Rising inflation is pushing the US and Europe to speed up tighter monetary policy; In China and Japan, adverse impacts from pandemic would keep their policies relaxed

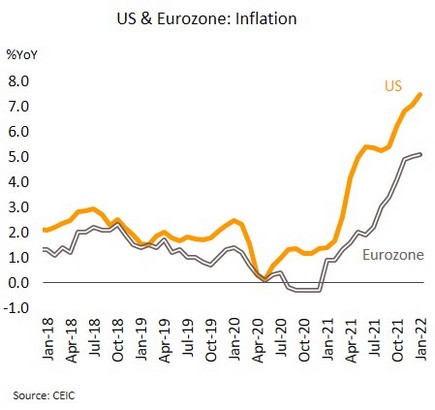

In many advanced economies, escalating inflation pressures central banks towards rapid normalization. In January, US headline inflation hit 7.5%, the highest since February 1982, marking the 3rd month that increases have reached 40-year highs. Likewise, Eurozone inflation is now at historic highs of 5.1%. In the UK, December’s headline inflation touched a 30-year record of 5.4%.

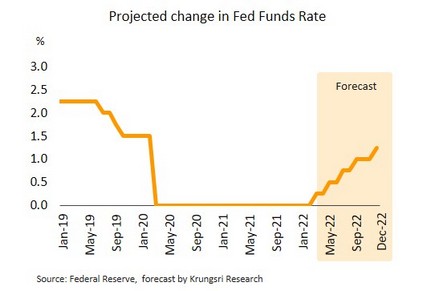

Some major western economies have seen inflation run above central bank targets for many months. The accelerating core inflation in these countries points to the spread of strong rises across a broad range of products. In addition to escalating manufacturing costs, driven in particular by the global rise in commodity prices, inflation is being stoked by recovery in labor markets that is lifting purchasing power and boosting demand. In response, central banks in Europe and the US are likely to speed up normalization and hike rates faster than previously thought. Krungsri Research anticipates that the Fed would raise policy rates by 25 bps at its March meeting (the first increase since 2018), with a total of 5 possible rate hikes this year. For the European Central Bank (ECB), we expect twice rate hikes in 4Q22 for a likely combined increase of 50 bps.

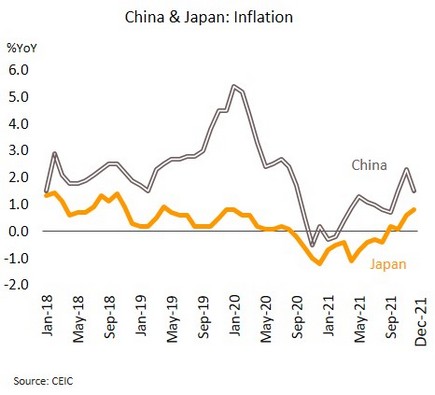

As domestic demand is still weakening, China and Japan are likely to keep monetary policy loose. In December, Japan’s headline inflation reached a 2-year high of 0.8%, rising for the 4th month. In China, inflation slipped to 1.5%, down from November’s 15-month high of 2.3%, though this was also the 10th consecutive month that inflation has remained in positive territory.

Although rising costs, in particular of energy, are keeping inflation positive in the major Asian economies, there are still below national targets. Core inflation in both Japan (0.5%) and China (1.2%) remains low. This was partly a result of the COVID-19 outbreak that worsened demand-pull inflationary pressure. Japanese household spending slipped -0.2% YoY in December, the 5th month of declines. Meanwhile, zero COVID policy, coupled with liquidity crunch, continued to affect domestic demand. China is thus expected to further relax monetary policy, possibly by lowering interest rates or by cutting reserve requirement ratio in 1H22. In Japan, policy rates should remain low through the rest of 2022, and possibly in 2023.

US is going to remove tariffs on Japanese steel, potentially being short-term benefit for global trade. As of 1 April, the US will lift the 25% tariff on imports of Japanese steel that were imposed during the Trump administration. Under the new agreement, import quota up to 1.25m metric tonnes of Japanese steel will be duty-free each year, though over-quota imports will continue to face the earlier 25% tariff.

The US’s relaxation of tariff on Japanese steel is quite a similar deal with the EU. This attempt to build trade partnerships may then provide a short-term benefit to the global economy. It is in contrast to President Trump’s fondness for initiating trade wars, which pushed toward de-globalization. In fact, the US will likely continue trade policy in conjunction with other allies, including the UK, as it tries to add pressure against China. This move would eventually step up risks for the global economy and world trade through splitting global supply chains going forward.

