The war in Ukraine and the lockdown in China are hitting the global economy harder than expected; The Fed is accelerating the current round of rate hikes

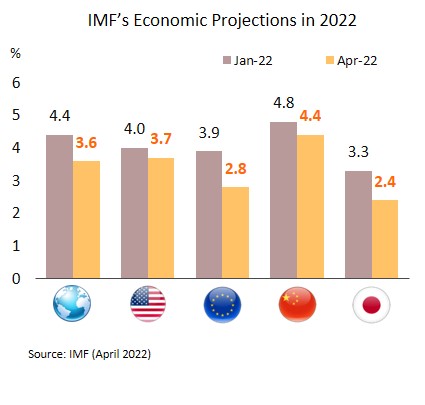

With risks to growth mounting, the IMF has downgraded its 2022 forecast for the world economy. It thus revised down 2022 global GDP growth to 3.6% from its prior prediction of 4.4%, decelerating from 2021’s growth of 6.1%. The IMF has also cut its predictions for the US, the Eurozone, Japan and China from respectively 4.0% to 3.7%, 3.9% to 2.8%, 3.3% to 2.4%, and 4.8% to 4.4%.

Global growth has weakened with the war in Ukraine, while inflation is pressuring central banks worldwide to tighten monetary policy, though this will delay ongoing recoveries in many countries. The global economy is also threatened by a number of other headwinds. (i) Russia is now attempting to take control of the Donbas, dragging out the war in Ukraine. (ii) Sanctions on Russia may be tightened in response, and the EU is considering restricting energy imports from Russia (by value, imports of gas and oil from Russia account for respectively 40% and 27% of total imports of these to the EU). (iii) Long-running imbalances between supply and demand continue to stoke inflationary pressures. (iv) The Chinese lockdown, which hit Chinese GDP growth and add to global supply chain disruptions.

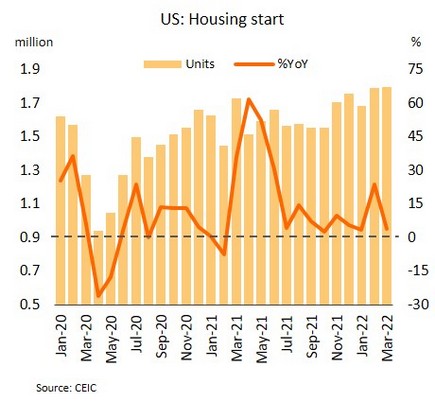

The US economy remains strong; Inflation is forcing Fed’s hand and rates are likely to hit 2.25-2.50% by year-end. Housing starts hit a 15-year high of 1.79m units in March. As of 9 April, the continuing jobless claims dropped to 1.42m, the lowest since 1970. The Fed’s latest Beige Book reports that economic activity is growing modestly but inflation remains strong, with knock-on effects for consumers. Business owners are also struggling with tight labor markets and supply bottlenecks.

The US economy is growing strongly, particularly reflected by the tightness of labor markets, while inflation has persistently elevated. As such, the Fed is signaling clearly that this round of rate hikes will accelerate, with Fed Chair Powell recently stating, “I would say that 50 basis points will be on the table for the May meeting.” We expect rates to reach 2.25-2.50% by the end of this year.

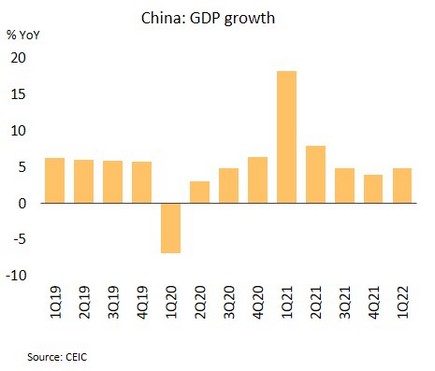

The Chinese economy is slowing amid limited monetary policy room; 5.5% GDP growth target may be challenging. 1Q22 growth of 4.8% YoY beat market expectations, but March’s economic indicators point to a slowdown, with falls seen for industrial production (down to 5.0% from 7.5% over January and February) and fixed asset investment (a rise of 9.3% against one of 12.2%), while for the first time since July 2020, retail sales contracted (down 3.5% from growth of 6.7%).

