The Fed may accelerate rate hikes and employ measures to anchor inflation expectations; Stiffening headwinds in Eurozone and China threaten growth in the next period

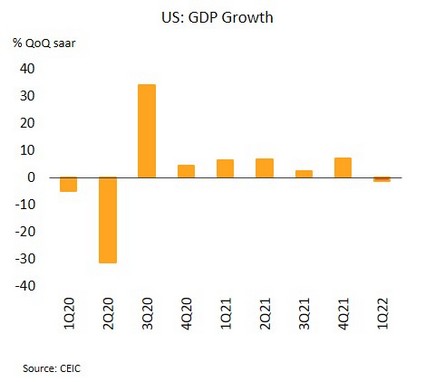

With inflation weighing on the US economy and tight labor markets, the Fed is expected to hike rates by 50 bps at this week’s meeting. In 1Q22, US GDP contracted 1.4% QoQ saar, but wages jumped by the 21-year high of 4.5% YoY. In March, the Personal Consumption Expenditures price index surged by the historic high of 6.6%, with personal consumer expenditure now up for the past 3 months. For the week ending 16 April, continuing jobless claims fell to 1.4m, their lowest since 1970.

Although GDP contracted in 1Q22 on weaker government spending and the effects of strong commodity prices on accelerated imports, private consumption (68.7% of GDP) rose by 2.7% from the previous quarter. Inflation is still rising on strong demand and the effect on wages of tight labor markets. Given this, market see a 94% likelihood of a 75 bps increase in rates in June. However, we expect that the Fed will hike rates by 50 bps at its May and June meetings. The Fed is likely to use other measures, including forward guidance and quantitative tightening to anchor inflation expectations.

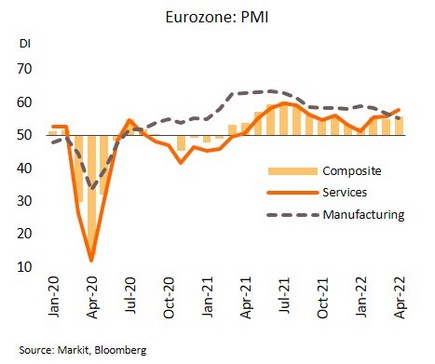

The Eurozone recovery is weakening; The ECB is indicating that rates may rise to slow mounting inflation. The Eurozone economy grew 0.2% QoQ in 1Q22. In April, headline inflation touched a historic high of 7.5%. Meanwhile, the Flash Composite PMI hit a 7-month high of 55.8. This was a result of the services PMI climbing to 57.7, its highest since August 2021. However, the manufacturing PMI slipped to a 16-month low.

April’s indicators reflect Eurozone fragility. While the services sectors have improved with the easing of the pandemic, manufacturing sectors have weakened on the impact of supply constraints from the Ukraine war and the Chinese lockdown. Softening consumption undercut the new orders component of the PMI, which then dropped to its lowest since June 2020. In addition, the economy is being hit by rising costs that may force the ECB to hike rates. Indeed, the ECB President has said that there is a strong possibility of rate rises before the end of 2022. In our view, the ECB will first need to consider the risks arising from the Ukraine war since the sanctions and retaliation appear to be intensifying. Recently, Russia blocked on gas exports to Poland and Bulgaria, implying additional pressure on Eurozone where largely relies on Russia gas.

China’s worsening outbreak is adding to risks for the economy, and the latter is likely to slow through Q2. China’s Composite PMI dropped to 42.7 in April, its lowest since February 2020, and both the Manufacturing and Non-manufacturing PMIs contracted (indices<50) for the second month.

The Chinese economy is being affected by efforts to control the latest outbreak of COVID-19, which has now spread to Beijing. In response, the authorities, most notably President Xi Jinping, have promised that new stimulus measures will be unrolled, and investment will be stepped up. Nonetheless, the measures are unlikely to be sufficient to lift the economy to the target of 5.5% GDP growth. In light of this, many research institutions have cut their 2022 GDP growth projection (see table). Looking forward, the economy in Q2 is likely to worsen on a combination of the Ukraine war, the global slowdown, and the impact of China’s lockdowns.

Strong overseas demand supported growth through Q1, but rising prices will weigh on consumption in the coming period

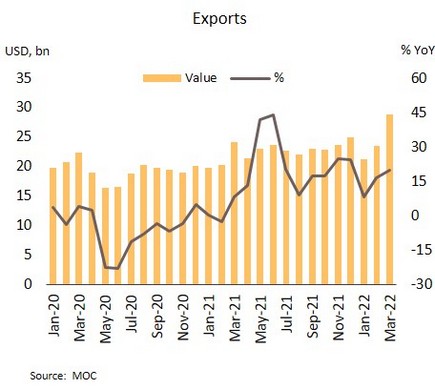

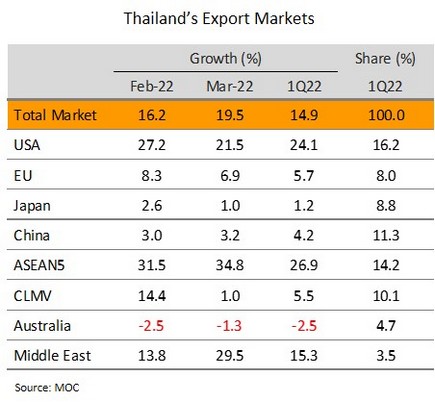

Though exports rose to a record-breaking value in March, these remain uneven and are likely to weaken through Q2. Export value hit a new record of USD 28.9bn in March, growing 19.5% YoY. Excluding gold, exports expanded 9.5%, slowing down from 13.2% in February. The strongest growth was seen for: (i) goods that are benefiting from the surge in energy and commodity prices (e.g., refined oil products, chemicals, and plastics); (ii) food and agricultural products (e.g., rice, cassava products, and sugar); and (iii) electronics and electrical appliances, for which demand is rising with stronger economies and labor markets. Exports to the US and the ASEAN-5 countries performed well in the month, but growth in exports to the EU, China, Japan and the CLMV nations was anemic, while unsurprisingly, exports to Russia and Ukraine fell back sharply.

