Economic activity strengthened in the major economies at the start of 2023, but the outlook for growth remains weak

US

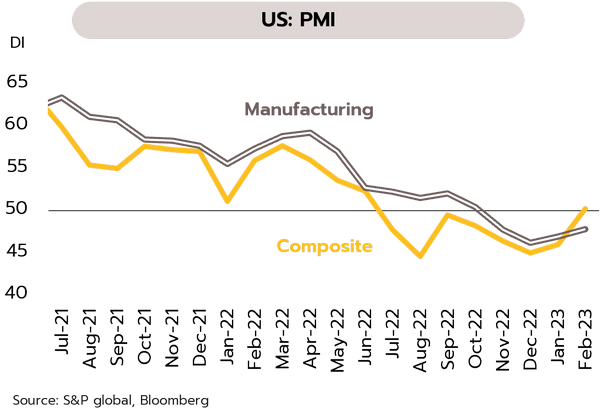

More rate rises are now likely following the release of strong economic data and signs of still-high inflation, but growth prospect remains weak. February’s Flash Composite PMI rose to an 8-month high of 50.2. The Consumer Confidence Index also climbed to a 13-month high though it remains lower than its historical average. At 1.8% MoM, January’s increase in personal spending was near a 2-year high, helped by stronger incomes. However, the PCE Price Index also rose, edging up to 5.4% YoY from 5.3% in December.

There is higher probability of three more rate hikes to 5.25-5.50% this year following strong economic data. However, these have been partly affected by temporary factors (e.g., warmer weather), and some key indicators also reflect weakening conditions. For example, 4Q22 GDP growth was revised down to 2.7% from 2.9%. Excluding net exports and inventories, domestic demand rose just 0.1%. 1Q23 GDP growth is likely to undershoot 2%. Although February’s manufacturing PMI climbed up to 47.8, this is its 4th month in contraction zone with a fall in the new orders component. In addition, suppliers’ delivery times was at its lowest since mid-2009 and input prices are sliding, which may then help to ease inflationary pressures in the period ahead.

Eurozone

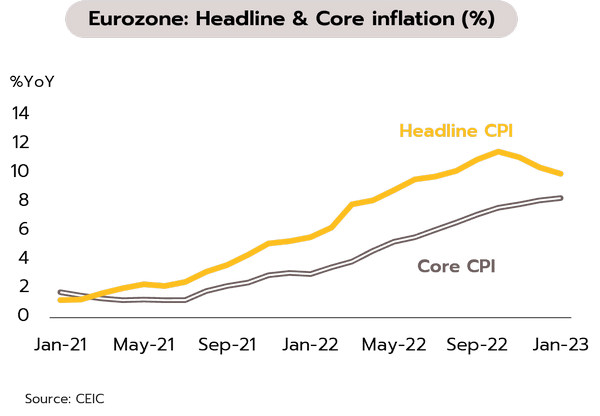

The Eurozone could dodge the recession but the road ahead remains foggy. Headline inflation cooled to 8.6% YoY in January from December’s 10.4%, but core inflation rose to a new high of 5.3% YoY. The Composite PMI rose to 52.3, its 2nd month north of the key 50-point waterline thanks to a rise to 53.0 in the Services PMI, its largest jump in 7 months. However, the Manufacturing PMI underperformed market expectations and fell to 48.5, its 8th month in the contraction zone.

The Eurozone may have avoided a winter recession but most indicators in 4Q22 pointed to continuing fragility and a possible slowdown, including (i) the weakest GDP growth rate since 3Q18 at 1.83% YoY; and (ii) a 2.93% YoY contraction in retail sales. Service inflation has accelerated, which may delay any softening in core inflation. The ECB will thus need to maintain a hawkish monetary stance, and this will have negative impacts on private consumption and investment through 2023, with this already evident in softer loan demand by consumer and corporates in 4Q22. Beside, geopolitical risks remain intense following talks by the G20 on increasing support for Ukraine and reducing Russia’s war-fighting ability.

China

Chinese property sector remains in trouble. Though the financial risk is still manageable, the economy is vulnerable to geopolitical tensions. In January, new house prices in 70 major cities were steady on a month-on-month (MoM) basis but saw a 2.26% drop on a year-on-year (YoY) basis. Prices for second-hand houses fell 0.28% MoM and 3.76% YoY. The 100 largest Chinese property developers also reported a 33% YoY crash in sales. Meanwhile, authorities continue reviving the market, so a scheme to allow private equity funds to invest in real estate would be piloted. As for a fiscal position, although government debt was rising last year, reaching 50.4% of GDP as of 4Q22, it remains substantially lower than the US’s 123.4%.

However, international relations are still uncertain. On 22 February, Wang Yi, China’s top diplomat, traveled to Russia to reaffirm a close relationship between the two countries without referring to the “no limits” strategic partnership announced before Russia invaded Ukraine. China is reportedly pushing for multilateral peace talks, and Xi Jinping is expected to visit Russia in April or May. Its foreign minister also called on “certain countries” to stop hyping “today Ukraine, tomorrow Taiwan.” Meanwhile, the US is increasing the number of troops active in Taiwan for training purposes from 30 to 100-200.

