The US is likely to raise interest rates amid economic growth and rising inflation; The Eurozone and Japan would keep low policy rates

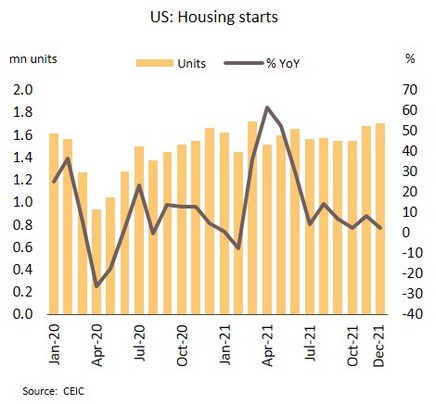

Strengthening US economy with escalating inflationary pressure would push Fed for accelerating rate hike. In December, building permits surged by 9.1% MoM to its highest since January 2021, and new house starts rose to a 9-month high of 1.7m units. In January, the Philadelphia Fed’s Manufacturing Index beat expectations to hit 23.2. Meanwhile, for the week ending 14 January, the Mortgage Market Index touched a 3-week high of 593.7.

US Omicron infections seem to have peaked with declining daily new cases and the adverse impacts are thus limited. This would help build consumer confidence alongside lifting purchasing power with higher wages, though these effects would strengthen demand-pull inflation. On the supply side, commodity price hike still pushes up production cost, in particular from the rising West Texas Intermediate (WTI) crude futures to a 7-year high. Markets are now expecting that the Fed will raise rates sooner and at a faster pace than previously anticipated in response to a strong recovery and likely persistent inflation. Yields on 10-year Treasuries thus recorded a 2-year high of 1.85%. Krungsri Research foresees that Fed is likely to provide clear signals regarding rate hikes and balance sheet reduction at its meeting this week. In 2022, four rate hikes with the first move in March are expected.

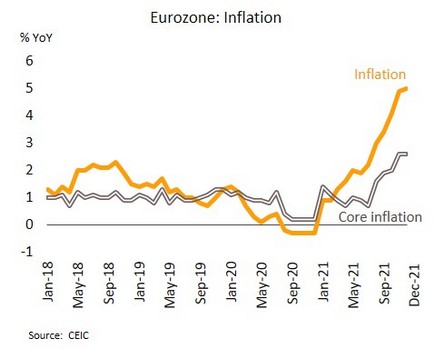

Low interest rates will remain in the Eurozone until at least end-2022; Inflation lifted by temporary factors. In December, headline and core inflation reached their highest records of 5% and 2.6%. The January ZEW Economic Sentiment Index rose to 49.4, its highest since July 2021, as the Omicron has had lower fatality rate than earlier variants, which helped improve confidence.

Though headline inflation has been above the ECB’s targets for 6 months, the bank believes that this is due to temporary factors, and thus kept policy rates low and maintained PEPP asset purchase until its end in March 2022 when the Asset Purchase Program (APP) will continue. The president of the ECB has stated that unlike the US, where inflation is being driven by strong demand and rising wages, in the Eurozone, inflation is caused by temporary supply constraints and high energy prices from low base effect relative to previous year. We therefore see the ECB would gradually unwind its monetary stimulus, with cutting asset purchase under APP scheme from 3Q22 onwards and maintain low interest rates until at least the end of 2022.

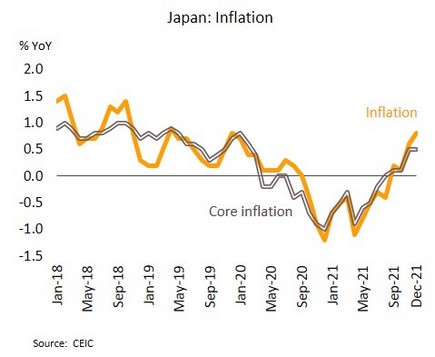

Japan faces pressure from surging infections; The policy rates is likely to be kept at a low record. In December, exports rose 17.5% YoY, the 10th month of expansion. Meanwhile, headline inflation was up by 0.8%, its highest since December 2019. Core inflation also grew for the 4th month, staying at 0.5%.