March’s record-breaking export figures lifted 1Q22 exports to USD 73.6 billion, which represents a rise of 14.9% (excluding gold, exports grew 10.1%). However, growth is likely to slow in Q2 given the less degree of diversification in export categories and geographical markets. In fact, exports of some goods (e.g., autos, auto parts, rubber products, and air conditioners) contracted. Exports may be further hurt by: (i) the impact of the Ukraine war on the world economy, with the IMF now seeing 2022 global GDP growth of 3.6% (down from 4.4%); (ii) the sanctions on Russia, where is a major exporter of raw materials, may impact supply chains for many industries; (iii) higher energy and commodity prices that are raising manufacturing and transport costs; and (iv) the likely widening of the lockdown in China, which may undercut Chinese economy and its external demand, where is one of Thai’s important export markets.

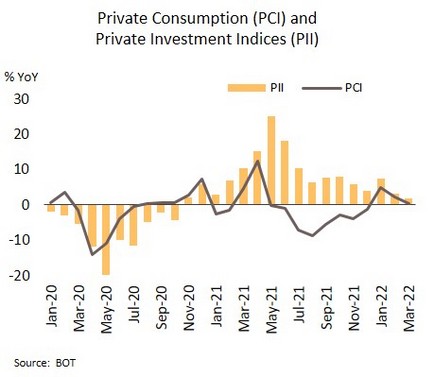

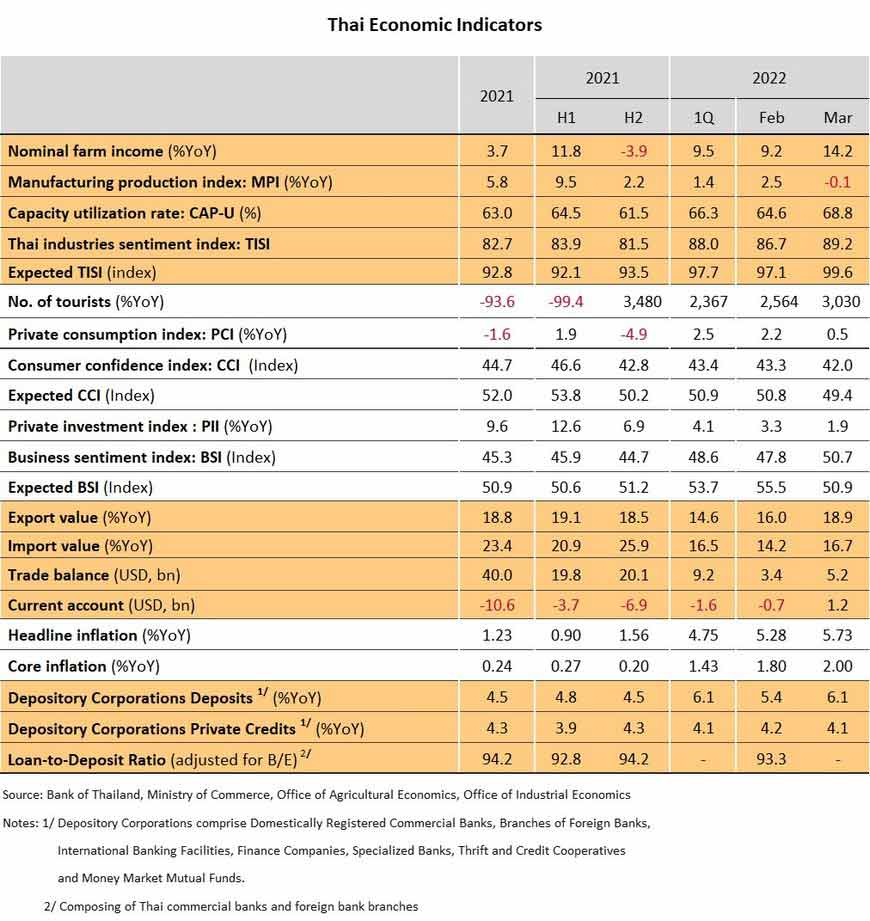

The Thai economy benefited from strong exports and tourism in March, but domestic demand remains soft. Thailand’s Private Consumption Index rose just 0.5% YoY in March as the spread of the Omicron variant pushed daily caseloads to new highs, while the cost of living also climbed on more expensive energy. Weakness in domestic demand and higher production costs then fed into a slowdown in growth in March’s Private Investment Index (up 1.9%), but this was counterbalanced by stronger exports and rising tourist arrivals, now that traveling restrictions are being relaxed.

Through Q1, the Thai economy continued to grow despite the effects of the spread of Omicron and the rising cost of living, helped by government measures to support purchasing power and an expansion in the export and tourism sectors. In the coming period, though the economy will be boosted by the relaxation of control measures and the lifting of quarantines for fully vaccinated arrivals, it will be buffeted by headwinds from the lengthening war in Ukraine, which will drag on Thailand’s trade partners and keep energy prices elevated. The domestic diesel prices are rising to THB 32/liter from 1 May, and then be adjusted step by step to a new ceiling of THB 35/liter. This will add to manufacturing costs and cut household purchasing power, especially among low-income groups. In reply, the government is preparing new measures to soften the impact of higher prices on selected groups, most recently by increasing payments to the elderly by THB 100-250/month for 6 months (April - September) at a total budget of THB 8 bn.