The global outlook is weighed down by tighter monetary policy and the loss of the impetus gained by the reopening of national economies

US

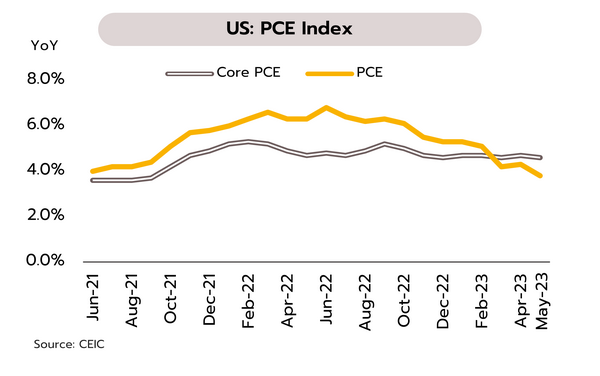

With stronger-than-expected indicators, the probability of Fed’s July rate hike is rising. US GDP expanded by 2.0% QoQ in Q1, above initial estimates of 1.1% and 1.3%, while consumer sentiment rose to a 4-month high of 64.4 in June. May headline and core PCE price indices increased at a slower pace of respectively 4.3% to 3.8% YoY, and 4.7% to 4.6%. Likewise, initial jobless claims dropped by 26,000 to 239,000 last week.

US economic indicators are positive, and with the economy and labor markets stronger than expected and Stress Tests of major banks showing that these remain resilient, the risk of a recession has weakened. In addition, PCE remains above the Fed target of 2%, and so the forecast probability of a July increase in rates now stands at 86.8% (up from 71.9% a week earlier). This outlook has only been strengthened by comments by Fed Chair Powell that at least 2 more rate hikes can be expected this year as the Fed looks to continue its attempts to cool labor markets and quell inflationary pressures. Nevertheless, given the possibility of a weaker-than-expected growth in the second half of the year, a likely softening of both labor markets and the service sector, and the fact that real interest rates have now turned positive, we believe that the Fed may raise rates only once more in 2023, bringing the Fed Funds Rate to 5.25-5.50%.

Japan

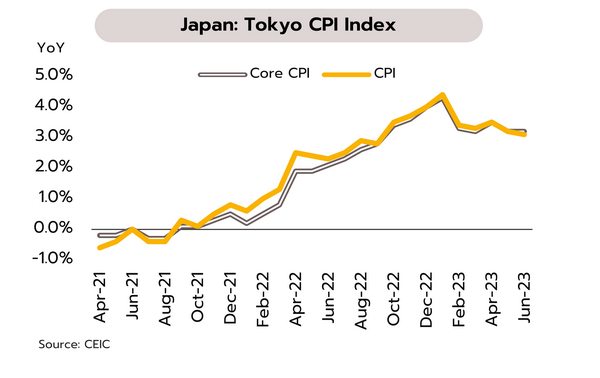

In light of a worsening outlook for the world economy and the possibility of weaker-than-expected inflation, the BOJ is leaving its ultra-loose monetary policy unchanged. In May, retail sales rose 5.7% YoY, up from 5.1% in April, but manufacturing output slipped 1.6% after growing 0.7%. June’s Tokyo CPI climbed 3.1% YoY, down from May’s 3.2%, while Tokyo Core CPI increased by 3.2%, the same rate as April. Minutes from the Bank of Japan’s (BOJ) April meeting show that given worries over the global outlook and domestic wages, all 9 committee members agreed that the current ultra-loose monetary policy should remain in place.

Through 2H23, negative real wage and a worsening economic conditions of Japan’s trading partners that is increasing risk for the export sector will drag on the economy, but the boost given to tourism by the reopening of the country and the impact of the BOJ’s very relaxed monetary policy will mean that Japan is less likely than other advanced economies to see a recession. Moreover, a decline in commodity prices is expected to help pull inflation back into the target range in mid-2024. We therefore believe that there is an increasing possibility that to reduce pressure in bond markets and to shore up the value of the yen, the BOJ will consider tightening policy, though to reduce the risk of deflation returning, any moves in this direction will be only gradual.

China

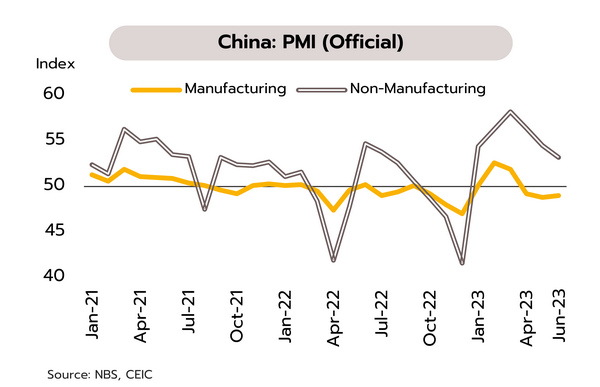

The latest data from China underline the fact that for services, manufacturing, and lending, the momentum gained by reopening the country is dissipating. China’s National Bureau of Statistics reports that although the manufacturing PMI edged up from 48.8 in May to 49.0 in June, this is its 3rd month below 50 points. June’s services PMI also weakened from 54.5 to 53.2. The China Beige Book indicates that last August’s rate cut may only have had limited impacts on the wider economy. Alongside this, national figures for borrowing show that lending fell to the lowest since records began in 2010 and loan demand dropped from a year ago.

