Recessionary threats are receding, but global risks remain due to recent rate hikes, the slowing Chinese economy, and continuing US-China tensions

US

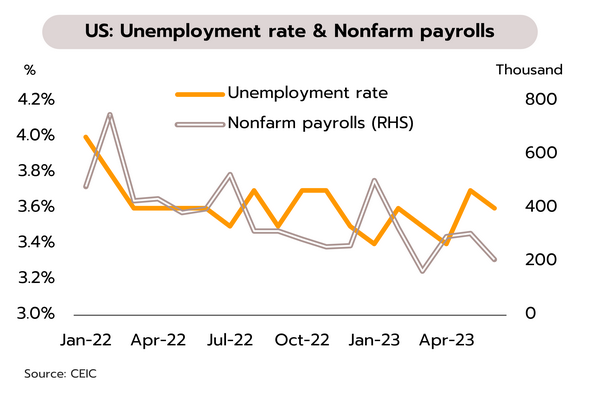

Strong employment data may encourage the Fed to raise rates higher, but this is also reducing the risk of a US recession. In June, non-farm payrolls expanded by 209,000, down from 306,000 a month earlier, but the unemployment rate edged down to 3.6% from 3.7% with strong wage growth. The ISM services PMI also strengthened from 50.3 to 53.9.

US-China trade tensions have been escalated by China’s retaliation to efforts by the US and its allies to prevent the export of high-tech products to China by restricting exports of key metals used in the production of chips, EVs, and telecoms equipment. This will likely lead to chip shortages, and this may have additional consequences for related industries. At the same time, strong employment data may slow the fall in inflation, encouraging the Fed to tighten monetary policy further as it tries to bring inflation back to its 2% target. Data from FedWatch Tools thus show that the chance of a rate hike in July has risen from 86.8% at end-June to 95% now. Nevertheless, while the risk of recession appears to be falling, given the continuing impacts of tightening monetary policy, softening labor markets, positive real interest rates, and a slowdown in key indicators, we expect the Fed to raise rates only once more in 2023, bringing these to 5.25-5.50%.

Japan

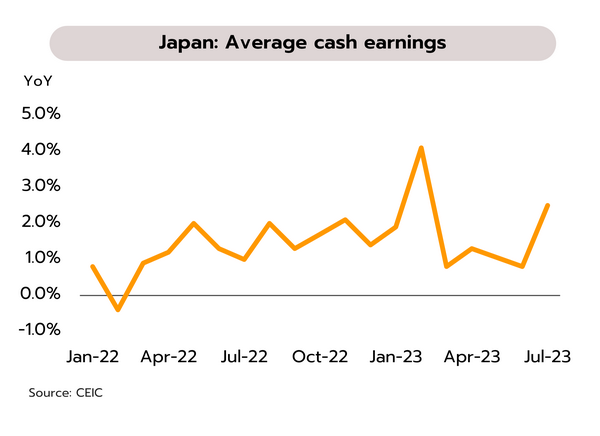

Wage hike policy against a backdrop of high inflation could strengthen domestic consumption and offer a chance of monetary policy tweaks. In June, the manufacturing PMI slipped back into recessionary territory at 49.8, but at 54.0, the services PMI continued its 10-month run in expansionary territory. Average cash earnings were also up 2.5% YoY, the strongest increase in 6 months, with Rengo, the Japanese Trade Union Confederation, reporting that across both large corporations and SMEs, negotiations resulted in a 3.58% average increase in salaries (or JPY 10,560 per month), the biggest jump in three decades.

The impetus given to the economy by the lifting of pandemic restrictions, the reopening of the country and the return of overseas tourists, the continuation of ultra-easing monetary policy and rising wages should be a major driver of growth and because of this, the risk of a recession is declining. In addition, falling commodity prices should help to pull inflation back into the target range by mid-2024. We therefore believe that it is increasingly likely that to reduce pressure in the bond market and to underpin the value of the yen, the BOJ will consider tweaking its monetary policy, though to avoid the return of deflation, any moves in that direction will be only gradual.

China

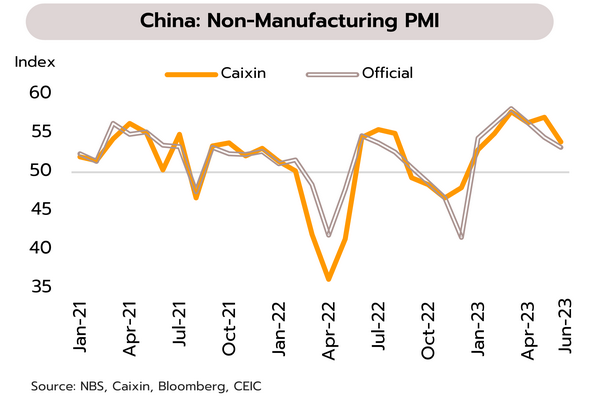

With the boost given by the reopening of the country now dissipating and tensions with the US still intense, threats to the Chinese economy are rising. Private-sector measures of the services PMI slipped from 57.1 to 53.9 in June on weaker new orders and slower business activity, which was mirrored in the official data. Tensions with the US have also recently worsened following the 3 July announcement by China’s Ministry of Commerce that from 1 August, export licenses will be required for overseas sales of gallium and germanium.

