The collapse of SVB triggers fear of domino effects and confidence crisis; Fed rate hikes could be smaller than previous market expectations

US

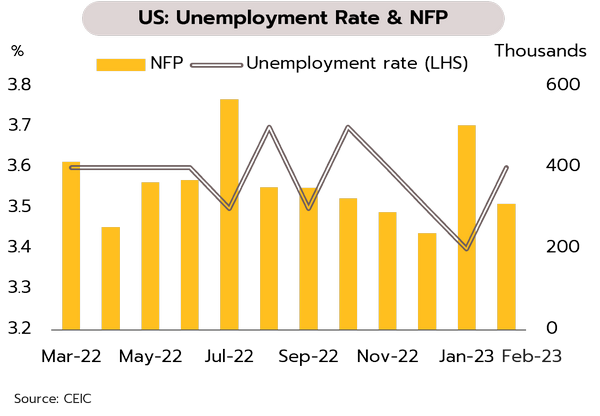

The collapse of Silicon Valley Bank (SVB) has raised concerns and increased risks of domino effects. The US government was shutting down SVB following a severe liquidity shortage. This was followed by the closure of Signature Bank. This has been hit by mass depositor withdrawals and deteriorating. For the latest key indictors, non-farm payrolls increased by 311,000 in February, down from a 504,000 rise in January, but above market expectations. Unemployment also edged up to 3.6%, compared to the forecast 3.4%.

The US authorities recently launched emergency measures to shore up confidence in the banking system by allowing the failed bank’s customers to access all their deposits starting Monday (Mar 13) and setting up a new facility - USD25 bn Bank Term Funding Program – to give banks access to emergency funds to protect the banks from facing the same risks as SVB and to prevent the wide-spread Domino Effects. However, it still needs to be closely monitored given risks of confidence crisis and its effects on the overall economy. In our view, the Fed may become less aggressive about the direction of interest rates. We expect the Fed to raise interest rates by 25bp (compared to the previous market expectation of 50bp) to a range of 4.75-5.00% in March's meeting.

Eurozone

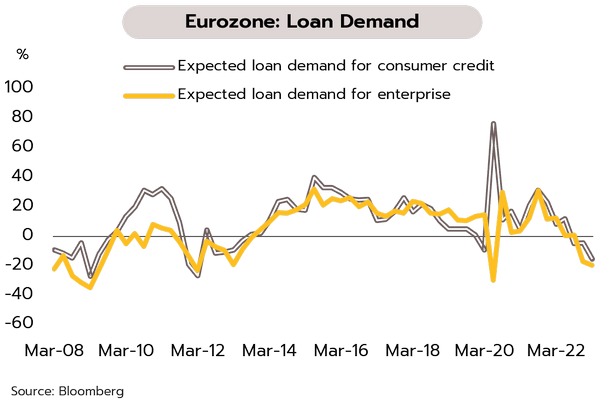

The Eurozone is under pressure from the twin headwinds of high inflation and rate hikes. Retail sales slipped 2.3% YoY in January, the 8th month of declines, though this is in keeping with continuing weakness in consumer confidence. Eurozone 4Q22 GDP growth was also revised down from 1.9% in the previous estimate to 1.8%, reflecting the high levels of uncertainty that continue to surround the Eurozone economy.

With the Euro area’s consumer confidence indicator at -19 points in February, private sector consumption would remain weak. Core inflation also hit a new high of 5.6%, and the stickiness of Eurozone inflation may force the ECB to continue tightening monetary policy, possibly resulting in the terminal rate hitting 4% during 1H23 before quantitative tightening begins in the second half of the year. We therefore expect that with both the cost of financing and inflation remaining high, the Eurozone’s overall economy will stay weak through 2023 and this will drag on private sector’s consumption and investment.

China

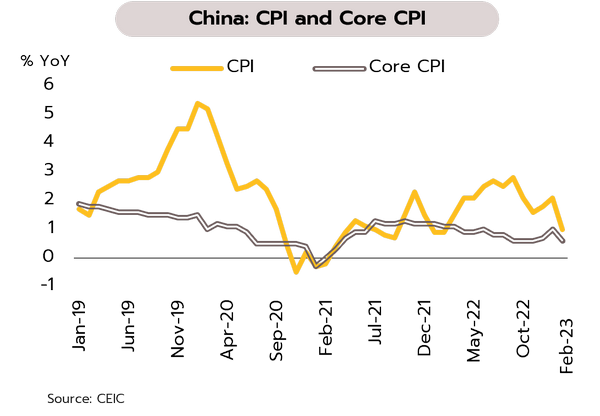

The National People’s Congress (NPC) has dashed hope for a strong rebound in 2023 growth, with the focus now on the quality not quantity of growth. The NPC has set a 5% target for 2023 growth, down from both 2022’s 5.5% target and market expectations. Economic activity recovered but still not healthy. February car sales rose 13.5% to 1.98mn. Exports improved over the first 2 months of this year from December’s 10.1% YoY contraction to a 6.8% decline but imports contracted deeper to -10.2% from -7.5%. Weakness in demand was also reflected in inflation. February’s headline inflation eased to a 1-year low of 1.0% YoY (from 2.1% in January), while core inflation eased from 1.0% to 0.6%.