We see a slowdown in the decline of property prices and sales through 2Q23 thanks to a combination of a recovery in private consumption and measures to stimulate demand and improve liquidity, which have been in place since last year. Despite the risk posed by high non-financial corporate debt (160.9% of GDP), the country’s financial stability remains manageable. The central government can still take on more debt to fund additional stimulus measures and assist local governments that are suffering from the property slump. China’s position on Ukraine may reflect a desire to improve relations with Europe. However, US-China relations are at a trough and are unlikely to recover in the short term, representing a key risk to the Chinese and global economies.

Activities related to May’s election will help increasing velocity of money in Thai economy

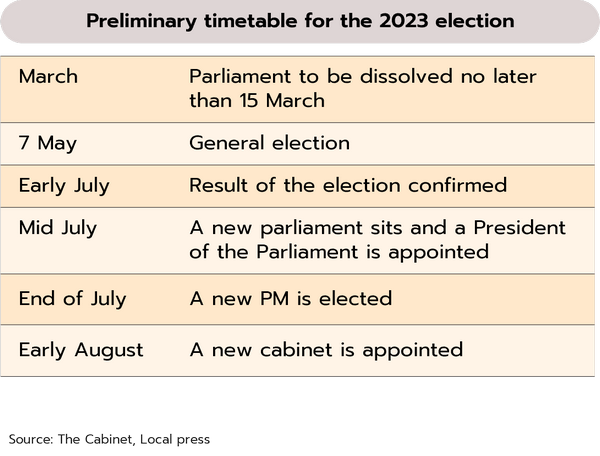

Political developments become a closely-watched factor after the timeline for the forthcoming election is clearer. Following a cabinet meeting held 21 February, PM Prayuth Chan-o-cha announced the preliminary timeline for the 2023 general election. Parliament will be dissolved by 15 March, the election day has been set by the Election Commission of Thailand (ECT) on 7 May, and the election results would be announced at the start of July. Following the schedule outlined in the table, the new government should be in place at the beginning of August.

The election timetable has become clearer after the PM has confirmed that parliament will be dissolved before the 23 March deadline and the election will take place on 7 May. Spending for campaigning and for the election itself will now push additional funds into the economy: (i) With the number of constituencies increasing from 350 to 400, the ECT’s budget for the 2023 election has been set at THB 5.9bn, up from THB 4.2bn in 2019. (ii) The ECT has also approved campaign budgets of up to THB 1.9mn per candidate for constituency MPs and up to THB 44mn per party for list MPs. However, although the timetable for the election has now been established, it is not certain that this will be adhered to, and if installing the new government falls behind schedule, this may result in disbursements from the FY2024 budget being delayed (the budget disbursement for FY2024 will start in October 2023). In this were to happen, both economic growth and investor sentiment may be negatively impacted.

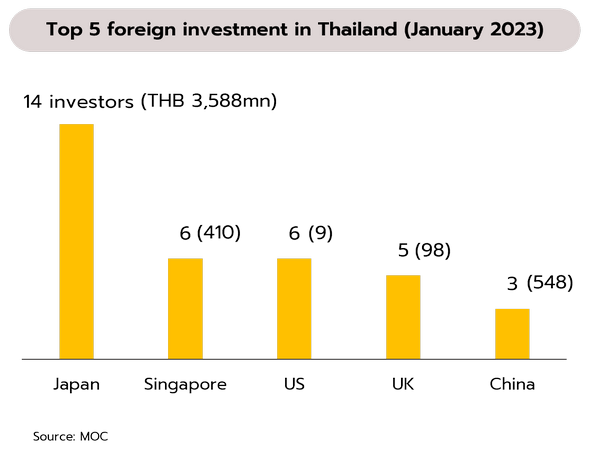

Foreign investment remains somewhat underwhelming at the start of 2023. Data from the Ministry of Commerce show that as per the 1999 Foreign Business Act, 52 investors for investment in Thailand were approved in January 2023. These had a combined value of THB 5.13bn and employed 298 Thais. The 5 most important sources of investment were Japan (14 investors worth THB 3.59bn), Singapore (6 investors worth THB 410mn), the US (6 investors worth THB 9mn), the UK (5 investors worth THB 98mn), and China (3 investors worth THB 548mn). By area, 8 investors were for projects in the EEC (15% of the total by number) and these had a value of THB 683mn (13% of the total by value). Of these, 5 were from Japanese investors (worth THB 632mn), 2 were Chinese (THB 48mn), and 1 was UK (THB 3mn).

Although at 52, the number of foreign investors approved in January 2023 is slightly higher than the 49 approved in January 2022. At THB 5.13bn, the value of these is down sharply against both the THB 9.77bn received a year earlier and the THB 16.31bn in inflows a month earlier (in December 2022). Nevertheless, the overall trend is upward, and for 2022, total FDI applications for BOI investment support totaled THB 433.97bn, up 36% from the previous year and above the THB 350bn averaged annually over 2017-2021 (led by investments from China, Japan and the US). The outlook thus remains positive for future investment, especially in EVs, smart electronics, clean energy, and digital technologies.