Although growth may have accelerated in Q2 relative to Q1, signs of a slowdown are appearing in many parts of the economy. Manufacturing contracted for the 3 straight months, while growth in the services sector is at its weakest since China’s reopening. Industrial profits also fell 12.6% YoY in May. The real estate sector is still struggling; defaults on dollar-denominated corporate bonds continue to be reported after hitting a historic high in 2022. Weakening domestic and external demands are also now showing up in retail sales, investment and exports, and unfortunately, June’s 10bp cut in policy rates may be limited impetus to boost the post-reopening slowdown of the economy.

With slowing exports and rising political uncertainty, Q2-Q3 growth may be supported by rebounding tourism sector and rising domestic spending.

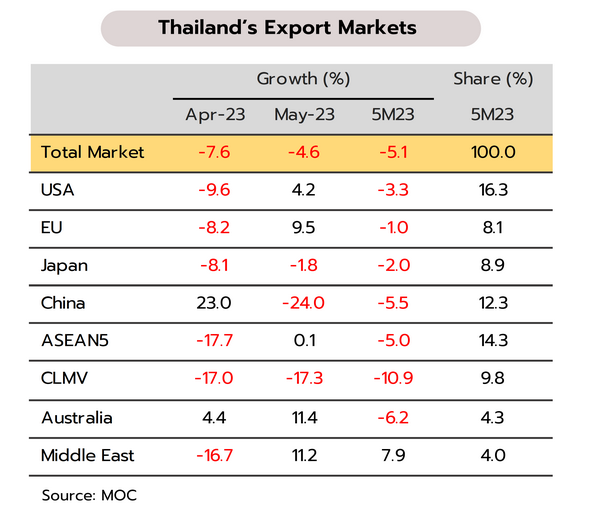

Exports contracted for the 8th month in May albeit at a slower pace. If Thailand maintains the current monthly export value the rest of this year, full-year exports will see zero growth. Data from the Ministry of Commerce show that May’s exports generated USD 24.3bn in income, and while this was a decline of 4.6% YoY, this was better than both April’s 7.6% contraction and market expectations of a fall of 8%. Moreover, excluding oil, gold, and weapons brings the decline down to just 1.4%. While exports rose to major markets in the EU, the US and the ASEAN-5, they weakened to China, Japan and the CLMV nations. Exports of industrial goods were up 1.5%, the first expansion in 8 months, with growth seen in autos & parts, air conditioners & parts, solar cells, and motorcycles & parts. However, exports of agricultural and agro-processing goods slipped for the first time in 4 months, dropping 16.3% on weaker overseas sales of fresh, chilled, frozen & dried fruits, and of cassava and rubber products. Over the first 5 months of 2023, export value has therefore slipped 5.1%.

Despite softening for the 8th month in May, the value of exports remained above the monthly average seen through the first 4 months of the year. If, through the rest of 2023, exports continue to generate an equivalent monthly income as May, Thai exports will return to growth of 1% in Q3 and will then expand by more than 10% in Q4, though this would partly be a result of baseline effects carried over from 2022. In this case, overall 2023 exports would see zero growth. However, the export sector continues to face challenges arising from uncertainty around the world economy and the impacts of tighter monetary policy, and from slowing manufacturing sectors in key overseas markets (including US, Eurozone, China and Japan), which with PMIs below 50, are now in contractionary territory. This will be mitigated by the positive impacts resulting from the easing of supply-chain bottlenecks, falling freight rates, and strong demand for food as countries try to build food security. We are therefore maintaining our export forecast of only 0.5% growth in 2023.

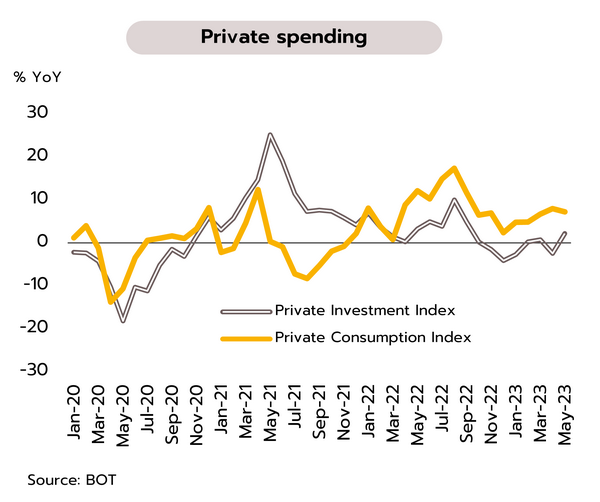

In May, the Thai economy benefitted from strong domestic spending and expansion in the tourism sector, and so Q2 and Q3 growth rates should be close to that seen in Q1. The Bank of Thailand reports that overall, the Thai economy continued to grow, helped by private consumption and the strength of the tourism sector, with both the domestic and international segments doing well. The economy was also boosted by temporary factors relating to the recent election, which helped to lift private consumption index by 7.3% YoY, while private investment index climbed 2.2% on greater spending on plant and machinery (partly on the import of new airplanes). However, exports have shrunk for 8 consecutive months, mirroring an 8-month-long decline in manufacturing output, which is now down 3.1%.

A range of indicators from April and May show that the economy continues to grow at a gradual pace, and we see Q2 and Q3 growth likely remaining close to the 2.7% YoY expansion that was recorded in Q1. This outlook is supported by the ongoing rebound in the tourism sector, continuing strength in private sector consumption, and labor markets that are now back to their pre-Covid state. However, weak overseas demand continues to weigh on the export sector and with uncertainty swirling around the question of if and when a new government will be installed, there is a growing risk that the FY2024 budget will be delayed. This would then undermine sentiment and weaken the recovery. In light of this, we are leaving our earlier forecast of 2023 GDP growth of 3.3% unchanged.