Economic activity is picking up in China, but worries are rising over both inflation and the risk of a slowdown in the advanced economies

US

The US economy tends to slow down due to the impact of high interest rates. In February, the Consumer Confidence Index slipped to 102.9, down from 106.6 in January, while one-year ahead inflation expectations fell to 6.3% from 6.7%. Although strong new orders helped to lift the ISM Manufacturing PMI from 47.4 to 47.7, this is its 4th month in recessionary sub-50-point territory.

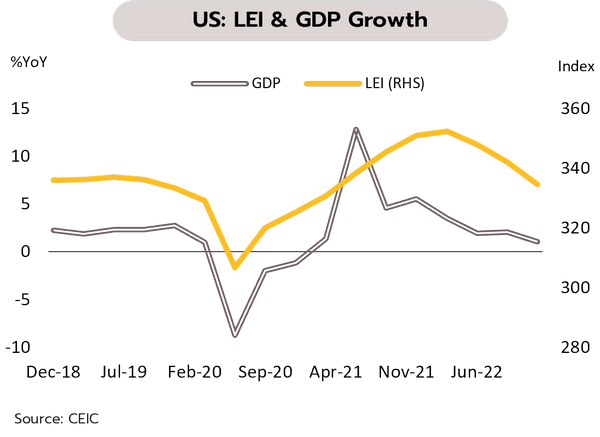

Markets have abandoned their hopes of a year-end rate cut, and with inflation higher and stickier than expected, CME Group’s FedWatch Tool now gives a 38.5% chance (up from 25.1%) of the Fed funds rate hitting 5.50-5.75% by September. This view has been amplified by Fed officials’ hawkish stance, and by the news that February’s prints for the PCE price, consumer price, and producer price indices were all running hotter than expected. US 10-year Treasury yield thus broken north of 4.0% to hit a 4-month high. With leading economic indicators (LEI) worsening for the 10th consecutive month, we see the US economy slowing further.

Eurozone

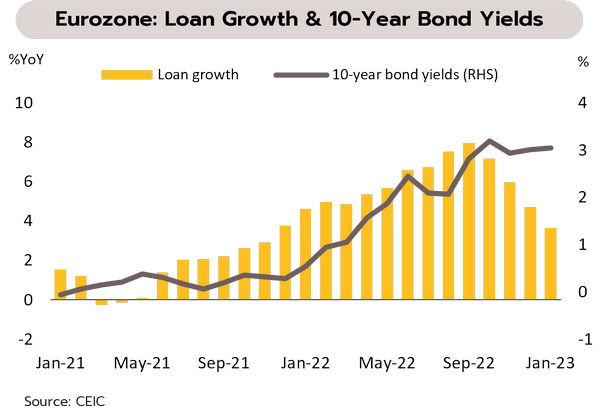

The strength of Eurozone core inflation is adding to pressure on ECB monetary policy. In February, headline inflation inched down from 8.6% in January to 8.5% YoY, but core inflation climbed to a new high of 5.6% YoY, far above the ECB’s 2% target. Meanwhile, at 6.7%, unemployment remains close to an historic low, underlining the strength of Eurozone labor market.

We believe the Eurozone remains in a slowdown and is highly vulnerable due to: (i) a further increase in borrowing costs through the acceleration of the ECB’s rate hikes, and this fed into a drop in new lending for both consumption and investment in 4Q22; (ii) consumption indicators point to ongoing weakness, and the market expects January retail sales to fall 2.7% YoY, while January’s consumer confidence index is also forecast at -19.0 points, keeping it in the recessionary zone as seen in 4Q22; (iii) geopolitical tensions and prolonged sanctions on Russia could create further constraints on the economic growth of the eurozone countries. In addition, inflation remains strong in the service sector and this may delay any softening in core inflation. The ECB may therefore pull harder on the monetary brake, and so it is possible that the Eurozone terminal rate could hit 4% in 1H23.

China

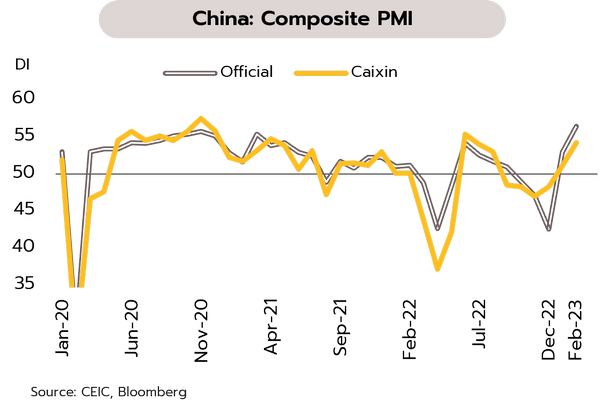

China’s reopening has allowed the manufacturing and service sectors to bounce back to health, but tensions with the US are weighing on foreign investment. Following the ending of Covid controls and the easing of the latest wave of infections, China’s official composite PMI jumped from 52.9 in January to a historic high of 56.4 in February, with the manufacturing PMI posting the strongest growth in almost 11 years and the services showing the largest growth in almost 2 years. Likewise, the Caixin composite PMI survey of small businesses rose from 51.1 to an 8-month high of 54.2 in February, and both the manufacturing and services PMIs saw their largest increase since mid-2022 on strengthening in the new orders, foreign orders, and employment components.

