The US is likely to continue with rate hike cycle, and Eurozone rates may increase in July; China will need to step up stimulus measures in the face of gathering headwinds

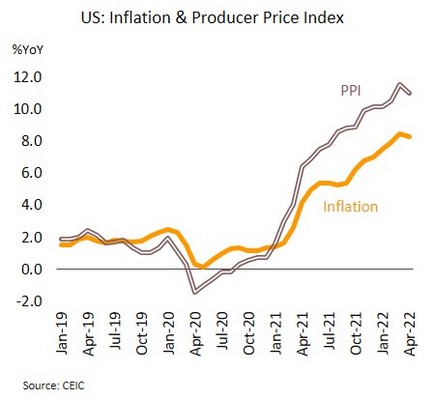

High US inflation and tight labor markets will push the Fed to raise rates by 50 bps at each of next two meetings. In April, headline inflation weakened slightly, edging down to 8.3% YoY from March’s 41-year high of 8.5%. The Producer Price Index (PPI) rose steadily by 11.0%, being close to last month's 12-year highest growth. Medium-term inflation expectation for the next 3 years remained high at 3.9%, the highest since December 2021. For the week ending 30 April, continuing jobless claims dropped to 1.34m, the 5th week of falls.

Despite weakening slightly in April, the US continues to face strong inflation and tight labor markets that are fueling higher wages, but household balance sheets remain strong, and these factors will support a continuation of this rate hike cycle. The Fed Chair has stated that the Fed aims to pull inflation back into its 2% target range. Although the central bank is aiming for a soft landing, the risk of economic pain remains, while it is impossible to fully manage uncontrollable risks, especially that arising from geopolitical conflict and ongoing supply chain disruptions. We thus expect that the Fed will hike rates by 50 bps at each FOMC meetings in June and July.

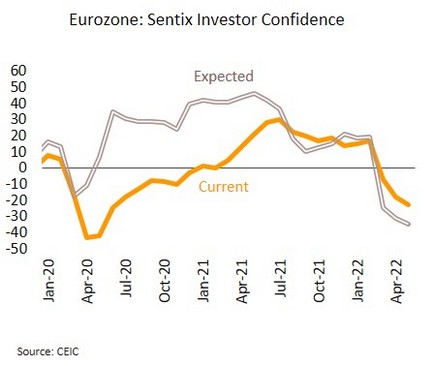

The ECB may raise rates for the first time in almost a decade to tame inflation; Both the Eurozone and the UK are at risk of recession. For the Eurozone, industrial production slipped by 1.8% MoM in March, the sharpest decline in almost 2 years. The May’s Sentix Investor Confidence Index dropped to -22.6, hitting its lowest since June 2020. For the UK, monthly GDP figure contracted by 0.1% in March, the first fall in GDP this year.

The latest UK and Eurozone indicators highlight the growing risk of recession. This is partly due to the war in Ukraine and supply constraints. Nonetheless, inflation is also continuing to run hot, and with price rises hitting a 30-year high of 7.0% in the UK in March and then the historic high of 7.5% in the Eurozone in April, the risk of prolonged high prices is adding to pressure on central banks. The President of the European Central Bank has thus said that the first ECB rate rise in a decade may be seen in the weeks following the termination of QE in July. However, having hiked rates 4 times, the increasing risk of a recession means that the Bank of England (BOE) is now no rush for further hike.

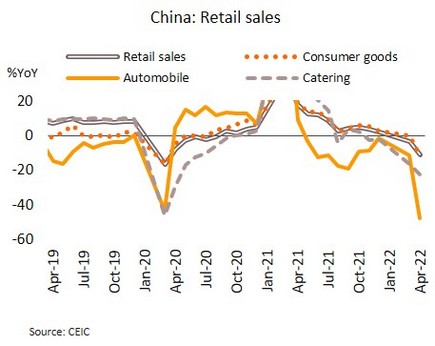

China is facing several threats, and the authorities may implement additional targeted measures. Key economic indicators in April weakened, especially from contraction in industrial production ((-2.9% from +5.0% in March) and retail sales (-11.1% from -3.5%), together with a slowdown of fixed asset investment (+6.8% from +9.3%) and exports (+3.9% from +14.7%).

Recent data from China reflect the negative impacts from the lengthy enforcement of China’s zero-COVID policy and the liquidity crunch, especially the most recent default by the developer Sunac on coupon payments due on its dollar-denominated bonds. These problems combine with the impacts of the war in Ukraine would drag on the Chinese economic growth. The People's Bank of China (PBOC) announced to cut interest rates on mortgage loans for first-home buyers by 20 bps to 4.4%. In addition, the authorities are expected to deploy additional targeted monetary and fiscal stimulus measures, for example, additional assistance targeted for SMEs and households, in order to help prevent a sharp slowdown.

