The new wave of COVID-19 infections is increasing uncertainty in the major economies; The Fed is likely to raise rates earlier than expected

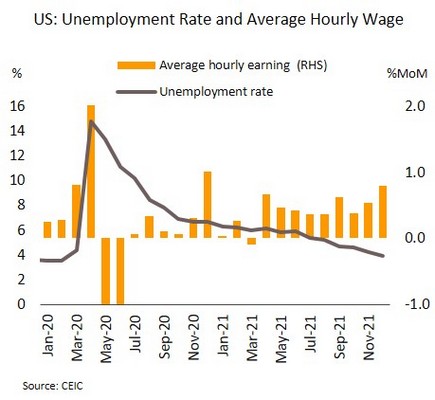

US labor markets remain strong amid pressure from Omicron; The Fed would raise rates ahead of earlier expectation. In December, unemployment rate dropped to 3.9%, its lowest since February 2020. Moreover, average hourly wages rose at faster pace by 0.6% MoM, beating market expectations. Private-sector payrolls also increased by a 7-month high of 807,000.

US labor markets are continuing to strengthen, and higher than expected wages are adding to inflationary pressures. Regarding to the minutes of the Fed’s December meeting, the most important takeaways are that: (i) high inflation and a much stronger economic outlook, especially of tight labor markets, both underscore the need to hike policy rates faster than anticipated; and (ii) for the first time, the Fed is talking about reducing its balance sheet, citing elevated risks from inflation. The Fed has also assessed that the spread of Omicron could exacerbate inflationary pressure through supply restrictions and labor shortages, which would then push up production costs. Recently, daily new infections hit a new record high of over 1m per day. As a result of the Fed’s stance, yields on 10-year Treasuries climbed to 1.77%, their highest since March 2021. We thus expect the Fed to cease QE by the end of 1Q22, paving the way for rate hikes at earliest in March, with 3 increases possible in 2022.

The Eurozone policy rates are likely to stay low regarding negative impact of surging infections. In December, the European Composite PMI slipped to a 10-month low of 53.3. Meanwhile, the Eurozone Economic Sentiment Indicator dropped to a 7-month low of 115.3.

The Eurozone is being hit by rising Omicron infections that have reached over 1m cases per day, a historical high since the pandemic starts, and this is now weighing on economic activity. Headline inflation has also climbed to a highest record of 5.0%. It has been above the ECB’s 2% target for 6 months due mainly to temporary factors, including supply constraints and energy price hike from base effect compared to 2020. Nevertheless, we see inflation peaking in 4Q21 and then weakening as supply improves and inventories piles up, falling beneath the ECB target in 2H22. In light of this, policy rates are expected to remain unchanged until at least the end-2022.

China is likely to further ease monetary policy in response to the latest outbreak and real estate sector’s liquidity crunch. December’s Composite PMI hit 53.0, its highest since July 2021. The Manufacturing PMI reached a 5-month high of 50.9, while at 53.1, the Services PMI has remained in expansionary territory for 4 months.

The latest data indicate that the Chinese economy is still growing, in particular, a return to expansion of the Manufacturing PMI due partly to the easing of supply constraints. The PMI’s output sub-index has shown the strongest growth in a year and the new orders sub-index has strengthened for 3 months consecutively. Nonetheless, China is still facing uncertainties, including property developers’ default risk. Recently, Shimao has missed a CNY 645m debt payment and the Evergrande’s liquidity problem has resulted in a temporary suspension of its share trading. In addition, latest outbreaks and subsequent lockdowns in Yuzhou and Xian would drag on growth in 1Q22. These uncertainties are likely to cause the PBOC to relax monetary policy further in order to prevent a sharp slowdown.

The spread of Omicron may slow Thai economic recovery, while inflation will trend upwards in the first quarter of 2022

