The Thai Economy in 2021 and Outlook for 2022

The Thai economic recovery in 2021 was delayed by multiple waves of infections

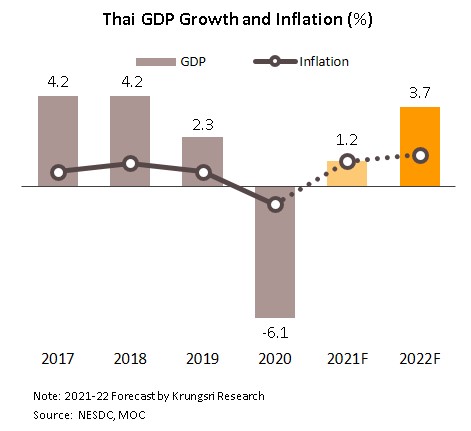

The recurrent waves of infections since 2020 and the subsequent Delta-driven outbreak that swept through the country in 2Q21 forced the government to implement containment measures for several months. The pandemic weighed on economic activities, especially supply disruption and temporary halt on construction sites. However, the significant progress of vaccination program in 4Q21 has later allowed for relaxed restrictions and resumption of economic activity. Nevertheless, fears rose again in late 2021 over the spread of the Omicron variant, raising concern over a further economic recovery. As such, following a contraction of 6.1% in 2020, we expect the 2021 overall economy to grow by just 1.2% in 2021.

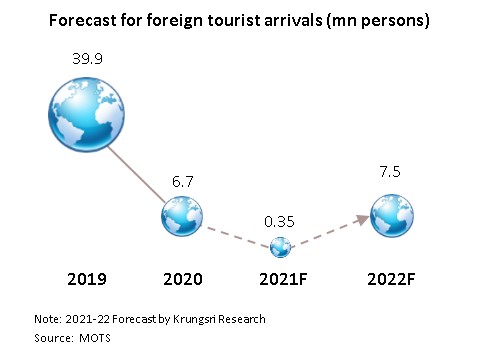

The depressed conditions in the tourism sector in 2020 persisted into 2021 as the pandemic intensified since the beginning the year. In fact, the Thai tourism sector was benefited from the mid-2021 introduction of the ‘Phuket Sandbox’ and then from the reopening of the country to quarantine-free arrivals from 63 countries in November (admitted under the Test & Go system). Nonetheless, restrictions on outbound travel in departure countries and the emergence of Omicron variant at the end of 2021 forced the authorities to temporarily suspend the Test & Go system. As such, compared to arrivals of 6.7 million in 2020, 2021 foreign arrivals were estimated at just 0.35 million. Against this, exports remained a major driver of economic growth for the country through 2021. Following a 6.5% contraction in 2020, exports rose 16.5% in 2021 on the back of a return to growth in global trade and the world economy. The improvement of exports was seen across export markets and product categories, while many sectors benefited further from the work-from-home policy and ongoing demand for protective products against the spread of COVID-19. A rally in commodity prices at the end of 2021 supported further growth in some export categories.

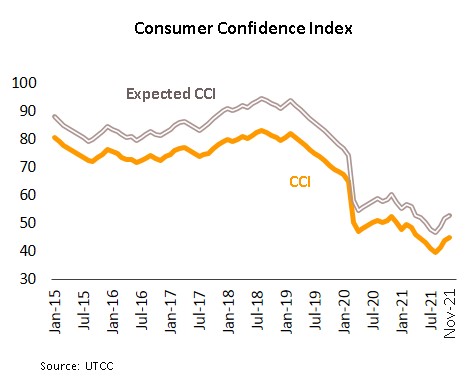

Despite being boosted by government expenditure, domestic spending remained weak. Having shrunk by -1.0% in 2020, private consumption was expected to expand by just 1.1% in 2021. This was affected by restrictions that caused disruption in many economic activities, weakening labor markets, undercutting workers’ income, and dragging consumer confidence to historic lows. Nevertheless, spending began to recover as the pandemic abated, together with government stimulus and strengthening in domestic tourism towards the year-end. Private investment improved alongside exports expansion, rebounding by an estimated 4.2% in 2021. Meanwhile, private construction was negatively affected by labor shortages and the spread of COVID-19 into construction sites, while a lack of liquidity in SMEs related to tourism industry also weighed on recovery in investment. Conversely, public spending played an important role providing support for the economy through the year. The 2021 fiscal budget disbursements were made as planned. However, the continuing impacts of COVID-19 on the country compelled the government to issue an emergency decree authorizing THB 500bn in borrowing that followed emergency borrowing of THB 1trn in 2020. These additional funds are aimed to alleviate the consequences of the pandemic and to help revive the economy. The public debt would thus rise, and so the public debt ceiling has been lifted from 60% to 70% of GDP.