Krungsri Research maintains our GDP growth forecast at 2.8% despite weak confidence and several headwinds

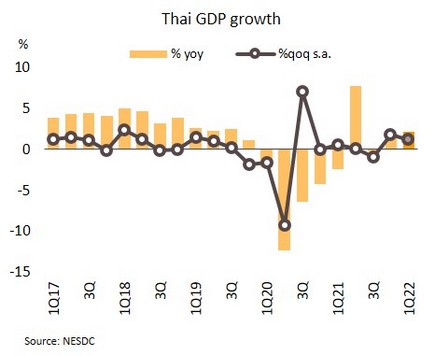

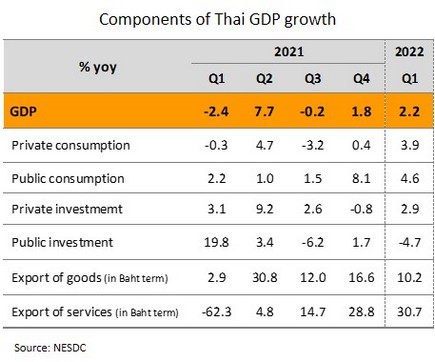

Over 1Q22, Thai GDP grew by 2.2% YoY; Our full-year growth forecast is kept at 2.8%. The NESDC reported Thai GDP growth in 1Q22 continued to expand from a rise of 1.8% in 4Q21, fueled by accelerated growth of private consumption and services-based exports, together with the continuing expansion of public consumption and merchandise exports. In contrast, growth of public investment turned negative. On the supply side, production related to accommodation & food services and agriculture performed well. Growth of manufacturing and wholesale & retail sales production decelerated, while construction continued to shrink.

The overall Thai economy showed positive signs from better-than-expected GDP figure in 1Q22 that grew at 1.1% QoQ sa, beating Krungsri Research’s projection (0.8%) and Reuters polls (0.9%), together with faster-than-expected reopening. For the rest of the year, the Thai economy still faces the following external risks and other headwinds: i) uncertain and protracted Russia and Ukraine conflicts; ii) China’s economic slowdown premised on tightened containment measures, which would hit Thai exports and result in supply chain disruption; and iii) surging domestic inflation, reducing government subsidies (such as for diesel oil and cooking gas) and unwinding of stimulus measures , all of which may dampen domestic purchasing power ahead. Krungsri Research; therefore, maintains our GDP growth forecast at 2.8%. The NESDC revised down 2022 GDP growth forecast at 2.5-3.5% from 3.5-4.5% and upgraded inflation forecast to 4.2-5.2% from a previous projection of 1.5-2.5%.

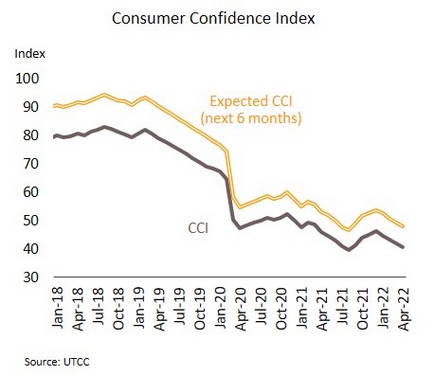

Confidence slipped to near-historic lows; Authorities prepare to rollout phase 5 of ‘Co-payment’ scheme to support spending. April’s Consumer Confidence Index (CCI) declined for the 4th month, and having dropped from 42.0 in March to 40.7, this is now at its lowest in 8 months and second only to the record low of 39.6 recorded in August 2021. Falls are attributable to fears over the high Omicron infection rates in April and the effect on the cost of living from rising prices for oil and consumer goods.

Consumer confidence remains no signs of recovery with the sentiment of the next 6 months expectation sliding to a 7-month trough of 48.0. It implies that domestic demand is likely to be weakened further by the rising cost of commodities, especially the elevated oil prices, for which high prices would stay persistently by the prolongation of the war in Ukraine and the tightening of sanctions on Russia. Nevertheless, there would be some positive factors that may support spending and restore confidence in the next period. In particular, the authorities are gradually downgrading of the pandemic alert status alongside the declining tendency of new COVID-19 caseloads, which in turn should help to drive a rebound in economic activity. In addition, the government is preparing to extend the phase 4 of the ‘We Travel Together’ program until September (previously scheduled to end by May) and planning to offer another 1m registrations for this. Moreover, they also plans to rollout phase 5 of the ‘Co-payment’ scheme.