 key principles but the success of the coalition is not assured. (i) Coalition parties continue to struggle over both policy and positions within the prospective new administration. (ii) The coalition needs to find an additional 64 votes from MPs and/or senators to ensure that Move Forward leader Pita Limjaroenrat is voted in as prime minister. (iii) Pita Limjaroenrat is also accused of wrongdoing over his holding of shares in ITV. Fitch Ratings has warned of the impacts of this uncertainty, and delays to installing the new government may interrupt disbursements from the annual budget. In addition, Thailand’s fiscal position deteriorated markedly during the Covid-19 pandemic and if the next government is not able to regain control of government debt, this may drag on Thailand’s credit profile.

Labor markets are strengthening but over 85% of indebted households are exposed to risk. The NESDC reports that as of 1Q23, 39.6m people were employed in Thailand, up 2.4% YoY. This is a result of a 1.6% increase in employment in the agricultural sector and a 2.7% rise in non-farm jobs. The latter has been lifted by stronger demand for workers from employers in retail & wholesale trade, and in hotels & restaurants, which have benefited from recovery in the tourism sector and the rebound in the domestic economic activity. However, growth in employment in manufacturing has been minimal, while employment in construction and in warehousing & distribution have experienced declines of respectively -1.6% and -7.2%.

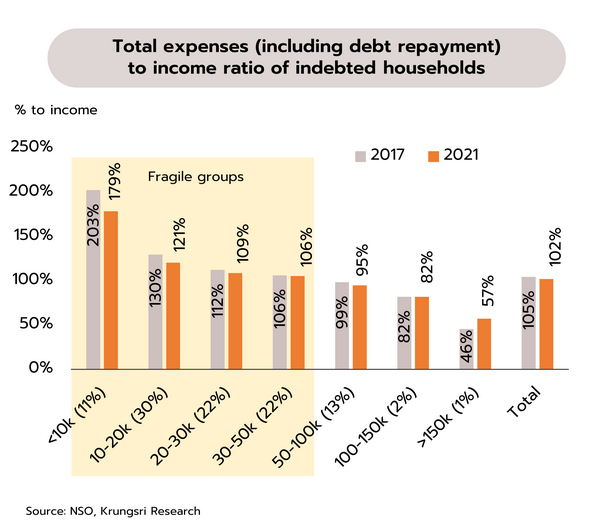

Household incomes are strengthening with improving labor markets, and as of 1Q23, unemployment rates had returned to their pre-Covid level of 1.05%, but for some households, rising incomes are failing to keep pace with expenditures. In 4Q22, the latest period for which data are available, Thai households collectively owed THB 15.09trn, or 86.9% of GDP. A survey carried out by the National Statistical Office indicating that over 50% of Thai households were currently indebted. Analysis by Krungsri Research further shows that indebted households that have an income of less than THB 50,000 a month may be unable to meet the higher costs of borrowing and expenditure since their total outgoings (including debt repayments) would exceed their income (in the figure, this is the group for whom expenditure is greater than 100% of income). 85% of indebted households fall into this category, though both the majority of non-indebted households and indebted households with incomes over THB 50,000 a month will be able to expand their consumption and/or indebtedness. The specter of further rate rises thus holds the potential to add to the burdens placed on domestic consumers, with this especially problematic for households that are already exposed to risk.