We believe that although the reopening of the country has clearly been instrumental in driving current growth, over the mid- to long-term, China will have to navigate a number of headwinds, including the troubles in the real estate sector, the heavy levels of debt weighing on local governments, unfavorable demographics, and worsening tensions with the US. Indeed, FDI inflows into China slumped to an 18-year low in 2H22 on the US-China tensions, technology restrictions, China’s trend of economic slowdown, and worries over the direction of Chinese policy and the potential impacts of this on business profits. It remains to be seen what will be decided at the March meeting of the 2023 National People's Congress (NPC). The outcome of this could have impacts on economic policy over the short- and long-terms.

Krungsri Research has trimmed our outlook for 2023 Thai economic growth to 3.3% from 3.6% in the previous projection

Although the economy was supported through January by growth in services and in private consumption, across the year, the outlook is for growth to undershoot earlier expectations. The Bank of Thailand (BOT) reports that indicators of private consumption have strengthened, helped by government stimulus packages and stronger household spending power, the latter supported by improving labor markets and firmer consumer confidence. In addition, spending on services has risen with recovery in domestic and international tourism. Although private investment has improved with greater spending on plant and machinery, investment in construction has weakened. Exports also contracted for the 4th consecutive month, while the number of foreign arrivals were at 2.24m in December, compared to 2.14m in January.

The recovery has continued its momentum through the start of 2023, but with 4Q22 growth coming in at just 1.4% YoY compared to our prediction of 3.7% and a consensus outlook of 3.6%, we are trimming our outlook for overall 2023 economic growth. We thus now see the Thai economy expanding by 3.3% this year, rather than our earlier prediction of 3.6%. Our outlook for 2023 public consumption and public investment is likely to weaker than expected with lower government expenditure following unwinding of Covid-19 stimulus measures and delayed spending on infrastructure projects. The effects of this will be amplified by the negative multiplier effect on private consumption and private investment. Our prediction for 2023 export growth is unchanged at just 0.5%. Overall, we still see Thailand avoiding a recession this year, and with economic growth outpacing last year’s 2.6%, Thailand’s economic activity (or GDP level) would rise beyond its pre-Covid size by the end of 2023.

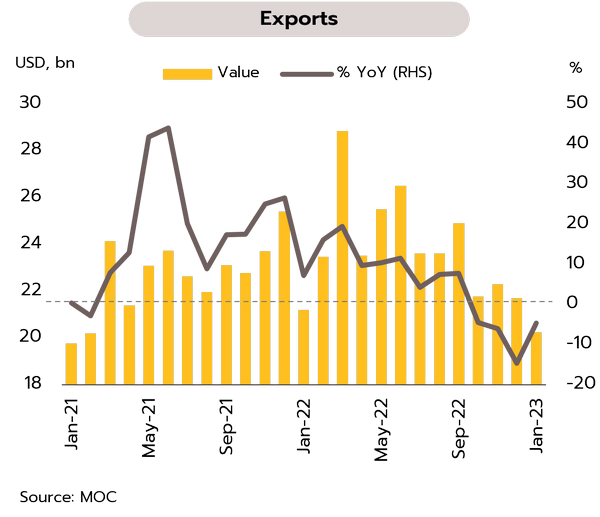

Export value dropped to a near-2-year low in January, and for the year, exports are likely to see only anemic growth. Data from the Ministry of Commerce show that January exports generated receipts of USD 20.2 billion, down 4.5% YoY. Excluding gold and oil, exports contracted by 3.0%. The contraction was seen in exports to the US, Japan, China and the CLMV countries, though the expansion was seen in exports to the EU and the ASEAN-5. By sector, exports posted -5.4% for industrial goods, -3.3% for agro-industrial products, and -2.2% for agricultural goods. However, gains were seen in some major product categories including autos & parts, air-conditioners & parts, and fresh, chilled & frozen chicken.

Weakness in global demand has undercut export value, which in January contracted for the 4th month running, though Thailand’s exports saw only a relatively minor decline compared to other countries in the Asia-Pacific region, including Vietnam (-25.9%), Taiwan (-21.2%), and South Korea (-16.6%). Nevertheless, Thai exports will likely continue to contract in 1H23, partly due to comparison with the high baseline set last year. However, positive factors affecting the outlook will include the following: (i) the risk of global recession is weakening, and the IMF has now upgraded its outlook for 2023 global growth from 2.7% to 2.9%; (ii) the reopening of China will have a positive impact on demand, and this will become increasingly evident going forward; and (iii) global supply chain disruptions are easing. On balance, we therefore see the value of Thai exports growing by just 0.5% in 2023.