Major economies are trying to maintain financial stability while also aiming to contain inflation

US

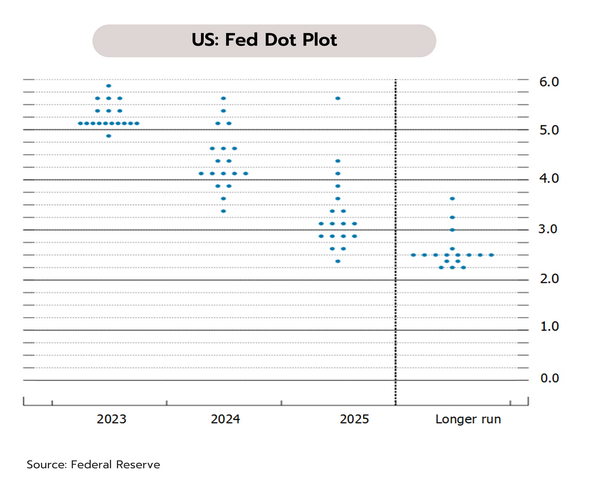

US Fed signals that the current cycle of rate hikes is nearing an end as economic outlook becomes less promising. March’s 25-bp increase has taken the Fed funds rate to 4.75-5.00%. Although risk to financial stability has risen, the FOMC is not unduly worried about troubles in the banking sector. At the same time, the latest Fed ‘Dot Plot’ indicates that the current bout of rate increases is nearing an end, with expectation of one more rate hike this year giving a terminal rate of 5.10%, followed by rate cuts in 2024 and 2025 that will take rates back down to 4.30% and 3.10% in each of these years.

The deteriorating confidence in the financial sector will likely lead to a tightening of credit conditions for both businesses and households, with consequent impacts on consumption, investment, and employment. In addition, inflation will also likely trend downward. We therefore see the US economy slowing through the rest of 2023 and with this, the impact of worries about inflation will lighten. However, the risk of a recession or of stagflation could be emerging, especially during the second half of the year.

Eurozone

The plunge in the value of Deutsche Bank (DB) shares has raised fears over the stability of the European banking sector. DB credit default swaps (CDS) spiked to a 4-year high following news that the bank will redeem subordinated Tier-2 notes due 2028. This has raised doubts over the bank’s financial status, and because DB is Germany’s largest bank and is considered to be a ‘Systemically Important Financial Institution’, this has increased risk for the European banking system and as such, bank stocks were sold-off heavily on Friday.

The latest data indicate that DB remains profitable and sufficiently liquid to avoid being the latest domino to fall following the collapse of Credit Suisse. The wider risk to the European banking sector therefore appears to be relatively low, especially given the support of central banks in reestablishing confidence and reducing the short-term risk of contagion. However, the outlook for individual banks remains opaque and with interest rates rising, the future is highly uncertain and a crisis cannot be definitely ruled out. Given the prevailing conditions of high interest rates and high inflation, we see the Eurozone economy remaining sluggish and growth potentially stagnant this year.

China

Ties between China and Russia have strengthened, but China’s peace proposals face problems and the US has further tightened Chinese access to tech. President Xi Jinping’s visit to Russia over 20-22 March led to agreements to increase Russian-Chinese cooperation on areas including the use of the ruble and the yuan for making international payments, stronger bilateral trade, greater cooperation on energy & food security, and the development of cross-border rail & logistics systems. President Putin also promised to deepen Russia-China links, while praising China’s peace proposals, indicating that these met many of Russia’s demands and could provide the basis for peace talks.

The Chinese economy is improving with the country’s reopening, but US-China relations are at a low. China’s peace proposals could see dispute in several issues such as suggesting the unilateral ending of sanctions and the continued Russian presence in Ukraine. However, Ukraine insists that the Russians must be expelled. The US and its allies also object to the rewarding of aggression. Meanwhile, the USD 50bn CHIPS and Science Act will limit beneficiaries of US funding to a maximum increase in production capacity in China of 5% for advanced chips and 10% for older technology. The act also caps investment in China in advanced chip production at USD 100,000.

Election campaigning will help boost domestic economic activity through the start of Q2; Foreign investments in Thailand see a gradual increase

Political developments will take center stage in Thailand now that the election has been set for 14 May. As of the announcement in the Royal Gazette, parliament has been dissolved from 20 March, and the Election Commission has now set 14 May as election day.

