The US and Europe are heading towards harder and faster rate rises than previously expected, but Japan will need to keep monetary policy loose to support recovery

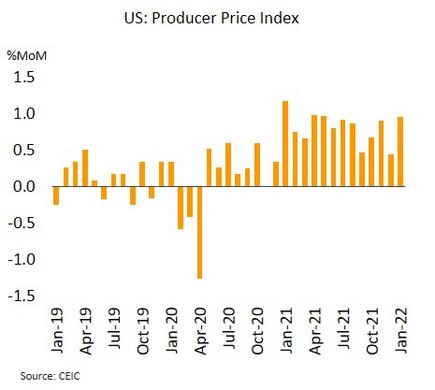

The US economy is strengthening with rising inflation; The Fed indicates to speed up rate hike. In January, retail sales beat expectations to jump by a 10-month high of 3.8% MoM. The Producer Price Index rose at 1.0%, its highest since May 2021. The Industrial Production expanded by 1.4%, its best performance in 3 months. For the week ending 12 February, continuing jobless claims also slipped to a 5-week low of 1.59 million.

US manufacturing and labor markets continue to improve, boosting consumption but adding to rising inflationary pressures. This is in line with the Fed members’ view in the minutes of January meeting that noted “if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate.” We therefore expect the Fed to hike rates 5 times this year, with a rise of 25 bps likely at the March meeting. In light of a more aggressive stance, a rise of 50 bps is possible if inflation remains strong into 2Q22.

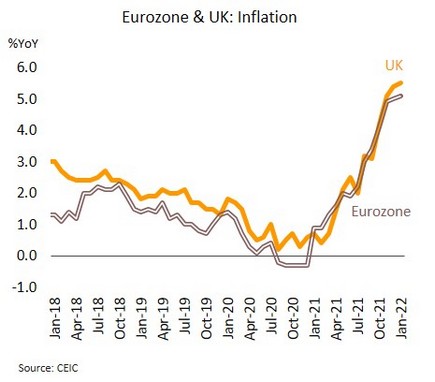

Rising inflation may trigger faster-than-expected rate rise in Eurozone; 50 bps hike is likely at BOE’s next meeting. In December, the Eurozone Producer Price Index climbed to a 2-month high of 2.9% MoM. In January, headline inflation hit a historic high of 5.1%. Meanwhile in the UK, December’s unemployment rate stood at the 2-year low of 4.1%. January’s headline inflation surged to 5.5%, its highest since March 1992. Retail sales strengthened at their fastest rate in 9 months to hit 1.9%.

The ECB is expected to hike rates in 2022 due to: (i) the relaxation of containment measures across the continent, which is feeding recovery in labor markets and a strengthening of economies; and (ii) the continuously elevated inflation, which has run above the 2% target for 7 months. In addition, energy prices are under significant pressure from rising tensions between Russia and NATO over the fate of Ukraine. It is also possible that the Bank of England (BOE) will raise rates by another 50 bps in March. This is because: (i) inflationary pressures remain intense, and inflation is now at a 30-year high; (ii) labor markets and consumption are both recovering strongly; and (iii) at its last meeting, 4 out of 9 MPC members voted for a 50 bps rate hike.

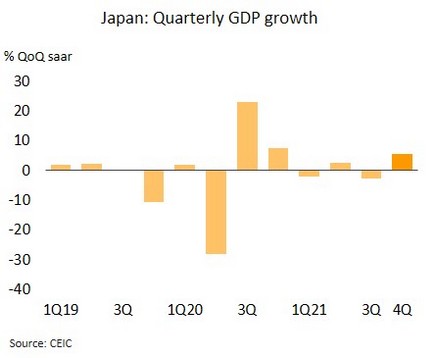

In Japan, positive signs emerge; Policy rates are likely to remain low as inflation still undershoots target. In 4Q21, GDP growth came in at 5.4% QoQ annualized, compared to -2.7% in 3Q21. In December, machinery orders exceeded market expectation to jump 5.1% YoY. In January, exports expanded for the 11th month, rising by 9.6% YoY.

Japan is showing signs of recovery. With an easing of the latest wave of infections, the government lifted the quasi-state of emergency in 5 prefectures from 20 February. From March, the country will begin to reopen to foreign arrivals. Nevertheless, the recovery is at an early stage and its fragility is reflected in the recent slip in Tankan manufacturers’ sentiment index, which has dropped to its weakest since March 2021. The inflation data also decelerated, with headline (from 0.8% to 0.5%) and core inflation (from 0.5% to 0.2%) both softening. Core inflation thus still run significantly below its target. The Bank of Japan (BOJ) is therefore likely to maintain ultra-loose monetary policy to further support economic recovery.

