Recessionary risks are abating and the Chinese reopening should ease global supply chain disruptions, but the world economy is still slowing

US

Markets are pricing in more rate hikes following unexpectedly strong data, although these may reflect temporary factors. January indicators surprised to the upside for retail sales and industrial output, rising respectively 3% MoM and 1.0% MoM against anticipated rises of 1.8% and 0.8% and following December falls of

-1.1% and -1.8%. Initial unemployment claims were also down. Producer Price Index rose by 6.0% YoY, hotter than the market expectation of 5.4%.

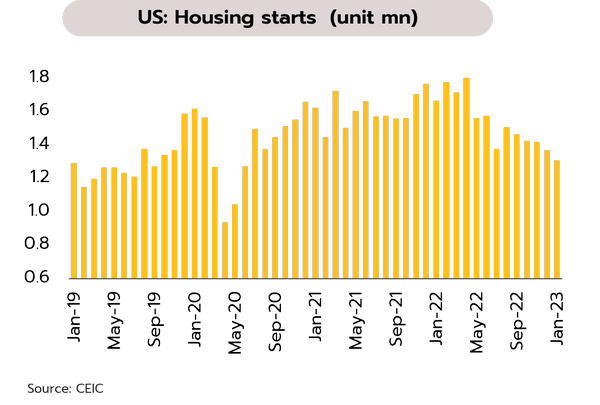

Given unusually strong data, markets are now weighing the possibility of 3 more Fed rate hikes and a potential cut at the year-end. However, we believe the data reflect temporary factors including a warm winter that encouraged consumers to spend more time on activities outside the home and the easing of supply disruptions (e.g., for chips), which has then lifted industrial output and sales (e.g., for autos, sales of which beat expectations). However, the effect of rate hikes will become increasingly evident in consumption, investment, and real estate. The housing market is also now contracting, with January’s new housing starts down 4.5% MoM to 1.31m units, beneath expectations and the lowest since June 2020.

Japan

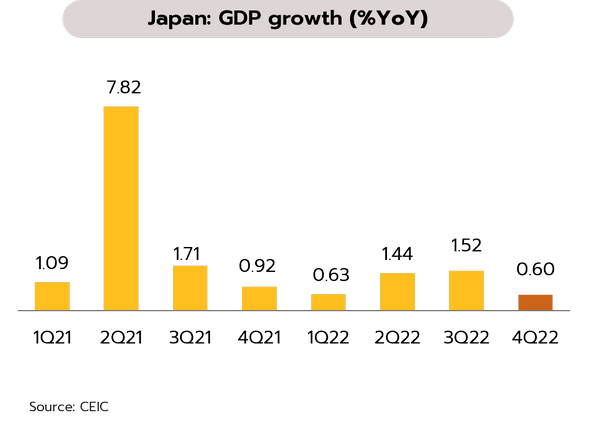

Lower-than-expected GDP in 4Q22 raising questions over Japan’s monetary policy and economic direction in 2023. The economy grew 0.6% YoY in 4Q22, significantly below the street’s expectation of 2.0%. Exports grew just 3.5% YoY in January, slowing from growth of 11.5% in December mainly on weaker Chinese demand; meanwhile, imports jumped 17.8%, lifting January’s current account deficit to its historic high of USD 26bn. Separately, Kazuo Ueda has been proposed as the replacement for the outgoing Haruhiko Kuroda (due to leave in April) as head of the Bank of Japan.

In 1H23, we see that Japan’s economy remains weak and highly uncertain due to: (i) a global slowdown that will drag on exports; (ii) high levels of inflation, which will suppress consumer expenditure, especially with savings now dissipating; and (iii) any benefit provided by the rebound in Chinese tourism being limited by the continuing imposition of strict Covid-19 restrictions, while in addition, Japan is not among the 20 countries to which Chinese tour groups are authorized to travel. Given this, we expect the Bank of Japan (BOJ) to carefully loosen monetary policy through 2H23 as the BOJ looks to balance the need for price stability with the desire to maintain long-term growth.

China

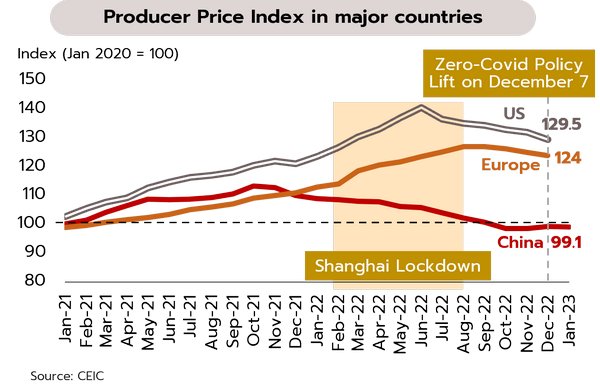

The Chinese reopening has had only limited inflationary impacts and this has freed up supply chains. Despite the surge in infections following the ending of the zero-Covid policy and the resulting supply chain disruption in December, inflation rose to just 1.8%, below the 2.1% high during the Shanghai lockdown. Moreover, while the January reopening of China and the subsequent celebration of Chinese New Year accelerated the rebound in manufacturing and services, inflation has remained calm, standing at 2.1% in January.

We expect the Chinese recovery to have minor effects on domestic inflation while also helping to alleviate global price pressures thanks to China’s easing supply chain disruptions. Chinese manufacturing costs remain low compared to the US, Europe, and the period of the Shanghai lockdown (as reflected in January’s PPI, which is below the pre-pandemic levels), while pent-up demand would likely help to compensate for weakening demand at the global level. In addition, 2023 oil demand is forecast to grow by 3.9%, close to China’s 10-year average of 4.1%, so it is unlikely that crude prices will rise far beyond their 2022 level, thus lessening impacts on global inflation.