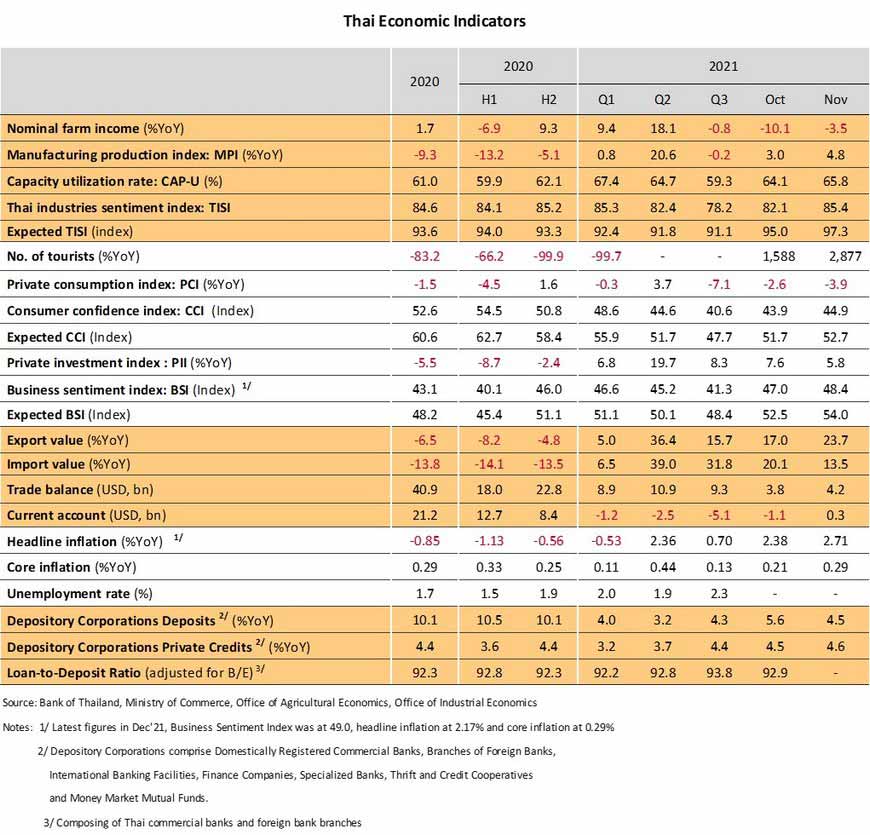

The Thai economy faces rising challenges at the beginning of 2022 since the spike in Omicron infections is likely drag on recovery. Data in November 2021 showed an improvement across all economic fronts, with exports jumping +23.7% YoY on recovery in trading partners’ demand, and the increase in the number of foreign tourists that recorded almost 100,000 following the reopening under the introduction of the Test & Go system on 1 November. Private consumption continued to recover (+0.9% MoM sa) due mainly to the easing of the pandemic and vaccinations progress that helped improve economic activity and consumer confidence. Likewise, private investment rose +4.3%, gaining from domestic and overseas demand.

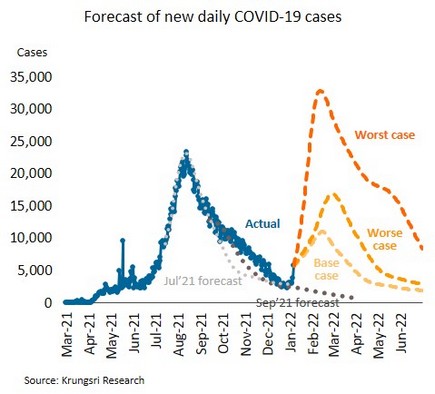

Nonetheless, the recent situation with COVID-19 has taken a turn for the worse since New Year as the daily new infections have risen precipitously, driven especially by the spread of the Omicron variant. Based on an SIR model, Krungsri Research has estimated 3 possible scenarios: (i) in the base case scenario, daily new caseloads peak at 11,000 in mid-February before declining slowly, with deaths peaking at around 50/day at the end of the month; (ii) in the worse case scenario, daily new caseloads reach a peak of 16,000/day at the end of February, with deaths hitting a maximum of 100 people/day; and (iii) in the worst case scenario, boosters are ineffective in limiting infections and daily new caseloads reach a maximum of 32,000 in mid-February, pushing deaths to a peak of 300/day. These 3 possible scenarios are assumed under different level of stringency index. Under the base case scenario, containment measures may only be slightly tighter than those in effect prior to the Omicron outbreak, whereas under the worst case scenario, more strict controls may need to be reintroduced. We have also analyzed the impacts of these outcomes on the tourism sector and on domestic economic activity (the sum of these is total economic activity which is used as a proxy for GDP). Overall, total economic activities in each scenario tend to decline by 0.6%, 1.4% and 3.0%, respectively. However, this analysis does not include the impact of any positive effects, for example from government stimulus measures, which may cushion negative impact of Omicron (the GDP may just slightly fall from the previous forecast).

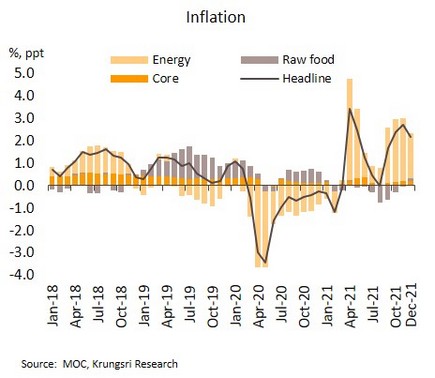

Headline inflation slowed slightly in December but this will trend upwards in 1Q22. In December, headline inflation dropped from 2.71% to 2.17% YoY on diesel price cap measure, though raw food prices rose slightly with higher pork meat prices. Core inflation (excluding raw food and energy prices) remained unchanged at 0.29%. For all of 2021, headline and core inflation averaged 1.23% and 0.23%, compared to respectively -0.85% and 0.29% in 2020.

Krungsri Research foresees inflation continuing to rise, topping out at around 3% in 1Q22 before gradually weakening to the lower bound of the BOT’s inflation target range at the end of the year. This will be a result partly of low base effect as compared to 1Q21, and partly of the rising global commodity prices, especially elevated crude oil prices. Nevertheless, the cost pass-through may be limited by the rapid spread of Omicron that would drag on recovery. For all of 2022, headline inflation is thus forecasted to average 1.5%.