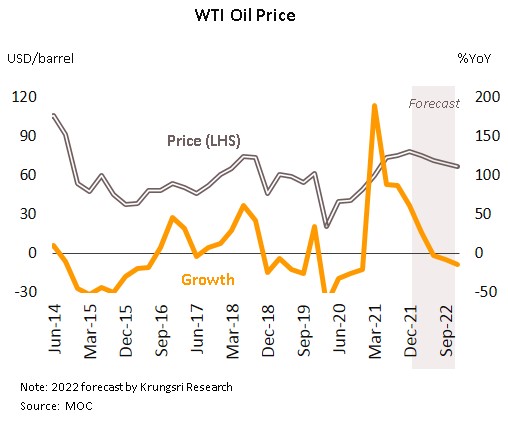

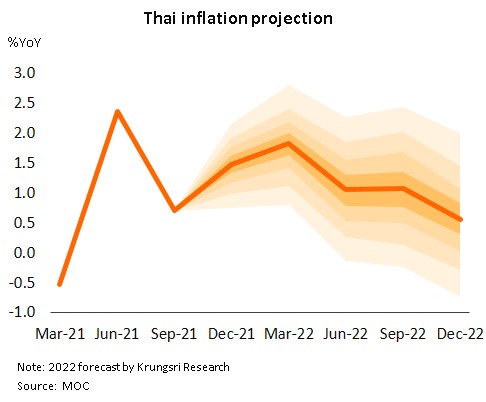

Greater progress with the vaccine rollout worldwide in 4Q21 helped to support both a rebound in economic activity and greater global demand for commodities. Combining with above mentioned factors and supply disruptions, headline inflation thus escalated at the end of 2021. However, rising inflationary pressure would be temporary, driven mainly by energy price hike. Nonetheless, the severe impacts of the outbreak on the domestic economy encouraged the Bank of Thailand (BOT) to keep policy rates at the record-breaking low of just 0.50% throughout 2021. The BOT’S monetary policy has been shifted to a greater emphasis on targeted measures that included, for example, offering soft loans, debt moratorium, refinancing for retail debtors, and debt consolidation for those with mortgages and other types of debt, as well as relaxing rules to help lenders provide additional assistance to debtors, and temporarily loosening the LTV regulations. The Thai baht saw volatility through the year, weakening sharply in 3Q21 as the Delta variant spread rapidly. The value of the baht was further undercut by a stronger dollar, following the Fed’s signal to unwind monetary stimulus that paves the way for subsequent rate hikes. The expected raising of Fed funds rate is likely to be more aggressive and faster than previously anticipated. In addition, pressure also came from the current account deficit, the first negative record seen in eight years. In fact, Thailand’s external stability remains sound, reflected by high level of foreign reserves, which helps cushion a fluctuation in financial markets.

In 2022, the Thai economy is taking first steps on the path to recovery despite an uneven course

The Thai economy is expected to grow by 3.7% in 2022, recovering from an estimated 1.2% in 2021, and this should bring Thailand’s GDP level back to its pre-pandemic size during 2H22. Key drivers would be a recovery in economic activity at home and abroad, supported by progress of vaccination program worldwide, including Thailand, which in turn broadens reopening activities. In addition, the global economic recovery and windfalls from regionalization help further boost exports. Moreover, industry transformation could lead to a new investment cycle. Government stimulus measures would also buoy domestic spending. The tourism sector has shown a sign of improving, though this is still at an early stage of recovery. However, uncertainties remain high given several risks and challenges ahead which could affect the pace of Thailand’s economic recovery. Private consumption would improve at an uneven pace with growth of 3.6% in 2022. Although the relaxation of control measures, the progress of the domestic vaccination program, and government stimulus spending will help over the short term, the expansion of spending would be limited as labor markets remain weak. We expect average wage in 2022 to rise but still below pre-pandemic level. Consumption recovery is also patchy in terms of region, income group and business sector, and so income and expenditure in harder hit sectors will remain weak, especially in services connected to the tourism sector. For exports outlook, despite a slowdown, we project 2022 export growth at 5.0%, higher than average of 2.9% during 2001- 2019 (pre-pandemic), supported by the widespread progress of vaccination programs and recovery in the world economy. In addition, Thailand will benefit from greater regionalization, including the RCEP which takes effect in 2022. The Asian Development Bank (ADB) estimates that, given benefits from the RCEP, Thailand would see incremental exports of 4.9% by 2030 following gains in Japan and South Korea, and would register larger gains than other ASEAN countries.

Alongside this, private investment would rise 4.6% on recovery in domestic and external demand, which will then spur a new investment cycle. Another supportive factor is business investment in response to the ‘new normal’ and accelerating digitalization. Furthermore, there is a positive sign from net inflows of foreign direct investment (FDI) for 1H21 which increased and exceeded the level for the whole of 2019. Pushing ahead with government infrastructure spending will also help to induce private investment, with most projects organized as public-private partnerships (over 80% of infrastructure investment during 2022-2026 are PPPs). Government expenditures are likely to decline due to lower amount of budget framework. Nonetheless, there is more than THB 200bn loans remaining from the emergency decree of additional THB 500bn loans for economic and social revitalization. For the tourism sector, there are signs of nascent recovery. Although Thailand reopened to quarantine-free travel from over 60 countries in November, the recovery could be disrupted by continuing uncertainty over the spread of COVID-19 and travel restrictions in many of Thailand’s major tourism markets. Given this, we see foreign arrivals totaling 7.5 million in 2022 and we do not expect the sector to return to its pre-COVID-19 total of 40 million arrivals until 2025. Domestic tourism will recover ahead of this, and following an expected 90 million domestic trips in 2022, the industry is forecast to record 160 million domestic trips (equal to its pre-pandemic level) in 2024.

The drawn-out nature of the COVID-19 crisis has left deep scars on the economy. Recovery thus remains fragile, and inflationary pressures are temporarily rising, which are expected to peak in 1Q22 due to the low base and cost pass-through effects. Inflation would ease to around 1% in 2H21, close to the lower end of its inflation target range, in line with the trend of slowing down global crude oil prices after the gradual rebalance of demand and supply. Meanwhile, domestic demand remains weak and uneven. The Monetary Policy Committee (MPC) is thus expected to hold the policy interest rate at a record low of 0.50% throughout 2022 to nurture the economic growth which would remain below its potential level.

In 2022, there are high uncertainties over several risks and challenges which could affect the pace of Thailand’s economic recovery. Key factors are still-fluid COVID-19 pandemic with concerns over mutant strains and vaccine efficacy, side effects of US unwinding monetary stimulus on financial markets, impact of global supply-side disruption on production costs, geopolitical risks and conflicts between major countries, as well as domestic political uncertainties and its impact on continuity of economic policies.