Activities related to campaigning for the coming general election will play an important role in injecting additional funds into the economy over April and May. This will come from two main sources. (i) THB 5.9bn has been assigned for spending on the election by the Election Commission. This is up from THB 4.2bn in 2019 thanks to the increase from 350 to 400 in the number of constituencies. (ii) Constituency candidates are permitted to spend up to THB 1.9mn each, while parties proposing list MPs are allowed to spend a maximum of THB 44mn each. However, although the timeline for the election has now been set, it remains to be seen when the new government will actually be set up and running. It is expected that this will be by August. This would then allow only 1 month for the FY2024 budget Act to be passed before the 1 October deadline, and so there is a risk of delays to disbursements. (In 2019, the election was held in March but the government was not installed until July and this then delayed the 2020 budget by 3-4 months). However, recovery in the tourism sector should strengthen in Q4, and this will help to maintain growth and mitigate the negative impacts arising from any interruption to central government spending.

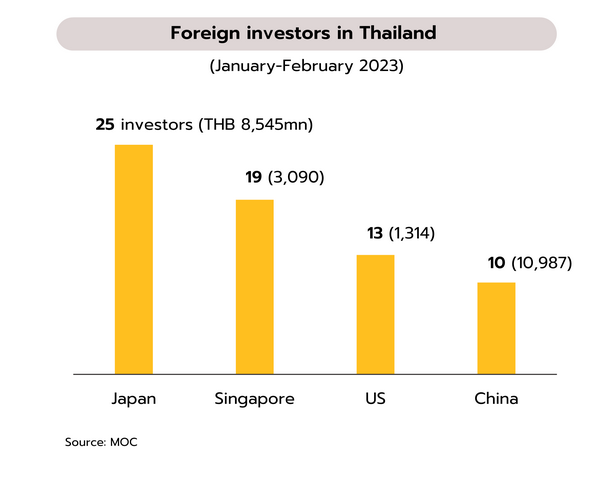

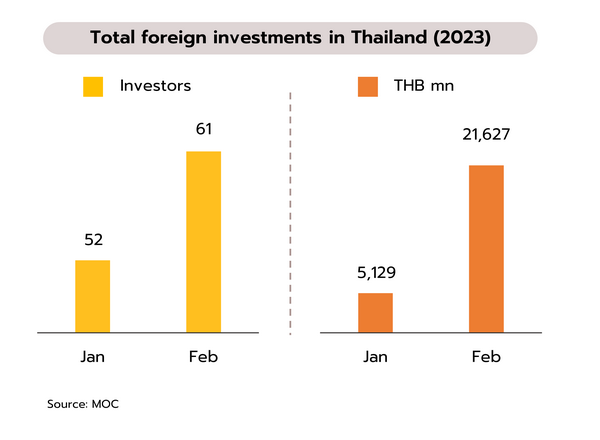

The latest data point to a positive outlook for overall investment while export-related investments would remain weak. The Ministry of Commerce reports that as per the Foreign Business Act, B.E. 2542 (1999), 113 applications (+82%YoY) for business licenses for overseas operators were granted in the first 2 months of the year. These had a total investment value of THB 26.77bn (+305%) and employed 1,651 local hires (+33%). With 25 applications worth THB 8.55bn, Japan was the most important source of overseas investment, followed by Singapore (19 applications worth THB 3.09bn), the US (13 applications worth THB 1.31bn) and China (10 applications but with the highest overall value at THB 10.99bn). In addition, the Board of Investment (BOI) also approved investment promotion for large-scale projects worth THB 56.62bn that included a THB 32.71bn liquified natural gas portside facility, a Thai-Singaporean THB 5bn cogeneration powerplant, and 2 large datacenters worth THB 10.37bn.

Foreign investments in Thailand are strengthening and for the first 2 months of 2023, these increased more than 3-fold relative to the same period last year. In particular, total investment value for February 2023 increased sharply to THB 21.27bn from THB 5.13bn in January. This jump is partly a result of China’s reopening, which then boosted inflows from China from just THB 0.55bn in January to THB 10.44bn in February. In addition, projects approved for investment promotion by the BOI are concentrated in areas that will strengthen infrastructure and power generation. However, slowing world trade and a weaker global economy, especially in the US and Europe, may limit any increase in investments in export-related sectors. In January, Thai exports contracted by 4.5% YoY.