With fragile recovery and weak demand-pull inflationary pressure, the MPC is expected to keep policy rates low throughout the year

The MPC sees downside risk to growth improved and upside risk to inflation increased; We expect policy rates to remain at 0.50% through 2022. At the Monetary Policy Committee (MPC)’s first meeting of 2022 on 9 February, it voted unanimously to leave policy rates unchanged at 0.50% to support the economic recovery. The MPC saw economic progress would continue, driven by strong exports, an improvement of tourism sector, and the only limited impacts of the Omicron variant. However, higher-than-expected food and energy prices, higher cost pass-through and prolonged supply disruption could push prices above earlier predictions, and inflation is likely to run hotter than anticipated, possibly exceeding the BOT target through 1H22.

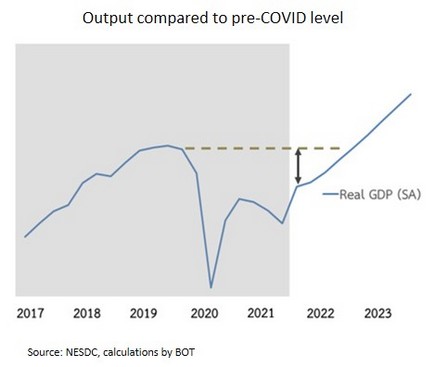

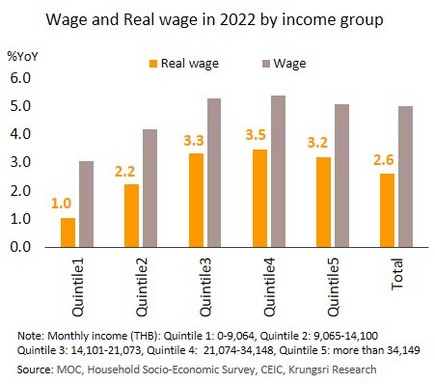

We expect the MPC to maintain policy rate at 0.50% until at least the year end. (i) Although upside inflationary risks are increasing, the MPC predicts that both average 2022 inflation and the medium-expected inflation will remain below its 3% target, and there are no signs of price increases across a broad range of goods and services. Demand-pull inflation also remains weak. (ii) The recovery is fragile and patchy, especially with regard to the recovery in tourism sector that has been delayed and was far below pre-COVID level. For the overall economy, Thai GDP is unlikely to reach its pre-pandemic level until the end of this year or the beginning of next year. (iii) The labor market remains vulnerable and wages are likely to be lower than pre-COVID levels. Krungsri Research’s projected that the real wage among the lowest-income group could rise by only 1% this year, weaker than a 3.2% increase among the highest-income group. In addition, real wages across all income groups this year would remain lower than pre-pandemic levels. The weak purchasing power would cause divergent spending and reflects fragile recovery.

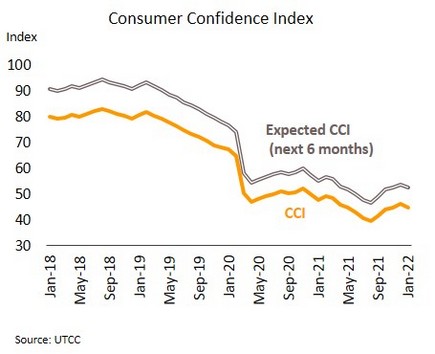

The first decline in 5 months of consumer confidence in January reflected weakening domestic expenditure, though stimulus could partly support. The Consumer Confidence Index (CCI) edged down to a 3-month low in January, dropping from 46.2 to 44.8. Likewise, the sentiment of the next 6 months expectation softened, falling from 53.8 in December to 52.5 in January. Sentiment was undercut by the rapid spread of the Omicron variant, surging oil prices that are pushing up the cost of both raw materials and finished goods, and increased concerns over possible domestic political instability.

At the start of 2022, purchasing power is coming under pressure from higher inflation, driven by rising global oil prices that are triggering higher energy costs. Recovery in consumer spending also remains weak and divergent across different income groups. Nonetheless, the further relaxation of containment measures and the implementation of government stimulus packages are going to support domestic spending. These measures include phase 4 of 'Khon La Khrueng' co-payment subsidy scheme (THB 34.8bn), cash transfer for welfare card holders and vulnerable groups (THB 9.4bn), and phase 4 of 'We Travel Together' tourism subsidy program (THB 9bn). These measures are expected to inject around THB 100-150bn into the economy.