Chinese growth is under threat from: (i) slowing momentum in the service sector, where this is at its weakest since the reopening; (ii) problems in banking, real estate, and local governments, with a downgrade by Goldman Sachs to a ‘sell’ recommendation for Chinese banks, based in part on their exposure to local government debt and the likely impacts of this on amplifying the economic slowdown and eroding profits; (iii) worsening tensions with the US, most recently due to China’s imposition of export controls on two rare earth metals used in the production of chips, EVs and telecoms equipment. The US has responded to this by preparing to block Chinese access to US-based cloud-computing services. All of these factors may affect countries that have economic or trade connections with China.

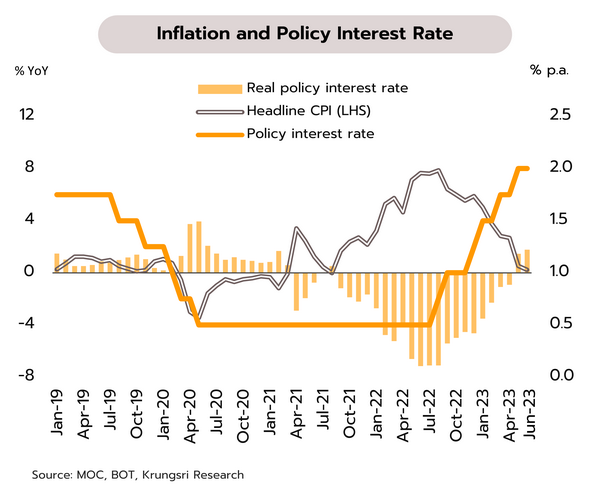

Inflation has dropped below the target range, pushing interest rates into positive territory. The BOT has revised data collection on indebtedness and is preparing a plan to sustainably address household debt problem.

In June, headline inflation slumped to just 0.23%, undershooting the BOT’s target range for the 2nd month and bringing our forecast 2023 inflation down to 1.9%. In June, headline inflation softened for the 6th month, slipping from May’s 0.53% to a 22-month low of 0.23% YoY. This was due to a combination of last year’s low base, lower global crude prices that then fed through into a 16.0% fall in domestic pump prices, and lower prices for pork, vegetable oil, and food preparation equipment. June’s core inflation, which excludes prices for raw food and energy, also fell from 1.55% to 1.32%, and so for the first half of the year (January to June 2023) headline and core inflation have averaged 2.49% and 1.87% respectively.

In June, headline inflation came in below the BOT’s target range of 1-3% for the 2nd month, and inflation is now expected to average 1-1.5% through the second half of 2023. This will be in part thanks to fuel prices that will remain low and below their level of a year ago. We estimate that the impacts of the approaching drought will be limited this year and mostly deferred through 2024. In light of these changing circumstances, we are cutting our forecast for average 2023 inflation from 2.5% to 1.9%. In addition, real interest rates turned positive in May, and this is reducing the pressure to further tighten monetary policy. Nevertheless, given the BOT’s positive view on the outlook for growth and fears that core inflation may prove to be stickier than anticipated, the Monetary Policy Committee (MPC) may raise policy rate once more at its 2 August meeting, thus bringing the rate to 2.25%. This would then expand the policy space available to the authorities, providing additional room within which they can act to confront future risks.

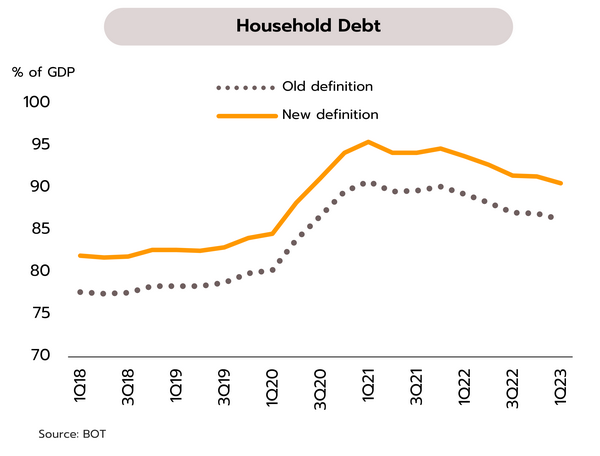

Household debt stood at 90.6% of GDP in Q1 while 85% of indebted households are classified as having only a limited capacity to engage in additional spending or borrowing. The BOT has redefined and broadened its definition of indebted households to include additional lenders, with the result that as of 1Q23, the total debt owed by Thai households came to THB 16trn, or 90.6% of GDP (vs 86.3% based on the earlier measurement scheme), though this is down from 91.4% of GDP (or 87.0% on the previous scheme) in 4Q22. The BOT is also preparing guidelines to restructure household debts and to put these onto a sustainable footing. These will be based on the principles of: (i) responsible lending (RP); (ii) risk-based pricing (RBP), which will set interest rates according to risk; and (iii) macro prudential policy (MaPP), which will ensure that credit is only extended in accordance with the ability of the borrowers to repay these debts, thus restricting excessive growth in indebtedness.

Analysis by Krungsri Research of data supplied by the National Statistical Office of Thailand shows that 85% of indebted households (or indebted households with a total income below THB 50,000/month) face a situation in which their monthly outgoings (including debt repayments) are greater than their monthly income, and so these families will have difficulty increasing future spending or borrowing. Worse, the current cycle of rate hikes will likely add to the problems experienced by these households. Data from the BOT show that home loans are the largest single contributor to household debt, accounting for 34% of the total, followed by personal loans and credit card debt (27%), and auto loans (11%). It remains to be seen whether efforts to restructure these loans will be put into effect rapidly, what outcomes they will have, and if this will help to offset the impacts of rising rates and measures to help debtors that will terminate this year.