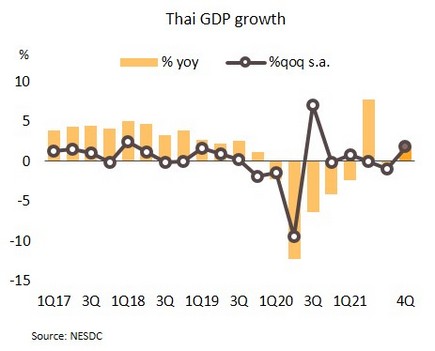

2021 GDP grew better than expected at 1.6%; We maintain 2022 growth outlook at 3.7%

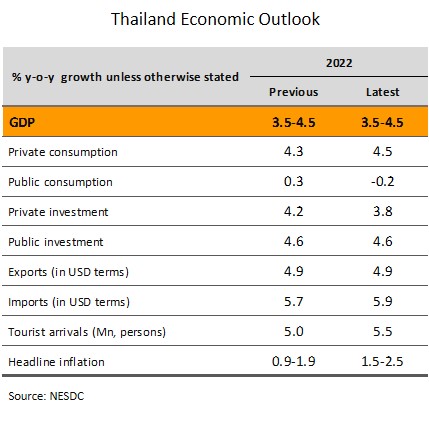

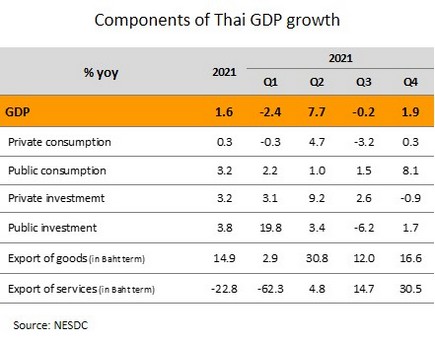

Thai GDP grew 1.9% YoY in 4Q21; It is expected to recover unevenly; A slowdown would be seen in 1Q22 due to Omicron outbreak. According to the NESDC’s report, the Thai economy in 4Q21 rose by 1.9% YoY, beating consensus and Krungsri Research’s forecast of 0.7% and 0.8%, respectively, fueled by accelerated government consumption due to the fiscal budget disbursement and utilized loan under emergency decree authorizing the MOF to borrow money to alleviate impact from the COVID-19 outbreak. Merchandised exports and service sectors performed well, supported by a recovery in external demand and the reopening for international tourism. However, private consumption picked up slightly but private investment contracted due partly to the completed construction of the Yellow and Pink mass transit lines. For the whole year of 2021, the Thai economy grew at 1.6% (from -6.2% in 2020), better than consensus and Krungsri Research forecasts (1.1% and 1.2% respectively). The NESDC maintains 2022 GDP projection at 3.5-4.5%.

Since the better-than-expected growth of government consumption, exports and tourism in 4Q21 should not translate to a new boost to growth outlook going forward, Krungsri Research maintains our full-year 2022 GDP forecast at 3.7%. Thai economy in 1Q22 is likely to slow down due to the adverse impact of the Omicron-driven outbreak. Despite the recent rise in daily infections, the impacts are likely to be limited and short lived because the fatality rate is low, allowing authorities to use a less stringent restrictions as compared to the earlier waves of infections. We still expect the economy would recover at a gradual pace during the remainder of the year given the following factors: (i) Exports will still be key driver for economic growth, and would encourage manufacturing activity and help support private investment; (ii) Tourism sector is likely to pick up gradually though it would remain far below pre-COVID level; and (iii) Consumption would continue to improve, supported by the easing of containment measures, the progress of booster vaccination, additional stimulus package (worth THB 53.2bn) and improving labor market, as well as pent-up demand after the pandemic subsides. Nonetheless, rising inflationary pressure would raise households’ burden, reduce real wage growth, and undermine purchasing power, especially for low- to medium-income groups. This implies the economic recovery would be uneven and still fragile.

New measures to ease the rising cost of living will keep diesel prices below THB 30/liter until May. The government has approved THB 2.79/liter cuts to diesel excise that will bring this down from THB 5.99 to THB 3.20 per liter. These cuts will run from 18 February to 20 May 2022, and will cut diesel pump prices from THB 29.94 to THB 27.94/liter. Nonetheless, it is estimated that this measure would cause the loss of tax revenue by THB 17.1bn.

Crude prices have been on a sustained rise, and as of 18 February, Dubai crude had hit USD 90.9/bbl, up 24% from the end of 2021. This is then pushing up the cost of living and feeding into higher business expenses at a time when recovery is still only at an early stage. Analysis by the Ministry of Commerce also shows that a THB 5/liter increase in diesel prices (i.e., from THB 25 to THB 30/liter) would translate into price rises of 1.45% for food and drink, 1.2% for construction materials, 1.1% for household goods, and 0.5% for agricultural inputs. Against a backdrop of rising external pressures, in particular from turbulent global energy markets, these moves to hold back increases in the cost of diesel will therefore help to slow more general domestic price rises.