At 2.6%, 2022 GDP growth was significantly weaker than expected; authorities are attempting to reduce long-term risk by addressing problems with household debt

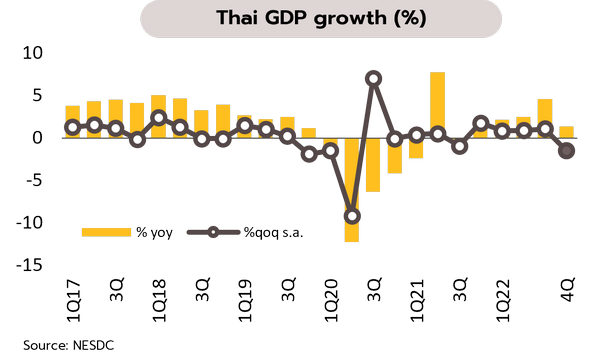

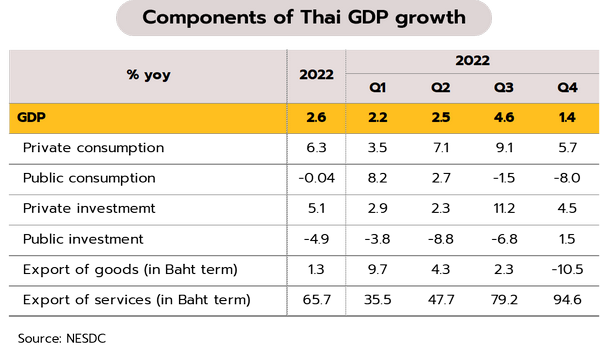

4Q22 GDP grew by just 1.4% YoY, but the positive effects of the Chinese reopening will be seen in Q1 of 2023. The Office of the National Economic and Social Development Council (NESDC) reports that the Thai economy grew by just 1.4% in 4Q22, sharply down from 3Q22’s 4.6%, and lower than either the consensus expectation of 3.6% or our prediction of 3.7%. This was a consequence of the 10.5% drop in exports and the 8.0% fall in government consumption, and the slowdown in private consumption and investment from the last quarter (down to respectively +5.7% and +4.5%). Compared to 2021 growth of 1.5%, for all of 2022, growth ran to just 2.6%, sharply below the view of market and Krungsri Research at 3.2%. The NESDC has also revised its 2023 outlook downwards, cutting its growth forecast from 3.0-4.0% to 2.7-3.7%.

We are trimming our prior forecast for 2023 growth of 3.6% in light of the unexpectedly weak data for 4Q22, which represented the first drop in QoQ growth since 3Q21 (down -1.5% QoQ sa). However, we retain our positive outlook for 1Q23, and we believe that a technical recession (two quarters of negative GDP growth) will be avoided thanks to the positive impacts of China’s rapid reopening, the loosening of tight global supply chains, and government stimulus spending (the Shop and Refund scheme, phase 5 of the We Travel Together program, and additional assistance for welfare card holders through January). Over the longer term, Thailand’s growth prospects remain exposed to risk arising from the increasingly clear impacts of global rate hikes that have now taken interest rates to highs not seen in many years, and from the risk of uncertainty over domestic economic policy if there are delays to installing the new government in 2H23. However, growth may improve from 2022, and 2023 should still see the Thai economic activity to rise beyond its pre-Covid level.

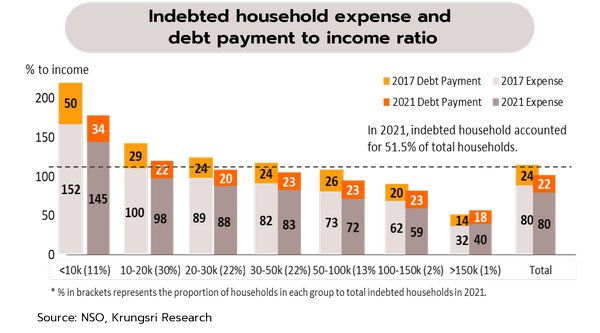

The BOT has issued guidelines for the sustainable resolution of the debt overhang while the consumption recovery remains patchy. Data from the Bank of Thailand (BOT) show that for 3Q22, household debt stood at 86.8% of GDP, and although this was down from a peak of 90.1%, this was due to growth in GDP, not a fall in debt. The projection is for household debt to stand at 84% of GDP in 2027, which may then pose a threat to financial stability and to overall economic health. The BOT has thus laid out a plan for addressing this situation. (i) Current NPLs (especially those originating from the pandemic) are mostly personal or agricultural loans, and debt assistance will focus on the long-term restructuring of these. (ii) Persistent debtors will be helped towards fully paying down their debts. (iii) For fast-growing new debts that are at risk of becoming persistent or of becoming NPLs, new guidelines will help to tighten the release of credit. (iv) Other debts not included in the statistics (e.g., informal debt) will be more closely tracked and ways of bringing debtors into the formal sector will be pursued.

Data from the National Statistical Office indicate that as of 2021, 51.5% of households carried some debt. Those with incomes below THB 50,000/month were more likely to have debt problems since combined expenses and debt repayments were likely to be greater than income, a situation that has been worsened by recent rate hikes. It is also much more probable that vulnerable families, or those earning less than THB 10,000/month, are reliant on the government to help pay for expenses that may be significantly higher than household incomes. This then reflects the as-yet significantly unequal nature of recovery in household consumption, though the rebound in employment and greater spending by debt-free households and by mid-income earners will play an important role in driving continued growth in household consumption this year.