Both the latest data and the NPC’s meeting results have dashed hope for a strong rebound in 2023 growth. However, the authorities are instead targeting quality growth by: (i) keeping the fiscal deficit at 3.0%, close to 2022’s 2.8% to reflect fiscal discipline; (ii) maintaining inflation target 3%, unchanged from last year; and (iii) engaging in structural reform to strengthen fundamentals by, e.g., regulatory reform of the financial sector and making progress in science and technology. This will help to mitigate risks and reduce impacts of technology restrictions by other countries. Over the medium- to long-term, this is likely to have positive effects on the overall economy.

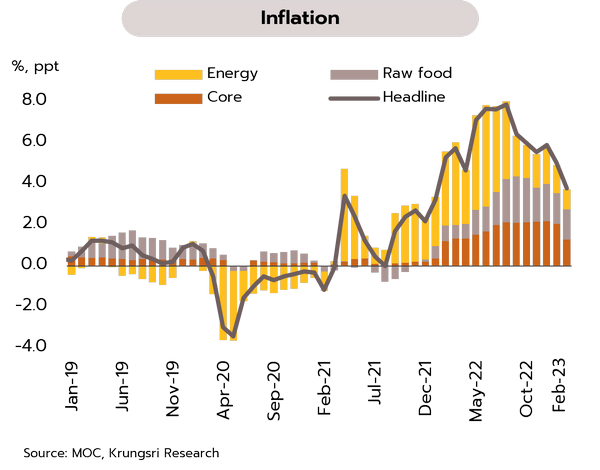

Pressure on policy rate is declining with the faster-than-expected softening in inflation; improving sentiment is supporting stronger consumption

Headline inflation slipped to a 13-month low in February. The MPC is expected to raise policy rate to 1.75% at its March meeting. Headline inflation dropped from 5.02% YoY in January to 3.79% in February, below both our forecast of 4.16% and the consensus expectation of 4.18%. Declines were driven by weaker global crude markets, which then fed into a softening of domestic energy prices that included a THB 1/liter cut in the retail diesel price. In addition, prices for many fresh foods also declined. February’s core inflation, which excludes raw food and energy items, also dropped from 3.04% to 1.93%. For the first 2 months of the year, headline and core inflation have thus averaged 4.40% and 2.48%, respectively.

We see a broad range of factors conspiring to release some of the upward pressure on domestic policy rate. (i) Inflation is softening and headline inflation should slip back into the target range during 2H23. Likewise, core inflation should fall beneath 2% across the remainder of the year, indicating that demand-pull pressures are less intense than many expected. (ii) 4Q22 GDP data came out much weaker than many expectations, and this has affected growth forecasts for 2023. The NESDC has trimmed its 2023 growth forecasts from 3-4% to 2.7-3.7%. Krungsri Research has likewise cut our projection for 2023 GDP growth from 3.6% to 3.3%. (iii) Thai economic recovery will also come under pressure from uncertainty around the global economy and weakness in major export markets. Although the collapse of Silicon Valley Bank (SVB) would shake financial markets and raise uncertainty in global economic and financial situation, we view that Thailand’s monetary policy is likely to be guided by the need to balance price stability with growth, and so the MPC is expected to continue to normalize monetary policy by taking the policy rate from 1.50% in January to 1.75% in March. After that, the BOT will likely adopt a wait-and-see stance to assess how inflation, the economy, and risk evolve in the coming period.

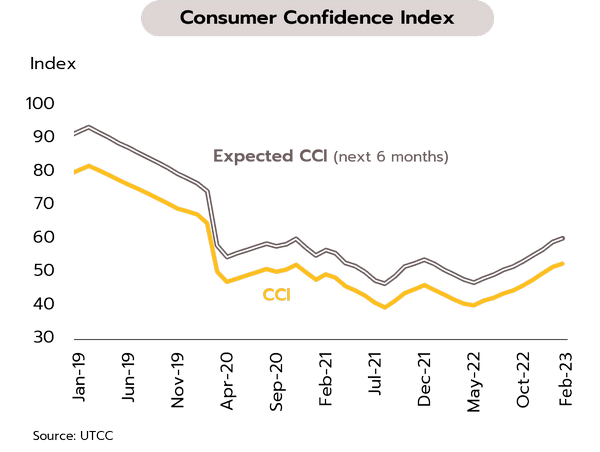

February Consumer Confidence Index rose to a 3-year high, and so consumption should be a major driver of the economy this year. The Consumer Confidence Index strengthened for the 9th consecutive month in February, climbing from 51.7 in January to 52.6, its highest since March 2020. Sentiment has strengthened on government stimulus spending (e.g., the Shop and Refund scheme), clearer signs of recovery in the tourism sector and especially in the all-important Chinese market, stronger farm incomes that have strengthened spending power upcountry, and a softening of pump prices. However, fears persist that growth may underperform this year thanks to weakness in the export sector, the high cost of living, and the volatility of the baht.

Sentiment is strengthening and private sector consumption is therefore likely to be a major driver of growth. This situation will improve further thanks to the rise in anticipated consumer confidence 6-months out, which edged up from 59.6 in January to 60.2 in February. The outlook is also benefiting from further stimulus spending in the form of additional funds for the 14.6mn government welfare card holders and the allocation of THB 2bn for phase 5 of the We Travel Together program (scheduled to run from 10 March to 30 April). The coming general election will also help to inject money into local economies around the country, though higher rates and the heavy burden of household debt will limit how far consumption can grow, especially among low-income earners.