The Chinese economy is struggling under the pressure of the Ukraine war and the worst wave of infections since Wuhan outbreak. The authorities have responded to surging caseloads with lockdown measures. The People’s Bank of China (PBOC) is thus cutting the reserve requirement ratio by 0.25% to stimulate the economy and increase liquidity, effectively from 25 April. However, the central bank’s room for cutting policy rates is limited by the need to maintain financial stability and the worry over widening US-China interest rate spreads, which put downward pressure on the yuan. This will then add to the difficulty of reaching this year’s 5.5% target for GDP growth.

The Thai tourism sector will be supported by the removal of the Test & Go program; The government is preparing to lay out a plan for rehabilitation

To support recovery in the tourism sector, officials are further relaxing restrictions on entry to Thailand. At a recent meeting of the Centre for COVID-19 Situation Administration, it was agreed that as of May 1, fully vaccinated tourists would no longer need to have an RT-PCR test on arrival and that the value of the required health insurance would be cut from USD 20,000 to USD 10,000. The color zone restricted areas have also been redesigned by declaring 65 provinces under close surveillance status (yellow zones) and 12 provinces under pilot areas for tourism (blue zones).

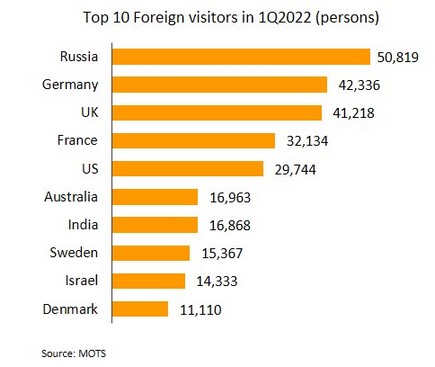

The tourism sector will benefit from the lifting of the Test & Go program and the relaxing of other controls on entry, moves that are in line with policies in many countries in Asia and Europe, which are likewise easing restrictions on international travel. Moreover, the US has recently upgraded its COVID-19 travel warnings for Thailand, moving these from a level 4 alert (advising against travel) to a level 3 alert (recommending vaccination against COVID-19 before travel). In 1Q22, the US ranked 5th in terms of the total number of foreign arrivals, coming after Russia, Germany, the UK, and France. Nevertheless, we see 2022 foreign arrivals numbering just 5.5m, and over the rest of 2022, the sector will continue to come under pressure from: (i) the war in Ukraine, which will have direct consequences for the number of Russian arrivals and may disrupt plans for travel to Thailand from other countries, most especially in Europe, while the conflict has led to a spike in energy prices and this is dragging on global growth; (ii) China (Thailand’s main market) continues to impose strict controls on international travel to and from the country as it tries to control the spread of COVID-19; and (iii) competition between tourist destinations in Asia and South Pacific region over their share of the market for international tourists is fierce.

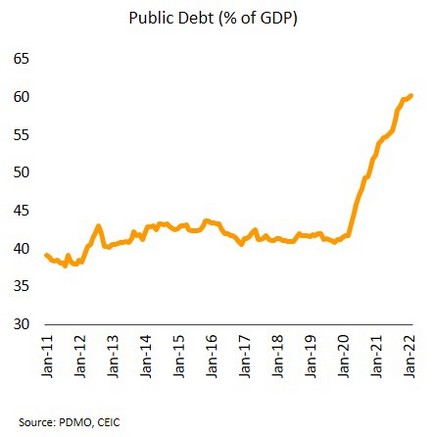

The government still has THB 1.3 trn of fiscal space for borrowing; MOF sees additional borrowing is unnecessary while government prepares to gather opinions to formulate revitalization plan. To bring policy into line with the current situation, the finance minister recently ordered the Fiscal Policy Office to reassess the state of the economy and to decide whether or not any further injections of money into the economy are necessary. If these are indeed required, thought should be given to where funding should come from, though additional borrowing would be unnecessary since the economy is strengthening and expenditure is increasing. Given this, the government should be able to raise more revenue through normal economic mechanisms.

At present, THB 74bn leftover from the THB 500bn under the emergency loan decree, and the THB 60bn remaining of central budget (part of this is being set aside for disaster relief, worth THB 30-40bn) are available. The Public Debt Management Office believes that if the government needs to increase its borrowing, it has around THB 1.3trn of fiscal space within the public debt ceiling that has been raised from 60% to 70% of GDP (as of the end of February 2022, public debt stood at 60.17% of GDP). The government is also preparing to open a public hearing in May that would allow all interested parties to express their views and give suggestions on how best to deal with the current economic situation and move forward with a plan to boost economic recovery, thus healing from the twin impacts of COVID-19 and the war in Ukraine.