The first stage of Japan’s recovery is supported by exports, but this is coming under pressure from the 6th wave of infections. Daily new case numbers have reached a record high of around 50,000, and a quasi-state of emergency has thus been imposed in 13 prefectures. In addition, the BOJ left policy rates unchanged and kept its QE and yield curve control programs. Forecasts for 2022 core inflation have been raised from 0.9% to 1.1%, though this is still below the 2% target. We expect that monetary easing would remain in place to support the fragile recovery and counter the impacts of the latest wave of infections.

Exports would remain the key driver of Thai economy in 2022; Tourism sector tends to recover slowly

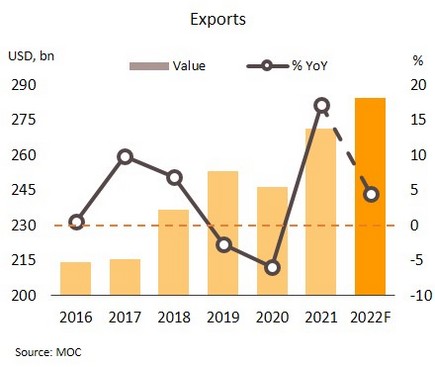

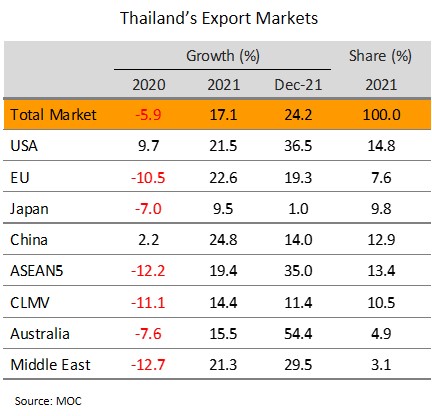

December’s exports recorded historical high; External demand would continue to be growth engine in 2022. In December, exports totaled USD 24.9bn, up 24.2% YoY with the 4th month of double-digit growth. Strong sales were seen in major product categories, including passenger vehicles (+47.3%), chemicals (+38.9%), construction materials (+30.7%), agricultural products (+21.1%), and plastics (+20.2%), with sales being boosted by recovery in trade and global economy as well as the rush by importers in many countries to build stocks ahead of the New Year. Geographically, increases were seen in almost all markets, including Japan, which returned to growth for the first time in 3 months. For 2021 overall, exports were up 17.1% to a value of USD 271.2 bn, which compared to 2020’s total of USD 231.6bn with a decline of 5.9%.

The record-breaking exports in December and the 19.8% rise of those exports which excluded oil, gold, and weapons in 2021 reflected growth of real economy. Krungsri Research expects that exports would remain a major driver of Thai economy through 2022 with growth projection of 4.5% (on data from the Ministry of Commerce) or 5.0% (Bank of Thailand data). This outlook is supported by: (i) likely growing above the historical average of economies in major trading partners, including the US, Europe, Japan, and Asia; (ii) the momentum given by growth in key export items and by imports of raw materials and intermediate products (up 38%); and (iii) greater regionalization that is strengthened by the coming into force of RCEP agreement since the beginning of 2022, which will broaden opportunities for Thai manufacturers and exporters. In addition, the weakening of the baht will also help to generate additional revenue for exporters. Nonetheless, the spread of the Omicron variant in many countries at the start of the year may affect purchasing power and push up transportation costs as tighter restrictions are imposed.

Despite slow recovery, the relaunch of Test & Go scheme by next month could support tourism sector. At a meeting of the Center for COVID-19 Situation Administration (CCSA), the number of controlled areas (orange zones) was cut from 69 to 44, with 25 provinces declared to close surveillance areas (yellow zone) and 8 provinces set as pilot tourism areas (blue zones). The authorities have also expanded the sandbox program to include parts of Chonburi and Trat provinces, and from 1 February, arrivals from all countries will be admitted under the Test & Go system.

The number of daily new infections stayed quite steady around 7,000 for the past week, but deaths remain rare, reflecting both the less severe nature of the Omicron variant and progress of vaccination. 112m doses have now been administered, with 72% of the population having had a single jab, 66% having fully vaccinated, and 17% having had a booster, and this is now allowing the authorities to relax restrictions. The relaunch of Test & Go scheme will also help improve the recovery of tourism sector. From the start of this scheme on 1 November until the end-2021, over 300,000 foreign arrivals were recorded, compared to around 45,000 in 3Q21. Nevertheless, the recovery is expected to slow, especially in the 1H22 because many countries, particularly China, continue to restrict international traveling and impose quarantines measures.